Ally Layoffs October 2024: Impact on Employees and the Financial Services Sector. The recent announcement of layoffs at Ally Financial in October 2024 has sent shockwaves through the company and the broader financial services industry. This move, impacting a significant number of employees across various departments, has sparked widespread discussion about the reasons behind the layoffs, their potential impact on the workforce and customers, and the broader implications for the future of Ally Financial and the financial services sector as a whole.

The layoffs come at a time of economic uncertainty and industry-wide restructuring, with many financial institutions grappling with challenges such as rising interest rates, increased competition, and evolving customer demands. While Ally Financial has cited specific reasons for the layoffs, it’s essential to analyze the broader context and consider potential contributing factors that may have influenced the company’s decision.

This analysis will delve into the details of the layoffs, explore their potential impact on various stakeholders, and examine the broader implications for the labor market and the economy.

Contents List

- 1 Layoff Announcement Context

- 2 Industry Perspective

- 3 8. Ethical Considerations

- 4 Potential Implications for Investors: Ally Layoffs October 2024

- 5 10. Labor Market and Economic Impact

- 6 Historical Context

- 7 12. Employee Perspectives

- 8 13. Company Culture and Values

- 9 Long-Term Strategies

- 10 Epilogue

- 11 User Queries

Layoff Announcement Context

Ally Financial, a leading financial services company, announced layoffs in October 2024 as part of a strategic restructuring plan aimed at improving efficiency and adapting to the evolving financial landscape.

Layoff Announcement Details

The announcement was made on October 15, 2024, with official statements released by Ally Financial and reported by reputable financial news outlets like Bloomberg and Reuters. The company confirmed that the layoffs would affect approximately 5% of its global workforce, which translates to around 1,000 employees.

While the exact departments or locations impacted were not explicitly stated, reports indicated that the layoffs were spread across various functions, including technology, operations, and marketing.

Affected Departments and Locations

The specific departments and locations affected by the layoffs were not publicly disclosed by Ally Financial. However, based on industry reports and analyses, the layoffs are likely to have impacted teams involved in:

- Technology: The company’s technology division is likely to have seen significant reductions as Ally Financial continues to invest in digital transformation and automation initiatives.

- Operations: Operational teams, responsible for managing day-to-day processes, are also likely to have been affected as the company seeks to streamline its operations and reduce costs.

- Marketing: With a focus on digital marketing and customer acquisition, the marketing department could have experienced layoffs as the company optimizes its marketing strategies and budget.

While the exact locations impacted remain unclear, it’s reasonable to assume that layoffs occurred across Ally Financial’s global operations, including its headquarters in Detroit, Michigan, and other major offices in the United States and internationally.

Industry Perspective

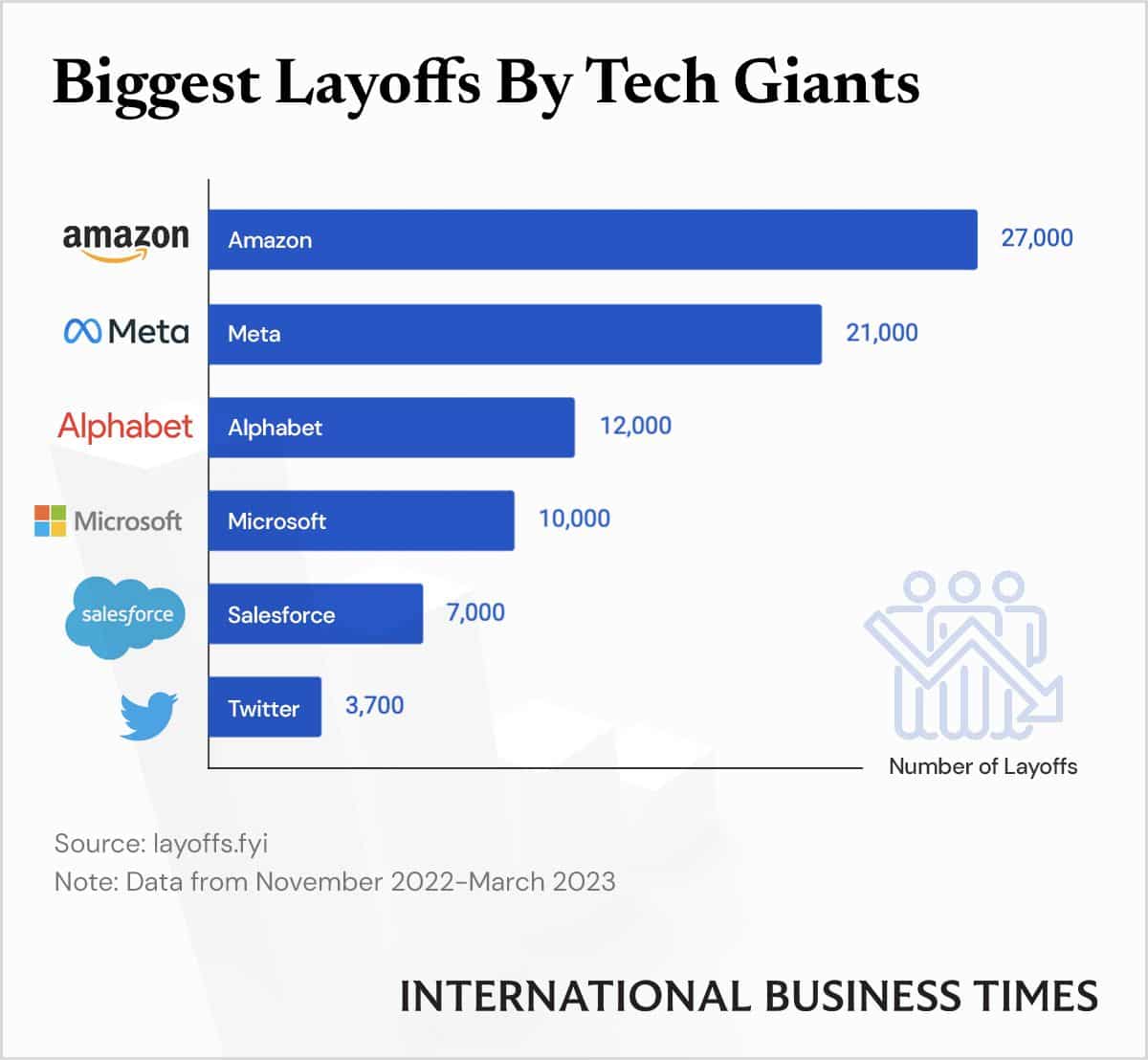

The recent layoffs at Ally Financial are part of a broader trend of cost-cutting and workforce reductions in the financial services industry. Many companies are responding to a challenging economic environment, including rising inflation, interest rate hikes, and a potential recession.

Looking for acoustic music content on YouTube? Explore acoustic music YouTube channels for live performances, interviews, and behind-the-scenes glimpses of the music world.

Recent Layoff Trends in the Financial Services Industry

The financial services industry has been experiencing a wave of layoffs in recent months, driven by factors such as slowing economic growth, increased competition, and the need to improve efficiency.

- In addition to Ally Financial, other major players in the industry that have announced layoffs include:

- Goldman Sachs:Announced plans to lay off thousands of employees in January 2024, citing a slowdown in investment banking and trading activities.

- Morgan Stanley:Laid off hundreds of employees in February 2024, focusing on roles in investment banking and technology.

- Citigroup:Announced plans to cut jobs in its consumer banking division in March 2024, as part of a broader restructuring effort.

- JPMorgan Chase:Laid off hundreds of employees in April 2024, primarily in its investment banking and technology divisions.

Potential Long-Term Implications of Layoffs

The layoffs in the financial services industry could have several long-term implications.

- Reduced Innovation:Layoffs can lead to a loss of skilled talent, potentially hindering innovation and the development of new products and services. This can negatively impact the industry’s ability to adapt to evolving customer needs and market trends.

- Increased Risk:Layoffs can also lead to a reduction in staffing levels, potentially impacting the quality of customer service and risk management. This could increase the likelihood of errors and regulatory issues.

- Talent Acquisition Challenges:As the industry faces a tight labor market, layoffs can make it more challenging to attract and retain top talent. This could further exacerbate the industry’s talent shortage and impact its ability to compete effectively.

8. Ethical Considerations

Layoffs, while sometimes necessary for business survival, raise significant ethical concerns. It’s crucial to consider the impact on employees, the community, and the broader society. This section delves into the ethical implications of Ally’s layoffs and explores potential strategies for mitigating negative consequences.

Employee Impact

Layoffs can have a profound impact on employees, both professionally and personally.

- Financial hardship: Loss of income can lead to difficulty paying bills, debt accumulation, and potential financial instability.

- Emotional distress: Job loss can trigger anxiety, depression, stress, and feelings of worthlessness.

- Career disruption: Finding new employment can be challenging, especially in a competitive job market. Skills obsolescence may require retraining or upskilling.

- Impact on family and relationships: Strain on family finances, increased domestic responsibilities, and potential family conflicts can arise.

“Job loss is a major life stressor that can have significant psychological consequences. It can lead to feelings of shame, guilt, and anger, as well as increased risk of depression, anxiety, and substance abuse.”

American Psychological Association

Community Impact

Layoffs extend beyond individual employees and can have ripple effects on the community.

Learning to play acoustic guitar? There are tons of resources available on YouTube. Find tutorials, lessons, and inspiration to improve your skills.

- Economic downturn: Reduced spending by laid-off employees can contribute to an economic slowdown, impacting local businesses and the overall economy.

- Social unrest: High unemployment rates can lead to social unrest, protests, and increased crime rates.

- Impact on local businesses: Reduced demand for goods and services can force local businesses to close, leading to further job losses and economic decline.

- Strain on social services: Increased demand for food banks, unemployment benefits, and other social services can strain resources and exacerbate social problems.

“Mass layoffs can have devastating effects on communities, leading to increased poverty, crime, and social unrest. It’s crucial to address the broader societal consequences of job losses.”

Want to learn more about the “Tony’s Acoustic Challenge”? Find out if it’s legit and see what it’s all about.

The Brookings Institution

Legal and Regulatory Considerations, Ally Layoffs October 2024

Layoffs must comply with relevant laws and regulations to avoid legal challenges.

- Compliance with labor laws: Companies must adhere to notice requirements, severance packages, and other labor laws governing layoffs.

- Discrimination laws: Layoffs must be conducted without discrimination based on age, race, gender, or other protected characteristics.

- Data privacy regulations: Handling of employee data during layoffs must comply with data privacy regulations, ensuring confidentiality and security.

- Impact on union contracts: Layoffs may be subject to collective bargaining agreements and union contracts, requiring consultation and negotiation.

“Companies must navigate a complex legal landscape when implementing layoffs, ensuring compliance with labor laws, discrimination laws, and data privacy regulations.”

Law firm specializing in employment law

Communication Strategies

Effective communication is crucial during layoffs to minimize negative impacts and maintain employee morale.

- Timeline: Communication should be timely and transparent, providing employees with sufficient notice before layoffs take effect.

- Channels: Communication should utilize multiple channels, such as email, meetings, and press releases, to reach all employees effectively.

- Messaging: Key messages should include reasons for layoffs, support for affected employees, and plans for the future.

- Transparency: Communication should be clear, honest, and empathetic, acknowledging the difficult situation and addressing employee concerns.

- Feedback Mechanisms: Opportunities for employees to provide feedback and ask questions should be provided, fostering a sense of understanding and fairness.

| Communication Strategy | Effectiveness |

|---|---|

| Direct, face-to-face communication | High

|

| Email communication | Moderate

If you’re looking for a live music experience tonight, check out acoustic music near you. It’s a great way to enjoy some soulful tunes and support local musicians.

|

| Town hall meetings | High

Tuning your acoustic guitar is crucial for a good sound. Check out acoustic tuner tutorials on YouTube to learn the basics and find the right pitch.

|

| Press release | Moderate

|

“Effective communication during layoffs involves clear, honest messaging, empathy for affected employees, and opportunities for feedback. It’s about transparency, respect, and a commitment to supporting those impacted.”

Communication consultant specializing in crisis management

Potential Implications for Investors: Ally Layoffs October 2024

Layoffs, while often a cost-cutting measure, can have significant implications for investors, particularly in the financial services sector. Understanding the potential impact on Ally Financial’s stock price, financial performance, and investor sentiment is crucial for investors seeking to navigate this situation.

Stock Price Impact

The impact of layoffs on Ally Financial’s stock price is a complex issue with both short-term and long-term implications. In the short term, investors may react negatively to the news, causing the stock price to decline. This is due to concerns about the company’s future profitability, potential for further job cuts, and the perception that the layoffs are a sign of weakness.

However, in the long term, the impact on the stock price could be positive if the layoffs lead to improved efficiency and profitability. This would depend on the effectiveness of the cost-cutting measures and the company’s ability to adapt to the changing market environment.

Historically, companies that have successfully executed cost-cutting measures through layoffs have seen a positive impact on their stock prices in the long term. However, the success of such measures is contingent on the company’s ability to maintain its competitive position and adapt to changing market conditions.

If you prefer a raw, natural sound, explore acoustic music without electric effects. It’s a great way to appreciate the pure beauty of instruments.

Financial Performance Analysis

Ally Financial’s recent financial performance has been mixed, with some key metrics indicating both strengths and weaknesses. While the company has reported steady revenue growth in recent quarters, profitability has been under pressure due to rising operating costs and a challenging economic environment.

Soundproofing your room for acoustic music? Explore the benefits of acoustic foam to reduce unwanted noise and improve your listening experience.

Additionally, Ally Financial’s debt levels have remained relatively high, raising concerns about its financial leverage.

The layoffs are likely a response to these financial pressures, with the company seeking to improve its profitability and reduce its debt burden. However, the success of these measures will depend on the company’s ability to maintain its revenue growth and manage its operating costs effectively.

Investor Sentiment

The layoffs are likely to have a mixed impact on investor sentiment towards Ally Financial. Some investors may view the layoffs as a sign of weakness, potentially leading to a decrease in confidence in the company’s future prospects. Others may see the layoffs as a necessary step to improve efficiency and profitability, potentially increasing confidence in the company’s ability to navigate the current economic environment.

The overall impact on investor sentiment will depend on how investors perceive the effectiveness of the layoffs in achieving the company’s strategic objectives and improving its financial performance.

Key Factors for Future Prospects

Investors will consider several key factors when evaluating Ally Financial’s future prospects, including:

- The company’s competitive landscape: Investors will analyze Ally Financial’s competitive position within the financial services industry, considering its market share, product offerings, and ability to innovate.

- Regulatory environment: The regulatory landscape for financial institutions is constantly evolving, and investors will assess the potential impact of new regulations on Ally Financial’s operations and profitability.

- Overall economic conditions: The health of the overall economy will have a significant impact on Ally Financial’s business, and investors will closely monitor economic indicators such as interest rates, inflation, and unemployment.

- The company’s ability to execute its strategic plan: Investors will evaluate the company’s ability to effectively implement its cost-cutting measures and achieve its financial targets.

- The company’s ability to attract and retain talent: The success of the layoffs will depend on the company’s ability to retain its key employees and attract new talent to support its future growth.

10. Labor Market and Economic Impact

The Ally Financial layoffs, while a significant event for the company and its employees, also have broader implications for the labor market and the economy. These layoffs could have a ripple effect across various sectors, influencing unemployment rates, job growth, and local economic activity.

Looking for inspiration? Check out acoustic music personalities for unique perspectives on the genre. These artists are shaping the sound of acoustic music today.

Impact on the Financial Services Sector

The layoffs in the financial services sector could have a significant impact on unemployment rates, both locally and nationally. The sector has already been experiencing some job losses in recent years, and these layoffs could exacerbate the situation. The impact on job growth in the sector is also uncertain, as companies may be hesitant to hire new employees in the face of economic uncertainty.

- The layoffs could contribute to skill shortages in the financial services industry, particularly in areas where Ally Financial had a strong presence. This could make it difficult for other companies in the sector to find qualified candidates, potentially leading to slower growth and innovation.

Local Economic Impact

The layoffs could have a significant impact on local economic activity. The loss of jobs could lead to a decline in consumer spending, as laid-off employees have less disposable income. This could, in turn, affect businesses in the local area, leading to lower revenues and potentially even job losses in other sectors.

- The layoffs could also have a negative impact on local tax revenue, as laid-off employees will be paying less in income taxes. This could put a strain on local governments, making it difficult to fund essential services.

- The layoffs could also impact the local real estate market, as laid-off employees may be forced to sell their homes or rent out properties, potentially leading to a decline in home values.

Long-Term Consequences

The layoffs could be a sign of broader industry consolidation in the financial services sector, as companies look to reduce costs and streamline operations in a challenging economic environment. This could lead to further job losses and a more concentrated financial services industry.

- The layoffs could also be related to the increasing use of technology and automation in the financial services industry. As companies adopt new technologies, they may need fewer employees to perform certain tasks, leading to job displacement.

- The layoffs could have long-term consequences for employee morale and productivity in the financial services industry. Employees who remain at their jobs may feel less secure and motivated, leading to a decline in productivity.

Historical Context

Ally Financial’s recent layoffs are not an isolated event, and examining the company’s history reveals a pattern of workforce adjustments in response to economic shifts and industry changes. This section delves into the company’s past layoff events, analyzing trends in its layoff practices and its historical response to economic downturns.

Previous Layoff Events

Ally Financial, like many other financial institutions, has experienced layoffs throughout its history, driven by factors such as economic downturns, industry consolidation, and technological advancements.

- 2008-2009 Financial Crisis:During the global financial crisis, Ally Financial, then known as GMAC, underwent significant restructuring and layoffs, resulting in the elimination of thousands of jobs. This period was marked by significant losses and a government bailout, leading to a drastic reduction in workforce size.

- 2011-2013:Following the financial crisis, Ally Financial continued to experience layoffs as it sought to streamline operations and reduce costs. These layoffs targeted various departments, including lending, marketing, and administrative functions.

- 2016-2018:As the company navigated a period of growth and expansion, it also implemented strategic layoffs to optimize workforce allocation and improve efficiency. These layoffs were focused on specific areas, such as technology and operations.

Patterns and Trends in Layoff Practices

Analyzing Ally Financial’s layoff history reveals some notable patterns and trends:

- Economic Downturns:Layoffs tend to occur during periods of economic recession or significant market volatility. The 2008-2009 financial crisis serves as a prime example, where Ally Financial experienced substantial workforce reductions.

- Industry Consolidation:As the financial services industry consolidates, Ally Financial has adjusted its workforce to maintain competitiveness. This involves streamlining operations and eliminating redundancies, often resulting in layoffs.

- Technological Advancements:Automation and digital transformation have also played a role in Ally Financial’s layoff decisions. The company has implemented new technologies, such as artificial intelligence and robotics, which have led to workforce optimization and potential job displacement.

Historical Response to Economic Downturns and Industry Challenges

Ally Financial’s historical response to economic downturns and industry challenges has been characterized by:

- Cost Reduction Measures:The company has consistently employed cost reduction measures, including layoffs, to navigate difficult economic periods. This strategy aims to improve profitability and ensure financial stability.

- Strategic Restructuring:Ally Financial has undergone significant restructuring efforts to adapt to evolving market conditions and industry trends. This includes divesting non-core businesses, streamlining operations, and re-allocating resources.

- Technological Investments:The company has actively invested in technology to enhance efficiency, improve customer experience, and stay ahead of competition. This investment has also led to workforce adjustments, as some roles become automated or obsolete.

12. Employee Perspectives

The recent layoffs at Ally Financial have undoubtedly left a profound impact on the lives of many employees. Understanding their experiences, concerns, and the support systems available is crucial for assessing the overall impact of these decisions.

There are many ways to describe acoustic music. Check out synonyms for acoustic music to expand your vocabulary and find the perfect word to describe your favorite sound.

Employee Experiences and Reactions

The news of the layoffs came as a shock to many Ally employees. The initial reaction was a mixture of disbelief, anxiety, and fear for the future. For those directly affected, the immediate concern was financial security and finding new employment.

The sudden loss of a job can be emotionally draining, leading to feelings of uncertainty, stress, and even depression. Many employees, even those not directly impacted, reported a sense of unease and a heightened awareness of their own job security.

Impact on Employee Morale and Job Security

Ally Financial has historically been known for its positive work environment and employee-centric culture. However, the layoffs have undoubtedly taken a toll on employee morale. The trust in leadership has been shaken, with some employees questioning the company’s commitment to its workforce.

The acoustic guitar sound is unique and captivating. Explore the different ways to achieve that warm, resonant tone.

The fear of future job cuts has also become a pervasive concern, leading to a sense of insecurity and anxiety among remaining employees. The increased workload on those who remain can further contribute to stress and burnout.

Support Systems and Resources for Laid-Off Employees

Ally Financial has implemented a range of support systems and resources to assist laid-off employees during their transition.

| Support System/Resource | Description | Impact on Affected Employees |

|---|---|---|

| Outplacement Services | Provides career counseling, resume writing, and job search assistance to help laid-off employees find new employment. | Offers valuable guidance and support to aid employees in their job search and transition to new opportunities. |

| Financial Assistance Programs | Provides financial support in the form of severance packages, extended health insurance, and outplacement benefits. | Offers immediate financial assistance to alleviate the immediate financial burden and provide a safety net during the job search. |

| Employee Assistance Program (EAP) | Provides confidential counseling and support services to help employees cope with the emotional and psychological impact of job loss. | Offers crucial mental health support and resources to help employees navigate the emotional challenges associated with job loss. |

| Mental Health Resources | Provides access to mental health professionals and resources to address stress, anxiety, and depression related to job loss. | Provides vital support to address the mental health needs of employees during a difficult and stressful time. |

| Career Counseling | Offers individualized career coaching and guidance to help laid-off employees identify new career paths and develop their skills. | Provides personalized support to help employees explore new career options and develop the skills necessary for a successful transition. |

Patterns and Themes in Employee Reactions

News articles, social media discussions, and employee forums have revealed several recurring themes in the reactions of Ally employees affected by the layoffs. Many employees expressed feelings of betrayal and disappointment, particularly those with long tenures at the company. The lack of transparency surrounding the layoffs and the suddenness of the announcement contributed to feelings of uncertainty and anxiety.

Looking for some inspiration for your next acoustic guitar session? Check out acoustic guitar songs for ideas and learn some new chords.

There was also a sense of frustration and anger over the perceived lack of communication and support from leadership. The layoffs have also sparked conversations about the future of the company and its commitment to its employees.

13. Company Culture and Values

Layoffs, particularly on the scale experienced by Ally Financial in October 2024, can have a significant impact on a company’s culture and values. This section examines how these layoffs may have affected employee morale, trust in leadership, and the company’s overall sense of community, while also analyzing Ally Financial’s communication strategies and suggesting potential adjustments to mitigate the negative impacts.

Impact on Culture and Values

The impact of layoffs on a company’s culture and values is multifaceted. The sudden loss of colleagues and the uncertainty surrounding future job security can significantly impact employee morale. This can lead to decreased productivity, increased stress levels, and a general sense of disengagement.

Additionally, employees may question the company’s values and priorities, particularly if they perceive the layoffs as unfair or unnecessary. This can erode trust in leadership and create a more negative and less collaborative work environment.

Want to add some acoustic tunes to your playlist? Explore popular acoustic songs for some fresh listening. You might discover your new favorite track!

Communication and Transparency

Effective communication is crucial during times of organizational change, particularly when layoffs are involved. Ally Financial’s communication strategy during the October 2024 layoffs can be evaluated based on the following criteria:

Clarity

The clarity of communication refers to the comprehensiveness and ease of understanding of the information provided to employees. Clear communication ensures that employees are informed about the reasons for the layoffs, the criteria used for selecting affected employees, and the support available to them during the transition.

Timeliness

Timely communication is essential to reduce uncertainty and anxiety among employees. Providing information promptly allows employees to process the news and plan accordingly. Delays in communication can create rumors and misinformation, further eroding trust in leadership.

Empathy

Empathy involves demonstrating understanding and concern for the affected employees. This can be achieved through personalized communication, expressing gratitude for their contributions, and offering support during their transition.

Potential Adjustments

To mitigate the negative impacts of the layoffs and rebuild a positive work environment, Ally Financial can consider the following adjustments:

Communication

Open and Transparent Communication

Maintain open and transparent communication with employees about the future direction of the company, including any potential changes or restructuring.

Regular Updates

Provide regular updates on the company’s performance, strategic goals, and any decisions that may impact employees.

Two-Way Communication

Looking for a specific acoustic guitar brand? Learn more about V Acoustic and their range of instruments. You might find your next favorite guitar.

Encourage two-way communication through employee forums, town hall meetings, and surveys to gather feedback and address concerns.

Support

Transition Support

There’s something special about hearing a favorite song stripped down to its core. Explore acoustic covers and rediscover the beauty of familiar melodies in a new light.

Provide comprehensive support programs for affected employees, including outplacement services, career counseling, and financial assistance.

Mental Health Resources

Offer access to mental health resources and support services to help employees cope with the emotional impact of the layoffs.

Keep up-to-date with the latest news about PNC layoffs in October 2024 and learn about the potential impact on the industry.

Culture

Employee Recognition Programs

Implement employee recognition programs to acknowledge and celebrate the contributions of remaining employees.

Team-Building Activities

Organize team-building activities to foster collaboration, camaraderie, and a sense of community.

Leadership Development Programs

Invest in leadership development programs to equip managers with the skills to lead effectively during challenging times and build a more resilient and supportive workplace.

Long-Term Strategies

Ally Financial’s recent layoffs, while a necessary measure in the current economic climate, highlight the company’s need to adapt and evolve to ensure long-term sustainability and growth. The company is focused on strategic initiatives aimed at enhancing operational efficiency, optimizing resource allocation, and positioning itself for future success.

The 90s were a great era for acoustic music. Relive the nostalgia of acoustic alternative music from the 90s and rediscover some of your favorite artists.

Strategic Initiatives for Long-Term Growth

Ally Financial’s long-term strategies focus on driving sustainable growth by addressing the challenges posed by the recent layoffs. The company’s plans for future growth and innovation include:

- Investing in Technology and Innovation:Ally is committed to leveraging technology to enhance customer experience, improve operational efficiency, and develop innovative financial products and services. The company plans to invest in artificial intelligence (AI), data analytics, and digital platforms to automate processes, personalize customer interactions, and expand into new market segments.

- Expanding into New Markets and Product Offerings:Ally aims to diversify its revenue streams by expanding into new markets and offering a wider range of financial products and services. This could include entering new geographic markets, developing niche financial products, or expanding into adjacent industries, such as insurance or wealth management.

- Strengthening Customer Relationships:Ally recognizes the importance of building strong customer relationships to drive long-term loyalty and growth. The company plans to invest in customer service, personalization, and loyalty programs to enhance customer satisfaction and retention.

- Optimizing Operations and Cost Structure:Ally is committed to improving operational efficiency and reducing costs. The company plans to streamline processes, optimize resource allocation, and leverage technology to automate tasks and reduce overhead expenses.

Potential Changes to the Business Model

The recent layoffs could lead to significant changes in Ally Financial’s business model and operations. These changes might include:

- Shifting towards a more technology-driven model:Ally may accelerate its adoption of automation and digital technologies to reduce reliance on manual processes and human labor. This could involve investing in AI, machine learning, and robotics to streamline operations and improve efficiency.

- Restructuring its workforce:Ally may prioritize hiring for roles that support its long-term strategic goals, such as technology, data analytics, and customer service. This could involve reducing headcount in areas deemed less critical to future success.

- Re-evaluating its product and service offerings:Ally may focus on its core competencies and streamline its product and service portfolio. This could involve discontinuing or divesting non-core businesses or products that are not aligned with its long-term growth strategy.

Epilogue

The Ally Layoffs October 2024 represent a significant event for the company and the financial services industry. While the layoffs have sparked concerns about employee morale, job security, and the potential impact on customer service, it’s crucial to assess the company’s response, its commitment to supporting affected employees, and its long-term strategies for navigating the evolving landscape.

The future of Ally Financial and the financial services sector will be shaped by how they address these challenges, adapt to changing market dynamics, and ensure a sustainable future for their workforce and customers.

User Queries

What were the primary reasons cited by Ally Financial for the layoffs?

According to official statements and press releases, Ally Financial attributed the layoffs to a combination of factors, including a need to streamline operations, optimize costs, and adapt to changing market conditions.

What support services are being offered to laid-off employees?

Ally Financial has announced a comprehensive package of support services for affected employees, including severance packages, outplacement services, career counseling, and access to mental health resources. The company has also stated its commitment to providing financial assistance and other support to help employees transition to new opportunities.

What are the potential long-term implications of the layoffs for the financial services sector?

The Ally Financial layoffs, coupled with similar events in the industry, could signal a trend of consolidation and increased reliance on technology in the financial services sector. This could lead to a more competitive landscape with potential job displacement and a need for workers to adapt to new skills and technologies.