Amazinggoodwilldonationreceipt 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This guide delves into the world of Goodwill donation receipts, exploring their purpose, benefits, and implications for the 2024 tax year.

If you’re looking for furniture at a good price and want to support a charity, Charity Furniture Shops 2024 can help you find shops in your area. These shops often sell donated furniture at affordable prices.

We’ll uncover how these receipts can help you claim valuable tax deductions while supporting a worthy cause.

The Hamlin Charity is a great organization to support, and you can learn more about their work on Hamlin Charity 2024. They focus on providing healthcare and education for women and children in developing countries.

Whether you’re donating clothing, furniture, or electronics, understanding the process and potential tax advantages associated with Goodwill donations is essential. This guide will provide you with the knowledge and resources to make informed decisions about your donations and ensure you receive the maximum benefit for your generosity.

The PayPal Generosity Network is a great platform for donating to charities, and you can learn more about it on Paypal Generosity Network 2024. This network connects donors with charities and makes it easy to give back.

Contents List

- 1 Goodwill Donation Receipt: An Overview

- 2 Benefits of Obtaining a Donation Receipt: Amazinggoodwilldonationreceipt 2024

- 3 Understanding the 2024 Tax Year Implications

- 4 Donation Receipt Formats and Accessibility

- 5 Illustrative Examples of Donation Receipts

- 6 Additional Considerations for Donation Receipts

- 7 Conclusive Thoughts

- 8 Common Queries

Goodwill Donation Receipt: An Overview

A Goodwill donation receipt is a vital document that acknowledges your charitable contribution to Goodwill Industries. It serves as proof of your donation and is crucial for claiming tax deductions.

Many churches offer donation programs, and you can find information on Church Donation 2024 about how to contribute to your local church. This can be a great way to support your faith community and give back to those in need.

Purpose and Significance

Goodwill donation receipts serve a dual purpose:

- Proof of Donation:The receipt acts as official documentation of your donation, verifying the items donated, their estimated value, and the date of the donation.

- Tax Deduction Eligibility:For most donations, the receipt is essential for claiming tax deductions. The receipt provides the necessary information for you to file your tax return accurately.

Many charities accept furniture donations, and you can find information on Donate Sofa To Charity 2024 about how to donate a sofa to a local charity. This can be a great way to give your unwanted furniture a new home.

Key Information on a Receipt

A typical Goodwill donation receipt includes the following essential details:

- Donor Information:Your name and contact information.

- Donation Details:A description of the items donated, including quantity and condition.

- Estimated Value:The estimated fair market value of the donated items. This value is often determined by Goodwill staff or volunteers.

- Donation Date:The date on which you made the donation.

- Receipt Number:A unique identification number for the receipt.

- Goodwill Information:The name, address, and contact information of the Goodwill organization.

For those interested in supporting St. Jude Children’s Research Hospital, you can find information on Forstjude Org Donation 2024 to make a donation. This organization is dedicated to finding cures and saving children with cancer, and your support can make a real difference.

Types of Donation Receipts

Goodwill donation receipts can vary depending on the type of items donated:

- Clothing:Receipts for clothing donations will typically list the quantity of items donated, their condition (e.g., good, fair, poor), and their estimated value.

- Furniture:Receipts for furniture donations will include a description of the furniture pieces, their condition, and their estimated value.

- Electronics:Receipts for electronic donations will list the specific electronics donated, their condition, and their estimated value.

Looking for charities near you to donate to? Charity Donations Near Me 2024 can help you find local organizations that accept donations and make a difference in your community.

Benefits of Obtaining a Donation Receipt: Amazinggoodwilldonationreceipt 2024

Obtaining a Goodwill donation receipt offers several advantages, including:

Tax Deductions

One of the primary benefits of receiving a donation receipt is the ability to claim tax deductions. By donating items to Goodwill, you may be eligible for a tax deduction based on the fair market value of your donation. This deduction can reduce your tax liability and save you money.

The Purple Heart organization often accepts donations, and you can find information on Purple Heart Donation Pick Up 2024 about their donation pick-up services. This organization supports veterans and their families.

Claiming Tax Deductions

To claim a tax deduction for your Goodwill donation, you will need to:

- Keep your donation receipt:Store the receipt in a safe and organized location.

- File your tax return:Use the information from your receipt to accurately report your donation on your tax return.

- Consult with a tax professional:For guidance on specific tax deduction rules and eligibility requirements.

If you have gently used clothing or household items to donate, consider checking out Goodwill Pick Up 2024. They offer pick-up services in many areas and help provide job training and employment opportunities to individuals in need.

Other Potential Benefits

Beyond tax deductions, donating to Goodwill offers other benefits:

- Supporting a Charitable Cause:Goodwill provides job training, employment placement services, and other programs to help individuals with disabilities and disadvantages find meaningful employment.

- Reducing Waste:Donating items to Goodwill keeps them out of landfills, promoting sustainability and environmental responsibility.

- Creating a Positive Impact:Your donations help Goodwill empower individuals and communities.

The Heart Foundation often accepts furniture donations, and you can learn more about their programs on Heart Foundation Furniture Collection 2024. This can be a great way to donate furniture and support heart health research.

Understanding the 2024 Tax Year Implications

It’s important to stay informed about any changes in tax laws that may affect your charitable donations.

Changes and Updates

The 2024 tax year may bring updates to tax laws related to charitable donations. It’s crucial to consult with a tax professional or the IRS website for the most current information.

Impact on Donation Receipts

Any changes in tax laws could potentially impact the way Goodwill donation receipts are used for tax purposes. For instance, there might be adjustments to the deduction limits or eligibility criteria.

Accurate Reporting

To ensure accurate reporting of your donations for tax purposes, consider these steps:

- Keep detailed records:Maintain a record of all your donations, including the items donated, their estimated value, and the donation dates.

- Verify receipt information:Carefully review the information on your donation receipt and ensure it is accurate and complete.

- Seek professional guidance:If you have any questions or uncertainties about reporting your donations, consult with a tax professional.

Donation Receipt Formats and Accessibility

Goodwill donation receipts are available in various formats to accommodate different preferences.

If you have items to donate to support diabetes research, Diabetes Pick Up 2024 can help you find organizations that offer pick-up services. This is a great way to contribute to a worthy cause.

Receipt Formats

Goodwill donation receipts are typically available in both paper and digital formats:

- Paper Receipts:These are printed receipts provided directly at the donation center.

- Digital Receipts:Some Goodwill locations offer digital receipts, which can be emailed or accessed online.

Donating blood is a vital way to help others in need. You can find information on American Red Cross Blood Donation Center 2024 to find a donation center near you.

Obtaining a Receipt

To obtain a donation receipt, you should:

- Request a receipt:When dropping off your donation, inform the Goodwill staff that you require a receipt.

- Provide contact information:Ensure that you provide your name and contact information to the staff so they can issue the receipt.

Peer-to-peer fundraising is a popular way to raise money for charities. You can learn more about Peer To Peer Fundraising 2024 and find opportunities to support causes you care about.

Accessing Receipts Online

Some Goodwill organizations provide online portals where you can access past donation receipts. You may need to create an account or log in to retrieve your receipts.

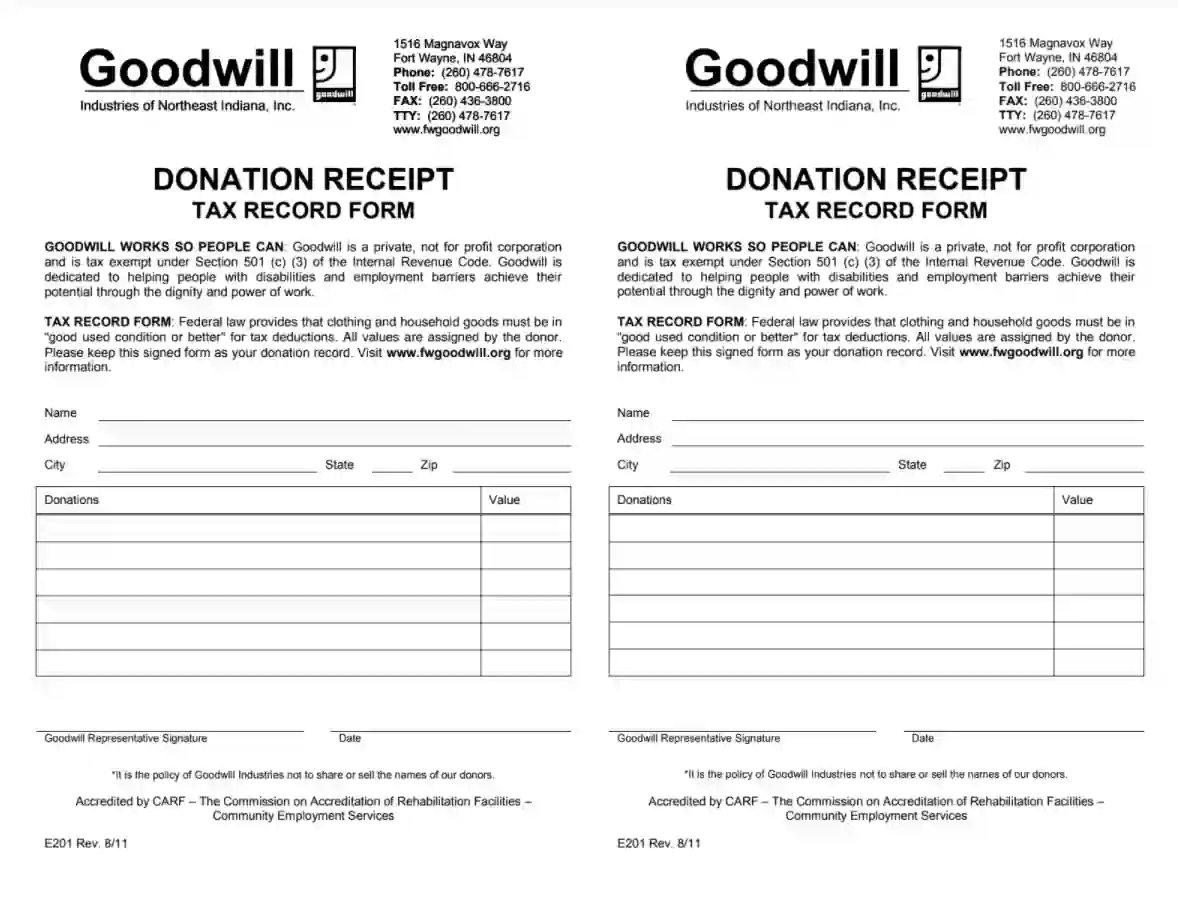

Illustrative Examples of Donation Receipts

Here is a sample table showcasing various donation items and their corresponding information on a donation receipt:

| Donation Item | Estimated Value | Donation Date | Receipt Number |

|---|---|---|---|

| Men’s Suit | $50 | 2024-01-15 | GDR-12345 |

| Dining Table and Chairs (Set of 4) | $200 | 2024-02-20 | GDR-67890 |

| Laptop Computer | $150 | 2024-03-05 | GDR-11122 |

| Books (Collection of 20) | $40 | 2024-04-10 | GDR-33344 |

Additional Considerations for Donation Receipts

Properly managing your donation receipts is crucial for tax purposes and future reference.

Storage and Organization, Amazinggoodwilldonationreceipt 2024

To ensure that your donation receipts are easily accessible, consider these storage tips:

- Dedicated File:Create a separate file for all your donation receipts.

- Digital Organization:Scan or photograph your receipts and store them electronically in a secure location.

- Date-Based Filing:Organize your receipts by donation date for easy retrieval.

If you have a piano you’d like to donate, Donate Piano To Salvation Army 2024 can provide information on how to donate to the Salvation Army. They often accept musical instruments and use them for community programs.

Retention

It’s important to retain your donation receipts for future reference. The IRS recommends keeping records for at least three years from the date you filed your tax return or the date the tax was paid, whichever is later.

Guidelines and Requirements

For specific guidelines and requirements regarding donation receipts, it’s best to consult with a tax professional or the IRS website.

Conclusive Thoughts

Navigating the world of charitable donations and tax deductions can be complex, but understanding the nuances of Goodwill donation receipts in 2024 is crucial. By following the guidelines Artikeld in this guide, you can confidently donate to Goodwill, maximize your tax benefits, and contribute to a cause that makes a real difference in the lives of others.

Common Queries

What if I don’t have a receipt for my donation?

If you’re looking to donate items and need them picked up, you can check out Pick Up My Donation 2024 for a list of organizations that offer pick-up services. This can be a convenient way to donate items you no longer need, and help out a worthy cause.

If you don’t have a receipt, you may still be able to claim a deduction. You can use a written record of your donation, such as a bank statement or a cancelled check, as evidence. It’s important to keep detailed records of your donations for future reference.

How long do I need to keep my donation receipts?

The IRS recommends keeping your donation receipts for at least three years after filing your tax return. This ensures you have documentation in case of an audit.

What if I donate items that are worth more than $500?

For donations valued over $500, you’ll need a formal appraisal from a qualified appraiser. This appraisal will be used to determine the fair market value of the donated items for tax purposes.