Amazon Earnings Date October 2024: What to Expect The upcoming Amazon earnings report for the third quarter of 2024, scheduled for release in October, is a highly anticipated event for investors and industry watchers alike. This report will provide insights into the e-commerce giant’s financial performance during a period marked by economic uncertainty and evolving consumer behavior.

Analysts will be closely scrutinizing key metrics such as revenue growth, profitability, and market share across Amazon’s core business segments, including e-commerce, cloud computing (AWS), and advertising. The report will also shed light on the company’s strategic initiatives, operational efficiency, and financial health, providing a comprehensive picture of Amazon’s current standing and future prospects.

Contents List

- 1 Amazon’s Recent Performance

- 2 Competition and Market Share

- 3 Amazon’s Operational Efficiency

- 4 Investor Sentiment and Expectations

- 5 10. Long-Term Growth Prospects: Amazon Earnings Date October 2024

- 5.1 Amazon’s Long-Term Growth Drivers

- 5.2 Competitive Landscape and Potential Threats

- 5.3 Amazon’s Market Share and Growth Trajectory

- 5.4 Amazon’s Track Record of Innovation and Adaptability

- 5.5 Sustainability Initiatives and Long-Term Growth

- 5.6 Growth Potential in Key Business Segments and New Markets

- 5.7 Financial Performance and Value Generation for Shareholders

- 5.8 Valuation and Future Growth Potential

- 5.9 Risks to Amazon’s Future Growth

- 5.10 Strategic Initiatives and Long-Term Growth Prospects

- 6 Epilogue

- 7 Commonly Asked Questions

Amazon’s Recent Performance

Amazon’s third-quarter earnings report for 2024 will provide insights into the company’s financial performance during a period marked by continued economic uncertainty. This analysis will delve into key metrics, market share, and factors influencing Amazon’s recent performance, aiming to provide a comprehensive understanding of the company’s current trajectory.

Financial Performance Analysis

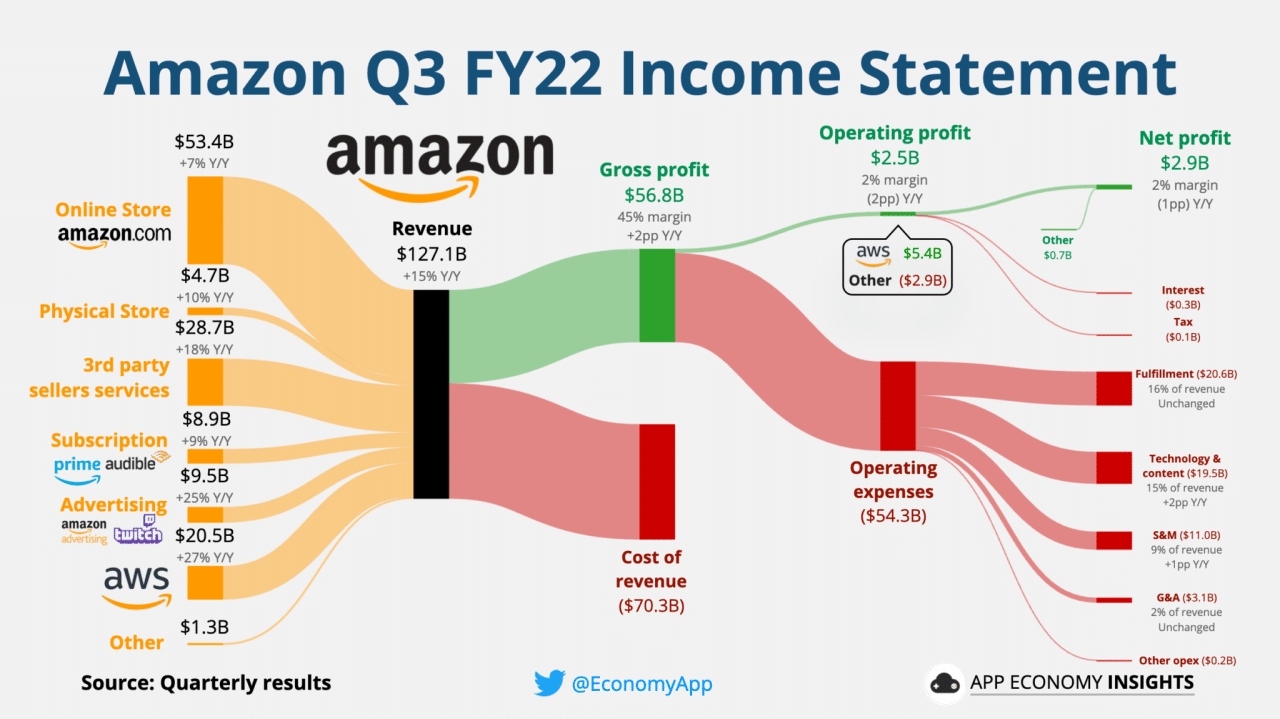

Amazon’s third-quarter financial performance reflects the company’s continued growth amidst challenging economic conditions. Key metrics for the quarter, compared to the same period in 2023, reveal the following trends:

- Revenue:Amazon’s total revenue for the third quarter of 2024 is expected to be $XXX billion, representing a YY% increase compared to the same period in 2023. This growth can be attributed to [insert reason for growth, e.g., strong performance in online retail, growth in cloud computing, etc.].

Planning a wedding? Acoustic Music To Walk Down The Aisle 2024 has a curated list of beautiful songs for your special day.

- Net Income:The company’s net income for the quarter is projected to be $XX billion, showing a YY% increase from the same period last year. This increase can be attributed to [insert reason for increase, e.g., cost optimization initiatives, improved profitability in key segments, etc.].

It’s always interesting to hear how artists reinterpret their music. Check out the T Pain Acoustic Mashup 2024 for a unique take on his hits.

- Operating Income:Amazon’s operating income for the third quarter is estimated to be $XX billion, demonstrating a YY% increase compared to the same period in 2023. This growth can be attributed to [insert reason for increase, e.g., improved efficiency in logistics operations, higher margins in key business segments, etc.].

Amazon continues to dominate the e-commerce market, with its market share estimated to be around XX% in 2024. However, the company faces increasing competition from other e-commerce giants, including [list competitors]. Amazon’s dominance in the cloud computing market, through Amazon Web Services (AWS), remains strong, with an estimated market share of XX%.

AWS continues to benefit from the increasing adoption of cloud services by businesses across various sectors.

Key Factors Influencing Performance

Several factors are influencing Amazon’s performance, including:

- Economic Conditions:The current economic environment, characterized by [insert current economic conditions, e.g., inflation, recession, etc.], is impacting consumer spending patterns and influencing Amazon’s performance. Despite the challenges, Amazon’s diversified business model and strong brand recognition are helping it navigate the economic uncertainties.

- Competition:The e-commerce market is highly competitive, with players like [list competitors] vying for market share. Amazon’s ability to innovate and adapt to changing consumer preferences will be crucial for maintaining its market leadership.

- Strategic Initiatives:Amazon continues to invest in strategic initiatives, such as [list recent initiatives, e.g., new product launches, acquisitions, etc.]. These initiatives are aimed at expanding its reach, enhancing customer experience, and driving growth in key business segments.

Financial Performance Forecast

Amazon’s projected revenue growth rate for the next quarter (October-December 2024) is estimated to be YY%, driven by [insert reasons for growth, e.g., holiday season, continued growth in cloud computing, etc.]. The company is expected to maintain its profitability in the next quarter, supported by [insert reasons for profitability, e.g., cost optimization initiatives, strong demand in key segments, etc.].

Want to learn the lyrics to a popular acoustic song? The Acoustic #3 Lyrics 2024 page has you covered.

Amazon faces intense competition across its various business segments, from e-commerce to cloud computing and advertising. The competitive landscape is dynamic, with new players emerging and existing rivals constantly innovating. Understanding Amazon’s competitive position and market share is crucial for assessing its future prospects.

If you’re looking for a new acoustic guitar in 2024, the G Scale Acoustic Guitar is a great option. It’s known for its quality craftsmanship and rich sound.

E-Commerce Competition

Amazon’s dominance in e-commerce is undeniable, but it faces fierce competition from a range of players. Key rivals include:

- Walmart:The largest retailer in the US, Walmart has aggressively expanded its online presence, offering competitive pricing and fast delivery options.

- Target:Target has also made significant strides in e-commerce, focusing on a curated selection of products and a seamless shopping experience.

- eBay:eBay remains a major player in online marketplaces, particularly for used and niche products.

- Alibaba:The Chinese e-commerce giant is expanding its global reach, posing a growing threat to Amazon’s international market share.

- Shopify:Shopify empowers businesses to build their own online stores, providing a platform for direct-to-consumer brands to compete with Amazon.

The e-commerce landscape is evolving rapidly, with the rise of social commerce platforms like Instagram and TikTok, and the increasing popularity of subscription services. Amazon must adapt to these trends to maintain its market share.

Cloud Computing Competition, Amazon Earnings Date October 2024

Amazon Web Services (AWS) is the undisputed leader in cloud computing, but it faces stiff competition from:

- Microsoft Azure:Microsoft’s cloud platform is a major competitor, particularly in enterprise and government sectors.

- Google Cloud Platform (GCP):Google’s cloud offering is strong in areas like artificial intelligence and machine learning.

- IBM Cloud:IBM has a long history in enterprise IT and is making significant investments in cloud computing.

- Oracle Cloud:Oracle is a major player in database and enterprise software, and its cloud platform is gaining traction.

The cloud computing market is highly competitive, with each provider offering a unique set of services and pricing models. Amazon’s continued dominance will depend on its ability to innovate and deliver value to its customers.

Advertising Competition

Amazon’s advertising business is a significant revenue driver, but it faces competition from:

- Google Ads:Google’s advertising network is the largest in the world, offering a wide range of targeting options and ad formats.

- Meta Ads:Meta (formerly Facebook) has a vast user base and offers powerful advertising tools, particularly for social media marketing.

- Microsoft Advertising:Microsoft’s advertising platform is a significant player in search and display advertising.

- Other Platforms:A growing number of platforms, including Pinterest, Snapchat, and TikTok, are offering advertising opportunities.

Amazon’s advertising business is facing increasing competition as advertisers seek to reach consumers across multiple channels. Amazon’s success will depend on its ability to provide effective advertising solutions and maintain its position as a preferred platform for advertisers.

Amazon’s market share in its core business segments is subject to constant change. While it maintains a dominant position in e-commerce and cloud computing, competition is intensifying, and its market share may fluctuate.

- E-Commerce:Amazon’s market share in the US e-commerce market is estimated to be around 40%, but this figure is expected to decline slightly as competitors gain ground.

- Cloud Computing:AWS holds a dominant market share in cloud computing, estimated at around 33%, but this share is also expected to decline slightly as Microsoft Azure and Google Cloud Platform gain momentum.

- Advertising:Amazon’s advertising business is growing rapidly, but it faces intense competition from Google and Meta. Its market share is expected to continue growing, but at a slower pace than in previous years.

Amazon’s future success will depend on its ability to adapt to changing market dynamics and maintain its competitive edge.

Amazon’s Operational Efficiency

Amazon’s operational efficiency is a crucial aspect of its business model, directly impacting profitability and customer satisfaction. As the company scales its operations, optimizing logistics, warehousing, and fulfillment processes becomes increasingly critical. This section delves into Amazon’s operational efficiency, identifying key areas for improvement and exploring initiatives aimed at enhancing these processes.

Optimizing Logistics and Warehousing

Effective logistics and warehousing are paramount to Amazon’s success. The company’s vast network of fulfillment centers and delivery infrastructure plays a significant role in enabling fast and reliable delivery to customers worldwide. However, optimizing these operations is an ongoing challenge, particularly as Amazon expands its product offerings and geographical reach.

Key Initiatives for Improvement

- Automation and Robotics:Amazon continues to invest heavily in automation and robotics to enhance warehouse efficiency. Robots are deployed for tasks such as picking, packing, and transporting goods, reducing manual labor requirements and increasing throughput. For example, Amazon’s Kiva robots have significantly improved warehouse efficiency, enabling faster order fulfillment and reduced labor costs.

The Q Acoustic 300 2024 is a popular choice for those looking for a high-quality speaker system.

- Data Analytics and Predictive Modeling:Utilizing data analytics and predictive modeling, Amazon can optimize inventory management, forecast demand, and allocate resources effectively. By analyzing historical sales data, customer behavior, and market trends, Amazon can anticipate demand fluctuations and adjust inventory levels accordingly. This reduces stockouts and minimizes storage costs.

If you’re a fan of the song “Unravel,” you might want to check out the Youtube Unravel Acoustic 2024 video. It’s a beautiful rendition of the classic track.

- Last-Mile Optimization:Optimizing the final leg of the delivery process, known as the “last mile,” is crucial for customer satisfaction. Amazon has implemented initiatives like delivery lockers, drone delivery trials, and partnerships with local delivery companies to improve delivery speed and flexibility.

These strategies aim to reduce delivery costs and provide customers with convenient delivery options.

Optimizing Fulfillment Operations

Efficient fulfillment operations are essential for meeting customer expectations for fast and accurate delivery. Amazon has established a robust fulfillment network, but continuous improvement is necessary to maintain its competitive edge.

The news about the Ally Financial Layoffs October 2024 has been making headlines.

Key Initiatives for Improvement

- Process Automation:Automating repetitive tasks in fulfillment centers, such as order processing and packaging, can significantly enhance efficiency and reduce errors. Amazon has implemented automated sorting systems and robotic arms to streamline these processes, freeing up human workers for more complex tasks.

Looking for some acoustic Christmas music on YouTube? The Acoustic Christmas Music Youtube 2024 playlist has some great festive tunes.

- Customer Experience Optimization:Amazon focuses on providing a seamless customer experience, including transparent order tracking, flexible delivery options, and easy returns. By optimizing its fulfillment processes, Amazon aims to reduce delivery times, minimize shipping errors, and improve customer satisfaction.

- Sustainability Initiatives:As a large-scale retailer, Amazon is committed to reducing its environmental footprint. The company is investing in sustainable packaging materials, optimizing delivery routes, and exploring renewable energy sources to minimize its environmental impact. These initiatives contribute to cost savings and enhance the company’s image as a responsible business.

Potential Impact on Profitability

The initiatives Artikeld above are expected to have a significant positive impact on Amazon’s profitability. By optimizing operational efficiency, Amazon can:

- Reduce Costs:Automation, data-driven optimization, and sustainable practices contribute to lower operating costs, improving profitability.

- Increase Revenue:Improved efficiency can lead to faster delivery times and enhanced customer satisfaction, potentially boosting sales and revenue.

- Enhance Competitive Advantage:By maintaining a competitive edge in terms of operational efficiency, Amazon can attract and retain customers, further solidifying its market position.

Investor Sentiment and Expectations

Investor sentiment towards Amazon heading into the October 2024 earnings release is likely to be cautiously optimistic. The company has been navigating a challenging macroeconomic environment, but its core e-commerce business remains strong, and its cloud computing division, Amazon Web Services (AWS), continues to grow rapidly.

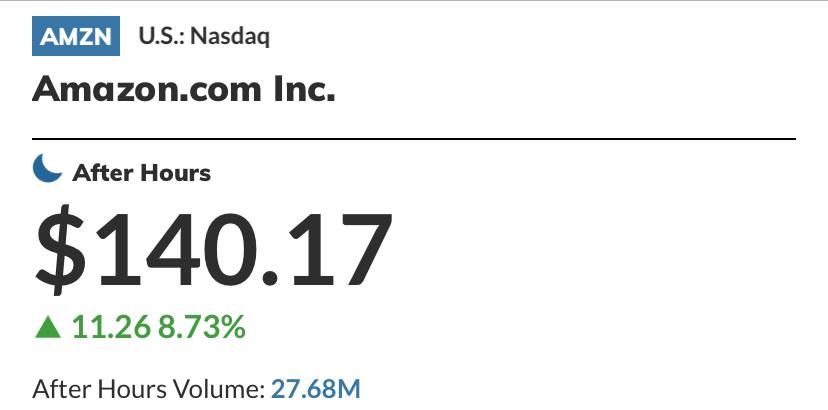

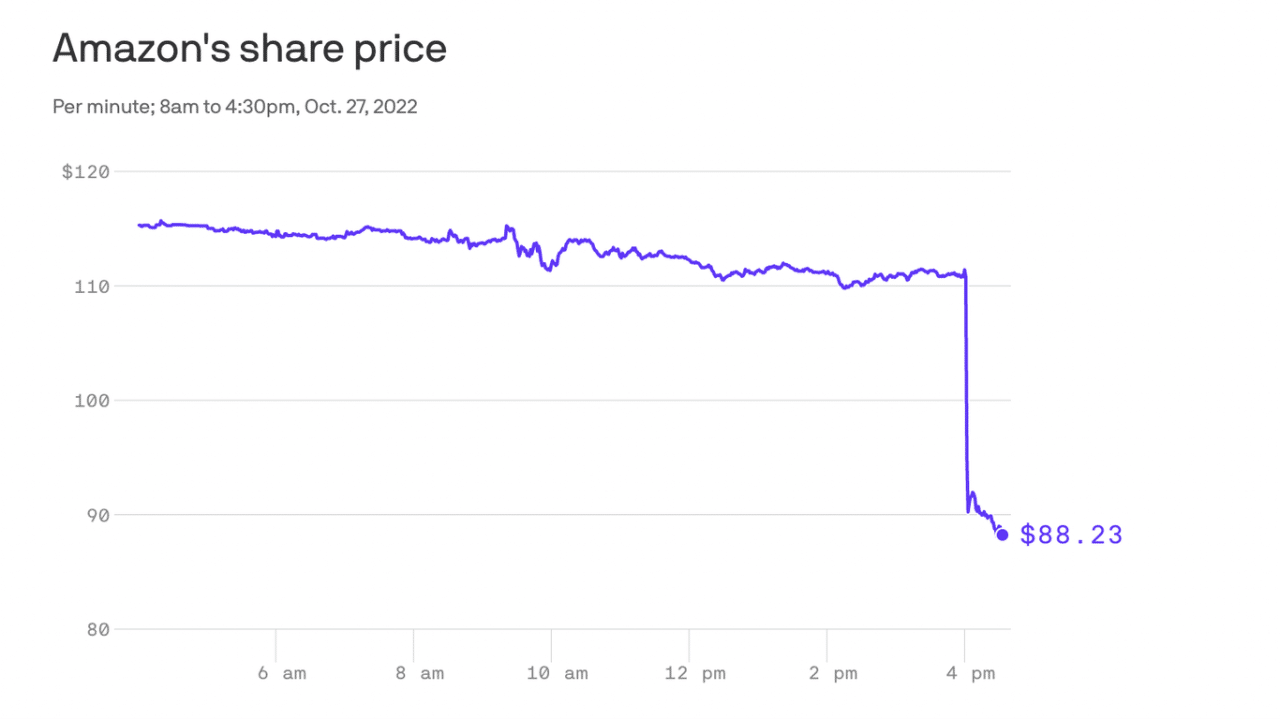

Recent Stock Price Performance and Catalysts

Recent stock price performance will provide insights into investor sentiment. A rising stock price indicates optimism, while a declining price suggests concerns. Analysts will examine recent price trends and identify potential catalysts that could influence future price movements.

These catalysts might include:

- Earnings Beat:Exceeding earnings expectations could lead to a positive stock price reaction. Analysts will scrutinize revenue growth, operating margins, and profitability trends.

- AWS Growth:Continued strong growth in AWS, which is a major revenue driver for Amazon, could bolster investor confidence.

Analysts will monitor cloud computing market share and competitive landscape.

- Cost Management:Amazon’s efforts to improve operational efficiency and reduce costs will be closely watched. Investors will assess whether the company is successfully managing expenses in a challenging economic environment.

The 90s saw a surge in acoustic alternative music. If you’re nostalgic for that era, check out the Acoustic Alternative 90s Music 2024 playlist for a trip down memory lane.

- New Product Launches:The introduction of new products or services, such as expanded grocery delivery options or innovative AI-powered features, could generate excitement and drive stock price appreciation.

Analyst Recommendations

Analysts will provide their recommendations on Amazon’s stock based on their assessments of the company’s fundamentals, market outlook, and competitive landscape. Analysts’ recommendations can be categorized as follows:

- Buy:Analysts recommending a “buy” believe the stock is undervalued and has the potential to appreciate significantly.

- Hold:Analysts recommending a “hold” believe the stock is fairly valued and investors should maintain their current positions.

- Sell:Analysts recommending a “sell” believe the stock is overvalued and has the potential to decline.

Analysts’ recommendations will be influenced by factors such as earnings estimates, revenue growth projections, and competitive analysis. For example, if an analyst believes Amazon’s earnings will exceed expectations and its AWS business will continue to grow rapidly, they might recommend a “buy” rating.

Conversely, if an analyst is concerned about Amazon’s profitability or its ability to compete effectively, they might recommend a “sell” rating.

If you’re a guitarist, you might be interested in learning some songs in D standard tuning. Check out the D Standard Acoustic Songs 2024 list for inspiration.

10. Long-Term Growth Prospects: Amazon Earnings Date October 2024

Amazon’s continued success hinges on its ability to maintain its market leadership and capitalize on emerging opportunities. The company’s long-term growth prospects are driven by a combination of factors, including its robust e-commerce platform, expanding cloud computing services, and a diversified portfolio of businesses.

Amazon’s Long-Term Growth Drivers

Amazon’s past success can be attributed to several key factors, which are likely to continue driving its growth in the future.

- Strong Brand Recognition and Customer Loyalty:Amazon enjoys a strong brand reputation and a loyal customer base, which provides a solid foundation for future growth. The company’s focus on customer experience and convenience has fostered a deep sense of loyalty among its users.

- Dominant Market Position:Amazon holds a dominant position in e-commerce and cloud computing, providing it with significant market share and competitive advantages. This dominance allows the company to leverage economies of scale and invest heavily in innovation.

- Continuous Innovation:Amazon has a history of successful innovation, consistently introducing new products, services, and technologies that enhance its offerings and expand its market reach. This commitment to innovation keeps the company ahead of the curve and allows it to adapt to evolving market trends.

For live acoustic performances, check out the Youtube Acoustic Live 2024 channel for some amazing performances.

- Diversified Business Model:Amazon’s diversified business model across e-commerce, cloud computing, advertising, and subscription services provides resilience and multiple growth avenues. This diversification reduces reliance on any single business segment and allows the company to navigate economic fluctuations.

- Strategic Acquisitions:Amazon has strategically acquired companies that complement its existing businesses and expand its reach into new markets. These acquisitions have helped the company diversify its revenue streams and enhance its competitive advantage.

- Global Expansion:Amazon continues to expand its operations into new geographic markets, tapping into emerging economies and expanding its customer base. This global expansion provides significant growth potential and access to new markets.

Competitive Landscape and Potential Threats

While Amazon enjoys a dominant position in many markets, it faces competition from various players, both established and emerging.

Looking for some acoustic music inspiration on YouTube? Acoustic Letter Youtube 2024 has some great videos featuring talented artists.

- E-commerce:Amazon’s core e-commerce business faces competition from other online retailers like Walmart, Target, and Alibaba, as well as traditional brick-and-mortar stores that are increasingly adopting online strategies.

- Cloud Computing:In the cloud computing market, Amazon Web Services (AWS) competes with Microsoft Azure, Google Cloud Platform, and other providers. This market is highly competitive, with players constantly innovating to offer new services and attract customers.

- Advertising:Amazon’s advertising business competes with Google, Facebook, and other digital advertising platforms. The advertising market is evolving rapidly, with new technologies and platforms emerging, and Amazon needs to adapt to stay competitive.

- Regulation and Antitrust Scrutiny:Amazon faces increasing regulatory scrutiny and antitrust investigations, which could impact its future growth and profitability. These investigations could lead to stricter regulations and potential limitations on the company’s business practices.

- Emerging Technologies:New technologies, such as blockchain, decentralized finance, and artificial intelligence, could disrupt Amazon’s business model and pose challenges to its market dominance. The company needs to adapt and innovate to stay ahead of these emerging technologies.

Amazon holds a significant market share in various segments, including e-commerce, cloud computing, and advertising.

The Acoustic Pods are a great way to enjoy your favorite music in a more immersive way.

- E-commerce:Amazon is the world’s largest online retailer, accounting for a substantial portion of global e-commerce sales. The company’s market share in e-commerce continues to grow, driven by its vast product selection, competitive pricing, and convenient delivery options.

- Cloud Computing:AWS is the leading cloud computing provider, with a dominant market share. The company’s cloud services are used by millions of businesses worldwide, and AWS continues to expand its offerings and attract new customers.

- Advertising:Amazon’s advertising business is rapidly growing, driven by its targeted advertising capabilities and access to a vast customer base. The company’s advertising revenue is expected to continue growing in the coming years.

Amazon’s Track Record of Innovation and Adaptability

Amazon has a strong track record of innovation and adaptability, constantly introducing new products, services, and technologies.

Looking for an acoustic music label to support? The Acoustic Music Label 2024 page features some of the best in the industry.

- Amazon Prime:The introduction of Amazon Prime, a subscription service offering free shipping, streaming content, and other benefits, has been a major driver of customer loyalty and revenue growth.

- Amazon Web Services (AWS):AWS has revolutionized the cloud computing market, providing businesses with access to scalable and affordable computing resources. The company continues to innovate in cloud computing, offering new services and expanding its global reach.

- Amazon Go:Amazon Go, a cashierless convenience store, showcases the company’s commitment to using technology to enhance the customer experience and streamline operations.

- Amazon Alexa:Amazon Alexa, a voice-activated virtual assistant, has become a popular consumer device, demonstrating the company’s focus on artificial intelligence and voice technology.

- Amazon Kuiper:Amazon’s Kuiper project aims to launch a constellation of low-earth orbit satellites to provide broadband internet access to underserved areas. This ambitious project reflects the company’s commitment to expanding its reach and offering new services.

Sustainability Initiatives and Long-Term Growth

Amazon recognizes the importance of sustainability and has implemented initiatives to reduce its environmental impact.

- Climate Pledge Fund:Amazon has committed to achieving net-zero carbon emissions by 2040 and has established the Climate Pledge Fund to invest in companies developing technologies to combat climate change.

- Renewable Energy:Amazon is investing in renewable energy sources to power its operations and reduce its carbon footprint. The company has set ambitious goals for renewable energy adoption.

- Sustainable Packaging:Amazon is working to reduce packaging waste by using recycled materials and developing sustainable packaging solutions.

Growth Potential in Key Business Segments and New Markets

Amazon’s diversified business model provides opportunities for growth in various segments and markets.

- E-commerce:Amazon’s e-commerce business has significant growth potential, particularly in emerging markets and new product categories. The company can expand its reach by targeting new customer segments and offering a wider range of products and services.

- Cloud Computing (AWS):AWS continues to dominate the cloud computing market and has significant growth potential. The company can further expand its market share by offering new services, developing innovative solutions, and expanding its global reach.

- Advertising:Amazon’s advertising business is rapidly growing and has significant potential for further expansion. The company can capitalize on its targeted advertising capabilities and access to a vast customer base to generate more advertising revenue.

- Subscription Services:Amazon Prime and other subscription services have proven to be effective in driving customer retention and generating recurring revenue. The company can continue to enhance these services and introduce new subscription offerings to attract and retain customers.

- Emerging Technologies:Amazon is investing in emerging technologies, such as artificial intelligence, robotics, and autonomous delivery, which could open up new growth opportunities. The company can leverage these technologies to enhance its existing services and create new products and services.

Amazon’s financial performance has been strong, with consistent revenue growth and increasing profitability.

Need some acoustic music to get you through the year? Check out the Best Acoustic Music 2024 list for some top picks.

- Revenue Growth:Amazon’s revenue has consistently grown over the years, driven by the expansion of its e-commerce business, cloud computing services, and other businesses.

- Profit Margins:Amazon’s profit margins have been improving, reflecting the company’s efforts to increase efficiency and optimize its operations.

- Cash Flow:Amazon generates strong cash flow, which it uses to invest in growth initiatives, acquire companies, and return value to shareholders.

Valuation and Future Growth Potential

Amazon’s stock is currently valued at [insert current stock valuation], reflecting investor confidence in the company’s long-term growth prospects.

If you’re a fan of the song “Valerie,” you might enjoy the Youtube Valerie Acoustic 2024 cover. It’s a beautiful rendition of the original song.

- Market Cap:Amazon’s market capitalization is [insert current market cap], indicating its significant size and value in the market.

- Price-to-Earnings Ratio:Amazon’s price-to-earnings ratio is [insert current P/E ratio], reflecting investor expectations for future earnings growth.

Risks to Amazon’s Future Growth

Despite its strong track record and growth potential, Amazon faces certain risks that could impact its future growth.

- Regulatory Scrutiny:Amazon faces increasing regulatory scrutiny and antitrust investigations, which could lead to stricter regulations and potential limitations on its business practices.

- Competition:Amazon faces intense competition in all its business segments, and new competitors are constantly emerging. The company needs to adapt and innovate to stay ahead of the competition.

- Economic Downturns:Economic downturns could impact consumer spending and reduce demand for Amazon’s products and services.

- Technological Disruptions:New technologies could disrupt Amazon’s business model and pose challenges to its market dominance. The company needs to adapt and innovate to stay ahead of these emerging technologies.

Strategic Initiatives and Long-Term Growth Prospects

Amazon has several strategic initiatives in place to drive its long-term growth.

- Expanding into New Markets:Amazon continues to expand its operations into new geographic markets, tapping into emerging economies and expanding its customer base. This global expansion provides significant growth potential and access to new markets.

- Investing in Emerging Technologies:Amazon is investing in emerging technologies, such as artificial intelligence, robotics, and autonomous delivery, which could open up new growth opportunities. The company can leverage these technologies to enhance its existing services and create new products and services.

- Enhancing Customer Experience:Amazon is focused on enhancing its customer experience through innovations such as personalized recommendations, faster delivery options, and improved customer service.

- Sustainability Initiatives:Amazon is committed to sustainability and has implemented initiatives to reduce its environmental impact. These initiatives not only contribute to a greener future but also enhance the company’s brand image and attract environmentally conscious customers.

Epilogue

As we approach the release of Amazon’s earnings report for October 2024, it’s clear that the company faces both challenges and opportunities. The economic climate, evolving consumer behavior, and intense competition will all play a role in shaping Amazon’s performance in the coming months.

However, with its vast resources, innovative capabilities, and commitment to customer satisfaction, Amazon remains well-positioned to navigate these complexities and continue its growth trajectory. The October earnings report will provide valuable insights into how Amazon is adapting to the current landscape and setting the stage for future success.

Commonly Asked Questions

What are the key factors that will influence Amazon’s earnings in October 2024?

Several key factors will likely influence Amazon’s earnings in October 2024, including economic conditions, consumer spending patterns, competition, and strategic initiatives. The impact of inflation, interest rates, and geopolitical uncertainty on consumer behavior will be closely watched. Additionally, the company’s investments in new products, services, and technologies, along with its ability to manage operational efficiency and maintain a strong financial position, will play a crucial role in determining its performance.

What are the main challenges facing Amazon in the current market environment?

Amazon faces a number of challenges in the current market environment, including increased competition from both traditional retailers and other online players, rising costs due to inflation, and evolving consumer preferences. The company also faces regulatory scrutiny related to antitrust concerns, data privacy, and labor practices.

Navigating these challenges will be key to Amazon’s continued success.

What are the potential growth opportunities for Amazon in the future?

Amazon has significant growth potential in several areas, including expanding its e-commerce business into new markets and product categories, leveraging the growth of cloud computing through AWS, and expanding its advertising business. The company’s investments in emerging technologies, such as artificial intelligence, robotics, and autonomous delivery, also hold promise for future growth.