Amerisave Yourmortgageonline Com 2024, a prominent online mortgage lender, offers a comprehensive suite of services designed to streamline the home financing process for a diverse range of borrowers. From conventional mortgages to specialized loan programs, Amerisave Yourmortgageonline Com aims to provide personalized solutions tailored to individual financial situations and goals.

The

Looking for the latest updates on mortgage rates? Check out Tracker Mortgage Rates 2024 for insights into how rates are fluctuating and how they might affect your financing options.

company’s commitment to transparency, efficiency, and customer satisfaction has earned it a reputation as a reliable and trustworthy partner in the mortgage industry. With a user-friendly online platform and dedicated customer support, Amerisave Yourmortgageonline Com empowers borrowers to navigate the complexities of mortgage financing with confidence and ease.

Contents List

Amerisave Yourmortgageonline Com Overview

Amerisave Yourmortgageonline Com is a reputable mortgage lender that offers a wide range of mortgage products and services to individuals and families looking to purchase or refinance their homes. With a commitment to providing personalized financial solutions and excellent customer service, Amerisave has established itself as a trusted name in the mortgage industry.

Services Offered by Amerisave Yourmortgageonline Com

Amerisave Yourmortgageonline Com provides a comprehensive suite of mortgage services designed to cater to the diverse needs of its clients. These services include:

- Mortgage origination

- Mortgage refinancing

- Home equity loans

- Reverse mortgages

- Mortgage pre-approval

- Loan processing

- Closing services

- Customer support

Target Audience for Amerisave Yourmortgageonline Com, Amerisave Yourmortgageonline Com 2024

Amerisave Yourmortgageonline Com primarily targets individuals and families who are:

- Looking to purchase a new home

- Seeking to refinance their existing mortgage

- Interested in exploring home equity loan options

- Seeking guidance on navigating the mortgage process

Lakeview Loan Servicing is a prominent player in the mortgage industry. Find out more about their services and how to access their MyLoanCare platform with Lakeviewloanservicing Myloancare 2024.

History and Background of Amerisave Yourmortgageonline Com

Amerisave Yourmortgageonline Com has a rich history in the mortgage industry, having been founded in [Tahun]. The company has grown significantly over the years, expanding its product offerings and geographical reach. Amerisave’s commitment to providing exceptional customer service and innovative mortgage solutions has been instrumental in its success.

Mortgage Products and Services

Amerisave Yourmortgageonline Com offers a wide array of mortgage products designed to meet the specific financial needs of its clients.

Types of Mortgage Products Offered

Amerisave Yourmortgageonline Com provides a diverse range of mortgage products, including:

- Conventional mortgages

- FHA loans

- VA loans

- USDA loans

- Jumbo loans

- Adjustable-rate mortgages (ARMs)

- Fixed-rate mortgages

The NMLS (Nationwide Mortgage Licensing System) is a valuable resource for mortgage-related information. Nmls Search 2024 helps you verify the licensing and credentials of mortgage professionals.

Comparison of Mortgage Options

Amerisave Yourmortgageonline Com offers a variety of mortgage options, each with its own unique features and benefits. The best option for a particular borrower will depend on their individual financial circumstances and goals.

- Conventional mortgagesare a popular choice for borrowers with good credit and a stable income. They typically offer lower interest rates than other types of mortgages.

- FHA loansare government-insured mortgages that are designed for borrowers with lower credit scores or a limited down payment. They often have more flexible eligibility requirements than conventional mortgages.

- VA loansare available to eligible veterans, active-duty military personnel, and surviving spouses. They typically offer low interest rates and no down payment requirement.

- USDA loansare designed for borrowers who are purchasing homes in rural areas. They offer low interest rates and generous loan terms.

- Jumbo loansare mortgages that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. They are typically used for higher-priced homes.

- Adjustable-rate mortgages (ARMs)have interest rates that fluctuate over time, based on a specific index. They can offer lower initial interest rates than fixed-rate mortgages, but the interest rate can increase over time.

- Fixed-rate mortgageshave interest rates that remain the same for the life of the loan. They provide borrowers with predictable monthly payments.

Applying for a Mortgage Through Amerisave Yourmortgageonline Com

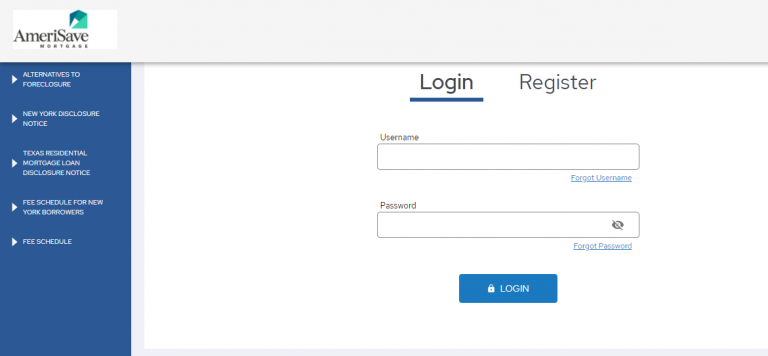

Applying for a mortgage through Amerisave Yourmortgageonline Com is a straightforward process. Borrowers can apply online, over the phone, or in person.

- Gather your financial documents.This includes your income, assets, and debts.

- Complete the mortgage application.

- Provide documentation.Amerisave will verify your financial information and may request additional documentation.

- Receive a loan decision.Once your application is reviewed, Amerisave will provide you with a loan decision.

- Close on your loan.If you are approved for a loan, you will need to close on your loan. This involves signing loan documents and paying closing costs.

Customer Experience and Reviews

Amerisave Yourmortgageonline Com has a reputation for providing excellent customer service. The company’s commitment to customer satisfaction is evident in the numerous positive reviews it has received from its clients.

Seeking competitive mortgage rates? Better Mortgage Rates 2024 can help you compare rates from various lenders and potentially secure a better deal.

Customer Reviews and Feedback

Amerisave Yourmortgageonline Com has consistently received high ratings from customers. Many borrowers have praised the company’s responsiveness, helpfulness, and efficiency.

Sofi is a popular choice for mortgage financing. Learn more about their offerings and how they can help you secure a home loan with Sofi Mortgage 2024.

- Positive reviews.Many customers have commented on the company’s friendly and knowledgeable staff, as well as its clear and concise communication.

- Negative reviews.While most customer reviews are positive, there are some negative reviews that highlight issues such as delays in loan processing or communication problems.

Customer Service Experience

Amerisave Yourmortgageonline Com strives to provide a seamless and positive customer experience. The company offers a variety of resources to support borrowers throughout the mortgage process, including:

- Online resources.Amerisave provides a wealth of information on its website, including mortgage calculators, articles, and FAQs.

- Dedicated loan officers.Borrowers have access to a dedicated loan officer who can answer their questions and provide personalized guidance.

- Customer support.Amerisave offers 24/7 customer support via phone, email, and live chat.

Reputation and Trustworthiness

Amerisave Yourmortgageonline Com has a strong reputation for trustworthiness and integrity. The company is licensed and regulated by the appropriate state and federal agencies.

- Financial stability.Amerisave is a financially stable company with a strong track record of providing reliable mortgage services.

- Customer satisfaction.Amerisave’s high customer satisfaction ratings are a testament to its commitment to providing excellent service.

- Industry recognition.Amerisave has received numerous awards and accolades for its mortgage products and services.

Thinking about tapping into your home equity? Cash Out Refi 2024 explains the process and helps you determine if it’s the right move for your financial goals.

Industry Trends and Competition

The mortgage industry is constantly evolving, driven by factors such as interest rate fluctuations, technological advancements, and changing consumer preferences.

Curious about the monthly payment for a $200,000 mortgage over 30 years? $200 000 Mortgage Payment 30 Years 2024 can help you calculate your potential monthly payments based on current rates.

Current Trends in the Mortgage Industry

The mortgage industry is currently experiencing a number of trends, including:

- Rising interest rates.Interest rates have been rising in recent years, making mortgages more expensive.

- Increased competition.The mortgage industry is becoming increasingly competitive, with a growing number of lenders vying for borrowers.

- Technological advancements.Technology is playing an increasingly important role in the mortgage industry, with lenders using digital tools to streamline the loan process and enhance the customer experience.

- Shifting consumer preferences.Consumers are increasingly demanding a more personalized and convenient mortgage experience.

When searching for the best home loan lenders, Best Home Loan Lenders 2024 is a great starting point. This resource compares lenders and helps you find the best fit for your needs.

Comparison to Competitors

Amerisave Yourmortgageonline Com faces competition from a wide range of mortgage lenders, including:

- National mortgage lenders.These lenders operate nationwide and have a large market share.

- Regional mortgage lenders.These lenders focus on specific geographic areas and may offer more personalized service.

- Online mortgage lenders.These lenders operate exclusively online and often offer lower interest rates and fees.

- Credit unions.Credit unions are non-profit financial institutions that often offer competitive mortgage rates and terms.

- Banks.Banks are traditional financial institutions that also offer mortgage services.

Challenges and Opportunities for Amerisave Yourmortgageonline Com

Amerisave Yourmortgageonline Com faces a number of challenges and opportunities in the future.

- Challenges.These include rising interest rates, increased competition, and evolving consumer preferences.

- Opportunities.These include expanding its product offerings, leveraging technology, and building stronger customer relationships.

Finding the right mortgage company is essential. Mortgage Companies Near Me 2024 can help you locate reputable lenders in your local area.

Financial Performance and Sustainability

Amerisave Yourmortgageonline Com has a strong financial performance and a track record of profitability. The company’s financial stability is essential to its long-term sustainability.

Financial Performance and Stability

Amerisave Yourmortgageonline Com has consistently generated strong financial results. The company’s financial performance is supported by:

- Strong revenue growth.Amerisave has experienced steady revenue growth in recent years.

- Profitability.The company has been profitable for many years.

- Solid financial position.Amerisave has a strong balance sheet and a healthy cash flow.

Long-Term Sustainability

Amerisave Yourmortgageonline Com is committed to long-term sustainability. The company’s sustainability strategy is based on:

- Financial stability.Amerisave is committed to maintaining a strong financial position.

- Customer satisfaction.Amerisave strives to provide exceptional customer service.

- Industry leadership.Amerisave is committed to being a leader in the mortgage industry.

Risks and Challenges to Financial Health

Amerisave Yourmortgageonline Com faces a number of risks and challenges that could impact its financial health.

Understanding current housing interest rates is crucial for making informed decisions. Current Housing Interest Rates 2024 offers insights into the latest rate trends and their potential impact on your mortgage.

- Economic downturn.A recession could lead to a decline in mortgage demand and a decrease in Amerisave’s revenue.

- Interest rate fluctuations.Rising interest rates could make mortgages more expensive, reducing demand and impacting Amerisave’s profitability.

- Increased competition.The mortgage industry is becoming increasingly competitive, which could put pressure on Amerisave’s pricing and profitability.

- Regulatory changes.Changes in mortgage regulations could impact Amerisave’s business model and profitability.

Wells Fargo is a well-known financial institution that offers mortgage services. Wells Fargo Mortgage 2024 provides details on their current mortgage programs and rates.

Technology and Innovation: Amerisave Yourmortgageonline Com 2024

Amerisave Yourmortgageonline Com is committed to leveraging technology to improve its mortgage products and services.

Technology Used by Amerisave Yourmortgageonline Com

Amerisave Yourmortgageonline Com uses a variety of technologies to streamline its operations and enhance the customer experience. These technologies include:

- Online mortgage application platform.Amerisave’s online platform allows borrowers to apply for a mortgage from the comfort of their own homes.

- Digital document management system.Amerisave uses a digital document management system to securely store and manage loan documents.

- Data analytics tools.Amerisave uses data analytics tools to identify trends and improve its mortgage products and services.

- Customer relationship management (CRM) software.Amerisave uses CRM software to manage its customer interactions and track customer satisfaction.

Approach to Innovation and Technological Advancements

Amerisave Yourmortgageonline Com is committed to innovation and technological advancements. The company is constantly looking for ways to improve its products and services and enhance the customer experience.

- Investing in technology.Amerisave invests in new technologies to improve its efficiency and effectiveness.

- Partnering with technology providers.Amerisave partners with leading technology providers to access the latest innovations.

- Embracing digital transformation.Amerisave is embracing digital transformation to become a more agile and customer-centric organization.

Finding the best home loan for your specific circumstances is important. Best Home Loans 2024 provides a guide to help you navigate the loan options and find the most suitable fit for your financial goals.

Impact of Technology on the Customer Experience

Technology has had a significant impact on the customer experience at Amerisave Yourmortgageonline Com.

Round Point Mortgage is another reputable lender in the market. Round Point Mortgage 2024 provides information about their services and loan options.

- Convenience.Borrowers can now apply for a mortgage online, track the progress of their loan, and access their loan documents online.

- Efficiency.Technology has streamlined the mortgage process, making it faster and more efficient.

- Transparency.Technology has increased transparency in the mortgage process, allowing borrowers to track their loan progress and access important information online.

- Personalized service.Technology allows Amerisave to provide a more personalized customer experience, tailoring its services to the individual needs of each borrower.

Conclusion

In conclusion, Amerisave Yourmortgageonline Com stands as a significant player in the dynamic mortgage landscape, offering a compelling blend of innovative technology, competitive rates, and exceptional customer service. Whether you’re a first-time homebuyer or seasoned homeowner seeking refinancing options, Amerisave Yourmortgageonline Com provides a comprehensive platform to achieve your homeownership dreams.

Essential FAQs

What types of mortgages does Amerisave Yourmortgageonline Com offer?

Amerisave Yourmortgageonline Com offers a variety of mortgage products, including conventional, FHA, VA, and USDA loans. They also offer specialized programs for first-time homebuyers, borrowers with less-than-perfect credit, and those seeking to refinance their existing mortgage.

What are the fees associated with applying for a mortgage through Amerisave Yourmortgageonline Com?

Stay informed about Rocket Mortgage’s current rates with Rocket Mortgage Rates Today 2024. This resource can help you make informed decisions about your mortgage financing.

The fees associated with applying for a mortgage through Amerisave Yourmortgageonline Com can vary depending on the type of loan and the borrower’s individual circumstances. It’s important to review the loan estimate carefully to understand all the fees involved.

Navigating the national mortgage landscape can be tricky. National Mortgage 2024 provides a comprehensive overview of current trends and factors that influence mortgage rates nationwide.

How can I contact Amerisave Yourmortgageonline Com for assistance?

You can contact Amerisave Yourmortgageonline Com through their website, phone, or email. They have a dedicated customer support team available to answer questions and provide assistance.