An Annuity Is 2024: A Guide to Retirement Income, is your comprehensive guide to understanding annuities in today’s economic landscape. Annuities, often considered a cornerstone of retirement planning, offer guaranteed income streams, tax deferral, and potential for growth. But in 2024, with a shifting economic climate and evolving regulations, it’s more crucial than ever to navigate the nuances of annuity investments.

Glovo offers a variety of payment options for your convenience. Glovo app payment methods and security features explains the different payment methods available, including credit cards, debit cards, and digital wallets. You can also learn about the security measures implemented to protect your transactions.

This guide will delve into the intricacies of annuities, exploring their features, benefits, and considerations for individuals seeking secure retirement income.

Wondering if Glovo is available in your city or country? Is Glovo app available in my city or country provides information on the app’s global coverage. You can easily check if Glovo is available in your area and start enjoying its services.

We’ll examine the different types of annuities, from fixed to variable, and explore their advantages and disadvantages. You’ll discover how annuities can fit into your overall financial strategy, whether you’re nearing retirement or just starting to save. We’ll also analyze the potential impact of current economic trends on annuity investments and provide insights into choosing the right annuity for your unique needs and goals.

Stay organized and productive with Google Tasks 2024: A Comprehensive Guide for Productivity. This guide will help you master Google Tasks, from creating and managing tasks to setting reminders and collaborating with others.

Contents List

What is an Annuity?: An Annuity Is 2024

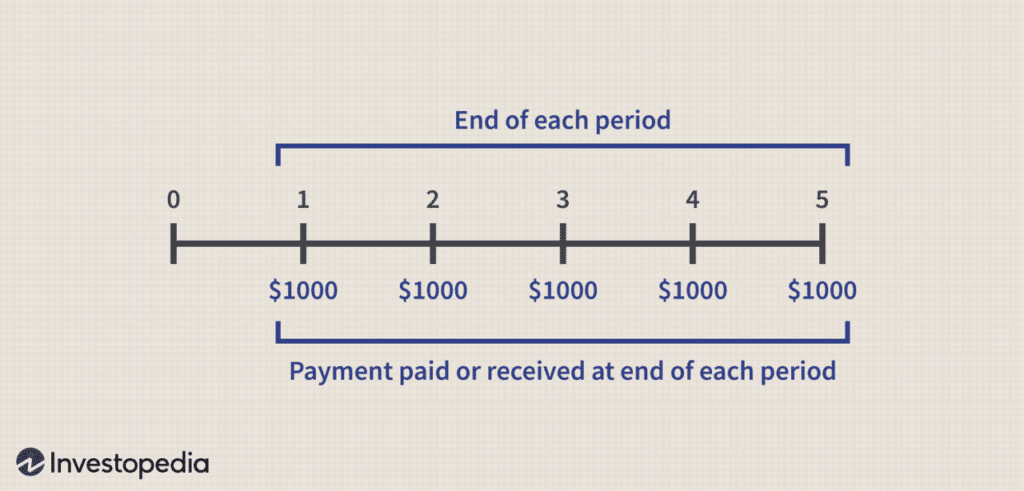

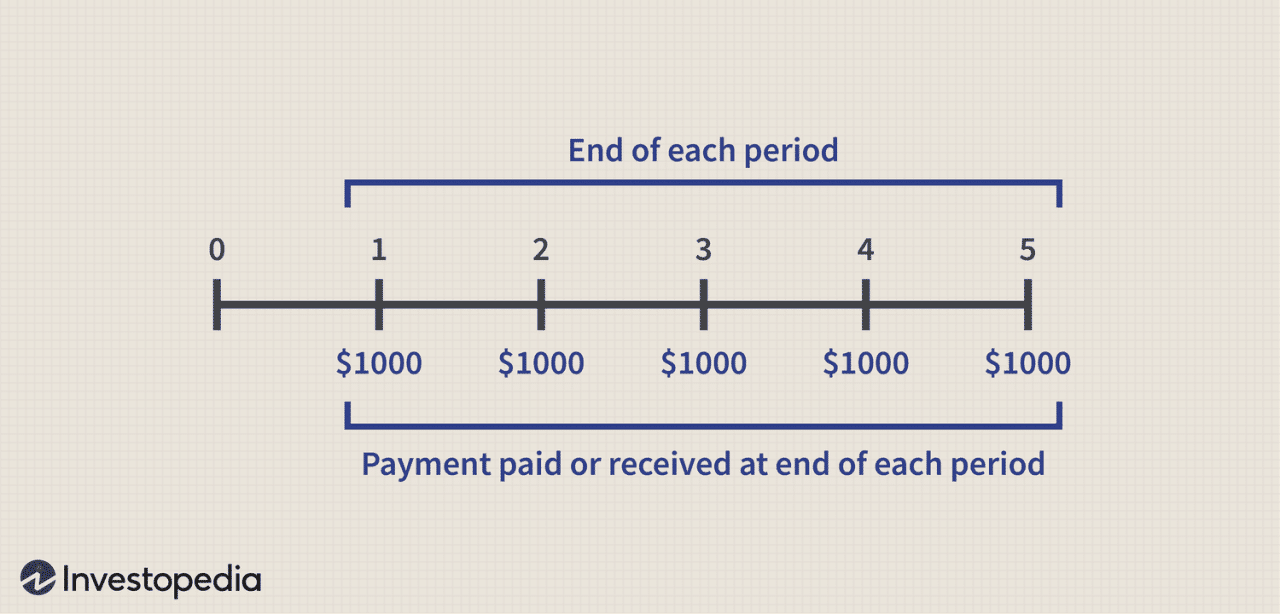

An annuity is a financial product that provides a stream of regular payments, either for a fixed period or for life. Annuities are often used by individuals in retirement to provide a steady income stream, but they can also be used for other purposes, such as saving for college or estate planning.

Annuity is a popular financial product, and Annuity Is A Life Insurance Product That 2024 explains its key features and benefits. It’s a life insurance product that provides a guaranteed stream of income for a specified period, offering financial security and peace of mind.

Basic Concept

An annuity is a contract between an individual and an insurance company. The individual makes a lump-sum payment or a series of payments to the insurance company, and in return, the insurance company agrees to make regular payments to the individual, starting at a specified date.

Foldable phones are the future of mobile technology, and Android Authority 2024 foldable phone reviews provides in-depth reviews of the latest models. Discover the best foldable phones on the market, their features, and their pros and cons.

Types of Annuities

- Fixed Annuities:These annuities offer a guaranteed rate of return, meaning that the payments will be the same every month, regardless of how the market performs. Fixed annuities are generally considered to be a safe investment option, but they may not offer the potential for high returns.

Ready to embark on your Android app development journey? Best Android app development courses in 2024 lists some of the top courses available to help you learn the skills needed to create amazing Android apps.

- Variable Annuities:These annuities offer the potential for higher returns, but they also come with more risk. The payments from a variable annuity are tied to the performance of the underlying investments, so they can fluctuate in value. Variable annuities are often used by individuals who are willing to take on more risk in exchange for the potential for higher returns.

Android WebView 202 is packed with exciting new features! Android WebView 202 new features include improved performance, enhanced security, and better compatibility with modern web technologies. These updates ensure a smoother and more secure browsing experience on Android devices.

- Indexed Annuities:These annuities offer a return that is linked to the performance of a specific index, such as the S&P 500. Indexed annuities offer the potential for growth without the risk of losing principal, but they may not offer the same level of returns as variable annuities.

Looking to cheat your way to victory in Among Us? You might want to check out GameGuardian 2024 for Among Us. This tool allows you to modify game values, potentially giving you an unfair advantage. However, be aware that using such tools can violate game rules and may result in account bans.

- Immediate Annuities:These annuities begin making payments immediately after the initial investment is made. Immediate annuities are often used by individuals who are ready to start receiving income right away, such as retirees.

- Deferred Annuities:These annuities begin making payments at a later date, such as at retirement. Deferred annuities are often used by individuals who are saving for retirement or other future goals.

Real-World Scenarios

- Retirement Income:Annuities can provide a steady stream of income for retirees, helping them to cover their living expenses and maintain their lifestyle.

- College Savings:Annuities can be used to save for college expenses, providing a tax-deferred growth opportunity.

- Estate Planning:Annuities can be used to create a stream of income for beneficiaries after the death of the annuitant.

Annuity Features and Benefits

Annuities offer several key features and benefits that can make them an attractive investment option for individuals in different life stages.

Dollify has become a popular app for creating adorable avatars. Dollify 2024: What’s New and Different highlights the latest updates and new features added to the app, allowing you to customize your avatars with even more options and creativity.

Key Features

- Guaranteed Income:Many annuities offer a guaranteed income stream, providing peace of mind for individuals who are concerned about outliving their savings.

- Tax Deferral:The growth of an annuity is typically tax-deferred, meaning that you will not have to pay taxes on the earnings until you start receiving payments.

- Potential for Growth:Some annuities, such as variable and indexed annuities, offer the potential for growth, allowing your investment to potentially grow over time.

Benefits for Different Life Stages

- Retirement:Annuities can provide a steady stream of income for retirees, helping them to cover their living expenses and maintain their lifestyle.

- Saving for College:Annuities can be used to save for college expenses, providing a tax-deferred growth opportunity.

- Estate Planning:Annuities can be used to create a stream of income for beneficiaries after the death of the annuitant.

Advantages and Disadvantages

Advantages

- Guaranteed Income:Annuities can provide a guaranteed income stream, providing peace of mind for individuals who are concerned about outliving their savings.

- Tax Deferral:The growth of an annuity is typically tax-deferred, meaning that you will not have to pay taxes on the earnings until you start receiving payments.

- Potential for Growth:Some annuities, such as variable and indexed annuities, offer the potential for growth, allowing your investment to potentially grow over time.

Disadvantages

- Potential for Lower Returns:Annuities may offer lower returns than other investment options, such as stocks or mutual funds.

- Lack of Flexibility:Once you purchase an annuity, you may not be able to access your funds without incurring penalties.

- Complexity:Annuities can be complex financial products, and it is important to understand the terms and conditions of the contract before purchasing one.

Annuity Considerations in 2024

The economic landscape in 2024 is expected to be dynamic, with potential impacts on annuity investments.

Looking for the perfect accessories to enhance your Android phone experience? Android Authority 2024 Android phone accessories review features a comprehensive list of the best accessories available, from cases and chargers to headphones and smartwatches.

Economic Landscape

- Interest Rates:Interest rates are expected to remain relatively low in 2024, which may impact the returns on fixed annuities.

- Inflation:Inflation is expected to remain a concern in 2024, which may erode the purchasing power of annuity payments.

- Market Volatility:Market volatility can impact the performance of variable and indexed annuities.

Regulatory Changes, An Annuity Is 2024

- SECURE Act 2.0:The SECURE Act 2.0, which was passed in December 2022, includes several provisions that could affect annuities, such as changes to required minimum distributions (RMDs) and the ability to roll over certain retirement plans into annuities.

Potential Return on Investment

- Fixed Annuities:The returns on fixed annuities are expected to remain relatively low in 2024, given the low interest rate environment.

- Variable Annuities:The returns on variable annuities will depend on the performance of the underlying investments, which could be volatile in 2024.

- Indexed Annuities:The returns on indexed annuities will be tied to the performance of the underlying index, such as the S&P 500.

Choosing the Right Annuity

Choosing the right annuity depends on your individual needs and goals.

Building an Android app for a specific industry requires careful planning and execution. Android app development for specific industries in 2024 explores the unique challenges and opportunities of developing apps for various industries, from healthcare to e-commerce.

Step-by-Step Guide

- Define your goals:What are you hoping to achieve with an annuity? Are you looking for guaranteed income, tax-deferred growth, or a combination of both?

- Consider your risk tolerance:How comfortable are you with the potential for market volatility? If you are risk-averse, a fixed annuity may be a better choice. If you are willing to take on more risk, a variable or indexed annuity may be a better option.

Need groceries delivered right to your doorstep? How to use Glovo app for grocery delivery is a comprehensive guide that explains how to use the Glovo app for convenient grocery shopping. From ordering to payment, this guide will help you navigate the app with ease.

- Compare annuity types:Research different annuity types and compare their features, benefits, and risks.

- Seek professional advice:Consult with a financial advisor to get personalized advice on the right annuity for your situation.

Annuity Comparison Table

| Annuity Type | Key Features | Pros | Cons |

|---|---|---|---|

| Fixed Annuity | Guaranteed rate of return, predictable payments | Safe investment, guaranteed income | Lower potential for growth, may not keep up with inflation |

| Variable Annuity | Returns tied to underlying investments, potential for growth | Higher potential for growth, tax-deferred growth | More risk, potential for loss of principal |

| Indexed Annuity | Returns linked to a specific index, potential for growth without losing principal | Potential for growth, limited downside risk | May not offer the same level of returns as variable annuities, limited upside potential |

| Immediate Annuity | Payments begin immediately after the initial investment | Immediate income, guaranteed payments | Limited flexibility, may not be suitable for long-term savings goals |

| Deferred Annuity | Payments begin at a later date, such as at retirement | Tax-deferred growth, potential for growth | May not be suitable for short-term savings goals, potential for penalties if withdrawn early |

Consulting with a Financial Advisor

Consulting with a financial advisor is essential before purchasing an annuity. A financial advisor can help you understand your needs and goals, compare different annuity options, and choose the right annuity for your situation.

Is your Android phone acting up? Android Authority 2024 how to fix common Android problems provides a comprehensive guide to troubleshooting common Android issues. From slow performance to battery drain, you’ll find solutions to get your phone back on track.

Annuity Risks and Limitations

While annuities offer several benefits, it’s crucial to understand the potential risks and limitations associated with them.

The future of AI is here, and Snapdragon 2024 AI and machine learning capabilities are pushing the boundaries. With advanced processing power and dedicated AI engines, Snapdragon devices are revolutionizing how we interact with technology, from personalized experiences to intelligent assistants.

Potential Risks

- Market Volatility:Variable and indexed annuities are subject to market volatility, which can impact the value of your investment.

- Interest Rate Risk:Fixed annuities are sensitive to interest rate changes. If interest rates rise, the value of your fixed annuity may decrease.

- Surrender Charges:Many annuities have surrender charges, which are penalties that you may have to pay if you withdraw your funds before a certain period.

- Inflation Risk:The purchasing power of your annuity payments can be eroded by inflation, especially with fixed annuities.

Limitations

- Potential for Lower Returns:Annuities may offer lower returns than other investment options, such as stocks or mutual funds.

- Lack of Flexibility:Once you purchase an annuity, you may not be able to access your funds without incurring penalties.

- Complexity:Annuities can be complex financial products, and it is important to understand the terms and conditions of the contract before purchasing one.

Risks and Limitations by Annuity Type

| Annuity Type | Risks | Limitations |

|---|---|---|

| Fixed Annuity | Interest rate risk, inflation risk | Lower potential for growth, may not keep up with inflation |

| Variable Annuity | Market volatility, potential for loss of principal | More complex, higher fees |

| Indexed Annuity | Limited upside potential, potential for loss of principal | May not offer the same level of returns as variable annuities |

| Immediate Annuity | Limited flexibility, potential for lower returns | May not be suitable for long-term savings goals |

| Deferred Annuity | Potential for penalties if withdrawn early, potential for lower returns | May not be suitable for short-term savings goals |

Final Review

As you embark on your retirement planning journey, understanding annuities is essential. By carefully considering your individual circumstances, seeking professional advice, and staying informed about market trends, you can make informed decisions about whether annuities are right for you. This guide has provided a foundation for understanding annuities in 2024.

Now, armed with this knowledge, you can confidently explore the world of annuities and make choices that align with your retirement goals and aspirations.

Answers to Common Questions

What is the minimum investment required for an annuity?

The minimum investment for an annuity varies depending on the type of annuity and the insurance company. It’s best to contact the insurance company directly for specific requirements.

Are annuity payments taxable?

The tax treatment of annuity payments depends on the type of annuity. Generally, the principal portion of the payment is tax-free, while the interest or earnings portion is taxable.

Can I withdraw my money from an annuity before retirement?

Most annuities have surrender charges for early withdrawals, so you may face penalties if you withdraw your money before the specified period.

Security is a major concern for Android phone users. Android Authority 2024 Android phone security concerns discusses common security threats and provides tips to protect your device and personal information.