An Annuity Is A Series Of 2024: A phrase that might sound like a futuristic concept, but it actually represents a powerful financial tool for securing your retirement. Annuities are essentially contracts that guarantee a stream of income for a specific period, providing a sense of financial stability in your golden years.

Android WebView 202 is a major update, but it can cause compatibility issues with some apps. This article addresses some of the common compatibility problems: Android WebView 202 compatibility issues.

Think of it as a personalized financial plan that ensures a consistent flow of income, even if the stock market takes a tumble.

Dollify is a fun and easy-to-use app for creating avatars. If you’re looking to take your Dollify skills to the next level, this article offers advanced techniques and customization tips: Dollify 2024: Advanced Techniques and Customization.

Imagine having a reliable source of income that continues even after you’ve stopped working. Annuities can help you achieve this by providing a predictable stream of payments, whether you choose a lump sum, monthly installments, or a combination of both.

GameGuardian is a powerful tool for modifying games, and it can be used to enhance your experience in Free Fire. If you’re a Free Fire player, check out this guide: GameGuardian 2024 for Free Fire.

They can act as a safety net, protecting your hard-earned savings from unexpected market fluctuations and ensuring you have the financial resources to enjoy your retirement to the fullest.

Contents List

What is an Annuity?

An annuity is a financial product that provides a stream of regular payments over a specified period of time. Think of it as a guaranteed income stream for the future, particularly during retirement. Annuities are designed to help individuals secure their financial well-being and ensure a consistent source of income, even after they stop working.

Definition of an Annuity

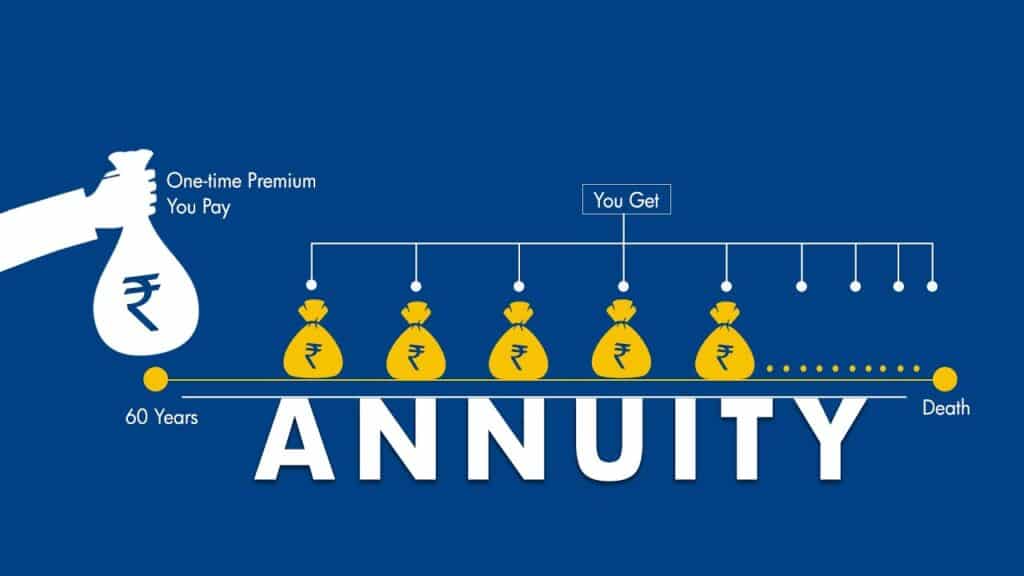

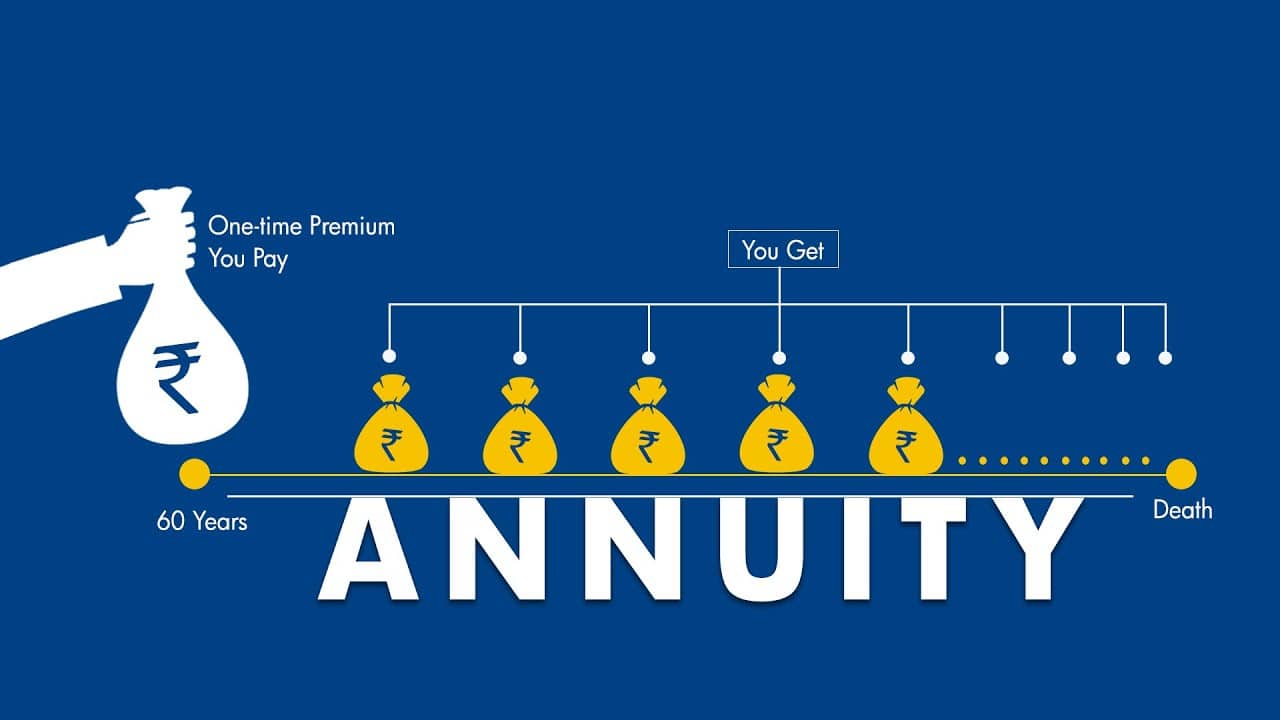

An annuity is a contract between an individual and an insurance company. The individual makes a lump sum payment or a series of payments, and in return, the insurance company agrees to make regular payments to the individual for a predetermined period of time.

Google Tasks is a simple yet powerful task management tool that can be used for personal projects. Learn how to effectively use Google Tasks for your projects in 2024: Google Tasks 2024: Using Google Tasks for Personal Projects.

These payments can be made for life, for a specific number of years, or for a combination of both.

Google Tasks has received several new features and enhancements in 2024. This article highlights the latest updates and improvements: Google Tasks 2024: New Features and Enhancements.

Types of Annuities

Annuities come in various forms, each with its own unique features and benefits. Here are some of the most common types:

- Fixed Annuities:These annuities offer a guaranteed rate of return, meaning the payments you receive will remain consistent throughout the contract period. Fixed annuities are suitable for individuals who prioritize stability and predictability over potential growth.

- Variable Annuities:Variable annuities invest your money in a variety of sub-accounts, such as mutual funds. The payments you receive will fluctuate based on the performance of these investments. Variable annuities offer the potential for higher returns but also carry greater risk.

- Indexed Annuities:Indexed annuities link your returns to the performance of a specific market index, such as the S&P 500. They offer potential growth while providing some protection against market downturns. Indexed annuities typically have a minimum guaranteed return, even if the index performs poorly.

How Annuities Work

Annuities work by converting a lump sum payment or a series of payments into a stream of regular income. This process is called annuitization.

Annuitization and Interest Rates

When you annuitize your money, the insurance company invests it in a portfolio of assets, such as bonds or stocks. The interest earned on these investments is used to fund your annuity payments. The interest rate applied to your annuity will vary depending on the type of annuity you choose and the prevailing market conditions.

Android WebView is a core component of the Android operating system, and it’s crucial for security updates. Stay informed about the latest security patches by reading this article: Android WebView 202 security updates.

Payment Options

Annuities offer a variety of payment options to suit different needs. You can choose to receive your payments:

- Lump Sum:You can receive your entire annuity payout at once.

- Monthly Payments:You can receive regular monthly payments for a specified period.

- Combination:You can receive a combination of lump sum and monthly payments.

Tax Implications

The tax implications of annuity payments depend on the type of annuity and how it is structured. Generally, the interest earned on your annuity is taxable as ordinary income. However, the principal amount you withdraw is typically not taxed.

GameGuardian is a popular tool for modifying games, and it can be used to enhance your experience in Brawl Stars. Find out more about using GameGuardian for Brawl Stars in 2024 here: GameGuardian 2024 for Brawl Stars.

Benefits of Annuities

Annuities offer several advantages for retirement planning, providing a reliable source of income and helping you achieve financial security.

Foldable phones are becoming increasingly popular, and Snapdragon processors are playing a key role in their development. Learn about the latest Snapdragon chips designed for foldable phones: Snapdragon 2024 for foldable phones.

Guaranteed Income Streams

One of the primary benefits of annuities is the guaranteed income stream they provide. Unlike investments that can fluctuate in value, annuities offer a consistent flow of payments, giving you peace of mind about your financial future.

Tax Advantages

Annuities can offer tax advantages, particularly when it comes to withdrawing your principal. As mentioned earlier, the principal amount you withdraw from an annuity is typically not taxed, while the interest earned is taxed as ordinary income.

Glovo is a popular delivery app, and it offers a variety of payment methods and security features. This article covers the different payment options and security measures available on the Glovo app: Glovo app payment methods and security features.

Protection Against Market Volatility

Annuities can help protect your retirement savings from market volatility. Fixed annuities, for example, provide a guaranteed rate of return, shielding you from potential losses in the stock market.

Supplementing Other Retirement Income Sources

Annuities can be used to supplement other retirement income sources, such as Social Security and pensions. This can help ensure you have a sufficient income stream to meet your living expenses in retirement.

Snapdragon processors are known for their power and efficiency. Learn about the battery life and efficiency improvements in Snapdragon chips in 2024: Snapdragon 2024 battery life and efficiency.

Considerations for Choosing an Annuity: An Annuity Is A Series Of 2024

Choosing the right annuity is crucial to ensure it aligns with your financial goals and risk tolerance. Here are some key factors to consider:

Financial Goals, Risk Tolerance, and Time Horizon

Before choosing an annuity, carefully consider your financial goals, risk tolerance, and time horizon. If you are looking for a guaranteed income stream with minimal risk, a fixed annuity might be a good option. However, if you are willing to take on more risk for the potential of higher returns, a variable annuity might be more suitable.

Dollify is a great way to create unique and expressive avatars. This article provides tips and inspiration for crafting unique and expressive avatars in Dollify: Dollify 2024: Creating Unique and Expressive Avatars.

Terms and Conditions

It is essential to carefully evaluate the terms and conditions of different annuity contracts, including:

- Fees:Annuities typically come with various fees, such as administrative fees, surrender charges, and mortality charges. Make sure you understand all the fees associated with an annuity before you commit.

- Surrender Charges:Surrender charges are penalties you may have to pay if you withdraw your money from the annuity before a certain period. These charges can be significant, so make sure you understand the surrender charge structure before you invest.

- Death Benefits:Some annuities offer death benefits, which can provide a payout to your beneficiaries if you pass away. These benefits can vary depending on the type of annuity and the contract terms.

Pros and Cons of Different Annuity Types, An Annuity Is A Series Of 2024

Weigh the pros and cons of different annuity types to make an informed decision. Fixed annuities offer stability and predictability, while variable annuities provide potential growth but carry greater risk. Indexed annuities offer a balance between growth and protection.

Android app development is constantly evolving. This article explores the key trends shaping Android app development in 2024: Android app development trends in 2024.

Annuity Trends and Future Outlook

The annuity market is constantly evolving, with new products and trends emerging regularly.

Pushbullet is a handy tool for transferring files between your phone and computer. It’s easy to use and can be a real time-saver. Want to learn how to use it? Check out this guide: Pushbullet 2024: How to use Pushbullet to send files from your phone to your computer.

Growing Popularity of Indexed Annuities

Indexed annuities have gained popularity in recent years, as individuals seek investment options that offer potential growth while providing some protection against market downturns.

Annuities can be a good investment, but it’s important to weigh the pros and cons carefully. This article explores whether annuities are a good investment in 2024: Annuity Is It A Good Investment 2024.

Impact of Rising Interest Rates

Rising interest rates can have a positive impact on annuities, as insurance companies can earn higher returns on their investments, potentially leading to increased annuity payments.

Future Outlook

The future outlook for annuities is promising, driven by several factors:

- Demographic Changes:The aging population is driving increased demand for retirement income solutions, making annuities a valuable tool for retirement planning.

- Evolving Retirement Needs:Individuals are living longer and facing rising healthcare costs, making annuities a reliable source of income to cover these expenses.

- Regulatory Developments:Regulatory changes are making annuities more accessible and affordable for individuals, further boosting their popularity.

Closure

As you approach retirement, the question of financial security often arises. Annuities offer a compelling solution, providing a guaranteed income stream and peace of mind. By carefully considering your financial goals, risk tolerance, and time horizon, you can choose an annuity that aligns with your individual needs and helps you navigate the complexities of retirement planning.

Remember, a well-structured annuity can act as a cornerstone of your retirement strategy, ensuring a comfortable and financially secure future.

Question & Answer Hub

What is the minimum amount I need to invest in an annuity?

The minimum investment amount varies depending on the annuity provider and the type of annuity you choose. It’s best to contact an annuity provider directly to inquire about their specific minimum investment requirements.

Can I withdraw my money from an annuity before retirement?

Yes, you can typically withdraw money from an annuity before retirement, but there may be penalties or fees associated with early withdrawals. The specific terms and conditions vary depending on the annuity contract.

How do I find a reputable annuity provider?

Annuity plans are a popular financial tool, and in 2024, there are many options to consider. If you’re looking for information on the latest developments in annuities, check out this article: Annuity Is A Series Of 2024.

It’s important to choose a reputable annuity provider with a strong financial track record. You can research providers online, read reviews, and consult with a financial advisor to get recommendations.