An Annuity Is Quizlet 2024: Your Guide to Retirement Income delves into the world of annuities, a financial tool that can provide a steady stream of income during your golden years. Annuities are a popular choice for retirement planning, offering a way to protect your savings from market volatility and guarantee a regular income stream.

Dollify continues to be a popular choice for creating custom avatars, and it’s constantly getting updated with new features. Dollify 2024: New Features and Updates explores the latest additions and improvements to this fun and creative app.

But with so many different types of annuities available, it can be overwhelming to know where to start.

Android 14 is here with a slew of new features and updates, including improved privacy controls and enhanced performance. Android Authority 2024 Android 14 features and updates provides a comprehensive overview of what’s new in this latest Android release.

This guide will break down the basics of annuities, explaining how they work, their benefits and risks, and how they compare to other investment options. Whether you’re just starting to think about retirement or you’re already nearing retirement age, understanding annuities is essential for making informed financial decisions.

For developers looking to build web-based applications on Android, Android WebView 202 offers a powerful tool for integrating web content into native apps.

Contents List

What is an Annuity?

An annuity is a financial product that provides a stream of regular payments for a specific period of time. It’s essentially a contract between you and an insurance company, where you make a lump-sum payment or series of payments in exchange for guaranteed income payments later.

Google Tasks is a great tool for students to manage their assignments and deadlines. Google Tasks 2024: Google Tasks for Students provides tips and tricks for using Google Tasks effectively in an academic setting.

Concept of an Annuity

Think of an annuity like a reverse savings account. Instead of depositing money and earning interest, you make a one-time payment or a series of payments, and the insurance company uses that money to generate income for you in the form of regular payments.

In the era of messaging apps, is Pushbullet still relevant? Pushbullet 2024 explores its features and capabilities to see if it still holds its ground.

These payments can last for a fixed period, for the rest of your life, or even for the lifetime of someone else.

Types of Annuities

There are various types of annuities, each with its own unique features and benefits. Here are some common examples:

- Fixed Annuities:These annuities offer a guaranteed rate of return on your investment. The payments you receive are fixed and predictable, making them ideal for individuals seeking stability and income security.

- Variable Annuities:These annuities invest your money in the stock market. Your payments will fluctuate based on the performance of your chosen investment options. They offer the potential for higher returns, but also come with greater risk.

- Indexed Annuities:These annuities link their returns to the performance of a specific index, such as the S&P 500. You can potentially benefit from market growth while still enjoying some protection from losses.

- Immediate Annuities:These annuities start paying out immediately after you purchase them. They are often used to provide a steady income stream during retirement.

- Deferred Annuities:These annuities start paying out at a later date, allowing you to accumulate interest and potentially grow your investment before you start receiving payments.

Key Features of Annuities

Annuities are characterized by several key features:

- Guaranteed Payments:Most annuities offer guaranteed income payments, providing financial security and peace of mind.

- Income for Life:Many annuities provide lifetime income, ensuring that you have a steady stream of payments throughout your retirement years.

- Tax Advantages:Annuities can offer tax-deferred growth and tax-advantaged income distributions.

- Protection from Market Volatility:Fixed annuities offer protection from market fluctuations, ensuring that your income payments remain stable.

How Annuities Work

Purchasing an annuity involves a straightforward process:

Purchasing an Annuity

1. Choose an Annuity

Need help with the Glovo app? Glovo app customer support contact information provides the necessary details to get in touch with their support team.

Select an annuity that aligns with your financial goals, risk tolerance, and income needs.

The world of avatars is getting more exciting with the advancements in AI. Dollify 2024 is a prime example of how AI is revolutionizing avatar creation, offering users more personalized and expressive representations.

2. Make a Payment

When choosing a delivery app, it’s important to compare prices. Glovo app delivery fees compared to other apps offers a breakdown of Glovo’s pricing structure in relation to its competitors.

You can make a lump-sum payment or a series of payments to purchase the annuity.

Google Tasks is constantly evolving with new features and enhancements. Google Tasks 2024: New Features and Enhancements highlights the latest updates and improvements to this popular task management tool.

3. Choose Payment Options

For teams looking to collaborate on projects, Google Tasks offers a streamlined solution. Google Tasks 2024: Setting Up Google Tasks for Teams provides a guide on setting up and using Google Tasks for collaborative work.

Determine how you want to receive your payments (e.g., monthly, quarterly, annually).

Interested in creating your own Android apps? How to get started with Android app development in 2024 offers a comprehensive guide for beginners looking to delve into the world of Android app development.

4. Start Receiving Payments

Snapdragon processors are known for their impressive camera capabilities. Snapdragon 2024 camera performance delves into the latest advancements in camera technology and how they enhance the user experience.

Once the annuity contract is in place, you will start receiving regular payments based on your chosen payment options.

Fixed vs. Variable Annuities

The key difference between fixed and variable annuities lies in how your investment grows and how your payments are determined:

- Fixed Annuities:Your investment grows at a fixed interest rate, and your payments are guaranteed and predictable.

- Variable Annuities:Your investment is linked to the stock market, and your payments can fluctuate based on market performance.

Payment Options

Annuities offer a variety of payment options to suit different needs:

- Lump-Sum Payments:You can receive a single lump-sum payment at the end of the annuity term.

- Periodic Payments:You can receive regular payments, such as monthly, quarterly, or annually.

- Lifetime Payments:You can receive payments for the rest of your life.

- Joint-Life Payments:You can receive payments for the lifetime of you and your spouse.

Benefits of Annuities

Annuities offer several advantages for retirement planning:

Retirement Planning

Annuities can be a valuable tool for retirement planning, providing:

- Guaranteed Income:Annuities can provide a steady stream of income during retirement, ensuring financial security.

- Income for Life:Many annuities offer lifetime income, eliminating the risk of outliving your savings.

- Protection from Market Volatility:Fixed annuities offer protection from market fluctuations, ensuring that your income payments remain stable.

- Tax Advantages:Annuities can offer tax-deferred growth and tax-advantaged income distributions.

Tax Benefits

Annuities can offer tax advantages, including:

- Tax-Deferred Growth:The earnings on your annuity investment grow tax-deferred, meaning you don’t pay taxes on the earnings until you start receiving payments.

- Tax-Advantaged Income Distributions:The income you receive from an annuity may be taxed at a lower rate than other types of income.

Income Security

Annuities can provide income security in retirement, ensuring that you have a steady stream of payments to cover your living expenses.

Snapdragon’s latest processors are packed with advanced AI and machine learning capabilities. Snapdragon 2024 AI and machine learning capabilities explore how these advancements are shaping the future of mobile technology.

Risks and Considerations

While annuities offer benefits, they also come with potential downsides:

Potential Downsides

- High Fees and Expenses:Annuities can have high fees and expenses, which can erode your returns over time.

- Limited Liquidity:Annuities are generally illiquid, meaning you may not be able to easily access your money if you need it before your payments start.

- Risk of Outliving Your Annuity:If you choose an annuity with a fixed term, you may run out of payments before you die.

- Potential for Lower Returns:Fixed annuities generally offer lower returns than other investment options, such as stocks or bonds.

Understanding Fees and Expenses

It’s crucial to carefully review the fees and expenses associated with any annuity before you purchase it. These fees can significantly impact your overall returns.

Comparing Risks

Annuities carry different risks compared to other retirement savings options:

- Traditional Retirement Accounts:401(k)s and IRAs offer more flexibility and control over your investments, but they don’t provide guaranteed income payments.

- Stocks and Bonds:Stocks and bonds offer the potential for higher returns but also come with greater risk and volatility.

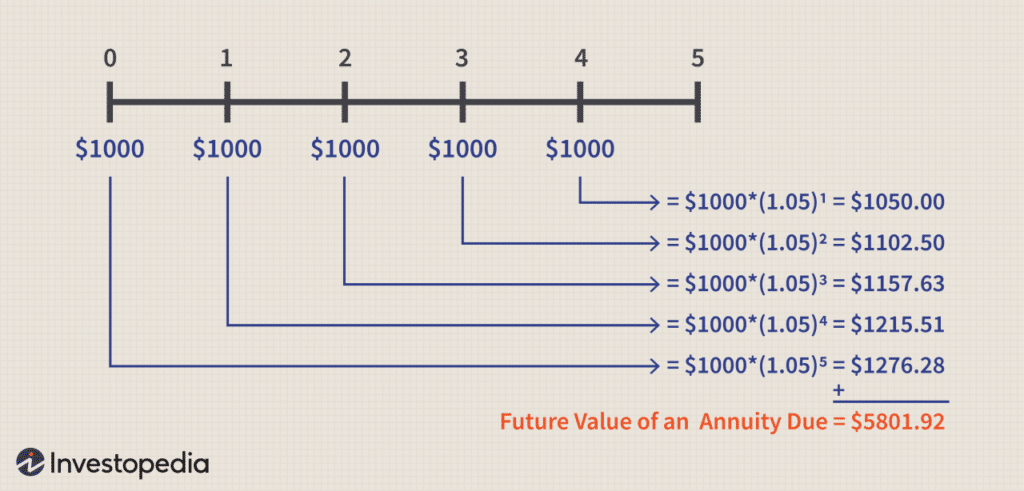

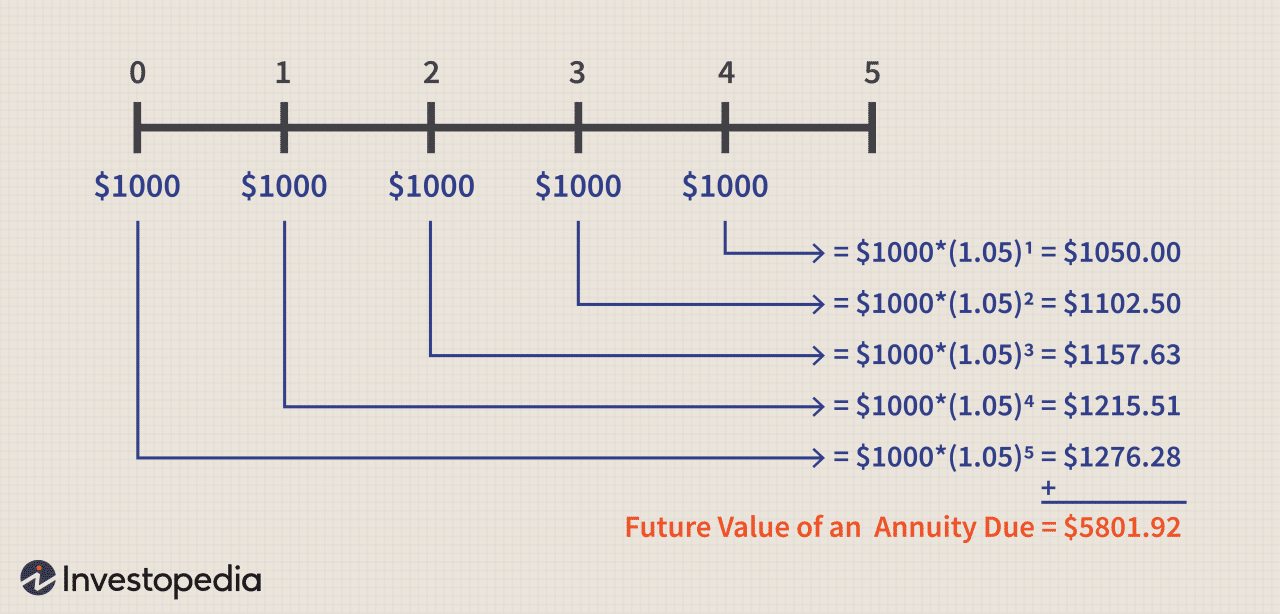

Annuity Examples

Annuities are used in various ways for retirement planning:

Real-World Examples

- Income Replacement:A retiree may purchase an annuity to replace a portion of their lost income from their former job.

- Supplementing Social Security:An annuity can be used to supplement Social Security payments and provide additional income for retirement.

- Long-Term Care Planning:Annuities can be used to fund long-term care expenses, providing financial protection against unexpected healthcare costs.

Comparing Annuity Products

| Annuity Type | Key Features | Benefits | Risks ||—|—|—|—|| Fixed Annuity | Guaranteed interest rate, fixed payments | Predictable income, protection from market volatility | Lower returns than other investments || Variable Annuity | Investment options, potential for higher returns | Potential for growth, tax-deferred earnings | Higher risk, payments fluctuate with market performance || Indexed Annuity | Returns linked to a specific index | Potential for growth, protection from losses | Limited upside potential, fees and expenses || Immediate Annuity | Payments start immediately | Instant income stream, guaranteed payments | Lower returns than deferred annuities || Deferred Annuity | Payments start at a later date | Time for investment to grow, tax-deferred earnings | Risk of market volatility, fees and expenses |

Common Annuity Providers

| Provider | Offerings ||—|—|| | Fixed annuities, variable annuities, indexed annuities || | Immediate annuities, deferred annuities, long-term care annuities || | Retirement income solutions, financial planning services |

Annuity plans are a popular choice for retirement planning, but it’s important to understand their pros and cons. Annuity Is Good Or Bad 2024 delves into the factors to consider when deciding if an annuity is right for you.

Annuity vs. Other Investments

Annuities are just one option for retirement savings. Here’s a comparison with traditional retirement accounts and other investment options:

Traditional Retirement Accounts, An Annuity Is Quizlet 2024

- 401(k):Employer-sponsored retirement savings plan that offers tax-deferred growth and potential for matching contributions.

- IRA:Individual retirement account that offers tax-deferred growth and potential for tax deductions.

Suitability for Different Goals

The suitability of annuities depends on your investment goals and risk tolerance:

- Guaranteed Income:Annuities are well-suited for individuals who prioritize guaranteed income and income security in retirement.

- Growth Potential:Variable annuities offer the potential for higher returns, but they also come with greater risk.

- Flexibility:Traditional retirement accounts offer more flexibility and control over your investments, but they don’t provide guaranteed income payments.

Potential Returns and Risks

| Investment Option | Potential Returns | Risks ||—|—|—|| Annuities | Lower to moderate returns, guaranteed income | High fees and expenses, limited liquidity || Traditional Retirement Accounts | Moderate to high returns | Market volatility, no guaranteed income || Stocks | High potential returns | High volatility, risk of loss || Bonds | Moderate returns, lower risk | Interest rate risk, inflation risk |

Final Conclusion: An Annuity Is Quizlet 2024

As you navigate the complex world of retirement planning, understanding annuities can be a valuable asset. By carefully considering your individual financial goals, risk tolerance, and investment horizon, you can determine if annuities are a suitable fit for your portfolio.

This guide has provided a foundation for your exploration, empowering you to make informed decisions and secure your financial future.

Keeping track of your tasks can be a challenge, especially across multiple devices. Google Tasks 2024 offers a simple and effective solution for syncing your to-do lists across your devices.

FAQ Summary

What is the minimum age to purchase an annuity?

There is no minimum age requirement to purchase an annuity, although most individuals typically buy them closer to retirement age.

Are annuities subject to taxes?

Yes, annuity payments are generally subject to taxes. However, the tax treatment of annuities can vary depending on the type of annuity and how it was purchased.

Can I withdraw my contributions from an annuity before retirement?

You may be able to withdraw your contributions from an annuity before retirement, but you may be subject to penalties and taxes. The specific rules and regulations vary depending on the type of annuity.

What are the common fees associated with annuities?

Annuities typically come with various fees, such as administrative fees, mortality and expense charges, and surrender charges. It’s crucial to carefully review the fee structure before purchasing an annuity.

Can I use an annuity to leave an inheritance to my heirs?

Yes, you can use an annuity to leave an inheritance to your heirs. Depending on the type of annuity, your beneficiaries may receive a death benefit or a stream of payments after your death.