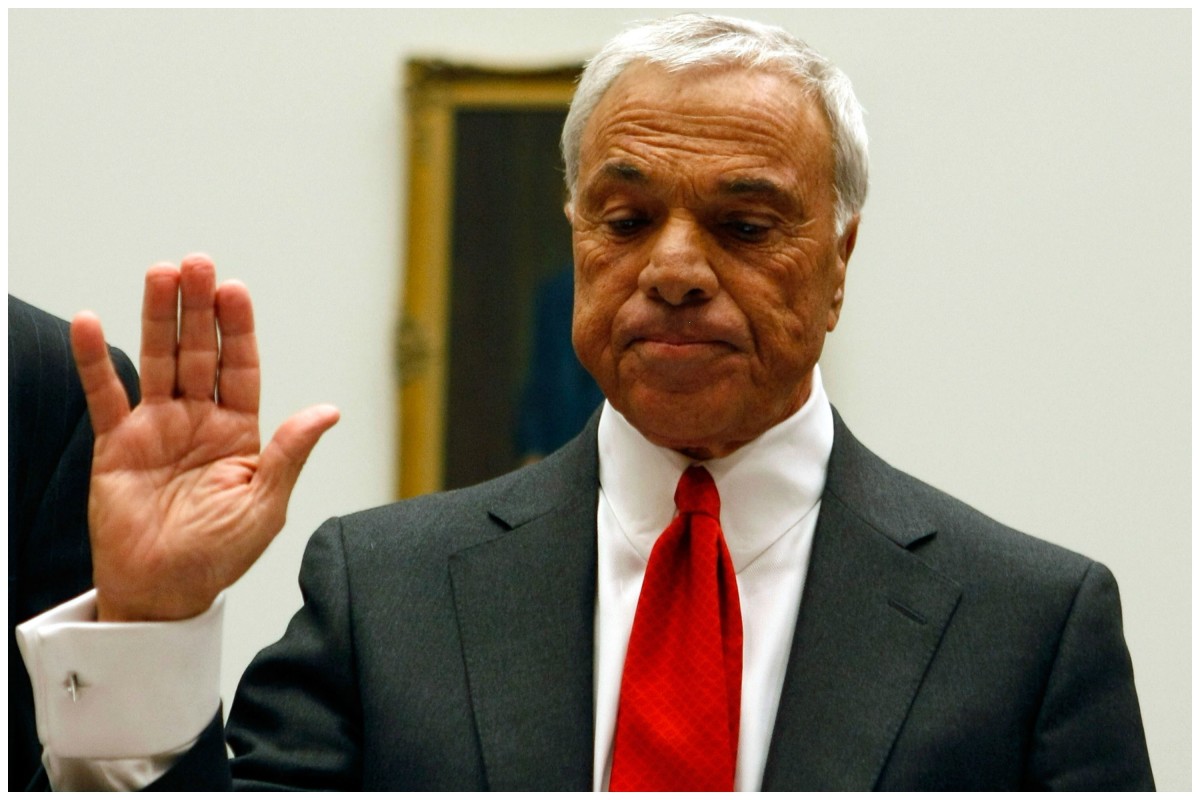

Angelo Mozilo 2024: A Legacy of Subprime Lending, delves into the rise and fall of a financial titan, exploring the impact of his leadership on Countrywide Financial and the broader mortgage in

Zillow is a popular platform for finding homes and getting mortgage information. Zillow Mortgage 2024 provides insights into Zillow’s

Chase Bank is another major lender offering a range of mortgage products. Chase Bank Mortgage 2024 provides information on Chase Bank’s current mortgage rates and terms, allowing you to compare them to other lenders and potentially find a suitable option.

mortgage offerings, including rates and terms, allowing you to compare them to other lenders and potentially find a suitable option.

dustry. The narrative begins with Mozilo’s early career, tracing his ascent to the helm of a company that would become synonymous with the housing bubble and the subprime mortgage crisis.

Thi

For those seeking long-term financial stability, a 10-year mortgage might be an attractive option. 10 Year Mortgage Rates 2024 gives you insight into the current rates for this type of mortgage, helping you make an informed decision about your home financing.

s story examines the decisions that led to Countrywide’s phenomenal growth, the role of subprime lending in fueling the housing market, and the devastating consequences that followed.

The story of Angelo Mozilo is a cautionary tale, a reminder of the risks associated with unchecked financial innovation and the potential for individual decisions to have far-reaching consequences. This narrative offers a deep dive into the complexities of the subprime mortgage crisis, examining the forces at play and the lasting impact on the financial landscape.

Bank of America offers a variety of mortgage products, including zero-down options. Bank Of America Zero Down Mortgage 2024 provides information on Bank of America’s zero-down mortgage programs, allowing you to explore this option and potentially find a suitable loan.

Contents List

- 1 Angelo Mozilo’s Career Trajectory

- 1.1 Early Career and Rise at Countrywide

- 1.2 Impact of Mozilo’s Leadership on Countrywide

- 1.3 Mozilo’s Role in Subprime Lending

- 1.4 Countrywide’s Lending Practices and the Housing Bubble

- 1.5 Comparison with Other Mortgage Lenders

- 1.6 Role of Subprime Mortgages in the Crisis

- 1.7 Impact of Countrywide’s Practices on the Crisis

- 1.8 Regulatory and Legislative Responses

- 1.9 Controversies Surrounding Mozilo’s Leadership

- 1.10 Long-Term Impact of Countrywide’s Collapse, Angelo Mozilo 2024

- 1.11 Lessons Learned from the Subprime Mortgage Crisis

- 2 End of Discussion

- 3 FAQ Compilation: Angelo Mozilo 2024

Angelo Mozilo’s Career Trajectory

Angelo Mozilo’s career path was marked by a steady climb in the mortgage industry, ultimately culminating in his position as CEO of Countrywide Financial, one of the largest mortgage lenders in the United States. This journey, however, is not without its complexities and controversies, particularly in the context of the subprime mortgage crisis.

Early Career and Rise at Countrywide

Mozilo began his career in the mortgage industry in the 1970s, working for several smaller mortgage lenders. He quickly rose through the ranks, demonstrating a keen understanding of the industry and a talent for building relationships. In 1985, he joined Countrywide Financial, a company then known as Countrywide Credit Industries.

Housing interest rates play a significant role in determining affordability. Housing Interest Rates 2023 2024 provides an overview of historical and current interest rates, allowing you to understand the market trends and potentially make informed decisions about your home purchase.

Mozilo’s leadership was instrumental in Countrywide’s growth and expansion, transforming it from a regional lender into a national powerhouse. He spearheaded a number of key initiatives, including the development of automated underwriting systems and the adoption of new technologies, which streamlined the mortgage lending process and made it more accessible to a wider range of borrowers.

Understanding mortgage rates over a period of time is essential for informed financial planning. Mortgage Rates 2023 2024 offers a historical perspective on rates, allowing you to see how they’ve fluctuated and potentially predict future trends.

Impact of Mozilo’s Leadership on Countrywide

Under Mozilo’s leadership, Countrywide became a dominant force in the mortgage industry. The company’s focus on efficiency, innovation, and customer service allowed it to capture a significant market share. Mozilo’s aggressive growth strategy, however, also came with a focus on expanding into the subprime mortgage market.

Mozilo’s Role in Subprime Lending

Mozilo played a pivotal role in the development and expansion of subprime lending practices at Countrywide. The company aggressively targeted borrowers with lower credit scores and less-than-perfect credit histories, offering them loans with higher interest rates and less stringent underwriting standards.

Jumbo mortgages are designed for higher-value properties, and understanding their rates is crucial. Jumbo Mortgage Rates 2024 provides up-to-date information on jumbo mortgage rates, allowing you to compare options and potentially find the best deal.

This strategy allowed Countrywide to reach a wider customer base and generate significant profits. While subprime lending practices were not unique to Countrywide, Mozilo’s leadership was instrumental in making the company a major player in this segment of the mortgage market.

Countrywide’s Lending Practices and the Housing Bubble

Countrywide’s lending practices during this period were characterized by a focus on volume and profitability, often at the expense of prudent underwriting standards. The company originated a large number of subprime mortgages, often with adjustable-rate mortgages (ARMs) that had low initial interest rates but could reset to higher rates in the future.

These loans were marketed to borrowers with limited credit histories and low incomes, who were often unaware of the risks associated with these products. As housing prices continued to rise, Countrywide’s business thrived. The company’s stock price soared, and Mozilo became a celebrated figure in the financial world.

Comparison with Other Mortgage Lenders

While Countrywide was a major player in the subprime mortgage market, it was not the only lender engaged in these practices. Other major mortgage lenders, such as Fannie Mae, Freddie Mac, and Washington Mutual, also originated significant volumes of subprime loans during this period.

Variable interest rates can fluctuate over time, making them a riskier but potentially cheaper option. Variable Interest Rate 2024 provides information on how variable interest rates are currently trending, helping you assess the potential risks and rewards.

However, Countrywide’s aggressive focus on subprime lending and its reliance on low-quality loan originations set it apart from many of its competitors.

Huntington Bank is a well-established financial institution offering a range of mortgage products. Huntington Bank Mortgage 2024 provides information on Huntington Bank’s current mortgage rates and terms, allowing you to compare them to other lenders and potentially find a suitable option.

Role of Subprime Mortgages in the Crisis

Subprime mortgages played a central role in the collapse of the housing market. When housing prices began to decline, many borrowers with subprime mortgages found themselves unable to make their payments. This led to a wave of foreclosures, which further depressed housing prices and created a vicious cycle of declining values and rising delinquencies.

Impact of Countrywide’s Practices on the Crisis

Countrywide’s lending practices, characterized by loose underwriting standards and a focus on volume over quality, contributed significantly to the subprime mortgage crisis. The company’s origination of a large number of subprime loans, many of which were ultimately unsustainable, exacerbated the problems in the housing market.

Purchasing your first home in 2024 can be an exciting but daunting journey. Understanding current market trends and available resources is key to making an informed decision. Buying Your First Home 2024 provides comprehensive information on navigating the home buying process, including tips on budgeting, financing options, and finding the right property.

As the crisis unfolded, Countrywide faced mounting losses and a sharp decline in its business. The company’s stock price plummeted, and it was eventually acquired by Bank of America in 2008.

Freddie Mac is a major player in the mortgage market, and its rates are often a benchmark for other lenders. Freddie Mac Mortgage Rates 2024 provides current data on Freddie Mac mortgage rates, allowing you to compare them to other lenders and potentially find a favorable deal.

Regulatory and Legislative Responses

The subprime mortgage crisis led to a series of regulatory and legislative responses aimed at addressing the problems that contributed to the crisis. These measures included stricter lending standards, increased oversight of mortgage lenders, and reforms to the financial system.

For first-time homebuyers, down payment assistance programs can be invaluable. First Time Home Buyer Down Payment Assistance 2024 provides information on available down payment assistance programs, helping you navigate the process and potentially qualify for financial aid.

The Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in 2010, was a major piece of legislation that aimed to prevent future financial crises. It established the Consumer Financial Protection Bureau (CFPB), which has authority over mortgage lending and other consumer financial products.

Controversies Surrounding Mozilo’s Leadership

Mozilo has faced significant criticism for his role in the subprime mortgage crisis. He was accused of encouraging the origination of risky loans, prioritizing short-term profits over long-term stability, and misleading investors about the quality of Countrywide’s mortgage portfolio. In 2010, the Securities and Exchange Commission (SEC) filed a civil lawsuit against Mozilo, alleging that he had misled investors about Countrywide’s financial health.

The lawsuit was eventually settled, with Mozilo agreeing to pay a $67.5 million fine without admitting wrongdoing.

If you’re considering a mortgage, keeping an eye on interest rates is crucial. Rocket Mortgage Rates Today 2024 provides real-time data on current rates, allowing you to compare offers and potentially secure a favorable deal.

Long-Term Impact of Countrywide’s Collapse, Angelo Mozilo 2024

The collapse of Countrywide Financial had a significant impact on the mortgage industry and the financial system. The company’s failure contributed to the widespread turmoil in the housing market and the subsequent financial crisis. The crisis led to a sharp contraction in mortgage lending, making it more difficult for borrowers to obtain financing.

Chase is a popular choice for refinancing, offering competitive rates and flexible terms. Chase Refinance Rates 2024 provides current information on Chase’s refinance rates, helping you compare them with other lenders and make an informed decision.

The crisis also led to a significant increase in government involvement in the mortgage market, with the Federal Housing Administration (FHA) and the Federal National Mortgage Association (Fannie Mae) playing a more prominent role in supporting homeownership.

Lessons Learned from the Subprime Mortgage Crisis

The subprime mortgage crisis highlighted the dangers of unchecked lending practices, the importance of sound risk management, and the need for effective regulation. The crisis also demonstrated the interconnectedness of the financial system and the potential for a failure in one sector to have ripple effects throughout the economy.

The lessons learned from the subprime mortgage crisis continue to inform financial regulations and practices today.

FHA loans are often used by first-time homebuyers, and knowing their current rates is essential. Fha Loan Rates Today 2024 provides current data on FHA loan rates, allowing you to see how they compare to other loan types and potentially find a suitable option.

End of Discussion

Angelo Mozilo 2024: A Legacy of Subprime Lending, concludes with a reflection on the lessons learned from the subprime mortgage crisis. The story highlights the need for robust regulations and ethical practices within the financial industry, emphasizing the importance of responsible lending and risk management.

It also underscores the enduring impact of the crisis, serving as a reminder of the fragility of financial systems and the importance of transparency and accountability.

FAQ Compilation: Angelo Mozilo 2024

What were some of the key controversies surrounding Angelo Mozilo?

Mozilo faced criticism for his role in promoting subprime lending and for his compensation during Countrywide’s boom years. He was also accused of misleading investors about the company’s financial health.

How did the subprime mortgage crisis impact the financial system?

The crisis led to a widespread collapse in housing prices, a wave of foreclosures, and a global recession. It also triggered a major financial crisis, as banks and other financial institutions suffered significant losses due to their exposure to subprime mortgages.

What changes were made to financial regulations after the subprime mortgage crisis?

The Dodd-Frank Wall Street Reform and Consumer Protection Act was passed in 2010 to address the systemic risks exposed by the crisis. It introduced new regulations for banks, created the Consumer Financial Protection Bureau, and aimed to prevent future financial crises.