Annuity 1 Million 2024 takes center stage as we delve into the realm of retirement planning. This guide explores the potential of annuities as a vehicle to accumulate a substantial retirement nest egg, setting the stage for a secure and comfortable future.

While annuities are primarily financial products, they are not directly related to health insurance. To learn more about health insurance options in 2024, you can visit this article: Annuity Health Insurance 2024.

We will dissect the intricacies of annuities, exploring their various types, benefits, and drawbacks. Moreover, we will meticulously craft a roadmap for reaching your $1 million goal by 2024, encompassing realistic savings strategies, investment diversification, and a comprehensive understanding of inflation’s impact.

Tax rules for annuities can vary across countries. If you’re in the UK and wondering about the taxability of annuity income in 2024, you can find relevant information in this article: Is Annuity Income Taxable In Uk 2024.

Our exploration extends beyond traditional annuities, delving into alternative investment avenues such as real estate, precious metals, and cryptocurrency. We will analyze the risk-reward profiles of these options, examining their suitability within a diversified portfolio. Finally, we will address the crucial financial planning considerations that underpin achieving your $1 million milestone, emphasizing the importance of individual circumstances, risk tolerance, and expert guidance.

Annuity and pension are both retirement income options, but they have key differences. To learn more about the differences between annuities and pensions in 2024, you can visit this article: Annuity Vs Pension 2024.

Contents List

What is an Annuity?

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s essentially a contract between you and an insurance company, where you make a lump sum payment or a series of payments, and in return, the insurance company guarantees a series of payments in the future.

While annuities are often associated with insurance, they are not considered traditional insurance products. To understand the difference between annuities and insurance in 2024, you can read this article: Is Annuity Insurance 2024.

Annuities are often used as a retirement income strategy, but they can also be used for other purposes, such as supplementing income during retirement, providing a guaranteed income stream for a beneficiary, or protecting against longevity risk.

The taxability of annuity income can vary depending on the country. If you’re interested in the tax implications of annuities in India, you can find more information in this article: Is Annuity Income Taxable In India 2024.

Core Components of an Annuity

The core components of an annuity include:

- Premium:The initial payment or series of payments made to the insurance company to purchase the annuity. This can be a lump sum or a series of regular payments.

- Annuity Period:The duration of time over which the annuity payments are made. This can be for a fixed period, such as 10 years, or for the lifetime of the annuitant.

- Payment Amount:The amount of money paid out to the annuitant on a regular basis, which can be monthly, quarterly, or annually.

- Interest Rate:The rate of return earned on the premium, which determines the amount of the annuity payments.

Types of Annuities

Annuities can be categorized into different types based on how the interest rate is determined and how the payments are structured.

Annuity health careers focus on providing financial security for healthcare professionals. If you’re interested in learning more about annuity options for healthcare professionals in 2024, you can check out this article: Annuity Health Careers 2024.

- Fixed Annuities:These offer a guaranteed rate of return, which means the payment amount is fixed for the duration of the annuity. This provides stability and predictability, but the returns may not keep pace with inflation.

- Variable Annuities:These invest the premium in a sub-account that fluctuates with market performance. The payment amount can vary depending on the performance of the sub-account, offering the potential for higher returns but also higher risk.

- Indexed Annuities:These offer a return linked to the performance of a specific index, such as the S&P 500. They provide some protection against inflation and market downturns while offering the potential for growth. However, the return is capped, limiting the potential upside.

Annuity is often associated with life insurance due to its focus on providing income for a specific period. However, it’s important to note that annuities are not the same as life insurance. To understand the distinction, you can read this article: Annuity Is A Life Insurance Product That 2024.

Benefits and Drawbacks of Annuities

Annuities offer several benefits, including:

- Guaranteed Income:Fixed annuities provide a guaranteed stream of income, offering peace of mind during retirement.

- Longevity Protection:Annuities can help protect against outliving your savings, as they provide a steady income stream for life.

- Tax Advantages:Annuity payments may be tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them.

However, annuities also have drawbacks:

- Limited Flexibility:Once you purchase an annuity, you generally can’t access your premium without incurring penalties.

- Potential for Lower Returns:Fixed annuities may offer lower returns compared to other investments, especially during periods of high inflation.

- Fees and Expenses:Annuities often come with fees and expenses, which can reduce your overall returns.

Accumulating $1 Million by 2024

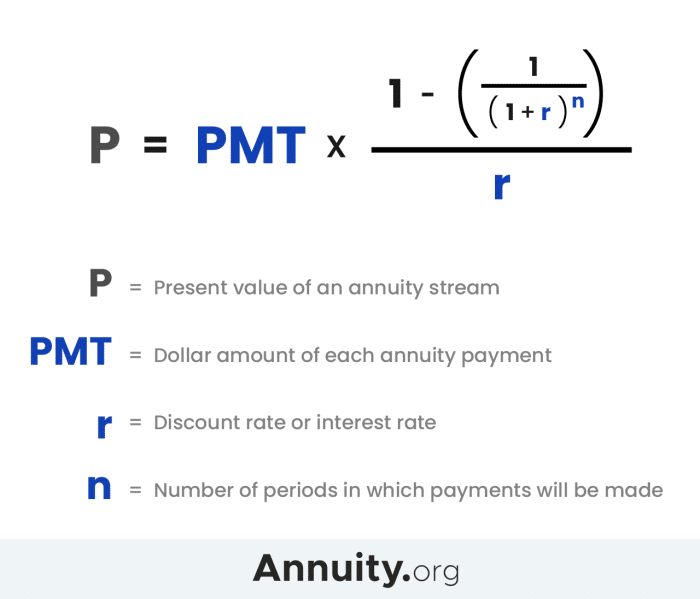

Reaching $1 million by 2024 is a significant financial goal, and it requires a disciplined savings plan and a strategic investment approach. To calculate the required annual contribution, we need to consider the expected average annual return on your investments.

When considering an annuity, you may wonder if it’s a guaranteed income stream. The answer depends on the specific type of annuity. To learn more about the certainty of annuities in 2024, you can check out this article: Is Annuity Certain 2024.

Calculating Required Annual Contribution

Let’s assume a conservative average annual return of 5%. Using a financial calculator or online tools, we can calculate that you would need to contribute approximately $150,000 per year to reach $1 million by 2024. This assumes you have no existing savings.

Annuity products are designed to provide a steady stream of income, making them a popular choice for retirement planning. If you’re curious about the various ways annuities are used in 2024, you can find more information in this article: Annuity Is Used In 2024.

Designing a Savings Plan

A realistic savings plan should incorporate diversification across asset classes to mitigate risk and enhance potential returns. This might include:

- Stocks:Equities offer the potential for higher returns over the long term, but they also carry more risk.

- Bonds:Bonds provide more stability and income, but they generally offer lower returns than stocks.

- Real Estate:Real estate can offer both income and appreciation potential, but it requires significant capital and management.

- Cash and Equivalents:Cash provides liquidity and safety, but it offers little potential for growth.

Impact of Inflation

Inflation can erode the purchasing power of your savings over time. To mitigate its effects, consider:

- Investing in Inflation-Protected Assets:Some investments, such as Treasury Inflation-Protected Securities (TIPS), are designed to keep pace with inflation.

- Adjusting Savings Goals:As inflation rises, you may need to adjust your savings goals to account for the decreased purchasing power of $1 million in the future.

Annuity Options for Reaching $1 Million

Annuities can play a role in reaching a $1 million goal, but it’s important to consider their suitability based on your individual circumstances and risk tolerance.

Joint ownership in an annuity allows multiple individuals to benefit from the payments. If you’re considering joint ownership of an annuity in 2024, this article can provide helpful information: Annuity Joint Ownership 2024.

Suitability of Annuity Products

- Fixed Annuities:These can provide a guaranteed income stream for life, which can be helpful if you’re seeking stability and predictability. However, they may not offer the potential for high returns.

- Variable Annuities:These offer the potential for higher returns, but they also carry more risk. They may be suitable for those with a higher risk tolerance and a longer investment horizon.

- Indexed Annuities:These provide some protection against inflation and market downturns, making them a good option for those seeking a balance between growth and stability.

Advantages and Disadvantages of Using an Annuity

Annuities can be used as a primary or supplemental investment vehicle, but it’s important to weigh the advantages and disadvantages:

- Advantages:

- Guaranteed income stream

- Longevity protection

- Tax deferral on earnings

- Disadvantages:

- Limited flexibility

- Potential for lower returns

- Fees and expenses

Tax Implications of Annuity Payments, Annuity 1 Million 2024

The tax implications of annuity payments depend on the type of annuity and how it is structured. Generally, the earnings portion of annuity payments is taxed as ordinary income, while the principal portion is not taxed. However, it’s important to consult with a tax advisor to understand the specific tax implications of your annuity.

An annuity is a financial product that can provide a steady stream of income during retirement. If you’re curious about what an annuity is and how it works in 2024, this article can provide valuable information: Annuity Is What 2024.

Concluding Remarks: Annuity 1 Million 2024

As we conclude our journey through Annuity 1 Million 2024, it becomes evident that achieving this ambitious goal requires a multifaceted approach. A well-structured plan, encompassing diverse investment strategies, a deep understanding of market dynamics, and a commitment to financial discipline, will be paramount.

Annuity payments are considered income and are typically taxable. To learn more about whether annuity income is taxable in 2024, you can visit this article: Is Annuity Income 2024.

By carefully considering the information presented, you can equip yourself with the knowledge and tools to navigate the path toward a secure and prosperous retirement.

Annuity death benefits can be a valuable source of income for beneficiaries, but it’s important to understand the tax implications. You can find out if the death benefit from an annuity is taxable in 2024 by visiting this article: Is Annuity Death Benefit Taxable 2024.

Popular Questions

What are the tax implications of annuity payments and withdrawals?

The tax implications of annuity payments and withdrawals vary depending on the type of annuity and the individual’s tax situation. Generally, withdrawals from a traditional annuity are taxed as ordinary income, while withdrawals from a Roth annuity are tax-free.

How can I mitigate the impact of inflation on my $1 million goal?

To mitigate the impact of inflation, consider investing in assets that tend to outpace inflation, such as stocks, real estate, and commodities. Additionally, you can explore inflation-protected securities like TIPS (Treasury Inflation-Protected Securities).

Is it necessary to consult with a financial advisor?

Consulting with a financial advisor is highly recommended, especially for complex financial goals like reaching $1 million. They can provide personalized advice, create a tailored plan, and help you navigate the intricacies of investing and financial planning.

Annuity investments are typically considered safe, but it’s essential to understand the risks involved. To learn more about the safety of annuities in 2024, you can read this article: Is Annuity Safe 2024.

An annuity is a financial product that provides a series of regular payments for a specific period. To learn more about how annuities work and the nature of these payments, you can visit this article: Annuity Is A Series Of Equal Payments 2024.