Annuity 600k 2024: Planning for Retirement Income, this guide explores the potential of annuities as a retirement income strategy. We’ll delve into the world of annuities, specifically focusing on how a $600,000 investment could generate a steady stream of income for your golden years.

An annuity is a contract where you make a lump sum payment or a series of payments in exchange for regular income payments, usually starting at a later date. Annuity Is Meaning 2024 explains the concept in more detail, including the different types of annuities and their features.

We’ll examine the various types of annuities available, analyze the factors influencing payout amounts, and discuss the current economic climate’s impact on annuity investments. This guide aims to provide a comprehensive overview of annuities, empowering you to make informed decisions about your retirement planning.

An annuity is a financial product that provides a stream of payments over a set period of time, often used for retirement income. Annuity What Is The Meaning 2024 can help you understand the basics of annuities, including how they work and the different types available.

From understanding the basics of annuities to exploring the potential of a $600,000 investment, this guide will equip you with the knowledge to make informed decisions about your retirement income. We’ll cover the different types of annuities, analyze the factors influencing payout amounts, and discuss the current economic climate’s impact on annuity investments.

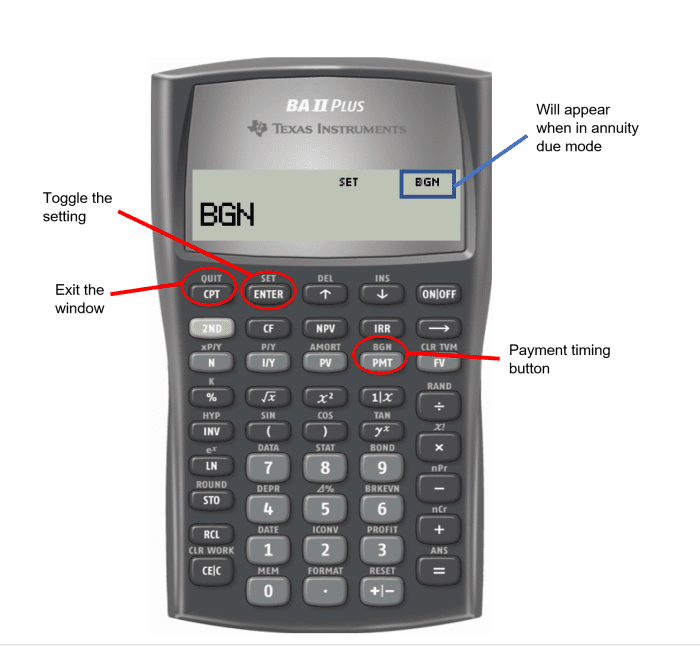

To determine the required annuity amount for a specific period, you can use a calculator or consult with a financial advisor. What Annuity Is Required Over 12 Years 2024 explores the process of calculating the necessary annuity payments to meet your financial goals.

Our goal is to provide you with a clear understanding of annuities, allowing you to confidently navigate this important aspect of your financial planning.

Contents List

Annuity Basics

An annuity is a financial product that provides a stream of regular payments over a set period of time. It is typically used for retirement planning, but can also be used for other purposes, such as income generation or estate planning.

An annuity is essentially a stream of regular payments that provides a guaranteed income source, often used for retirement planning. An Annuity Is A Stream Of 2024 elaborates on the concept of an annuity as a stream of income and its implications for financial planning.

Annuities are often purchased with a lump sum of money, which is then invested and used to generate the regular payments.

Types of Annuities

There are several different types of annuities, each with its own features and benefits. Here are some of the most common types:

- Fixed Annuities:These annuities guarantee a fixed rate of return, meaning that the payments will remain the same over the life of the annuity. They provide a predictable income stream, but the return may not keep pace with inflation.

- Variable Annuities:These annuities invest in a portfolio of securities, such as stocks or bonds. The payments are not guaranteed, but they have the potential to grow over time. Variable annuities can be a good option for investors who are willing to take on more risk for the potential of higher returns.

A reversionary annuity is a type of annuity where the payments continue to a designated beneficiary after the death of the original annuitant. Annuity Is Reversionary 2024 delves into the specifics of reversionary annuities and their potential benefits for estate planning.

- Indexed Annuities:These annuities offer a return that is linked to the performance of a specific index, such as the S&P 500. They provide some protection from inflation, but the returns may be limited.

Key Features of Annuities

Annuities offer a variety of features that can be tailored to your individual needs. Some of the key features include:

- Payout Options:You can choose how you want to receive your annuity payments, such as a lump sum, monthly payments, or a combination of both.

- Guarantees:Some annuities offer guarantees, such as a minimum return or a death benefit.

- Tax Advantages:Annuities can offer tax advantages, such as tax-deferred growth or tax-free withdrawals.

Annuity for $600,000

If you have $600,000 to invest in an annuity, you have a variety of options available to you. The type of annuity you choose will depend on your individual needs and goals.

While both annuities and IRAs are retirement savings vehicles, they have distinct characteristics and purposes. Is Annuity The Same As Ira 2024 clarifies the differences between annuities and IRAs, helping you understand which option may be more suitable for your needs.

Examples of Annuity Products

Here are some examples of annuity products that might be suitable for a $600,000 investment:

- Fixed Annuity:A fixed annuity with a $600,000 investment could provide a guaranteed income stream of $30,000 per year, depending on the interest rate and payout options chosen.

- Variable Annuity:A variable annuity with a $600,000 investment could potentially generate a higher income stream than a fixed annuity, but the payments would not be guaranteed. The actual income stream would depend on the performance of the underlying investments.

- Indexed Annuity:An indexed annuity with a $600,000 investment could provide a return that is linked to the performance of a specific index, such as the S&P 500. The income stream would fluctuate based on the index’s performance, but there would be a minimum return guarantee.

Annuities are sometimes referred to as “guaranteed income streams” or “retirement income plans.” Annuity Is Also Known As 2024 provides further insight into the alternative names and synonyms used for annuities.

Potential Income Streams

The potential income stream from a $600,000 annuity will vary depending on the type of annuity, the interest rate, and the payout options chosen. For example, a fixed annuity with a 4% interest rate could generate an annual income stream of $24,000.

Annuities are typically provided by insurance companies or financial institutions. Annuity Is Given By 2024 provides insights into the process of choosing an annuity provider and the factors to consider.

A variable annuity could generate a higher income stream if the underlying investments perform well, but the payments would not be guaranteed.

Factors Influencing Annuity Payouts

Several factors can influence the annuity payouts for a $600,000 investment, including:

- Age:Younger investors will generally receive lower annuity payouts than older investors, because they have a longer life expectancy.

- Interest Rates:Higher interest rates generally lead to higher annuity payouts.

- Investment Choices:The investment choices made for a variable annuity will affect the potential income stream.

Annuity Considerations in 2024

The economic climate and market trends can have a significant impact on annuities. It is important to consider these factors when making investment decisions.

The taxation of inherited annuities depends on the type of annuity and the beneficiary’s relationship to the deceased. How Is Inherited Annuity Taxed 2024 explains the tax implications of inheriting an annuity and the different scenarios that may apply.

Current Economic Climate

In 2024, the economic climate is expected to be volatile, with inflation and interest rates remaining elevated. This could impact annuity payouts, as interest rates are a key factor in determining the return on fixed annuities.

Potential Changes in Regulations

The regulatory environment for annuities is constantly evolving. In 2024, there may be changes to regulations that affect annuity products, such as changes to payout options or guarantees.

Annuity Gator is a popular online resource for information and comparisons of annuity products. Annuity Gator 2024 offers a comprehensive guide to annuity products and tools for finding the best options for your situation.

Risks and Benefits of Investing in an Annuity

Investing in an annuity has both risks and benefits. Some of the key considerations include:

- Risk:Fixed annuities offer a guaranteed return, but the return may not keep pace with inflation. Variable annuities are subject to market risk, and the payments are not guaranteed.

- Benefits:Annuities can provide a predictable income stream, tax advantages, and guarantees. They can be a valuable tool for retirement planning and income generation.

Annuity vs. Other Investment Options: Annuity 600k 2024

Annuities are just one of many investment options available to investors. It is important to compare and contrast annuities with other options to determine the best choice for your individual needs and goals.

The death benefit from an annuity may be taxable, depending on the type of annuity and the beneficiary’s relationship to the deceased. Is Annuity Death Benefit Taxable 2024 provides information on the tax treatment of annuity death benefits and the factors that influence their taxability.

Comparison of Investment Options, Annuity 600k 2024

Here is a table comparing the key features, risks, and returns of different investment options, including annuities:

| Investment Option | Key Features | Risks | Returns |

|---|---|---|---|

| Annuities | Guaranteed income stream, tax advantages, guarantees | Limited growth potential, potential for low returns | Variable depending on type of annuity and interest rates |

| Stocks | Potential for high growth, liquidity | Market risk, volatility | Variable, potentially high |

| Bonds | Lower risk than stocks, income stream | Interest rate risk, inflation risk | Lower than stocks, but more stable |

| Real Estate | Potential for appreciation, tax advantages | Illiquidity, market risk | Variable, potentially high |

Suitability for Different Financial Goals

The suitability of annuities for different financial goals and risk profiles will vary. Annuities can be a good option for investors who are looking for a guaranteed income stream, tax advantages, and protection from market risk. However, they may not be the best option for investors who are seeking high growth potential.

An annuity value calculator can help you estimate the value of an annuity based on various factors such as the initial investment, interest rate, and payout period. Annuity Value Calculator 2024 explores the use of annuity value calculators and the benefits they provide.

Annuity Planning and Strategies

Planning and purchasing an annuity requires careful consideration. Here is a step-by-step guide to help you make informed decisions.

You can get quotes from different annuity providers to compare their rates and terms. Annuity Quotes 2024 provides tips for obtaining quotes and understanding the key factors to consider when evaluating them.

Step-by-Step Guide

- Determine Your Financial Goals:What are you hoping to achieve with an annuity? Are you looking for a guaranteed income stream, tax advantages, or protection from market risk?

- Consider Your Risk Tolerance:How much risk are you willing to take on? Fixed annuities offer a guaranteed return, but the return may not keep pace with inflation. Variable annuities are subject to market risk, but they have the potential for higher returns.

- Research Annuity Products:Compare different annuity products from different providers to find the best fit for your needs.

- Seek Professional Advice:Consult with a financial advisor to get personalized advice on annuity planning and strategies.

Strategies for Maximizing Benefits

Here are some strategies for maximizing annuity benefits and managing risk:

- Choose the Right Payout Option:Select a payout option that aligns with your financial goals and income needs.

- Diversify Your Investments:If you choose a variable annuity, diversify your investments to reduce risk.

- Consider a Guaranteed Minimum Income Benefit (GMIB):A GMIB can provide a guaranteed minimum income stream, even if the underlying investments perform poorly.

Importance of Professional Advice

Seeking professional financial advice is essential when purchasing an annuity. A financial advisor can help you understand the different types of annuities, choose the right product for your needs, and develop a comprehensive financial plan.

The issuer of an annuity is the company that provides the contract and guarantees the payments. Annuity Issuer 2024 delves into the role of annuity issuers and the criteria for choosing a reputable provider.

Final Review

Annuity 600k 2024: Planning for Retirement Income, this guide has provided a comprehensive overview of annuities, exploring their potential as a retirement income strategy. We’ve discussed the various types of annuities, analyzed the factors influencing payout amounts, and discussed the current economic climate’s impact on annuity investments.

While annuities can be a valuable tool for retirement planning, it’s essential to consider your individual financial goals and risk tolerance before making any investment decisions. Consulting with a qualified financial advisor can provide personalized guidance tailored to your unique circumstances.

Query Resolution

What are the tax implications of annuity payouts?

The tax implications of annuity payouts depend on the type of annuity and the specific terms of the contract. Generally, the payouts are taxed as ordinary income. It’s essential to consult with a tax professional to understand the tax implications of your specific annuity.

Are there any fees associated with annuities?

An annuity works by converting a lump sum of money into a stream of regular payments. Annuity How It Works 2024 explains the mechanics of how annuities function, including the calculation of payments and the factors that influence their amount.

Yes, annuities often have fees associated with them, including administrative fees, surrender charges, and mortality and expense charges. It’s crucial to carefully review the fees associated with any annuity you’re considering to ensure they align with your financial goals.

How do I choose the right annuity for my needs?

Choosing the right annuity requires careful consideration of your financial goals, risk tolerance, and time horizon. It’s highly recommended to consult with a qualified financial advisor who can help you assess your needs and recommend an annuity that aligns with your financial plan.