Annuity 75000 2024 – Annuity $75,000 2024: Navigating the complex world of retirement planning can be daunting, but understanding the potential of annuities can provide a solid foundation for a secure future. This guide delves into the intricacies of annuities, exploring their various forms, growth potential, and relevance in the context of 2024’s economic landscape.

Annuities can be a complex financial product, and it’s important to weigh the pros and cons before making a decision. You can find information about whether an annuity is a good investment in 2024 on Annuity Is It A Good Investment 2024.

This can help you make an informed decision about your financial future.

We’ll analyze how a $75,000 annuity can be strategically incorporated into a comprehensive retirement plan, addressing both its benefits and potential drawbacks. Through a case study, we’ll demonstrate how this type of annuity can be used to achieve specific retirement objectives, offering valuable insights for individuals seeking financial stability in their golden years.

Annuities can provide a steady stream of income for a set period of time. You might be interested in exploring Annuity 300 000 2024 , which provides a fixed payment of $300,000 annually. This can be a helpful way to manage your finances during retirement.

The year 2024 presents unique challenges and opportunities for those planning for retirement. Interest rates, inflation, and tax policies are constantly evolving, making it crucial to stay informed about the latest trends and regulations. This guide will equip you with the knowledge to make informed decisions regarding annuities and their potential impact on your retirement planning.

Annuities can offer guaranteed income for a specific period of time. You might be interested in learning about Annuity 20 Year Certain 2024 , which provides a fixed income stream for 20 years. This can be a valuable tool for retirement planning.

Contents List

Annuity Basics

An annuity is a financial product that provides a stream of regular payments for a specified period of time. It is often used as a source of income during retirement, but it can also be used for other purposes, such as funding education expenses or providing income for a surviving spouse.

If you’re considering an annuity, you might be interested in learning about potential penalties. You can find information about a 10% penalty on annuities in 2024 on Annuity 10 Penalty 2024. This can help you understand the potential costs involved.

Annuities can be purchased from insurance companies, and they come in a variety of forms, each with its own set of features and benefits.

If you’re looking for educational resources on annuities, you might be interested in checking out Annuity Khan Academy 2024. Khan Academy provides free educational resources on a variety of topics, including annuities.

Types of Annuities

- Fixed Annuities: These annuities provide a guaranteed rate of return for a specified period of time. The payments are fixed and predictable, making them a good choice for individuals who are seeking stability and security.

- Variable Annuities: These annuities invest in a variety of sub-accounts, such as stocks, bonds, and mutual funds. The value of the annuity can fluctuate based on the performance of the underlying investments. Variable annuities can offer the potential for higher returns, but they also carry more risk.

Understanding the tax implications of annuities is crucial. You can learn about whether an annuity is qualified in 2024 by visiting Annuity Is Qualified 2024. This information can help you optimize your tax strategy.

- Indexed Annuities: These annuities offer a return that is linked to the performance of a specific index, such as the S&P 500. Indexed annuities provide some protection from market downturns, while still offering the potential for growth.

Key Features of Annuities, Annuity 75000 2024

- Payout Period: The payout period is the length of time that the annuity will make payments. It can be for a fixed period, such as 10 years, or for the lifetime of the annuitant.

- Interest Rates: Annuities typically offer a guaranteed interest rate, which can vary depending on the type of annuity and the current market conditions.

- Tax Implications: The tax implications of annuities can vary depending on the type of annuity and how it is structured. In general, the payments from an annuity are taxed as ordinary income.

Annuity Value of $75,000: Annuity 75000 2024

A $75,000 annuity can potentially provide a significant stream of income over time, depending on the interest rate and the type of annuity.

Annuities can be a good option for those looking for a guaranteed income stream. You might be interested in exploring Annuity 250k 2024 , which provides a fixed payment of $250,000 annually. This can be a helpful way to manage your finances during retirement.

Potential Growth of a $75,000 Annuity

The potential growth of a $75,000 annuity can vary significantly based on the interest rate and the investment options chosen. For example, a fixed annuity with a 3% annual interest rate would generate approximately $2,250 in annual income. However, a variable annuity invested in a stock portfolio with an average annual return of 8% could generate significantly higher returns.

Impact of Inflation on Annuity Value

Inflation can erode the purchasing power of an annuity over time. For example, a $75,000 annuity that provides $2,250 in annual income today may only be able to purchase goods and services worth $45,000 in 20 years if inflation averages 3% per year.

Annuities can be structured in various ways. You might be interested in learning about Annuity Contingent Is 2024 , which provides payments based on certain conditions. This type of annuity can be a good option for those looking for flexibility in their retirement planning.

Comparison with Other Investment Options

A $75,000 annuity can be compared to other investment options, such as stocks, bonds, and real estate.

If you’re looking for information about a specific annuity amount, you might be interested in learning about Annuity 600 000 2024. This type of annuity can provide a steady stream of income for a set period of time, and it can be a valuable tool for retirement planning.

- Stocks: Stocks offer the potential for higher returns than annuities, but they also carry more risk. The value of stocks can fluctuate significantly, and investors could lose money if the market declines.

- Bonds: Bonds are generally considered to be less risky than stocks, but they also offer lower returns. Bonds provide a fixed stream of income, similar to an annuity, but they are not as flexible.

- Real Estate: Real estate can be a good investment, but it requires significant capital and can be illiquid. Real estate investments can also be subject to market fluctuations and economic downturns.

Annuity Considerations for 2024

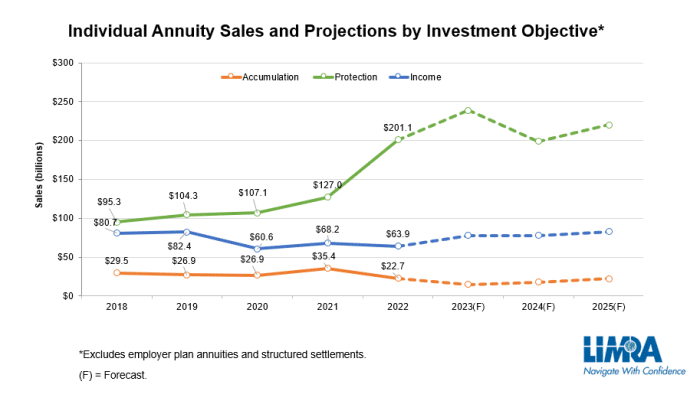

The current market trends and economic conditions will influence annuity decisions in 2024.

Annuities and IRAs are both retirement savings vehicles, but they have distinct features. You can find information about whether an annuity is the same as an IRA in 2024 on Is Annuity Same As Ira 2024. Understanding the differences can help you choose the right retirement savings strategy for you.

Current Market Trends and Economic Conditions

- Interest Rates: Interest rates are expected to remain low in 2024, which could make annuities less attractive to investors. Low interest rates can lead to lower returns on fixed annuities and may make variable annuities more appealing.

- Tax Policies: Tax policies can impact the attractiveness of annuities. Changes in tax laws could affect the taxability of annuity payments, making them more or less appealing to investors.

- Investment Regulations: Regulations governing annuities could change in 2024. New regulations could impact the types of annuities available, the fees charged, and the minimum investment requirements.

Risks and Rewards of Annuities

- Risk: Annuities can carry risks, such as the potential for low returns, inflation eroding the value of payments, and the possibility of losing principal if the annuity is not structured correctly.

- Reward: Annuities can offer the potential for a guaranteed stream of income, protection from market downturns, and tax advantages.

Planning for Retirement with an Annuity

An annuity can be a valuable tool for retirement planning.

When purchasing an annuity, it’s important to understand the different options available. You can find information about purchasing an annuity in 2024 on Annuity Is Purchased 2024. This can help you make informed decisions about your financial future.

Benefits and Drawbacks of Using an Annuity

- Benefits: Annuities can provide a guaranteed stream of income, protection from market downturns, and tax advantages. They can also help to simplify retirement planning by providing a predictable source of income.

- Drawbacks: Annuities can be illiquid, meaning that it may be difficult to access the funds before the payout period begins. Annuities can also be complex and require careful planning to ensure that they are structured appropriately.

Step-by-Step Guide for Retirement Planning with an Annuity

- Determine Your Retirement Income Needs: Calculate your estimated expenses in retirement, including housing, healthcare, travel, and entertainment. Consider your desired lifestyle and any potential changes in your spending habits.

- Evaluate Your Existing Retirement Savings: Assess your current retirement savings, including 401(k)s, IRAs, and other investment accounts. Consider your investment goals and risk tolerance.

- Explore Annuity Options: Research different types of annuities, including fixed, variable, and indexed annuities. Consider the features, benefits, and risks of each type.

- Seek Professional Advice: Consult with a financial advisor to discuss your retirement planning goals and to determine if an annuity is right for you. A financial advisor can help you choose the right type of annuity and structure it appropriately.

- Monitor Your Annuity: Once you have purchased an annuity, it is important to monitor its performance and make adjustments as needed. This includes reviewing your investment strategy, considering changes in interest rates, and adjusting your payout period if necessary.

Case Study: $75,000 Annuity for Retirement

Let’s consider a hypothetical scenario for an individual using a $75,000 annuity to supplement their retirement income.

Like any financial product, annuities can come with certain issues. You can find information about potential issues related to annuities in 2024 on Annuity Issues 2024. Being aware of these issues can help you make informed decisions.

Scenario

Sarah, a 65-year-old retired teacher, has $75,000 in savings that she wants to use to supplement her retirement income. She is looking for a reliable source of income that will provide her with a steady stream of payments for the rest of her life.

Sarah has a moderate risk tolerance and is looking for an annuity that will offer a balance between potential growth and security.

Understanding the exclusion ratio is crucial when considering annuities. You can find information about the exclusion ratio for annuities in 2024 on Annuity Exclusion Ratio 2024. This information can help you understand the tax implications of your annuity.

Solution

Sarah could consider purchasing a fixed annuity with a guaranteed interest rate of 3% per year. This would provide her with an annual income of $2,250 for the rest of her life. While this may not be a significant amount of income, it could provide Sarah with some additional financial security and help her to cover some of her essential expenses.

When considering annuities, it’s important to understand the licensing requirements. You can find information about whether an annuity is licensed in 2024 on Is Annuity Lic 2024. This can help you make informed decisions about your financial future.

Outcome

By purchasing a fixed annuity, Sarah can ensure a steady stream of income for the rest of her life. This can provide her with peace of mind and help her to manage her retirement expenses. However, it is important to note that the value of the annuity payments will be eroded by inflation over time.

When considering annuities, you might come across the term “Annuity 65 2024.” This likely refers to an annuity that starts at age 65 in the year 2024. You can find more information about this type of annuity on Annuity 65 2024.

Closing Notes

As you embark on your retirement planning journey, consider the potential of annuities as a valuable tool to supplement your income and secure your financial future. While there are inherent risks and considerations involved, a well-structured annuity strategy, tailored to your individual needs and circumstances, can provide peace of mind and financial stability in the years to come.

Remember to consult with a financial advisor to assess your specific situation and make informed decisions that align with your long-term goals.

FAQ Overview

What are the different types of annuities?

Annuities can be categorized as fixed, variable, or indexed. Fixed annuities offer guaranteed interest rates, while variable annuities link returns to the performance of underlying investments. Indexed annuities offer potential growth tied to a specific market index.

How do I calculate the potential growth of a $75,000 annuity?

The growth of an annuity depends on factors like the interest rate, investment options, and the duration of the payout period. Online calculators and financial advisors can help you estimate potential growth based on your specific circumstances.

What are the tax implications of an annuity?

Tax implications vary depending on the type of annuity and the distribution method. Generally, withdrawals from an annuity are taxed as ordinary income. Consult with a tax professional for specific guidance.