Annuity Calculation Formula 2024 is your key to understanding the intricate world of financial planning. Whether you’re saving for retirement, planning for a mortgage, or investing for the future, understanding annuity calculations is crucial. Annuities are a powerful tool that allows you to structure your finances for long-term growth and stability, and this guide will provide you with the knowledge to utilize them effectively.

Annuity bonds are a type of investment that can provide a fixed stream of income over time. If you’re interested in learning how to calculate the value of an annuity bond, you can find information on Calculate Annuity Bond 2024.

An annuity is a series of equal payments made over a specific period of time, often used for retirement planning, loan repayment, and investment strategies. This formula takes into account key variables like principal, interest rate, payment period, and the number of payments to calculate the present or future value of an annuity.

Annuity payments are generally considered unearned income. If you’re curious about the tax implications of annuity income, you can find information on Is Annuity Earned Income 2024.

By understanding these calculations, you can make informed decisions about your financial future and maximize your potential for wealth creation.

Contents List

Understanding Annuity Calculations

Annuity calculations are essential for financial planning, as they help individuals and institutions determine the present and future values of a series of payments. An annuity is a series of equal payments made over a specific period of time, often used in retirement planning, loan payments, and investment strategies.

An annuity equation is a mathematical formula used to calculate the present or future value of an annuity. You can learn more about this equation on Annuity Equation 2024.

Annuity Concept and Components, Annuity Calculation Formula 2024

An annuity consists of several key components:

- Principal:The initial amount of money invested or borrowed.

- Interest Rate:The percentage return earned on the principal or the cost of borrowing money.

- Payment Period:The frequency of payments, such as monthly, quarterly, or annually.

- Number of Payments:The total number of payments made over the life of the annuity.

The annuity calculation formula is used to determine the present value (PV) or future value (FV) of an annuity, based on these components. The formula takes into account the time value of money, which means that money received today is worth more than money received in the future due to its potential earning capacity.

Wondering how much income you can expect from an annuity? You can explore the potential payout for a specific amount, like $80,000, by visiting How Much Does A 80 000 Annuity Pay Per Month 2024.

Real-World Examples of Annuity Calculations

- Retirement Planning:Annuity calculations help determine how much to save for retirement, based on desired income and life expectancy.

- Loan Payments:Annuity calculations are used to determine monthly mortgage payments or car loan payments.

- Investment Strategies:Annuity calculations can be used to evaluate the profitability of different investment options, such as bonds or mutual funds.

Key Formula Elements

The annuity calculation formula involves several key variables that influence the final result:

Variables in Annuity Calculation

- Present Value (PV):The current value of a future stream of payments.

- Future Value (FV):The value of a series of payments at a future point in time.

- Payment Amount (PMT):The amount of each individual payment.

- Interest Rate (i):The rate of return earned on the investment or the cost of borrowing money.

- Number of Periods (n):The total number of payment periods over the life of the annuity.

The significance of each variable is evident in its impact on the final calculation. For example, a higher interest rate will result in a higher future value, while a longer payment period will result in a lower present value.

Purchasing an annuity involves making a lump sum payment in exchange for a guaranteed income stream. If you’re curious about the process of purchasing an annuity, you can find information on Annuity Is Purchased 2024.

Types of Annuities

Annuities can be classified into different types based on the timing of payments and interest rate fluctuations:

- Ordinary Annuity:Payments are made at the end of each period.

- Annuity Due:Payments are made at the beginning of each period.

- Fixed Annuity:The interest rate remains constant throughout the life of the annuity.

- Variable Annuity:The interest rate fluctuates based on market conditions.

Each type of annuity has its own specific formula, reflecting the timing of payments and interest rate adjustments.

An “X Share Annuity” is a type of annuity that may have specific features or terms. To learn more about this type of annuity, you can check out X Share Annuity 2024.

Annuity Calculation Methods

There are several methods for calculating annuities, each with its own advantages and disadvantages:

Present Value of an Annuity

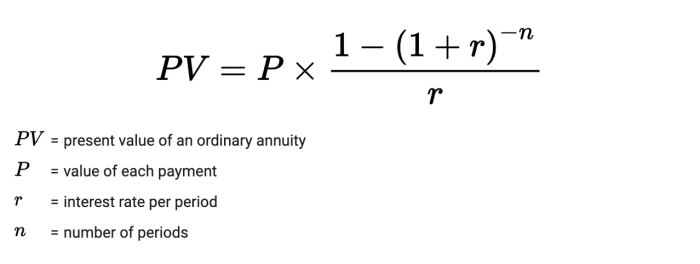

The present value of an annuity is the current value of a future stream of payments. To calculate the present value of an ordinary annuity, the following formula is used:

PV = PMT

- [1

- (1 + i)^-n] / i

Where:

- PV is the present value.

- PMT is the payment amount.

- i is the interest rate.

- n is the number of periods.

The formula calculates the present value by discounting each future payment back to its present value, using the interest rate as the discount factor.

Annuity payouts can be structured over different periods. If you’re interested in learning about annuities with a 5-year payout, you can find information on Annuity 5 Year Payout 2024.

Future Value of an Annuity

The future value of an annuity is the value of a series of payments at a future point in time. To calculate the future value of an ordinary annuity, the following formula is used:

FV = PMT

Annuity payments can be structured to last for a certain number of years, such as 30 years. You can find more information about annuities with a 30-year payout on Annuity 30 Years 2024.

- [(1 + i)^n

- 1] / i

Where:

- FV is the future value.

- PMT is the payment amount.

- i is the interest rate.

- n is the number of periods.

The formula calculates the future value by compounding each payment forward to its future value, using the interest rate as the compounding factor.

Annuity products can vary in their structure and terms. If you’re interested in learning more about a specific type of annuity, such as a “6 Annuity,” you can find information on 6 Annuity 2024.

Methods for Calculating Annuities

Annuities can be calculated using various methods, including:

- Tables:Annuity tables provide pre-calculated present and future values for different interest rates and payment periods. This method is simple but can be time-consuming and may not offer the desired level of accuracy.

- Financial Calculators:Financial calculators have built-in functions for calculating annuities, making the process faster and more accurate. However, calculators may not be readily available or may require specific knowledge of their functionalities.

- Online Tools:Numerous online tools and websites offer free annuity calculators, providing a convenient and user-friendly approach. However, the reliability and accuracy of these tools should be carefully evaluated.

Annuity Calculation Applications

Annuity calculations have numerous applications in financial planning, ranging from retirement planning to loan payments and investment strategies.

Real-World Applications of Annuity Calculations

| Application | Type of Annuity | Key Variables |

|---|---|---|

| Retirement Planning | Ordinary Annuity | Present Value (PV), Interest Rate (i), Number of Periods (n) |

| Loan Payments | Annuity Due | Payment Amount (PMT), Interest Rate (i), Number of Periods (n) |

| Investment Strategies | Fixed Annuity | Future Value (FV), Interest Rate (i), Number of Periods (n) |

Types of Annuities and Formulas

| Type of Annuity | Formula |

|---|---|

| Ordinary Annuity (PV) | PV = PMT

Annuity is a type of insurance product that can provide a guaranteed income stream, often used for retirement planning. If you’re curious about how annuities work as life insurance, you can check out this resource on An Annuity Is A Life Insurance Product That 2024.

|

| Ordinary Annuity (FV) | FV = PMT

Annuity is a financial product that can provide a steady stream of income for a set period of time. If you’re curious about how annuities work and how to calculate them, you can learn more by checking out this resource on An Annuity Is Quizlet 2024.

|

| Annuity Due (PV) | PV = PMT

Annuity is a term that has 9 letters. If you’re looking for a word puzzle or trivia related to annuities, you can find more information on Annuity 9 Letters 2024.

|

| Annuity Due (FV) | FV = PMT

To calculate the number of periods for an annuity, you can use a specialized calculator. You can find more information about this type of calculator on Annuity Number Of Periods Calculator 2024.

|

Factors Affecting Annuity Calculations: Annuity Calculation Formula 2024

Several factors can influence the results of annuity calculations, including interest rates, payment periods, and economic conditions.

An annuity is a financial product that offers a guaranteed income stream for a specific period. If you’re looking for a comprehensive definition of annuities, you can find it on An Annuity Is Best Defined As 2024.

Impact of Interest Rates

Interest rates play a significant role in annuity calculations. A higher interest rate will result in a higher future value and a lower present value. This is because a higher interest rate means that money will grow faster over time.

Annuity plans are available in the UK, providing income security and financial planning options. You can learn more about annuities in the UK by visiting Annuity Uk 2024.

Influence of Payment Periods

The frequency of payments, or payment period, also affects annuity calculations. More frequent payments, such as monthly payments, will result in a higher future value and a lower present value. This is because more frequent payments allow for more frequent compounding of interest.

Effect of Inflation and Economic Factors

Inflation and other economic factors can also influence annuity calculations. Inflation erodes the purchasing power of money over time, so it is important to consider inflation when calculating the future value of an annuity. Economic factors, such as changes in interest rates or economic growth, can also affect the value of annuities.

Conclusive Thoughts

Mastering annuity calculations empowers you to take control of your financial destiny. Whether you’re seeking a secure retirement, managing debt effectively, or investing wisely, understanding these formulas is essential. From retirement planning to investment strategies, the applications of annuity calculations are vast, offering a powerful framework for achieving your financial goals.

This guide has provided you with the foundation to confidently navigate the world of annuities, allowing you to make informed decisions and achieve financial success.

FAQ Resource

What are the different types of annuities?

There are several types of annuities, including ordinary annuities, annuities due, fixed annuities, and variable annuities. Each type has its own unique characteristics and formula, and the choice depends on your specific financial needs and goals.

How can I calculate an annuity using a financial calculator?

Most financial calculators have built-in functions for annuity calculations. You simply need to input the relevant variables, such as the interest rate, payment period, and number of payments, and the calculator will automatically compute the present or future value of the annuity.

What are the tax implications of annuities?

The tax implications of annuities can vary depending on the type of annuity and the specific tax laws in your jurisdiction. It’s essential to consult with a financial advisor or tax professional to understand the tax implications of any annuity investment.