Annuity Calculation Questions And Answers 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Annuities, a powerful financial tool, provide a steady stream of income for retirement or other financial goals.

Annuities can be a complex topic, but understanding the basics can help you make informed decisions about your financial future. Explore the details of annuities in this article on Annuity 712 2024.

Understanding how annuities work, how they are calculated, and the factors that influence their performance is crucial for making informed financial decisions.

There are different types of annuities available, each with its own set of features and benefits. Explore the five main types of annuities in this article on 5 Annuity 2024 to find the best fit for your needs.

This guide delves into the intricacies of annuity calculations, covering everything from the fundamental concepts to real-world applications. We will explore the key variables involved, different types of annuities, and the impact of factors like inflation and interest rates. Armed with this knowledge, you can confidently navigate the world of annuities and make informed choices for your financial future.

Trying to understand the complex world of annuities can be daunting. Fortunately, there are resources available to help you calculate your potential annuity payouts. Check out this helpful tool at Annuity Calculator Cnn 2024 to get started.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. These payments can be used for various purposes, such as retirement income, college savings, or debt consolidation. Annuities are often purchased with a lump sum payment, and the insurer then guarantees regular payments for a specific duration.

If you’re considering an annuity, it’s helpful to understand how your withdrawals will be calculated. Use this handy tool at Annuity Withdrawal Calculator 2024 to estimate your potential income stream.

Types of Annuities

Annuities are categorized into different types based on their payment structure, investment options, and other features. Some common types include:

- Fixed Annuities:These annuities offer a guaranteed fixed rate of return, providing predictable income streams. The payment amount remains constant throughout the annuity’s term, regardless of market fluctuations.

- Variable Annuities:These annuities invest in a variety of sub-accounts, typically mutual funds, with the potential for higher returns. However, the payment amount can fluctuate based on the performance of the underlying investments.

- Indexed Annuities:These annuities link their returns to the performance of a specific market index, such as the S&P 500. They offer potential growth while providing some downside protection.

Key Features of Annuities

Annuities possess several key features that differentiate them from other financial products:

- Payment Structure:Annuities can be structured to provide payments for a fixed period, for life, or for a combination of both. They can also be designed to start immediately or at a later date.

- Duration:The duration of an annuity, or the period over which payments are made, can vary significantly. Some annuities have a fixed term, while others continue for the lifetime of the annuitant.

- Tax Implications:The tax treatment of annuity payments depends on the type of annuity and the individual’s tax situation. Some annuities may be subject to taxes on both the principal and interest, while others may offer tax-deferred growth.

Comparing Different Types of Annuities

The choice of annuity type depends on an individual’s financial goals, risk tolerance, and time horizon. Here’s a comparison of the three major types:

| Feature | Fixed Annuity | Variable Annuity | Indexed Annuity |

|---|---|---|---|

| Return | Guaranteed fixed rate | Potentially higher, but not guaranteed | Linked to market index, with potential growth and downside protection |

| Risk | Low, as returns are guaranteed | Higher, as returns are not guaranteed | Moderate, with potential for growth and downside protection |

| Payment Structure | Fixed and predictable | Fluctuating based on investment performance | Potentially higher, but not guaranteed |

Annuity Calculation Fundamentals

Annuity calculations involve determining the present value, future value, or payment amount of an annuity based on specific variables.

While both annuities and IRAs are retirement savings vehicles, they have different features and benefits. Learn about the key differences between these two options at Is Annuity Same As Ira 2024 to decide which one is right for you.

Key Variables in Annuity Calculations

Several key variables are crucial for annuity calculations:

- Principal Amount:The initial lump sum payment used to purchase the annuity.

- Interest Rate:The rate of return earned on the annuity’s principal amount.

- Payment Frequency:The frequency at which annuity payments are made, such as monthly, quarterly, or annually.

- Time Period:The duration of the annuity, expressed in years or periods.

Present Value and Future Value of Annuities

Understanding the concepts of present value and future value is essential for annuity calculations:

- Present Value:The current value of a future stream of payments, discounted back to the present time. It represents the lump sum amount needed today to generate the desired annuity payments.

- Future Value:The value of an annuity at a future point in time, considering the growth of the principal amount and accumulated interest.

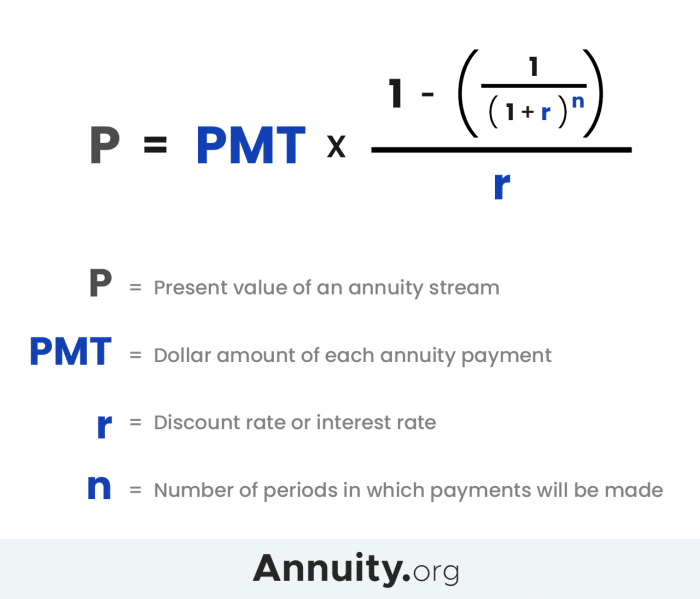

Annuity Calculation Formulas

Various formulas are used to calculate different aspects of annuities, including:

- Annuity Payment Calculation:This formula determines the regular payment amount based on the principal amount, interest rate, and time period.

- Present Value Calculation:This formula calculates the present value of a future stream of annuity payments, taking into account the discount rate.

- Future Value Calculation:This formula calculates the future value of an annuity at a specific point in time, considering the growth of the principal amount and accumulated interest.

Common Annuity Calculation Scenarios: Annuity Calculation Questions And Answers 2024

Annuity calculations are frequently used in various financial planning scenarios, such as:

Real-World Annuity Calculation Scenarios

- Retirement Planning:Annuities can provide a steady stream of income during retirement, ensuring financial security.

- College Savings:Annuities can be used to save for college expenses, providing a lump sum payment or a stream of payments to cover tuition and other costs.

- Debt Consolidation:Annuities can help consolidate multiple debts into a single payment, potentially lowering interest rates and simplifying debt management.

Steps Involved in Annuity Payment Calculation

| Scenario | Steps |

|---|---|

| Retirement Planning |

|

| College Savings |

|

| Debt Consolidation |

|

Flowchart for Annuity Calculation, Annuity Calculation Questions And Answers 2024

The following flowchart illustrates the process of calculating an annuity’s present or future value:

[Flowchart illustration showing the steps involved in calculating an annuity’s present or future value.]

Annuities are a versatile financial tool that can be used for a variety of purposes, including retirement planning, income generation, and even estate planning. Discover the different ways annuities are used in 2024 at Annuity Is Used In 2024.

Factors Affecting Annuity Calculations

Various factors can influence annuity calculations, impacting the payment amount, present value, and future value.

If you’re considering an annuity, it’s a good idea to get quotes from different providers to compare rates and features. You can easily find annuity quotes online at Annuity Quotes Online 2024 to help you make an informed decision.

Impact of Inflation, Interest Rates, and Life Expectancy

- Inflation:Inflation erodes the purchasing power of money over time. When calculating annuities, it’s crucial to consider inflation to ensure that payments maintain their value in the future.

- Interest Rate Fluctuations:Interest rates can fluctuate significantly, impacting the returns earned on annuities. Higher interest rates generally result in higher annuity payments, while lower interest rates lead to lower payments.

- Changes in Life Expectancy:Life expectancy is an important factor in determining the duration of an annuity. As life expectancy increases, the duration of the annuity may also increase, potentially leading to higher present value and lower payments.

Impact of Taxes on Annuity Payments

Taxes can significantly impact the net income received from annuities. The tax treatment of annuity payments varies depending on the type of annuity and the individual’s tax situation. Some annuities may be subject to taxes on both the principal and interest, while others may offer tax-deferred growth.

An annuity is a financial product that provides a steady stream of income for a set period of time. It’s often used for retirement planning, but can also be used for other purposes. To learn more about annuities, including how they work and how they can benefit you, visit Annuity Meaning With Example 2024.

Role of Fees and Charges

Annuities often come with fees and charges that can impact the overall return. These fees can include administrative fees, surrender charges, and mortality and expense charges. It’s essential to carefully consider these fees when comparing different annuity options.

An annuity can be a valuable part of your retirement planning. In many ways, it acts as a pension plan, providing a regular income stream after you stop working. Explore the relationship between annuities and pension plans in more detail at Annuity Is Pension Plan 2024.

Annuity Calculation Tools and Resources

Numerous online calculators and financial software programs are available to perform annuity calculations, simplifying the process and providing accurate results.

Calculating an annuity can seem complicated, but it’s not as difficult as you might think. This guide on how to calculate an annuity in 2024 will walk you through the steps.

Online Calculators and Financial Software

- Bankrate Annuity Calculator:This calculator allows you to compare different annuity options and estimate potential returns.

- Investopedia Annuity Calculator:This calculator helps determine the present value, future value, or payment amount of an annuity based on various variables.

- Financial Planning Software:Programs like Personal Capital and Mint offer features for annuity calculations and financial planning.

Reputable Financial Websites and Resources

- Securities and Exchange Commission (SEC):The SEC provides information on annuities and other investment products.

- Financial Industry Regulatory Authority (FINRA):FINRA offers resources on annuities and other financial products.

- National Association of Insurance Commissioners (NAIC):The NAIC provides information on insurance products, including annuities.

Comparison of Annuity Calculators

| Calculator | Features | Ease of Use | Accuracy |

|---|---|---|---|

| Bankrate Annuity Calculator | Comparison of annuity options, potential return estimates | User-friendly interface | Accurate calculations based on input parameters |

| Investopedia Annuity Calculator | Calculation of present value, future value, or payment amount | Simple and straightforward | Reliable calculations using industry-standard formulas |

| Financial Planning Software | Comprehensive financial planning features, including annuity calculations | May require a learning curve | Highly accurate calculations based on user-defined parameters |

Closure

As we conclude our exploration of annuity calculations, we are left with a deeper understanding of this powerful financial tool. From grasping the basic concepts to navigating the complexities of different annuity types and factors influencing their performance, this guide has equipped you with the knowledge needed to make informed decisions.

Remember, annuities can be a valuable part of your financial strategy, and by understanding the calculations involved, you can harness their potential to achieve your financial goals.

An annuity is often referred to as the “flip side” of a loan, as it involves receiving regular payments instead of making them. Learn more about the unique features of annuities and how they differ from loans at An Annuity Is Sometimes Called The Flip Side Of 2024.

General Inquiries

What is the difference between a fixed annuity and a variable annuity?

When planning for your future, it’s important to understand the different values associated with annuities. This guide on Calculating Annuity Values 2024 will help you determine the potential benefits of investing in an annuity.

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return is tied to the performance of underlying investments.

How do taxes affect annuity payments?

If you’re planning for retirement, you might be wondering how to calculate your annuity deposit. It’s a great way to ensure a steady income stream in your later years. Check out this guide on how to calculate your annuity deposit in 2024 to make sure you’re on track for a comfortable retirement.

The tax treatment of annuity payments depends on the type of annuity and the tax laws in your jurisdiction. It’s essential to consult with a financial advisor to understand the tax implications of your specific annuity.

Are there any fees associated with annuities?

Yes, annuities typically have fees, such as administrative fees, surrender charges, and mortality and expense charges. These fees can vary depending on the annuity provider and the specific type of annuity.

Sometimes, life throws us curveballs. If your annuity is out of surrender, it can be stressful. But don’t worry, there are resources available to help you navigate this situation. Check out this article on what to do if your annuity is out of surrender for guidance and support.

Where can I find an annuity calculator?

Many reputable financial websites and software providers offer online annuity calculators. You can also consult with a financial advisor for personalized advice.

What are some common annuity calculation scenarios?

Common scenarios include retirement planning, college savings, and debt consolidation. Annuities can be used to provide a steady stream of income during retirement, help fund a child’s education, or consolidate high-interest debt.

The National Pension System (NPS) offers annuity options as part of its retirement savings plan. Learn more about the role of annuities in the NPS at Annuity Nps 2024 to see how it can contribute to your retirement security.