Annuity Calculator Charles Schwab 2024 offers a powerful tool for individuals seeking to plan for their financial future. This comprehensive calculator allows users to explore various annuity options, understand their potential payouts, and make informed decisions about their retirement income.

Tax implications are a significant concern for many. Discover if your annuity payments are subject to taxation with the guide on Is Annuity Exempt From Tax 2024 to make informed financial decisions.

Whether you’re just starting to save or nearing retirement, the Charles Schwab Annuity Calculator can provide valuable insights into how annuities can contribute to your overall financial strategy.

The calculator takes into account key factors such as your age, retirement age, investment amount, and expected return. It then presents a detailed analysis of different annuity types, payout options, and their projected impact on your retirement income. This allows you to compare various scenarios and choose the option that best aligns with your financial goals and risk tolerance.

Explore the specific characteristics and benefits of a 4 Fixed Annuity 2024 to see if it aligns with your retirement goals.

Contents List

- 1 Charles Schwab Annuity Calculator Overview

- 2 Annuity Types Supported

- 3 Key Inputs and Considerations

- 4 Annuity Payout Options

- 5 Integration with Charles Schwab Accounts

- 6 Comparison with Other Annuity Calculators

- 7 Additional Considerations for Retirement Planning: Annuity Calculator Charles Schwab 2024

- 8 Ultimate Conclusion

- 9 FAQs

Charles Schwab Annuity Calculator Overview

The Charles Schwab Annuity Calculator is a powerful tool that can help you plan for your retirement by estimating your potential annuity payouts based on your individual circumstances. This calculator is designed to be user-friendly and provides valuable insights into the different annuity options available to you.

Purpose and Functionality

The calculator’s primary purpose is to help you understand how annuities can work within your retirement plan. It allows you to input your financial information, including your age, retirement age, investment amount, and expected return, and then calculates your estimated annuity payout based on your chosen annuity type and payout option.

The timing of your annuity payments is crucial. Learn more about annuity payment dates and their implications with the resource on Annuity Date Is 2024.

Features, Annuity Calculator Charles Schwab 2024

The calculator offers a comprehensive range of features, including:

- Multiple annuity types: The calculator supports various annuity types, allowing you to explore different options and compare their potential payouts.

- Adjustable inputs: You can customize the calculator’s inputs to reflect your specific financial situation and retirement goals.

- Personalized projections: The calculator provides personalized projections of your potential annuity payouts, helping you make informed decisions.

- Interactive charts and graphs: The calculator uses visual aids to illustrate your projected annuity payouts and growth over time.

Benefits of Using the Calculator

Using the Charles Schwab Annuity Calculator offers several benefits for retirement planning:

- Enhanced understanding of annuities: The calculator helps you gain a better understanding of how annuities work and their potential role in your retirement plan.

- Informed decision-making: By exploring different scenarios and comparing annuity options, you can make more informed decisions about your retirement savings.

- Personalized projections: The calculator provides personalized projections that are tailored to your specific financial situation and goals.

- Improved financial planning: The calculator can help you create a more comprehensive and effective retirement plan that includes annuities.

Annuity Types Supported

The Charles Schwab Annuity Calculator supports a variety of annuity types, each with its unique characteristics and suitability for different retirement scenarios.

Immediate annuities provide a steady stream of income right away. Learn more about the advantages and considerations of an Annuity Is Immediate 2024.

Types of Annuities

Here are the common annuity types supported by the calculator:

- Fixed Annuities:These annuities provide a guaranteed, fixed rate of return, offering predictable income streams. They are ideal for those seeking stability and security in their retirement income.

- Variable Annuities:These annuities invest in a variety of mutual funds, offering the potential for higher returns but also carrying greater risk. They are suitable for individuals with a higher risk tolerance and a longer investment horizon.

- Indexed Annuities:These annuities link their returns to the performance of a specific market index, such as the S&P 500. They offer potential for growth while providing some downside protection.

Suitability for Different Retirement Scenarios

The choice of annuity type depends on your individual retirement goals, risk tolerance, and time horizon. Here’s a general overview of their suitability:

- Fixed Annuities:Ideal for individuals seeking guaranteed income streams and a low-risk approach to retirement planning.

- Variable Annuities:Suitable for those with a higher risk tolerance and a longer investment horizon who are seeking the potential for higher returns.

- Indexed Annuities:A good option for individuals seeking potential growth while minimizing downside risk, particularly during market volatility.

Key Inputs and Considerations

The Charles Schwab Annuity Calculator requires several key inputs to generate accurate projections of your potential annuity payouts. These inputs reflect your financial situation and retirement goals, and the calculator’s projections are sensitive to changes in these inputs.

Taxation can be a complex aspect of annuities. Get clarity on whether annuity interest is subject to taxes with the resource on Is Annuity Interest Taxable 2024.

Essential Inputs

Here are the essential inputs required for the calculator:

- Age:Your current age is a key factor in determining your annuity payout, as it influences your remaining life expectancy.

- Retirement Age:The age at which you plan to retire is another important input, as it determines the duration of your annuity payments.

- Investment Amount:The amount of money you plan to invest in the annuity is a crucial factor in determining your potential payouts.

- Expected Return:Your expected return on investment is an important input, as it reflects your investment goals and risk tolerance.

Impact of Assumptions and Inputs

The calculator’s projections are sensitive to changes in your inputs. For example, a higher expected return generally results in a larger annuity payout, while a lower expected return may lead to a smaller payout. Similarly, a longer life expectancy will typically result in a lower annuity payout, as the payments will need to be spread over a longer period.

Understanding the concept of a reversionary annuity can be beneficial. Learn more about this type of annuity and its implications with the guide on Annuity Is Reversionary 2024.

Input Scenarios and Payout Projections

| Scenario | Age | Retirement Age | Investment Amount | Expected Return | Estimated Annuity Payout |

|---|---|---|---|---|---|

| Scenario 1 | 55 | 65 | $100,000 | 5% | $6,000 per year |

| Scenario 2 | 55 | 65 | $100,000 | 7% | $7,500 per year |

| Scenario 3 | 55 | 65 | $200,000 | 5% | $12,000 per year |

This table illustrates how different input scenarios can impact your estimated annuity payout. It’s essential to carefully consider your financial situation and retirement goals when entering these inputs into the calculator.

For those seeking a degree of security, a guaranteed annuity can be appealing. Explore the benefits of a Annuity 5 Year Guarantee 2024 and its potential to provide stability.

Annuity Payout Options

Once you’ve chosen an annuity type, you’ll need to select a payout option. The payout option determines how your annuity payments will be distributed, and each option has its own advantages and disadvantages.

Payout Options

Here are the common payout options available with annuities:

- Fixed Payout:This option provides a fixed, guaranteed amount of income each year for the duration of the annuity. It offers predictable income streams and is suitable for those seeking stability and security.

- Variable Payout:This option provides an income stream that fluctuates based on the performance of the underlying investments. It offers the potential for higher returns but also carries greater risk.

- Indexed Payout:This option links your income payments to the performance of a specific market index, such as the S&P 500. It offers potential for growth while providing some downside protection.

Advantages and Disadvantages

| Payout Option | Advantages | Disadvantages |

|---|---|---|

| Fixed Payout | Guaranteed income stream, stability and security | Limited growth potential, lower potential returns |

| Variable Payout | Potential for higher returns, potential for growth | Fluctuating income stream, greater risk |

| Indexed Payout | Potential for growth, some downside protection | Potential for lower returns than variable annuities, may not keep pace with inflation |

Comparison of Payout Options

The choice of payout option depends on your individual risk tolerance, investment goals, and retirement income needs. Here’s a comparison of the payout options based on key factors:

| Factor | Fixed Payout | Variable Payout | Indexed Payout |

|---|---|---|---|

| Risk | Low | High | Moderate |

| Growth Potential | Limited | High | Moderate |

| Longevity | Guaranteed income for life | Not guaranteed, subject to market performance | Not guaranteed, subject to index performance |

Integration with Charles Schwab Accounts

The Charles Schwab Annuity Calculator seamlessly integrates with your existing Charles Schwab accounts, providing a personalized and convenient experience for retirement planning.

When deciding between different retirement savings options, understanding the differences between annuities and IRAs is crucial. Compare these two popular choices with the resource on Annuity V Ira 2024.

Account Integration

By linking your Charles Schwab accounts to the calculator, you can automatically import relevant financial information, such as your account balances and investment history. This eliminates the need for manual data entry and ensures that the calculator’s projections are based on your most up-to-date financial data.

Are annuities a suitable investment option for your retirement plan? Discover the pros and cons of annuities as an investment with the guide on Is Annuity Good Investment 2024.

Benefits of Integration

The integration with Charles Schwab accounts offers several benefits:

- Personalized projections: The calculator uses your actual financial data to generate more accurate and personalized projections of your annuity payouts.

- Streamlined planning: The integration simplifies the retirement planning process by eliminating the need for manual data entry.

- Enhanced accuracy: Using your real financial data ensures that the calculator’s projections are more reliable and trustworthy.

Examples of Use

Here are some examples of how the calculator can be used to project future income and expenses:

- Projecting retirement income:You can use the calculator to project your potential annuity payouts based on your current savings and investment goals, providing an estimate of your future retirement income.

- Simulating different scenarios:The calculator allows you to experiment with different scenarios, such as adjusting your retirement age or investment amount, to see how these changes impact your potential annuity payouts.

- Planning for future expenses:You can use the calculator to project your potential annuity payouts and compare them to your estimated retirement expenses, helping you make informed decisions about your financial needs.

Comparison with Other Annuity Calculators

The Charles Schwab Annuity Calculator is just one of many available online. It’s helpful to compare it with other popular calculators to identify key differences in features, functionality, and user experience.

Planning for a long retirement? A Annuity 30 Years 2024 can provide a consistent income stream for an extended period, ensuring financial security in your later years.

Key Differences

Here are some key differences between the Charles Schwab Annuity Calculator and other popular calculators:

- Features:Some calculators may offer a wider range of features, such as additional payout options or more advanced customization options.

- Functionality:The functionality of different calculators may vary, with some offering more robust analysis or interactive tools.

- User Experience:The user interface and ease of use can vary significantly between different calculators.

Pros and Cons

Here’s a general analysis of the pros and cons of using different annuity calculators:

| Calculator | Pros | Cons |

|---|---|---|

| Charles Schwab Annuity Calculator | Seamless integration with Charles Schwab accounts, personalized projections, user-friendly interface | May not offer as many features as some other calculators, limited customization options |

| Calculator A | Wide range of features, advanced customization options, comprehensive analysis | May be more complex to use, less user-friendly |

| Calculator B | Simple and easy to use, intuitive interface, helpful explanations | Limited features, may not provide as detailed projections |

It’s important to choose a calculator that meets your specific needs and preferences. Consider the features, functionality, and user experience when making your selection.

Retirement planning often involves unique considerations for seniors. Explore the specifics of annuities for those aged 85 and above with the resource on Annuity 85 Years Old 2024.

Additional Considerations for Retirement Planning: Annuity Calculator Charles Schwab 2024

While annuities can be a valuable component of your retirement plan, it’s essential to consider them within a broader context of diversification and other retirement savings vehicles.

Diversification

Diversification is crucial for any retirement plan, as it helps reduce risk and enhance returns over the long term. Annuities can be part of a diversified portfolio, but they shouldn’t be your only source of retirement income.

Dreaming of a comfortable retirement with a monthly income of $10,000? Explore the feasibility of this goal with the information on Annuity 10000 Per Month 2024.

Other Retirement Savings Vehicles

In addition to annuities, you should consider other retirement savings vehicles, such as:

- 401(k)s:Employer-sponsored retirement savings plans that offer tax advantages.

- IRAs:Individual Retirement Accounts that allow you to save for retirement on a tax-advantaged basis.

Comprehensive Retirement Planning

A comprehensive retirement plan should include a mix of different savings vehicles and investments, including annuities, 401(k)s, IRAs, and other assets. This diversification can help you achieve your retirement goals while managing risk effectively.

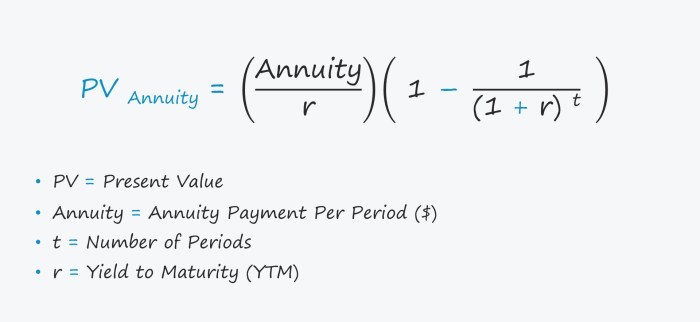

Calculating the right annuity rate is essential for maximizing your returns. Learn how to determine the appropriate rate with the comprehensive guide on Calculating An Annuity Rate 2024.

Ultimate Conclusion

In conclusion, the Charles Schwab Annuity Calculator is a valuable resource for anyone seeking to incorporate annuities into their retirement planning. Its user-friendly interface, comprehensive features, and integration with Charles Schwab accounts make it a powerful tool for understanding and exploring different annuity options.

By leveraging this calculator, individuals can gain a clearer picture of their potential retirement income and make informed decisions about their financial future.

FAQs

How accurate are the projections generated by the Charles Schwab Annuity Calculator?

The calculator’s projections are based on the inputs you provide and are subject to market fluctuations and other uncertainties. It’s essential to understand that the results are estimates and not guaranteed outcomes.

Understanding how annuities work in 2024 is crucial, especially when considering options like a Annuity Method 2024. This method involves making regular payments over a set period, ensuring a stream of income in the future.

Is the Charles Schwab Annuity Calculator available to non-Charles Schwab clients?

Yes, the calculator is accessible to all individuals, regardless of whether they have a Charles Schwab account.

Looking for a long-term solution? A Annuity 20 Year Certain 2024 guarantees payments for a specific duration, providing financial security and peace of mind.

What are the limitations of the Charles Schwab Annuity Calculator?

While the calculator offers valuable insights, it cannot account for all individual circumstances and financial goals. It’s always recommended to consult with a financial advisor for personalized advice.