Annuity Calculator Lifetime 2024: Navigating the complex world of retirement planning can be daunting, but with the right tools, it doesn’t have to be. Annuities, a popular retirement planning tool, offer a steady stream of income during your golden years, but choosing the right annuity and understanding its implications is crucial.

Understanding the factors that influence annuity payments is crucial. Annuity 2000 Mortality Table 2024 might provide insights into the mortality table used to calculate annuity payments. Depending on your location, you might be interested in Annuity Nz 2024 for information specific to New Zealand.

This guide explores the ins and outs of annuities, their benefits, drawbacks, and how to use an annuity calculator to plan for a comfortable and secure retirement.

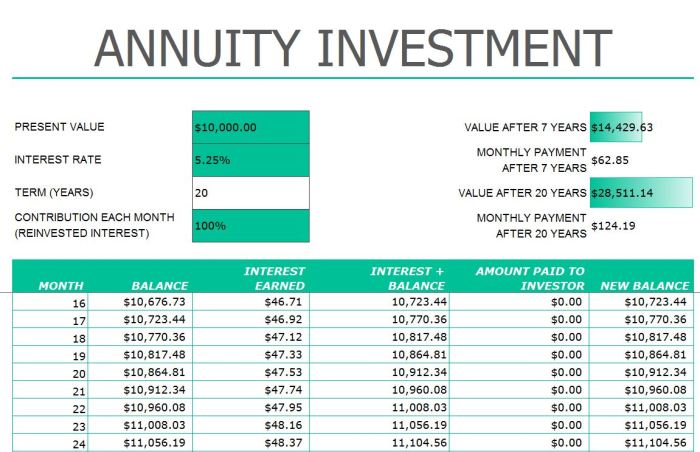

To understand the value of an annuity, it’s important to consider its present value. Annuity Is Present Value 2024 delves into the concept of present value in relation to annuities. Formula Annuity Bond 2024 might explore the formula used for annuity bonds, and Calculating Annuity Present Value 2024 provides guidance on determining the present value of an annuity.

From understanding different types of annuities, like fixed, variable, and indexed, to exploring the key factors considered by annuity calculators, such as age, life expectancy, interest rates, and investment goals, this guide equips you with the knowledge to make informed decisions about your retirement planning.

The tax implications of annuities are a significant consideration. Is Annuity Received From Lic Taxable 2024 explores the taxability of annuity payments, helping you make informed financial decisions. It’s important to understand that annuities are a voluntary retirement vehicle, as highlighted in Annuity Is A Voluntary Retirement Vehicle 2024.

Contents List

Introduction to Annuities

An annuity is a financial product that provides a stream of regular payments for a set period of time, often used for retirement planning. Annuities are designed to provide a steady income stream throughout your retirement years, helping you manage your finances and ensuring you have a consistent source of income.

Types of Annuities

- Fixed Annuities:These annuities offer a guaranteed rate of return, meaning you know exactly how much you’ll receive each month. However, the return is typically lower than other investment options.

- Variable Annuities:These annuities allow you to invest your money in a range of sub-accounts, similar to mutual funds. Your payments can fluctuate based on the performance of your chosen investments.

- Indexed Annuities:These annuities offer a return that is linked to the performance of a specific index, such as the S&P 500. They provide potential for higher returns but also carry some risk.

Benefits and Drawbacks of Annuities

- Benefits:

- Guaranteed income stream

- Protection against outliving your savings

- Potential for tax-deferred growth

- Drawbacks:

- Lower returns compared to other investments

- Potential for penalties if you withdraw funds early

- Limited flexibility in managing your money

Understanding Annuity Calculators

Annuity calculators are valuable tools that help you estimate the potential income you could receive from an annuity. They consider various factors to provide personalized projections, making it easier to understand the potential benefits of an annuity.

Key Factors Considered by Annuity Calculators

- Age:Your age at the time of purchase impacts the length of your annuity payments.

- Life Expectancy:Your life expectancy determines the total duration of your annuity payments.

- Interest Rates:The interest rate used to calculate the annuity payments affects the amount you receive.

- Investment Goals:Your investment goals, such as the desired income level, influence the annuity’s structure.

Types of Annuity Calculators

- Online Calculators:Many websites offer free annuity calculators that provide basic estimates.

- Financial Institution Calculators:Banks and insurance companies often provide more comprehensive calculators that consider their specific annuity products.

Lifetime Annuities in 2024: Annuity Calculator Lifetime 2024

Lifetime annuities are designed to provide income for the rest of your life, offering a sense of security and financial stability. However, understanding the current market conditions and potential risks is crucial before investing.

Trends and Market Conditions

- Interest Rate Fluctuations:Rising interest rates can impact the returns on annuities, making them less attractive to some investors.

- Inflation:High inflation can erode the purchasing power of your annuity payments, reducing their real value.

- Changes in Life Expectancy:Increased life expectancy can lead to higher annuity premiums, as insurers need to cover payments for a longer period.

Potential Benefits and Risks

- Benefits:

- Guaranteed income for life, providing peace of mind

- Protection against outliving your savings

- Potential for tax-deferred growth

- Risks:

- Lower returns compared to other investments

- Potential for inflation to erode the purchasing power of your payments

- Limited flexibility in managing your money

Using an Annuity Calculator for Lifetime Planning

Annuity calculators can be valuable tools to help you determine the optimal lifetime annuity for your individual needs. By inputting your personal information and financial goals, you can receive personalized projections and make informed decisions.

Step-by-Step Guide

- Gather Your Information:Determine your age, life expectancy, desired income level, and current savings.

- Choose an Annuity Calculator:Select an online or financial institution calculator that suits your needs.

- Input Your Information:Enter your personal details and financial goals into the calculator.

- Review the Results:Analyze the projections provided by the calculator, including estimated monthly payments and total lifetime income.

- Adjust as Needed:If the results don’t align with your goals, adjust your input parameters and run the calculations again.

Examples of Scenarios

- Scenario 1:A 65-year-old individual with a life expectancy of 20 years and $500,000 in savings might use an annuity calculator to determine the potential monthly income they could receive from a lifetime annuity.

- Scenario 2:A couple nearing retirement might use an annuity calculator to explore different annuity options and their impact on their retirement income.

Comparison of Annuity Calculators

| Annuity Calculator | Features | Pros | Cons |

|---|---|---|---|

| Calculator A | Basic features, free online access | Easy to use, quick estimates | Limited customization options |

| Calculator B | Comprehensive features, provided by a financial institution | Detailed projections, personalized results | May require account setup |

Factors to Consider Before Purchasing an Annuity

Before purchasing an annuity, it’s essential to consult with a financial advisor to understand your options and make informed decisions. They can help you assess your financial situation, investment goals, and risk tolerance.

Understanding the specifics of annuities is vital, as they can be complex financial instruments. Annuity 712 2024 might offer insights into a specific type of annuity, while Calculating Annuity Annual Payment 2024 provides guidance on determining the annual payment you can expect from an annuity.

Key Factors to Consider

- Investment Goals:Define your retirement income goals and how an annuity can contribute to them.

- Risk Tolerance:Assess your comfort level with potential fluctuations in returns and the security of guaranteed payments.

- Financial Situation:Evaluate your overall financial situation, including savings, debts, and other assets.

Pros and Cons of Annuity Options

- Fixed Annuities:

- Pros:Guaranteed income, low risk

- Cons:Lower returns compared to other investments

- Variable Annuities:

- Pros:Potential for higher returns

- Cons:Higher risk, potential for losses

- Indexed Annuities:

- Pros:Potential for higher returns, some downside protection

- Cons:More complex, potential for lower returns than variable annuities

Alternative Retirement Planning Strategies

Annuities can be a valuable component of a retirement plan, but they are not the only option. Exploring alternative strategies can help you create a diversified portfolio that meets your individual needs.

Retirement Savings and Investment Options

- 401(k) and IRA Accounts:These tax-advantaged accounts allow you to save for retirement and potentially grow your wealth over time.

- Real Estate Investments:Investing in real estate can provide rental income and potential appreciation in value.

- Stocks and Bonds:These investments offer the potential for higher returns but also carry greater risk.

Creating a Diversified Retirement Portfolio, Annuity Calculator Lifetime 2024

- Assess Your Risk Tolerance:Determine your comfort level with different investment options.

- Set Your Goals:Define your retirement income needs and time horizon.

- Allocate Assets:Divide your retirement savings among various asset classes, such as stocks, bonds, and real estate.

- Monitor and Adjust:Regularly review your portfolio and make adjustments as needed to ensure it aligns with your goals.

Ending Remarks

In conclusion, while annuities can be a valuable part of your retirement planning, they are not a one-size-fits-all solution. Carefully consider your financial situation, risk tolerance, and investment goals before making any decisions. Consulting with a financial advisor is always recommended to ensure you choose the best retirement planning strategy for your unique circumstances.

Calculating the return on your annuity investment is essential. Calculate Annuity Exclusion Ratio 2024 provides guidance on determining the exclusion ratio, which helps you understand the taxable portion of your annuity payments. However, it’s crucial to be aware of potential Annuity Issues 2024 that could affect your returns.

User Queries

What is the difference between a fixed and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns fluctuate based on the performance of the underlying investments.

How do I choose the right annuity calculator?

Consider the features and functionalities offered by different calculators, such as the ability to adjust variables like interest rates and life expectancy, as well as the ease of use and clarity of the results.

Annuities can be tailored to individual needs and preferences. Annuity Is Deferred 2024 might discuss the concept of deferred annuities, where payments begin at a later date. Understanding how annuities work is essential, and An Annuity Is A Life Insurance Product That 2024 provides insights into the nature of annuities as life insurance products.

Are annuities a good investment for everyone?

Annuities may not be suitable for everyone. It’s essential to consider your risk tolerance, investment goals, and overall financial situation before making a decision.

Retirement planning is a crucial aspect of financial security, and annuities can play a significant role in ensuring a comfortable future. If you’re considering annuities as part of your retirement strategy, it’s essential to understand their nuances. For instance, Is Annuity Retirement 2024 explores the concept of annuities in retirement, while Annuity Which Is Best 2024 delves into the different types of annuities available.