Annuity Calculator Lottery 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Imagine winning the lottery – the excitement, the dreams, the possibilities! But before you start planning your dream vacation or making impulsive purchases, it’s crucial to understand the implications of choosing an annuity over a lump sum payout.

An annuity can be a valuable tool for retirement planning, but it’s important to understand how it works. To learn more about the definition of an annuity, visit the An Annuity Is Defined As 2024 article. It explains the concept in simple terms.

An annuity calculator is your key to unlocking this complex world, helping you make informed decisions about your winnings and navigate the financial landscape of a life-changing event.

If you’re interested in exploring the relationship between annuities and bonds, the Is Annuity Bond 2024 article can provide insights. It explains whether an annuity can be considered a bond.

This comprehensive guide delves into the intricacies of annuity calculators, exploring their purpose, features, and how they can be leveraged to make the most of your lottery winnings. We’ll examine the different types of annuities, their tax implications, and how to estimate the present value of your future lottery payments.

To understand the specifics of an annuity with a specific investment amount, you can read the Annuity 30k 2024 article. This resource provides details about the potential benefits and features of such an annuity.

Furthermore, we’ll discuss the latest trends in lottery winnings and provide insights into the financial planning strategies that can help you manage your newfound wealth responsibly. So, whether you’re a seasoned lottery player or a curious newcomer, join us on this journey to uncover the secrets of the annuity calculator and unlock the potential of your lottery winnings.

Contents List

Annuity Calculator Basics

An annuity calculator is a valuable tool for anyone considering receiving a stream of regular payments over a set period. This calculator helps you understand the financial implications of choosing an annuity, especially when dealing with significant sums like lottery winnings.

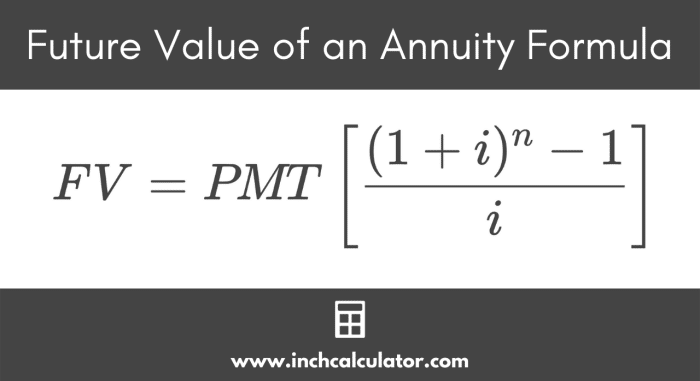

To learn more about the specific formula used to calculate annuities, you can visit the Annuity Formula Is 2024 article. It explains the formula in detail and provides examples of its application.

Purpose and Function

An annuity calculator serves as a financial forecasting tool. It allows you to estimate the future value of an annuity based on specific input variables, such as the initial principal amount, interest rate, payment period, and frequency of payments. Essentially, it helps you visualize how much you’ll receive over time, considering the compounding effect of interest.

An annuity can be a complex financial instrument, and it’s helpful to understand the various factors involved. If you’re curious about the specific formula used for half-yearly annuities, you can explore the Annuity Formula Half Yearly 2024 article for detailed information.

Key Input Variables

- Principal Amount:This is the initial sum invested or received, like a lottery prize.

- Interest Rate:The annual percentage rate (APR) at which the principal grows. This is typically determined by the financial institution offering the annuity.

- Payment Period:The duration of the annuity, usually expressed in years.

- Payment Frequency:How often payments are made, whether annually, semi-annually, quarterly, or monthly.

Types of Annuities

Understanding the different types of annuities is crucial as they affect the calculations and outcomes. Here are some common types:

- Ordinary Annuity:Payments are made at the end of each period.

- Annuity Due:Payments are made at the beginning of each period.

- Fixed Annuity:The payment amount remains constant throughout the annuity period.

- Variable Annuity:The payment amount fluctuates based on the performance of underlying investments.

Lottery Winnings and Annuities

Winning a lottery is a life-changing event, and often, the choice between a lump sum payout and an annuity is a significant decision. Understanding the pros and cons of each option is crucial.

Calculating the number of periods for an annuity can be useful for financial planning. You can find a helpful calculator and learn more about this process by visiting the Annuity Number Of Periods Calculator 2024 article.

Common Practice of Annuities

Many lotteries offer the option of receiving winnings as an annuity. This means you receive regular payments over a predetermined period, typically 20-30 years. The annuity option is often chosen to spread the wealth and avoid overwhelming financial burdens that come with a large lump sum.

Benefits and Drawbacks of Annuities

Benefits

- Financial Stability:Regular payments provide a steady income stream, helping with financial planning and avoiding reckless spending.

- Tax Advantages:Annuities often allow for tax deferral, meaning taxes are only paid on each payment as it is received, potentially leading to lower overall tax liability.

- Protection from Mismanagement:Receiving payments over time reduces the risk of financial mismanagement or impulsive spending.

Drawbacks

- Lower Overall Value:The present value of an annuity is generally less than a lump sum due to the time value of money.

- Inflation Risk:The purchasing power of future payments might decrease due to inflation, making them worth less over time.

- Uncertainty of Future Circumstances:Unexpected events, such as illness or market downturns, could impact the long-term value of the annuity.

Tax Implications

Tax implications are a significant factor in deciding between a lump sum and an annuity. In most cases, lottery winnings are subject to federal and state income tax. With an annuity, you typically pay taxes on each payment as it is received, while a lump sum payout is taxed in the year it is received.

If you’re curious about the specific formula used for annuity bonds, you can explore the Formula Annuity Bond 2024 article. This resource provides a breakdown of the formula and its applications.

Annuity Calculator Features for Lottery Winnings: Annuity Calculator Lottery 2024

Annuity calculators designed for lottery winnings often incorporate specific features to account for factors that directly impact the value of the annuity.

To efficiently calculate annuity cash flows, you can leverage the power of Excel. The Calculating Annuity Cash Flows Excel 2024 article offers guidance and practical examples for using Excel to manage annuity calculations.

Specialized Features

- Tax Withholding:The calculator can account for automatic tax withholding on each payment, giving a more accurate picture of the net amount received.

- Inflation Adjustment:Some calculators factor in inflation, allowing you to see how the purchasing power of your payments might change over time.

- Investment Strategies:Advanced calculators might allow you to simulate different investment strategies for the annuity payments, helping you estimate potential growth.

Estimating Present Value

An annuity calculator can help you determine the present value of your lottery winnings. This is the value of the future payments if they were received today. Understanding the present value allows for better comparison with the lump sum option and helps make informed financial decisions.

If you’re considering an annuity and want to understand how much you might receive for a specific investment amount, you can check out the How Much Annuity For 80000 2024 article. This resource provides insights into potential annuity payouts based on various factors.

2024 Lottery Trends and Considerations

The lottery landscape is constantly evolving, with new games, promotions, and regulations influencing the way winnings are distributed. Here’s a glimpse into some potential trends for 2024 that might impact annuity calculations.

To understand the tax implications of annuities, you might want to read the Is Annuity For Life Insurance Taxable 2024 article. It provides information about the tax treatment of annuities, which can be complex.

Significant Events and Changes

The lottery industry is expected to continue its digital transformation in 2024, with more online platforms and mobile apps for ticket purchasing and prize claiming. There might be changes in the way winnings are paid out, including adjustments to annuity schedules or the introduction of new payment options.

Factors Impacting Annuity Calculators

- Interest Rate Fluctuations:Changes in interest rates will directly affect the value of annuities, making it essential to use calculators that factor in current rates.

- Tax Law Modifications:Any changes to tax laws related to lottery winnings could significantly impact the after-tax value of annuities.

- Inflation Rates:High inflation rates could erode the purchasing power of future annuity payments, making it crucial to consider this factor in calculations.

2024 Lottery Annuity Options

| Lottery | Payout Schedule | Estimated Annual Payment |

|---|---|---|

| Mega Millions | 30 years | $X,XXX,XXX |

| Powerball | 29 years | $Y,YYY,YYY |

| Lotto America | 25 years | $Z,ZZZ,ZZZ |

Note: These are hypothetical examples. Actual payout schedules and estimated annual payments for major lotteries in 2024 may vary. It’s essential to refer to official lottery information for accurate details.

If you’re looking to understand how to calculate the payments you’ll receive from an annuity, you can check out the Calculating Annuity Formula 2024 article. This guide will walk you through the steps and formulas needed to determine your potential income.

Financial Planning with Lottery Winnings

Winning a lottery is a significant financial event. Proper planning is crucial to ensure responsible management and long-term financial security.

If you’re interested in learning more about annuities that provide payouts over a set period, you can check out the Annuity 5 Year Payout 2024 article. It explores the specifics of these types of annuities.

Step-by-Step Guide for Annuity Winners, Annuity Calculator Lottery 2024

- Seek Professional Advice:Consult with a financial advisor experienced in handling large sums and lottery winnings. Their guidance can help you navigate the complexities of taxes, investments, and estate planning.

- Create a Budget:Develop a realistic budget that considers your current expenses, future goals, and the annuity payments you’ll receive.

- Establish an Emergency Fund:Set aside a portion of your winnings for unexpected expenses or emergencies.

- Invest Wisely:Diversify your investments across different asset classes, considering your risk tolerance and long-term financial goals.

- Plan for Taxes:Consult with a tax professional to understand your tax obligations and develop strategies for minimizing your tax liability.

- Consider Charitable Giving:If you’re inclined, consider donating a portion of your winnings to charitable causes that resonate with you.

Managing and Investing Winnings Responsibly

Lottery winnings can be a blessing and a curse. Avoid impulsive spending and focus on building a secure financial future. Consider these tips:

- Avoid Lifestyle Inflation:Resist the temptation to dramatically change your lifestyle. Stick to your budget and avoid making major purchases impulsively.

- Pay Down Debt:Use a portion of your winnings to pay off high-interest debt, such as credit card balances or personal loans.

- Save for Retirement:Contribute to retirement accounts, such as 401(k)s or IRAs, to secure your financial future in the long term.

- Protect Your Assets:Consult with an estate planning attorney to set up trusts or other legal structures that protect your assets and minimize taxes.

Seeking Professional Advice

It’s highly recommended to seek professional financial advice after winning a lottery prize. A qualified financial advisor can provide personalized guidance based on your unique circumstances, helping you make informed decisions that align with your financial goals.

Understanding how to calculate the income you’ll receive from an annuity is crucial. The Calculating Annuity Income 2024 article provides guidance on determining your potential annuity payments.

Final Conclusion

As you embark on this exciting journey of lottery winnings, remember that knowledge is power. Understanding the nuances of annuity calculators and financial planning strategies can empower you to make informed decisions that secure your future. From analyzing the payout schedules of major lotteries to navigating the complexities of tax implications, this guide provides you with the tools and insights you need to make the most of your winnings.

Don’t let the excitement of a lottery win overshadow the importance of careful planning and responsible financial management. Embrace the opportunity to secure your financial future and transform your dreams into reality.

Expert Answers

How often are lottery payments made when choosing an annuity?

Lottery payments are typically made annually, although the frequency may vary depending on the specific lottery.

When considering an annuity, it’s essential to evaluate the potential benefits and drawbacks. You can find insights on the potential downsides of annuities by reading the Why An Annuity Is Bad 2024 article. This resource provides information to help you make an informed decision.

What factors influence the interest rate applied to lottery annuities?

The interest rate on lottery annuities is often determined by prevailing market interest rates and the specific lottery’s rules.

Are there any penalties for withdrawing lottery annuity payments early?

Yes, there are usually penalties for withdrawing lottery annuity payments before the end of the payout period.