Annuity Calculator Math 2024 provides a comprehensive guide to understanding and utilizing annuities for financial planning. This guide explores the intricacies of annuities, including their different types, key features, and practical applications. Whether you’re seeking retirement income, generating steady cash flow, or strategically planning your estate, annuities offer a unique set of tools to achieve your financial goals.

If you’re in New Zealand and looking to set up an annuity, you’ll want to find a reliable calculator to help you plan your investment. Luckily, there are several annuity calculators available online, so you can easily find one that meets your needs.

This article on Annuity Calculator Nz 2024 will provide some good options.

By delving into the fundamental mathematical concepts behind annuity calculations, this guide empowers you to make informed decisions regarding your financial future.

Annuity calculations can be a bit complex, but there are some simple methods to help you figure out your potential payouts. You can use online calculators or even work out the calculations yourself. For a comprehensive guide on how to calculate your annuity, check out this article on How Calculate Annuity 2024.

The guide covers the basic mathematical concepts behind annuity calculations, including present value, future value, and time value of money. It also explains the formula used to calculate the present value of an annuity and provides a step-by-step guide to using the formula.

An annuity is also known as a “guaranteed income stream.” This means that you’re guaranteed to receive regular payments for a set period of time, no matter what happens to the market. To learn more about the different names for annuities, check out this article on Annuity Is Also Known As 2024.

Furthermore, it discusses the factors that can affect the present value of an annuity, such as the interest rate, payment period, and number of payments.

An annuity can be a useful tool for financing a home loan. It can provide a steady stream of income to help you make your mortgage payments. To learn more about using an annuity for a home loan, check out this article on Annuity Home Loan 2024.

Contents List

Understanding Annuities

Annuities are financial products that provide a stream of regular payments for a specified period. They are often used for retirement planning, income generation, and estate planning. There are different types of annuities, each with its own features and benefits.

Deciding between an annuity and a 401(k) can be a tough choice. Both offer different benefits and drawbacks, so it’s important to carefully consider your options before making a decision. This article on Annuity Vs 401k 2024 will provide some insight into the differences between these two retirement plans.

This article will delve into the basics of annuity calculations and how an annuity calculator can help you make informed financial decisions.

An annuity is essentially a series of payments made over a set period of time. It can be a great way to provide yourself with a steady stream of income during retirement. Want to learn more about how annuities work in 2024?

Read about Annuity Is A Series Of 2024 for a better understanding.

Types of Annuities

Annuities can be broadly categorized into three main types:

- Fixed Annuities:These annuities offer a guaranteed rate of return for a specified period. The payments you receive are fixed and predictable, providing a sense of security. However, fixed annuities may not keep pace with inflation, which can erode the purchasing power of your payments over time.

Figuring out how much your annuity payout will be in 2024 can be a little confusing. You’ll need to take into account factors like your initial investment, interest rates, and the duration of your payout. Check out this guide on Calculating An Annuity Payout 2024 to get a better understanding of how it works.

- Variable Annuities:Variable annuities link the growth of your payments to the performance of underlying investments, such as stocks or bonds. This means that your payments can fluctuate based on market conditions. While variable annuities offer the potential for higher returns, they also come with higher risks.

Calculating the cash flows associated with an annuity can be a little tricky. You need to consider the initial investment, interest rates, and the duration of the payout. This article on Calculating Annuity Cash Flows 2024 will help you understand how to calculate these flows.

You could lose money if the underlying investments perform poorly.

- Indexed Annuities:Indexed annuities provide a minimum guaranteed rate of return, but they also offer the potential for growth linked to the performance of a specific market index, such as the S&P 500. This type of annuity combines some of the features of fixed and variable annuities, providing a balance between security and growth potential.

The primary purpose of an annuity is to provide a consistent income stream during retirement. This can be especially helpful if you’re worried about outliving your savings. To learn more about how annuities can help you secure your retirement, read this article on An Annuity Is Primarily Used To Provide 2024.

Key Features of an Annuity Contract

An annuity contract Artikels the terms and conditions of your annuity, including:

- Payment Period:This refers to the duration of the annuity payments, which can be for a fixed period or for the lifetime of the annuitant.

- Interest Rate:The interest rate determines the growth of your annuity payments. The rate can be fixed or variable, depending on the type of annuity.

- Death Benefit:This feature provides a lump sum payment to your beneficiaries upon your death, even if you have not yet received all of your annuity payments.

Examples of Annuity Applications

Annuities can be used in various financial situations, including:

- Retirement Planning:Annuities can provide a steady stream of income during retirement, supplementing your other retirement savings.

- Income Generation:Annuities can be used to generate a regular income stream for individuals who need to supplement their income or who have a need for predictable cash flow.

- Estate Planning:Annuities can be used to provide a legacy for your beneficiaries, ensuring that they receive a regular income stream after your death.

Annuity Calculator Fundamentals

An annuity calculator is a tool that uses mathematical formulas to calculate the present value and future value of an annuity. These calculations rely on basic financial concepts, such as:

Present Value, Future Value, and Time Value of Money

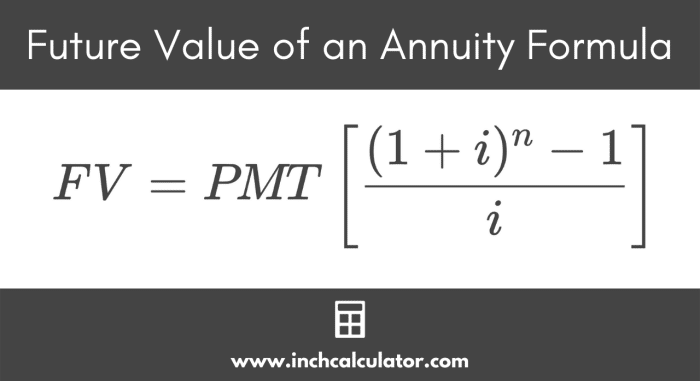

The present value (PV) of an annuity is the current value of a stream of future payments, discounted to reflect the time value of money. The future value (FV) of an annuity is the value of the stream of payments at a future point in time, taking into account the growth of the payments over time.

The “J” calculation is a common method used in annuity calculations. It helps determine the present value of a future payment stream, which can be useful when planning your retirement income. To learn more about the “J” calculation, read this article on J Calculation 2024.

The time value of money recognizes that money today is worth more than the same amount of money in the future, due to the potential for investment and earnings.

Fixed annuities are a type of annuity where the interest rate is set for a specific period of time. This can provide a sense of security and stability, as you’ll know exactly how much interest you’ll earn. For more information on fixed annuities, check out this article on 4 Fixed Annuity 2024.

Present Value of an Annuity Formula

The formula for calculating the present value of an annuity is:

PV = PMT

The word “annuity” has seven letters. It’s a relatively short word, but it can have a big impact on your retirement planning. To learn more about annuities, check out this article on Annuity 7 Letters 2024.

- [1

- (1 + r)^-n] / r

Where:

- PV is the present value of the annuity

- PMT is the periodic payment amount

- r is the interest rate per period

- n is the number of periods

Factors Affecting Present Value

Several factors can influence the present value of an annuity, including:

- Interest Rate:A higher interest rate results in a lower present value, as the future payments are discounted more heavily.

- Payment Period:A longer payment period generally results in a higher present value, as there are more payments to be discounted.

- Number of Payments:A larger number of payments generally results in a higher present value, as there are more payments to be discounted.

Annuity Calculator Applications

An annuity calculator can be used to perform various calculations related to annuities, providing valuable insights for financial planning and decision-making.

If you’re thinking about setting up an annuity, you might be wondering how much you’ll need to invest to get a specific payout. For example, if you want to receive $40,000 per year, you’ll need to know how much to invest initially.

This guide on How Much Annuity For 40 000 2024 will help you calculate your investment.

Annuity Calculator Scenarios

| Annuity Type | Payment Amount | Interest Rate | Payment Period |

|---|---|---|---|

| Fixed Annuity | $1,000 per month | 3% per year | 20 years |

| Variable Annuity | $500 per month | 5% per year (variable) | 15 years |

| Indexed Annuity | $750 per month | 2% per year (guaranteed) + 5% per year (indexed) | 10 years |

Using an Annuity Calculator, Annuity Calculator Math 2024

An annuity calculator can be used to:

- Determine the future value of an annuity:By inputting the present value, interest rate, and payment period, you can calculate the future value of an annuity.

- Calculate the amount of monthly payments needed to reach a specific future value:If you have a target future value in mind, you can use the calculator to determine the monthly payment amount required to reach that goal.

- Determine the length of time it will take for an annuity to grow to a certain amount:You can use the calculator to determine how long it will take for your annuity to reach a specific value, based on the interest rate and payment amount.

Making Informed Financial Decisions

An annuity calculator can help you make informed financial decisions by:

- Comparing different annuity options:You can use the calculator to compare the present value and future value of different annuity options, considering factors such as interest rates, payment periods, and death benefits.

- Determining the appropriate investment strategy:The calculator can help you assess the potential growth of your annuity and make informed decisions about your investment strategy, considering your risk tolerance and financial goals.

Annuity Calculator Considerations

While annuities can be a valuable tool for financial planning, it is important to consider the potential risks and benefits before making a purchase.

An annuity is essentially a way to calculate the future value of a series of payments. It’s a helpful tool for planning your retirement income, as it allows you to estimate how much you’ll have saved by a certain point in time.

Learn more about how annuities relate to future value in this article on Annuity Is Future Value 2024.

Risks and Benefits of Annuities

Here are some of the key risks and benefits associated with investing in annuities:

- Risks:

- Limited Liquidity:Annuities are generally illiquid, meaning that you may not be able to access your funds easily if you need them before the annuity payment period begins.

- Fees and Charges:Annuities can come with various fees and charges, such as surrender charges, administrative fees, and mortality and expense charges. These fees can erode the growth of your annuity payments over time.

- Inflation Risk:Fixed annuities may not keep pace with inflation, which can erode the purchasing power of your payments over time.

- Market Risk:Variable annuities are subject to market risk, meaning that you could lose money if the underlying investments perform poorly.

- Benefits:

- Guaranteed Income:Fixed annuities provide a guaranteed stream of income, providing a sense of security and predictability.

- Tax-Deferred Growth:The earnings on annuities grow tax-deferred, meaning that you will not have to pay taxes on the earnings until you begin receiving payments.

- Death Benefit:Annuities typically include a death benefit, which provides a lump sum payment to your beneficiaries upon your death, even if you have not yet received all of your annuity payments.

Understanding the Terms and Conditions

Before purchasing an annuity, it is crucial to carefully review the terms and conditions of the annuity contract. This includes understanding the following:

- Payment Period:How long will you receive annuity payments?

- Interest Rate:What is the interest rate on your annuity? Is it fixed or variable?

- Fees and Charges:What fees and charges are associated with the annuity? How will these fees impact the growth of your annuity payments?

- Death Benefit:What is the death benefit? Who will receive the death benefit?

Choosing the Right Annuity

The best annuity for you will depend on your individual needs and financial goals. Consider the following factors when choosing an annuity:

- Risk Tolerance:How much risk are you willing to take? If you are risk-averse, a fixed annuity may be a better choice. If you are willing to take on more risk, a variable annuity may be more suitable.

- Financial Goals:What are your financial goals? Are you looking for guaranteed income, growth potential, or a combination of both?

- Time Horizon:How long do you need the annuity payments to last?

- Fees and Charges:Compare the fees and charges associated with different annuity options to find the most cost-effective choice.

Final Summary: Annuity Calculator Math 2024

Understanding annuity calculations is crucial for making informed financial decisions. Annuity calculators empower you to explore different scenarios, compare annuity options, and determine the best investment strategy for your individual needs and goals. By utilizing the knowledge gained from this guide, you can confidently navigate the world of annuities and harness their potential to secure a brighter financial future.

Query Resolution

What are the different types of annuities?

Annuities come in various types, including fixed, variable, and indexed annuities. Each type offers distinct features and risk profiles, tailored to different financial objectives.

How do I choose the right annuity for my needs?

Selecting the right annuity depends on your individual financial goals, risk tolerance, and time horizon. Consulting a financial advisor can help you assess your options and make an informed decision.

What are the potential risks associated with annuities?

Like any investment, annuities carry potential risks. Understanding the terms and conditions of an annuity contract, including fees, surrender charges, and guarantees, is crucial to mitigating these risks.

To better understand how annuities work, it can be helpful to look at some real-world examples. This article on Annuity Examples 2024 will provide some practical examples of how annuities are used.