Annuity Calculator No Personal Details 2024 provides a powerful tool for exploring retirement planning without revealing personal financial information. Imagine a world where you can gain insights into the potential of annuities without sharing your income or savings details.

Annuity calculations can be complex, but they are essential for planning your retirement. You can use an IRR calculator for annuity to help you determine the potential return on your investment. Understanding how annuities are calculated is crucial, and you can find information on how annuity is calculated online.

This calculator allows you to understand how different factors influence annuity payments and explore various annuity options, empowering you to make informed decisions about your future.

For those using a financial calculator, you can learn how to calculate a growing annuity using the BA II Plus calculator. You can find resources on calculating growing annuities with the BA II Plus online. There are also rules regarding annuities, such as the 5-year rule.

You can find more information on the annuity 5-year rule online.

This guide delves into the workings of annuity calculators, highlighting their benefits and limitations. We’ll explore the key factors that influence annuity calculations, provide examples of how to use the calculator effectively, and guide you through interpreting the results. We’ll also discuss the different types of annuities available and offer valuable resources for further exploration.

It’s important to understand the implications of having no beneficiary for your annuity. You can learn more about annuities with no beneficiary to ensure your plan aligns with your wishes. One common question is whether immediate annuity income is taxable.

You can find answers on whether immediate annuity income is taxable online.

Contents List

- 1 Annuity Calculators: A Comprehensive Guide: Annuity Calculator No Personal Details 2024

- 1.1 Understanding Annuity Calculators, Annuity Calculator No Personal Details 2024

- 1.2 Benefits of Using an Annuity Calculator

- 1.3 Factors Affecting Annuity Calculations

- 1.4 Using an Annuity Calculator Without Personal Details

- 1.5 Interpreting Annuity Calculator Results

- 1.6 Types of Annuities

- 1.7 Annuity Calculator Resources

- 2 Closing Summary

- 3 FAQ Explained

Annuity Calculators: A Comprehensive Guide: Annuity Calculator No Personal Details 2024

Annuity calculators are valuable tools that can help individuals plan for their retirement and make informed decisions about their savings. These calculators allow you to estimate the amount of income you may receive from an annuity, based on various factors such as your age, savings, and investment choices.

It’s important to understand the tax implications of annuities. You can find information on annuities under the Income Tax Act online. You can also obtain an annuity statement to track your payments and other details. You can learn more about annuity statements online.

This article will delve into the workings of annuity calculators, exploring their benefits, factors affecting calculations, and how to interpret their results.

If you’re looking for information on a specific annuity amount, such as annuity 75000 , you can find resources online that can help you understand the details and implications of such an annuity.

Understanding Annuity Calculators, Annuity Calculator No Personal Details 2024

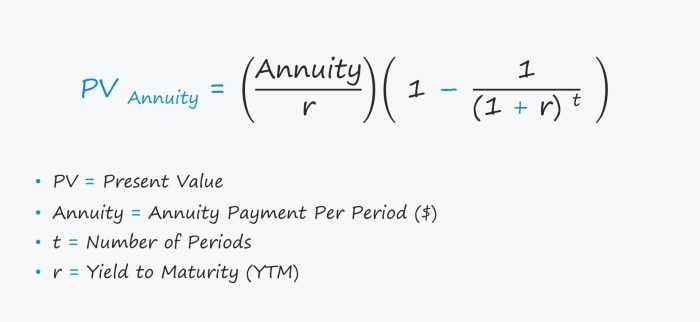

An annuity calculator is a financial tool that helps estimate the amount of income you can receive from an annuity based on your savings and investment choices. These calculators work by taking into account factors such as your age, the amount of money you have saved, the interest rate, and the length of time you plan to receive payments.

If you’re considering an annuity as part of your retirement savings plan, you may want to look into calculating annuity for NPS. An annuity is essentially a financial product that provides a stream of income for a set period of time.

If you’re unsure about the definition of an annuity, you can find more information on what an annuity is defined as online.

By inputting this information, you can get a projected estimate of your annuity payments.

Benefits of Using an Annuity Calculator

Annuity calculators offer numerous benefits for retirement planning, helping you make informed decisions about your savings. Here are some key advantages:

- Estimate Annuity Payments:Annuity calculators help you determine the potential amount of income you can receive from an annuity, based on your specific circumstances.

- Compare Different Annuity Options:By using an annuity calculator, you can compare different annuity products and their potential payouts, allowing you to choose the option that best suits your needs.

- Assess Your Retirement Income:Annuity calculators can provide a comprehensive picture of your potential retirement income, including your Social Security benefits, savings, and annuity payments.

- Identify Potential Shortfalls:If your projected annuity payments fall short of your desired retirement income, you can adjust your savings plan or explore alternative retirement income sources.

Factors Affecting Annuity Calculations

Several factors influence annuity calculations, impacting the overall payment amount. These factors include:

- Age:The older you are when you start receiving annuity payments, the lower the payments will be. This is because you have a shorter life expectancy, meaning the insurance company has to pay out less money.

- Savings:The amount of money you have saved for your annuity will directly impact the amount of income you receive. The more you save, the higher your annuity payments will be.

- Interest Rate:Interest rates play a significant role in annuity calculations. Higher interest rates generally lead to higher annuity payments.

- Annuity Type:Different types of annuities have different payment structures and features, which can affect the amount of income you receive.

- Inflation:Inflation can erode the purchasing power of your annuity payments over time. Annuity calculators may consider inflation to provide a more realistic estimate of your future income.

Using an Annuity Calculator Without Personal Details

While most annuity calculators require you to provide personal information, some calculators offer a basic estimate without requiring specific details. These calculators can provide a general idea of annuity payments based on hypothetical scenarios.

Understanding how to calculate annuity payments is crucial for planning your retirement income. You can find resources on calculating annuity payments online. Annuity due is a type of annuity where payments are made at the beginning of each period.

You can find more information on annuity due online.

Interpreting Annuity Calculator Results

Annuity calculators typically provide several outputs, including:

- Projected Annuity Payments:The calculator will show you the estimated amount of income you can receive from the annuity, based on your inputs.

- Total Annuity Payments:This figure represents the total amount of money you will receive from the annuity over the payout period.

- Annuity Payment Schedule:The calculator may provide a detailed breakdown of your annuity payments, showing the amount you will receive each year or month.

- Annuity Growth Projections:Some calculators may project how your annuity payments will grow over time, considering factors such as interest rates and inflation.

Types of Annuities

| Annuity Type | Description | Features | Benefits |

|---|---|---|---|

| Fixed Annuity | Guarantees a fixed rate of return and fixed payments for the life of the annuity. | Predictable income stream, guaranteed principal protection. | Provides financial security and stability. |

| Variable Annuity | Investments are tied to the performance of the stock market, offering the potential for higher returns but also greater risk. | Potential for higher growth, flexible investment options. | May provide higher returns than fixed annuities, but also comes with higher risk. |

| Indexed Annuity | Combines features of fixed and variable annuities, offering a guaranteed minimum return and the potential for growth based on a specific market index. | Guaranteed minimum return, potential for growth linked to market performance. | Provides a balance between security and growth potential. |

| Immediate Annuity | Payments begin immediately after the annuity is purchased. | Provides immediate income, ideal for those who need income right away. | Offers instant income, but may have lower returns than deferred annuities. |

| Deferred Annuity | Payments are delayed until a future date, allowing time for the annuity to grow. | Potential for higher returns, flexible payment options. | Allows for long-term growth, ideal for those who need income in the future. |

Annuity Calculator Resources

| Resource Name | Description |

|---|---|

| Bankrate.com | Offers a comprehensive annuity calculator that allows you to compare different annuity types and their potential payouts. |

| NerdWallet | Provides a user-friendly annuity calculator that helps you estimate your potential income and compare different annuity options. |

| Investopedia | Offers a variety of financial calculators, including an annuity calculator that allows you to explore different annuity scenarios. |

| AARP | Provides an annuity calculator specifically designed for individuals approaching retirement, taking into account factors such as Social Security benefits. |