Annuity Calculator Quarterly 2024 delves into the world of annuities, exploring their various types, benefits, and the crucial role of calculators in planning for a secure future. This guide provides a comprehensive overview of how annuities work, the factors that influence their calculations, and the practical applications of annuity calculators in making informed financial decisions.

From understanding the different types of annuities, such as fixed and variable, to analyzing the impact of interest rates and inflation on payouts, this quarterly report equips you with the knowledge necessary to navigate the complexities of retirement planning. We’ll explore how annuity calculators can help you estimate future income streams, assess the risks and rewards of different annuity options, and ultimately, make strategic choices that align with your individual financial goals.

Contents List

- 1 Understanding Annuities

- 2 The Role of an Annuity Calculator

- 3 Factors Affecting Annuity Calculations

- 4 Annuity Calculators for 2024

- 5 Practical Applications of Annuity Calculators

- 6 Understanding the Risks and Rewards of Annuities

- 7 End of Discussion

- 8 Popular Questions: Annuity Calculator Quarterly 2024

Understanding Annuities

Annuities are financial products that provide a stream of regular payments over a set period of time. They are often used in retirement planning, as they can provide a guaranteed income stream to supplement other retirement savings. There are several different types of annuities, each with its own unique features and benefits.

Types of Annuities

The main types of annuities are fixed, variable, immediate, and deferred. Each type has its own characteristics, which can affect its suitability for different individuals.

It’s important to know if an annuity qualifies for tax advantages. You can learn more about whether an annuity is a qualified plan at Is Annuity A Qualified Plan 2024.

- Fixed Annuities:These annuities offer a guaranteed rate of return, which means that the payments you receive will be fixed for the life of the annuity. This type of annuity is suitable for individuals who prefer a predictable income stream and are not willing to take on investment risk.

- Variable Annuities:These annuities offer a variable rate of return, which is linked to the performance of a specific investment portfolio. This type of annuity is suitable for individuals who are willing to take on more investment risk in the hope of earning a higher return.

If you inherit an annuity, you’ll need to understand the tax implications. You can find detailed information about how inherited annuities are taxed at How Is Inherited Annuity Taxed 2024.

- Immediate Annuities:These annuities begin paying out immediately after the initial premium is paid. This type of annuity is suitable for individuals who need an immediate income stream, such as retirees who are looking to supplement their income.

- Deferred Annuities:These annuities begin paying out at a later date, often after a specific period of time has elapsed. This type of annuity is suitable for individuals who are saving for retirement and want to defer receiving payments until they are older.

Annuities are a versatile financial tool, often used for retirement income. If you’re looking to understand how annuities are primarily used, you can find helpful information at Annuity Is Primarily Used To Provide 2024.

Real-World Scenarios

Annuities can be beneficial in various real-world scenarios. For example, an annuity can provide a guaranteed income stream for retirees who are looking to supplement their income. Annuities can also be used to protect against longevity risk, which is the risk that you will outlive your savings.

Many people use annuities as part of their retirement savings. If you’re considering an annuity within your 401(k) plan, you can find helpful information at Annuity 401k Plan 2024.

Additionally, annuities can provide a tax-advantaged way to save for retirement.

Pros and Cons

Like any financial product, annuities have both pros and cons. It is important to carefully consider these factors before making a decision about whether or not to purchase an annuity.

One of the key features of annuities is their potential for long-term payments. If you’re curious about the indefinite duration of annuities, you can find more information at Annuity Is Indefinite Duration 2024.

- Pros:

- Guaranteed income stream

- Protection against longevity risk

- Tax advantages

- Cons:

- Limited flexibility

- Potential for low returns

- High fees

The Role of an Annuity Calculator

An annuity calculator is a tool that can help you estimate the future value of an annuity. It can also help you determine the monthly payments you will receive from an annuity. Annuity calculators are essential for financial planning, as they can help you make informed decisions about your retirement savings.

Before deciding on an annuity, you might want to consider if it’s the right choice for you. You can explore the pros and cons of annuities and determine if it’s a good idea for your situation at Annuity Is It A Good Idea 2024.

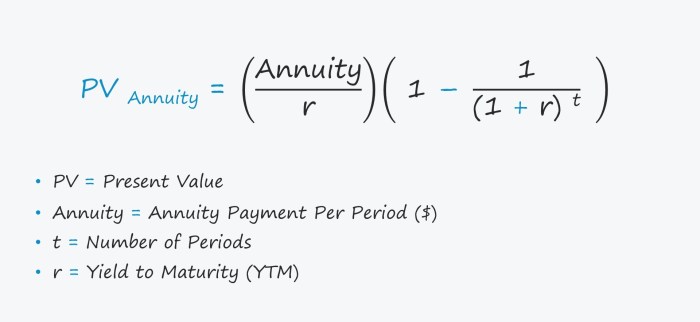

How Annuity Calculators Work

Annuity calculators work by taking into account several factors, including your age, the principal amount of the annuity, and the interest rate. These inputs are then used to calculate the future value of the annuity or the monthly payments you will receive.

Annuities can be tied to bonds, and it’s helpful to understand how to calculate their value. You can find resources for calculating annuity bonds at Calculate Annuity Bond 2024.

Inputs and Outputs

The inputs required for an annuity calculator include the following:

- Age:Your age is important because it determines the length of time you will be receiving payments from the annuity.

- Principal:The principal amount is the initial amount of money you invest in the annuity.

- Interest Rate:The interest rate is the rate of return you will earn on your investment.

The outputs provided by an annuity calculator include the following:

- Future Value:The future value is the total amount of money you will receive from the annuity at the end of the payment period.

- Monthly Payments:The monthly payments are the amount of money you will receive each month from the annuity.

Importance for Financial Planning

Annuity calculators are an essential tool for financial planning. They can help you make informed decisions about your retirement savings and ensure that you have enough income to meet your needs in retirement.

Annuities can be designed to last for a long time, potentially even indefinitely. You can learn more about the concept of a perpetual annuity at Annuity Is Perpetual 2024.

Factors Affecting Annuity Calculations

Several factors can impact annuity calculations, including interest rates, inflation, and investment performance.

There are different types of annuities, each with unique features. If you’re curious about the concept of an annuity certain, you can find more information at Annuity Certain Is An Example Of 2024.

Interest Rates

Interest rates are a key factor that can affect annuity calculations. Higher interest rates generally lead to higher annuity payouts, while lower interest rates lead to lower payouts. For example, if the interest rate on a fixed annuity is 3%, the annuity will pay out a higher amount than if the interest rate is 2%.

Inflation

Inflation is another important factor that can affect annuity calculations. Inflation erodes the purchasing power of money over time. This means that the same amount of money will buy less in the future than it does today. As a result, the payments you receive from an annuity may not be worth as much in the future as they are today.

For example, if the inflation rate is 2%, the purchasing power of your annuity payments will decrease by 2% each year.

Before committing to an annuity, it’s crucial to understand how long it will last. You can use a Annuity Calculator Lifetime 2024 to estimate the duration of your payments based on various factors.

Investment Performance

For variable annuities, investment performance is a key factor that can affect annuity calculations. The value of your annuity will fluctuate based on the performance of the underlying investment portfolio. If the portfolio performs well, your annuity will grow in value.

The term “Annuity Gator” might sound unfamiliar, but it refers to a specific type of annuity. You can find more information about the concept of an Annuity Gator at Annuity Gator 2024.

However, if the portfolio performs poorly, your annuity will lose value.

An immediate annuity provides payments right away. If you’re interested in learning more about immediate annuities, you can find information at Annuity Is Immediate 2024.

Annuity Calculators for 2024

There are many annuity calculators available online and through financial institutions. These calculators can be a valuable tool for helping you make informed decisions about your retirement savings.

Withdrawing from an annuity before a certain age can result in a penalty. If you’re looking for information about the 10-year penalty for early withdrawals, you can find more details at Annuity 10 Penalty 2024.

| Calculator Name | Features | Pros | Cons |

|---|---|---|---|

| Annuity.org | Fixed, variable, immediate, and deferred annuities | Easy to use, provides comprehensive information | Limited customization options |

| Bankrate | Fixed, variable, immediate, and deferred annuities | Provides personalized recommendations | Requires personal information |

| NerdWallet | Fixed, variable, immediate, and deferred annuities | Provides detailed explanations of annuity concepts | Limited customization options |

| SmartAsset | Fixed, variable, immediate, and deferred annuities | Provides side-by-side comparisons of different annuities | Requires personal information |

Practical Applications of Annuity Calculators

Annuity calculators can be used in a variety of ways to make informed financial decisions. For example, an annuity calculator can be used to:

- Estimate your future income stream from an annuity.

- Compare the payouts of different annuity types.

- Determine the amount of money you need to save for retirement.

- Plan for other financial goals, such as paying for college or buying a house.

Example: Retirement Planning

Suppose you are 55 years old and want to retire at age 65. You have $500,000 in savings and are considering purchasing a fixed annuity. Using an annuity calculator, you can input your age, savings amount, and the expected interest rate to estimate your monthly annuity payments.

This information can help you determine if the annuity will provide enough income to meet your needs in retirement.

Annuity plans can be a great way to secure your financial future, and they can be used in various ways. If you’re interested in learning more about how annuities work, check out this article on Annuity Is Pension Plan 2024.

It covers the basics of annuities and how they can be used as a pension plan.

Steps Involved in Using an Annuity Calculator

Using an annuity calculator is a straightforward process. The steps involved typically include the following:

- Choose an annuity calculator:Select an annuity calculator that meets your needs and provides the features you are looking for.

- Input your information:Enter your age, principal amount, interest rate, and other relevant information.

- Review the results:Analyze the outputs provided by the calculator, such as the future value of the annuity or the monthly payments you will receive.

- Make informed decisions:Use the information from the calculator to make informed decisions about your retirement savings or other financial goals.

Understanding the Risks and Rewards of Annuities

Annuities can provide a guaranteed income stream and other benefits, but they also come with certain risks. It is important to understand both the risks and rewards of annuities before making a decision about whether or not to purchase one.

Annuities can be complex, and understanding the exclusion ratio is essential. You can learn more about the Annuity Exclusion Ratio 2024 and its impact on your taxes.

Risks

The main risks associated with annuities include:

- Market Volatility:Variable annuities are subject to market volatility, which means that the value of your annuity can fluctuate based on the performance of the underlying investment portfolio.

- Interest Rate Fluctuations:Interest rate fluctuations can affect the payouts from fixed annuities. If interest rates rise, the value of your annuity may decrease.

- Inflation:Inflation can erode the purchasing power of your annuity payments over time.

- Fees:Annuities can have high fees, which can reduce your overall returns.

Rewards, Annuity Calculator Quarterly 2024

The main rewards associated with annuities include:

- Guaranteed Income Stream:Fixed annuities provide a guaranteed income stream, which can help you meet your financial needs in retirement.

- Protection Against Longevity Risk:Annuities can protect you against longevity risk, which is the risk that you will outlive your savings.

- Tax Advantages:Some annuities offer tax advantages, such as tax-deferred growth.

Risk-Reward Profiles

The risk-reward profiles of different annuity types vary. Fixed annuities have a lower risk profile than variable annuities, but they also offer lower potential returns. Variable annuities have a higher risk profile but also offer the potential for higher returns.

End of Discussion

As you embark on your retirement planning journey, remember that an annuity calculator can be a valuable tool. By understanding the nuances of annuities and utilizing these calculators, you can gain a clearer picture of your future financial landscape. Whether you’re seeking guaranteed income streams, tax advantages, or simply a more comprehensive approach to retirement planning, this guide provides the insights you need to make informed decisions and secure your financial well-being.

Popular Questions: Annuity Calculator Quarterly 2024

What is the difference between a fixed and a variable annuity?

A fixed annuity offers a guaranteed rate of return, while a variable annuity’s return is tied to the performance of underlying investments, which can fluctuate.

How do I find a reliable annuity calculator?

Look for calculators from reputable financial institutions, government agencies, or well-established financial websites.

What are the tax implications of annuities?

The tax treatment of annuities can vary depending on the type of annuity and the individual’s circumstances. Consult with a tax professional for specific guidance.