Annuity Calculator Quick 2024 provides a simple and efficient way to understand the potential benefits of annuities, a popular retirement planning tool. Annuities are financial products that provide a stream of regular payments, either for a fixed period or for life, offering a secure and predictable income source during retirement.

If you’re lucky enough to win the Powerball, you’ll have to decide whether to take a lump sum payment or receive payments over time. You can learn more about calculating Powerball annuity payments to make the best decision for your financial future.

By using an annuity calculator, you can explore different annuity options, estimate future payouts, and make informed decisions about your retirement savings.

Annuities can be a great way to supplement your retirement income. But are they the best way to retire ? You’ll want to carefully consider your financial situation and goals before making a decision.

An annuity calculator takes into account various factors, such as your age, the amount you invest, the interest rate, and the duration of the annuity. It then calculates the estimated monthly or annual payments you can receive. This information can help you determine if an annuity is the right choice for you and how it fits into your overall retirement plan.

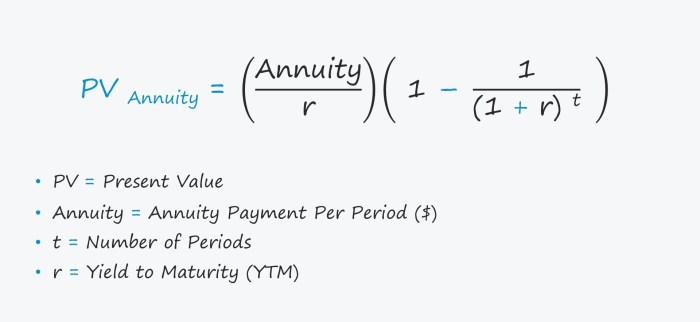

A present value (PV) calculator can be helpful for determining the current value of future cash flows. You can use a PV calculator to estimate the value of an annuity.

Contents List

- 1 What is an Annuity Calculator?

- 2 Key Features of an Annuity Calculator

- 3 Using an Annuity Calculator: A Step-by-Step Guide

- 4 Examples of Annuity Calculator Use Cases

- 5 Factors to Consider When Choosing an Annuity: Annuity Calculator Quick 2024

- 6 Resources and Tools for Annuity Calculations

- 7 Closing Notes

- 8 FAQ

What is an Annuity Calculator?

An annuity calculator is a valuable tool that helps individuals estimate the future value of their annuity payments. It provides a comprehensive analysis of the annuity’s growth potential and helps make informed decisions about retirement planning.

If you’re using a financial calculator, you can use the HP12c to calculate annuity payments. This calculator is popular among financial professionals and can be used to solve a variety of financial problems.

Purpose of an Annuity Calculator

An annuity calculator is designed to simplify the complex calculations involved in annuities. It allows users to input various parameters, such as the initial investment amount, interest rate, payment frequency, and duration, and then generates estimates of the future value of the annuity.

Understanding how to calculate future values of annuities can be helpful for financial planning. You can learn more about calculating annuity future values by consulting financial experts or using online resources.

Overview of Annuities

An annuity is a financial product that provides a stream of regular payments for a specified period. These payments can be used to supplement retirement income, provide a guaranteed income stream, or protect against outliving one’s savings. Annuities are typically purchased with a lump sum payment, which is then invested and grows over time.

When you purchase an annuity, you’re essentially exchanging a lump sum of money for a stream of guaranteed payments. But are these payments really guaranteed ? Understanding the different types of annuities can help you decide if this is the right investment for you.

Benefits of Using an Annuity Calculator

- Provides accurate estimates of future annuity payments.

- Helps compare different annuity options and choose the best one for individual needs.

- Simplifies complex calculations and makes retirement planning easier.

- Offers insights into the growth potential of annuities.

Key Features of an Annuity Calculator

An annuity calculator typically requires several inputs to provide accurate estimates. These inputs vary depending on the type of annuity being calculated.

Annuity calculators are a great tool for planning your retirement. You can use an annuity calculator to estimate how much income you’ll receive from an annuity, and how long your annuity payments will last.

Inputs Required, Annuity Calculator Quick 2024

- Initial Investment Amount:The amount of money invested in the annuity.

- Interest Rate:The annual rate of return on the annuity investment.

- Payment Frequency:The frequency of annuity payments, such as monthly, quarterly, or annually.

- Duration:The length of time for which payments will be made.

- Annuity Type:The specific type of annuity being calculated, such as a fixed annuity or a variable annuity.

Types of Annuities

- Fixed Annuities:Offer a guaranteed interest rate and a fixed stream of payments.

- Variable Annuities:Provide a stream of payments that fluctuate based on the performance of the underlying investment portfolio.

- Indexed Annuities:Link the growth of the annuity to the performance of a specific index, such as the S&P 500.

Outputs Generated

An annuity calculator typically provides the following outputs:

- Future Value:The estimated value of the annuity at the end of the specified period.

- Total Payments:The total amount of money received in annuity payments.

- Monthly Payment:The estimated amount of each monthly payment.

- Projected Growth:The estimated growth of the annuity over time.

Using an Annuity Calculator: A Step-by-Step Guide

Annuity calculators are typically user-friendly and straightforward to use. Here is a step-by-step guide to using an annuity calculator:

Step-by-Step Guide

- Select the Annuity Type:Choose the type of annuity you are interested in, such as a fixed, variable, or indexed annuity.

- Enter the Initial Investment Amount:Input the amount of money you plan to invest in the annuity.

- Specify the Interest Rate:Enter the expected annual interest rate on the annuity investment.

- Choose the Payment Frequency:Select the frequency of annuity payments, such as monthly, quarterly, or annually.

- Set the Duration:Input the length of time for which you want to receive annuity payments.

- Calculate:Click on the “Calculate” button to generate the estimated results.

Table of Inputs, Calculations, and Outputs

| Input | Calculation | Output |

|---|---|---|

| Initial Investment Amount | – | Future Value |

| Interest Rate | – | Total Payments |

| Payment Frequency | – | Monthly Payment |

| Duration | – | Projected Growth |

Examples of Annuity Calculator Use Cases

Annuity calculators are versatile tools that can be used in various scenarios. Here are some examples of how an annuity calculator can be beneficial:

Real-World Scenarios

- Retirement Planning:An annuity calculator can help individuals estimate the amount of income they can expect from their annuity during retirement.

- Income Supplement:Annuity calculators can be used to determine how much additional income an annuity can provide on top of other retirement savings.

- Estate Planning:Annuities can be used to provide a stream of income to beneficiaries after an individual’s death.

- Long-Term Care:Annuities can help cover the costs of long-term care expenses, such as nursing home care.

Factors to Consider When Choosing an Annuity: Annuity Calculator Quick 2024

Selecting the right annuity is crucial for maximizing returns and achieving financial goals. Here are some key factors to consider:

Comparison of Annuity Types

- Fixed Annuities:Offer guaranteed interest rates and predictable payments but may have lower returns than variable annuities.

- Variable Annuities:Provide the potential for higher returns but also carry the risk of losing money due to market fluctuations.

- Indexed Annuities:Link the growth of the annuity to the performance of a specific index, offering potential for higher returns but also carrying some market risk.

Key Factors to Consider

- Risk Tolerance:Consider your willingness to accept potential losses in exchange for higher returns.

- Investment Goals:Determine your financial objectives and choose an annuity that aligns with your goals.

- Time Horizon:Consider the length of time you plan to hold the annuity and choose an option that matches your time frame.

- Fees and Expenses:Compare the fees and expenses associated with different annuity options to ensure you are getting a good value.

Risks and Benefits

- Fixed Annuities:Low risk, guaranteed interest rate, but may have lower returns than variable annuities.

- Variable Annuities:Higher potential for returns, but also carry the risk of losing money due to market fluctuations.

- Indexed Annuities:Offer potential for higher returns linked to a specific index, but also carry some market risk.

Resources and Tools for Annuity Calculations

Several online resources and tools are available to help with annuity calculations.

It’s important to understand how annuities work before you buy one. You can learn more about how to calculate an annuity and how to determine if an annuity is right for you.

Reputable Online Annuity Calculators

- Bankrate:Offers a comprehensive annuity calculator that allows users to compare different annuity options.

- NerdWallet:Provides a user-friendly annuity calculator that helps estimate future annuity payments.

- Investopedia:Offers a variety of financial calculators, including an annuity calculator.

Financial Institutions Offering Annuity Products

- Fidelity Investments:Offers a range of annuity products, including fixed, variable, and indexed annuities.

- Vanguard:Provides a selection of annuity products designed for retirement planning.

- TIAA:Offers a variety of annuity products, including fixed, variable, and indexed annuities.

Relevant Financial Resources

- The Financial Industry Regulatory Authority (FINRA):Provides information and resources on annuities and other financial products.

- The Securities and Exchange Commission (SEC):Offers investor education materials on annuities and other investments.

- The National Endowment for Financial Education (NEFE):Provides financial education resources for consumers, including information on annuities.

Closing Notes

Whether you’re just starting to think about retirement or already nearing it, an annuity calculator can be a valuable tool for planning your future. By understanding the various types of annuities, their benefits, and their potential risks, you can make informed decisions that align with your financial goals.

An annuity due is a type of annuity where payments are made at the beginning of each period. If you’re interested in learning more about calculating annuity due , there are many resources available online.

Remember to consult with a financial advisor to get personalized advice and ensure you’re choosing the right annuity option for your specific circumstances.

FAQ

What are the different types of annuities?

There are several types of annuities, including fixed annuities, variable annuities, and indexed annuities. Each type offers different features and risks, so it’s important to understand the differences before making a decision.

Is an annuity calculator free to use?

Many online annuity calculators are free to use, but some may require you to provide personal information or contact details. It’s important to choose reputable calculators from trusted financial institutions.

Can I use an annuity calculator to compare different annuity products?

Yes, you can use an annuity calculator to compare different annuity products side-by-side. This allows you to see how the payouts and other features vary based on the type of annuity and the provider.

When you purchase an annuity, you can choose to receive a lump sum payment or a stream of payments over time. If you’re considering taking a lump sum , you’ll need to carefully consider the tax implications.

The annuity formula is a mathematical equation that can be used to calculate the present value or future value of an annuity. It’s important to understand the different components of the formula to use it correctly.

An annuity can be a great way to generate a steady stream of income. If you’re considering an annuity with a $70,000 principal, you’ll want to understand the terms of the annuity and the potential tax implications.

The interest earned on an annuity can be subject to taxation. You can learn more about whether annuity interest is taxable by consulting with a tax professional.

If you’re considering a $300,000 annuity, you’ll want to carefully consider the terms of the annuity and the potential tax implications. You can also use an annuity calculator to estimate how much income you’ll receive from the annuity.

Annuity income can be taxed differently than other types of income. You can learn more about whether annuity income is considered capital gains by consulting with a tax professional.