Annuity Calculator RBC 2024 empowers you to visualize your retirement goals and make informed financial decisions. This user-friendly tool allows you to explore various annuity options, understand their potential benefits, and plan for a secure future. Whether you’re looking to supplement your savings, protect your income, or simply gain clarity about your retirement planning, the RBC Annuity Calculator provides valuable insights and guidance.

By i

Understanding how annuity income is taxed is crucial for financial planning. This article, Is Annuity Income Capital Gains 2024 , clarifies whether annuity income is considered capital gains.

nputting your personal details, financial goals, and risk tolerance, the calculator generates personalized estimates and projections. It considers factors such as your age, investment amount, and desired income stream to help you determine the best annuity strategy for your circumstances.

This interactive experience allows you to experiment with different scenarios, adjust your inputs, and see how your choices impact your potential retirement outcomes.

Understanding the future value of an annuity is essential for long-term financial planning. This article, Calculating Annuity Future Values 2024 , provides guidance on calculating future values of annuities.

Contents List

RBC Annuity Calculator Overview

The RBC Annuity Calculator is a valuable tool designed to help individuals plan for their retirement by providing personalized estimates of their potential annuity payments. This user-friendly calculator allows users to input various financial details, such as their age, savings, and desired retirement income, to receive customized projections.

The National Pension System (NPS) offers annuity options for retirement planning. This article, Calculate Annuity Nps 2024 , provides insights on calculating annuity payments under NPS.

Key Features and Benefits

The RBC Annuity Calculator offers a range of features and benefits that can enhance retirement planning:

- Personalized Projections:The calculator provides tailored estimates based on individual financial circumstances, allowing users to visualize their potential retirement income.

- Scenario Analysis:Users can explore different retirement scenarios by adjusting various input parameters, such as retirement age, investment growth rates, and inflation rates.

- Comprehensive Information:The calculator provides detailed information about different annuity options, including their characteristics, advantages, and disadvantages.

- Easy-to-Use Interface:The calculator’s intuitive interface makes it simple for individuals to input their data and understand the results.

Planning for Retirement

The RBC Annuity Calculator can assist individuals in making informed decisions about their retirement planning by:

- Determining Annuity Needs:The calculator helps individuals understand how much annuity income they may need to maintain their desired lifestyle in retirement.

- Exploring Annuity Options:Users can compare different annuity types and their potential payouts based on their specific circumstances.

- Assessing Financial Goals:The calculator can help individuals determine whether their current savings and investment strategies are on track to achieve their retirement goals.

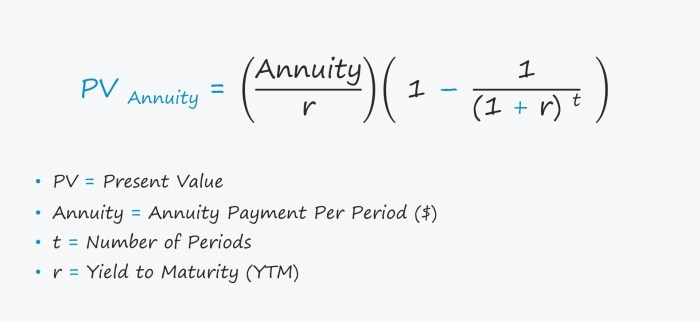

Visualizing the present value of an annuity can be helpful in making financial planning decisions. This article, Pv Annuity Chart 2024 , provides a chart that demonstrates the present value of annuities.

Types of Annuities Offered by RBC

RBC offers a variety of annuity products to meet the diverse needs and financial goals of its clients. These annuities can be broadly categorized into two main types:

- Fixed Annuities:These annuities provide guaranteed interest rates and payments, offering stability and predictable income streams.

- Variable Annuities:These annuities link returns to the performance of underlying investment portfolios, offering the potential for higher returns but also carrying higher risk.

Fixed Annuities

Fixed annuities offer a guaranteed rate of return, providing predictable income streams and a sense of security. They are suitable for individuals seeking stability and risk aversion.

Annuity payments can vary based on factors like the initial investment amount. This article, Annuity 600 000 2024 , explores annuity calculations for a specific investment amount.

- Advantages:

- Guaranteed interest rates

- Predictable income payments

- Lower risk compared to variable annuities

- Disadvantages:

- Lower potential returns compared to variable annuities

- Interest rates may not keep pace with inflation

Variable Annuities

Variable annuities offer the potential for higher returns but also carry higher risk. These annuities link returns to the performance of underlying investment portfolios, allowing for growth potential but also exposing investors to market fluctuations.

Tax implications are a key consideration when choosing an annuity. This article, Is Annuity Taxable In India 2024 , provides information about the taxability of annuities in India.

- Advantages:

- Potential for higher returns

- Flexibility in investment choices

- Disadvantages:

- Higher risk compared to fixed annuities

- Potential for loss of principal

- More complex investment decisions

Using the RBC Annuity Calculator

The RBC Annuity Calculator is designed to be user-friendly and intuitive. To effectively utilize the calculator, follow these steps:

- Access the Calculator:Visit the RBC website and locate the Annuity Calculator.

- Input Your Information:Enter your personal financial details, including your age, savings, desired retirement income, and other relevant information.

- Select Annuity Options:Choose the type of annuity you are interested in, such as fixed or variable.

- Review the Results:Analyze the calculator’s output, which will provide personalized estimates of your potential annuity payments and retirement income.

Input Fields and Descriptions

The RBC Annuity Calculator typically includes the following input fields:

| Input Field | Description |

|---|---|

| Age | Your current age |

| Retirement Age | The age at which you plan to retire |

| Savings | Your current savings balance |

| Desired Retirement Income | The amount of income you would like to receive in retirement |

| Investment Growth Rate | Your expected rate of return on your investments |

| Inflation Rate | The expected rate of inflation |

The Knights of Columbus (K of C) offers annuity products for its members. This article, K Of C Annuity 2024 , provides information about K of C annuity offerings.

Interpreting the Results, Annuity Calculator Rbc 2024

The RBC Annuity Calculator’s output typically includes:

- Estimated Annuity Payments:This shows the projected amount of income you may receive from your annuity.

- Retirement Income Projections:This provides estimates of your total retirement income, including your annuity payments and other sources of income.

- Scenario Analysis:The calculator may allow you to explore different scenarios by adjusting various input parameters to see how they impact your potential retirement income.

The BA II Plus calculator is a popular tool for financial calculations, including annuity calculations. This article, Calculating Annuity Ba Ii Plus 2024 , provides guidance on using the BA II Plus calculator for annuity calculations.

Factors to Consider When Choosing an Annuity: Annuity Calculator Rbc 2024

Selecting the right annuity for your retirement planning requires careful consideration of several factors:

- Age:Your age plays a significant role in determining the suitability of different annuity options. Younger individuals may have more time to benefit from potential growth in variable annuities, while older individuals may prefer the stability of fixed annuities.

- Risk Tolerance:Your risk tolerance determines your comfort level with potential losses.

Annuity is a financial product that provides regular payments over a specific period. If you’re interested in learning more about the concept of perpetuity in the context of annuities, you can read this article on Annuity Is Perpetual 2024.

Individuals with a higher risk tolerance may be more inclined towards variable annuities, while those with a lower risk tolerance may prefer fixed annuities.

- Financial Goals:Your financial goals, such as retirement income needs, legacy planning, or income protection, should be considered when choosing an annuity.

Flexibility is a factor to consider when choosing an annuity. This article, Is Annuity Flexible 2024 , explores the flexibility aspects of different annuity types.

- Investment Horizon:Your investment horizon, or the length of time you plan to hold the annuity, influences the suitability of different options. Longer investment horizons may allow for greater potential growth in variable annuities.

- Tax Implications:Annuities can have tax implications, and it’s important to understand how they will affect your overall tax situation.

Maximizing Annuity Benefits

To maximize the benefits of an annuity, consider the following strategies:

- Choose the Right Annuity Type:Select an annuity that aligns with your risk tolerance, financial goals, and investment horizon.

- Diversify Your Investments:Don’t put all your eggs in one basket. Diversify your investments to reduce risk and potentially enhance returns.

- Seek Professional Advice:Consult with a financial advisor to discuss your specific circumstances and receive personalized guidance on annuity selection.

Annuity rates can fluctuate over time, so it’s important to understand how they have changed. This article, Annuity Rates 2021 2024 , provides insights into annuity rate trends from 2021 to 2024.

Potential Risks and Drawbacks

While annuities can provide valuable benefits for retirement planning, they also come with potential risks and drawbacks:

- Limited Liquidity:Annuities can be illiquid, meaning you may not be able to easily access your funds before a certain age or for specific reasons.

- Potential for Loss of Principal:Variable annuities carry the risk of losing principal, especially during periods of market volatility.

- Fees and Expenses:Annuities often come with fees and expenses that can impact your returns.

When considering annuities in India, it’s essential to know how they are taxed. This article, Is Annuity Income Taxable In India 2024 , clarifies the tax implications of annuity income in India.

- Tax Implications:Annuity payouts can be subject to taxes, which can impact your overall retirement income.

Alternatives to RBC Annuities

While RBC offers a range of annuity products, there are other financial institutions that provide alternative annuity options.

Understanding what an annuity is and how it works is crucial for making informed financial decisions. This article, 1 An Annuity Is 2024 , provides a clear explanation of the basics of annuities.

Comparison of Annuity Products

When comparing annuity products from different providers, consider the following factors:

- Interest Rates or Returns:Compare the interest rates or potential returns offered by different annuities.

- Fees and Expenses:Analyze the fees and expenses associated with each annuity to determine their overall cost.

- Features and Benefits:Consider the features and benefits offered by each annuity, such as death benefits, living benefits, and withdrawal options.

An annuity involves regular payments, but it’s important to understand the nature of these payments. This article, Annuity Is Payment 2024 , explores the specifics of annuity payments.

- Financial Strength of the Provider:Choose a provider with a strong financial reputation and track record.

- Customer Service and Support:Evaluate the provider’s customer service and support resources.

Financial Planning Considerations

Annuities can play a significant role in an overall retirement planning strategy.

Retirement Planning Strategy

Annuities can provide a guaranteed income stream in retirement, helping to ensure financial security. They can be used to supplement other sources of retirement income, such as Social Security or pensions.

Tax Implications

Annuity payouts are generally taxed as ordinary income, but specific tax rules may apply depending on the type of annuity and other factors. It’s essential to consult with a tax advisor to understand the tax implications of annuity investments.

Diversified Investment Portfolio

Annuities can be incorporated into a diversified investment portfolio to provide income and protection against market volatility. However, it’s crucial to consider the overall asset allocation and risk management strategies within your portfolio.

Last Word

The RBC Annuity Calculator is a valuable tool for anyone seeking to understand the complexities of retirement planning. It simplifies the process, provides personalized projections, and empowers you to make informed decisions about your financial future. By utilizing this calculator, you can gain a clearer understanding of your options, explore different scenarios, and make strategic choices that align with your individual needs and goals.

For those seeking to understand the meaning of an annuity in Hindi, this article, Annuity Meaning In Hindi 2024 , provides a comprehensive explanation in Hindi.

Remember, retirement planning is a journey, and the RBC Annuity Calculator can be a trusted companion along the way.

Essential FAQs

Is the RBC Annuity Calculator free to use?

Yes, the RBC Annuity Calculator is available free of charge on the RBC website.

What types of annuities are offered through RBC?

RBC offers a range of annuity options, including fixed, variable, and indexed annuities. Each type has its own unique features, benefits, and risks.

Is it possible to adjust the calculator’s input parameters after generating results?

Yes, the RBC Annuity Calculator allows you to modify your input parameters after generating initial results. This enables you to experiment with different scenarios and see how your choices impact your projections.