Annuity Calculator Singapore 2024 is your comprehensive guide to understanding and utilizing annuities for retirement planning. Annuities, essentially financial contracts, provide a stream of regular payments, offering a sense of financial security during your golden years. This guide explores the various types of annuities available in Singapore, their benefits and risks, and how to effectively use annuity calculators to make informed decisions about your future.

Tax implications are a crucial aspect of financial planning. Understanding whether an annuity is tax-deferred can help you optimize your tax strategy. Explore the information on tax deferral for annuities to make informed decisions about your investments.

By understanding the mechanics of annuity calculators, you can explore different scenarios, analyze the impact of various factors on your potential payouts, and ultimately gain a clearer picture of your retirement financial landscape. This knowledge empowers you to make strategic choices about your financial future, ensuring a comfortable and fulfilling retirement.

Are you curious about how long your annuity payments will last? An annuity calculator can help you estimate your lifetime income stream. This tool considers factors like your age, starting principal, and interest rate to give you a personalized projection.

Contents List

- 1 Introduction to Annuities in Singapore: Annuity Calculator Singapore 2024

- 2 How Annuity Calculators Work

- 3 Finding the Right Annuity Calculator

- 4 Using Annuity Calculators for Planning

- 5 Factors Affecting Annuity Calculations

- 6 Understanding Annuity Terms

- 7 Resources for Further Information

- 8 Last Recap

- 9 Answers to Common Questions

Introduction to Annuities in Singapore: Annuity Calculator Singapore 2024

An annuity is a financial product that provides a stream of regular payments, typically for a fixed period or for the lifetime of the annuitant. In Singapore, annuities are often used as a retirement planning tool, offering a guaranteed income stream to help cover living expenses during retirement.

Financial calculators are invaluable tools for making informed financial decisions. Learning how to calculate annuity payments on a financial calculator can empower you to analyze different scenarios and make strategic choices. Explore the guide on calculating annuity payments on a financial calculator to enhance your financial literacy.

Types of Annuities in Singapore

There are several types of annuities available in Singapore, each with its own features and benefits. Some common types include:

- Fixed Annuities:These annuities provide a fixed, guaranteed payment amount for a specified period or for life. The payment amount is determined at the time of purchase and does not fluctuate with market conditions.

- Variable Annuities:These annuities offer a payment amount that varies based on the performance of an underlying investment portfolio. The payment amount can fluctuate with market conditions, but it has the potential for higher returns.

- Indexed Annuities:These annuities link the payment amount to the performance of a specific index, such as the Straits Times Index (STI). The payment amount may increase or decrease based on the index’s performance, but it typically has a minimum guaranteed return.

Deciding between an annuity and an IRA can be a tough choice. Both offer tax advantages, but their features differ. Understanding the pros and cons of each can help you make the right decision. Learn more about the differences between an annuity and an IRA to determine which aligns with your financial goals.

Benefits and Risks of Annuities

Annuities offer several benefits, including:

- Guaranteed Income:Fixed annuities provide a guaranteed income stream, offering peace of mind during retirement.

- Longevity Protection:Annuities can help protect against the risk of outliving your savings. They can provide a steady income stream for as long as you live.

- Potential for Growth:Variable and indexed annuities offer the potential for higher returns, but they also carry investment risk.

However, annuities also have some potential drawbacks:

- Limited Liquidity:Once you purchase an annuity, you typically cannot access the funds without incurring penalties.

- Investment Risk:Variable and indexed annuities carry investment risk, and the payment amount can fluctuate with market conditions.

- Complexity:Annuities can be complex financial products, and it’s important to understand the terms and conditions before making a purchase.

How Annuity Calculators Work

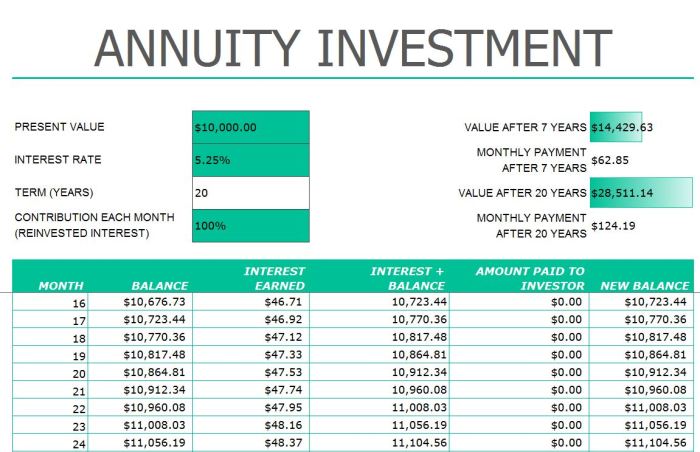

Annuity calculators are online tools that help individuals estimate their potential annuity payouts based on various factors. These calculators use mathematical formulas to project future income streams, taking into account factors such as:

Factors Considered in Annuity Calculations

- Age:The older you are, the lower your life expectancy, which generally results in a higher annuity payout.

- Gender:Women generally have a longer life expectancy than men, so they may receive a lower annuity payout for the same amount of money invested.

- Investment Amount:The amount of money you invest in the annuity directly affects the size of your annuity payments.

- Interest Rate:The interest rate offered on the annuity affects the growth of your investment and the size of your annuity payments.

- Annuity Type:The type of annuity you choose (fixed, variable, or indexed) will affect the calculation of your annuity payments.

- Payment Frequency:The frequency of your annuity payments (monthly, quarterly, annually) can also impact the overall amount you receive.

Using an Annuity Calculator, Annuity Calculator Singapore 2024

Using an annuity calculator is a straightforward process. You typically need to enter information about your age, gender, investment amount, and other relevant factors. The calculator will then use this information to estimate your potential annuity payouts.

Want to know how to calculate the present value of an annuity in Excel? You can use a built-in formula to quickly determine the current worth of a future stream of payments. Explore the guide on PV annuity calculations in Excel to streamline your financial planning.

For example, you might enter your age as 65, your gender as male, your investment amount as $100,000, and the interest rate as 3%. The calculator would then estimate your potential annuity payments based on these inputs.

Need to calculate the present value of an annuity? A PV calculator can help you determine the current worth of a future stream of payments. Explore the guide on PV annuity calculations to make informed financial decisions.

Finding the Right Annuity Calculator

There are numerous annuity calculators available online, each with its own features and functionalities. Choosing the right calculator depends on your individual needs and preferences.

Annuity options are diverse, catering to different needs and risk tolerances. If you’re considering an annuity, it’s essential to explore the various types available to find one that suits your goals. Research different annuity options to make an informed decision.

Annuity Calculator Comparison Table

| Calculator Name | Features | Ease of Use | Provider |

|---|---|---|---|

| Calculator A | Fixed, variable, and indexed annuities; life expectancy calculations; tax implications | Easy to use, user-friendly interface | Provider A |

| Calculator B | Fixed and variable annuities; inflation adjustment options; investment growth projections | Moderately complex, requires some financial knowledge | Provider B |

| Calculator C | Indexed annuities; personalized recommendations; comprehensive reports | Advanced features, may require financial advisor assistance | Provider C |

Choosing the Best Annuity Calculator

When choosing an annuity calculator, consider the following factors:

- Features:Ensure the calculator offers the features you need, such as the ability to calculate different annuity types, adjust for inflation, or project investment growth.

- Ease of Use:Choose a calculator that is easy to understand and navigate, especially if you are not familiar with annuities.

- Provider Reputation:Select a calculator from a reputable provider with a track record of providing accurate and reliable financial information.

Using Annuity Calculators for Planning

Annuity calculators can be a valuable tool for retirement planning. They can help you:

Retirement Planning with Annuity Calculators

- Estimate Retirement Income:By inputting your expected retirement age, investment amount, and other relevant factors, you can estimate your potential annuity payments and plan your retirement budget accordingly.

- Compare Different Annuity Options:Annuity calculators can help you compare different annuity types and see how they would affect your retirement income.

- Explore Different Investment Strategies:You can use annuity calculators to experiment with different investment strategies and see how they would impact your potential annuity payouts.

Scenarios Where Annuity Calculators Are Useful

Annuity calculators can be useful in a variety of scenarios, such as:

- Planning for a comfortable retirement:You can use an annuity calculator to determine how much you need to save and invest to achieve your desired retirement income.

- Supplementing your retirement income:If you have other retirement savings, you can use an annuity calculator to see how an annuity could supplement your existing income stream.

- Protecting against longevity risk:An annuity calculator can help you determine how much annuity income you need to ensure you have a steady stream of income for the rest of your life.

Impact of Variables on Annuity Payouts

| Variable | Impact on Annuity Payout |

|---|---|

| Age | Higher age generally results in higher annuity payout |

| Investment Amount | Higher investment amount generally results in higher annuity payout |

| Interest Rate | Higher interest rate generally results in higher annuity payout |

| Annuity Type | Different annuity types have different payout structures |

Factors Affecting Annuity Calculations

Several factors can influence the calculation of annuity payouts. These factors include:

Key Factors Influencing Annuity Payouts

- Interest Rates:Interest rates play a crucial role in annuity calculations. Higher interest rates generally lead to higher annuity payouts, as the investment grows faster.

- Inflation:Inflation can erode the purchasing power of your annuity payments over time. Annuity providers may offer inflation adjustments to help mitigate this risk, but these adjustments can vary depending on the annuity type.

- Life Expectancy:Your life expectancy is a significant factor in annuity calculations. The longer your expected lifespan, the lower your annuity payout will be, as you will receive payments for a longer period.

- Investment Options:The investment options available within a variable or indexed annuity can affect the potential for growth and the level of risk involved. Choosing the right investment options is crucial for maximizing returns while managing risk.

- Risk Tolerance:Your risk tolerance determines your willingness to accept fluctuations in the value of your annuity payments. If you have a high risk tolerance, you may be more comfortable with variable annuities that offer the potential for higher returns but also carry greater risk.

Annuity is a type of investment that provides a guaranteed income stream for a specific period. However, it’s important to note that it’s not life insurance. If you’re considering an annuity, understand its differences from life insurance to make an informed decision.

Understanding Annuity Terms

Understanding common annuity terms is essential for making informed decisions about annuity investments.

An annuity is a financial product that provides a stream of payments over a set period. Understanding the basics of an annuity can help you make informed decisions about your financial future. Explore the definition of an annuity to gain a solid understanding of its characteristics and potential benefits.

Glossary of Annuity Terms

| Term | Definition |

|---|---|

| Annuitant | The individual who receives the annuity payments |

| Annuity Period | The duration of the annuity payments, which can be for a fixed period or for life |

| Annuity Rate | The amount of each annuity payment |

| Premium | The initial investment amount used to purchase the annuity |

| Accumulation Phase | The period during which the premium grows before annuity payments begin |

| Annuitization | The process of converting a lump sum into a stream of regular payments |

| Guaranteed Minimum Income | A minimum guaranteed payment amount, often offered with indexed annuities |

| Death Benefit | A payment made to a beneficiary upon the death of the annuitant, if applicable |

Resources for Further Information

For more information on annuities, you can consult the following resources:

Reputable Sources for Annuity Information

- MoneySmart:A website providing financial information and resources for Singapore residents, including information on annuities.

- MAS (Monetary Authority of Singapore):The regulatory authority for financial institutions in Singapore, offering guidance on annuity products.

- Financial Planning Association of Singapore (FPAS):A professional association for financial advisors in Singapore, offering information on annuities and other financial planning topics.

Contacting Financial Advisors

For personalized advice on annuities, it’s recommended to consult with a qualified financial advisor. You can find financial advisors specializing in annuities through:

- FPAS website:The FPAS website provides a directory of certified financial advisors.

- Referral networks:Your bank, insurance company, or other financial institutions may have referral networks for financial advisors.

Last Recap

In the world of retirement planning, annuities offer a valuable tool for securing your financial future. By understanding the nuances of annuities and utilizing the power of annuity calculators, you can gain insights into your retirement options and make informed decisions that align with your goals.

Whether you’re just starting your retirement planning journey or seeking to refine your existing strategy, this guide serves as a stepping stone to financial confidence and peace of mind.

Are you looking for a financial product that provides a lifelong income stream? While many annuities offer long-term payments, it’s crucial to understand if they are truly for life. Some annuities have specific terms or conditions that might affect the duration of your payments.

Answers to Common Questions

What are the different types of annuities available in Singapore?

Common types include immediate annuities, deferred annuities, fixed annuities, variable annuities, and indexed annuities. Each type has its own characteristics and suitability depending on your individual needs and risk tolerance.

Annuity is a financial instrument that provides a stream of payments for a specific period. But is it right for you? If you’re considering this option, it’s crucial to understand its characteristics. You can learn more about what an annuity is by exploring different resources and comparing it to other investment options.

Are there any fees associated with using annuity calculators?

Most online annuity calculators are free to use. However, some financial institutions may charge fees for personalized consultations or more complex calculations.

How often should I review my annuity plan?

It’s recommended to review your annuity plan at least annually, or more frequently if there are significant changes in your financial circumstances, such as changes in interest rates, inflation, or your risk tolerance.

Annuity and IRA are both retirement savings vehicles, but they have distinct features. Understanding their similarities and differences can help you choose the best option for your needs. Explore the information on annuities and IRAs to make an informed decision.

Annuity formulas are essential for calculating payments and understanding the intricacies of this financial product. If you’re dealing with quarterly payments, you’ll need a specific formula to calculate the correct amount. Explore the guide on quarterly annuity formulas to enhance your financial knowledge.

Annuity health insurance is a type of coverage that provides financial support during times of illness or injury. If you’re looking for annuity health insurance in Westmont, Illinois, there are options available. Research different providers to find the best annuity health insurance plan for your needs.

Annuity rates are crucial for understanding the potential return on your investment. These rates can vary based on factors like the type of annuity, the provider, and market conditions. Explore the information on annuity rates to make informed decisions about your financial future.