Annuity Calculator UK Gov 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In the realm of financial planning, annuities play a crucial role, offering individuals a steady stream of income during their retirement years.

Choosing the right annuity for retirement can be a big decision. You can explore different options and learn more on What Annuity Is The Best For Retirement 2024 to help you make the best choice.

The UK government recognizes the importance of annuities and actively regulates this sector, providing consumers with valuable information and resources to make informed decisions.

If you’re using the Groww platform, you might be interested in their annuity calculator. You can learn more about Annuity Calculator Groww 2024 to see how it works.

The year 2024 marks a significant period for those considering annuities, as the financial landscape continues to evolve. Understanding the nuances of annuities and how they work is essential. Annuity calculators have become invaluable tools for individuals looking to explore their retirement income options.

It’s common to wonder if an annuity is the same as an IRA. While they share similarities, there are key differences. You can learn more about this on Is Annuity Same As Ira 2024.

These calculators provide a personalized assessment, taking into account various factors such as age, gender, health, and investment preferences. By inputting these details, individuals can gain a clearer picture of their potential annuity payments and make informed choices about their retirement planning.

When it comes to retirement planning, you might be wondering whether an annuity or a lump sum is better for you. You can explore this topic further on Annuity Or Lump Sum 2024.

Contents List

Annuity Calculators: A Guide for UK Residents in 2024

An annuity is a financial product that provides a guaranteed stream of income for a specified period, often for life. Annuities are commonly used as part of retirement planning, offering a steady income stream to supplement savings and pensions. The UK government plays a significant role in regulating the annuity market and providing information to consumers to ensure transparency and fairness.

Stay up-to-date on the latest annuity news with resources like Annuity News 2024.

In 2024, using an annuity calculator is more important than ever. With evolving market conditions and increasing longevity, it’s crucial to understand how annuities can fit into your financial plan. Annuity calculators allow you to explore different scenarios, compare options, and make informed decisions about your retirement income.

If you’re considering an annuity due, you might want to know how to calculate its present value. A helpful resource on Calculate Annuity Due Present Value 2024 can guide you through the calculations.

Understanding Annuity Calculators, Annuity Calculator Uk Gov 2024

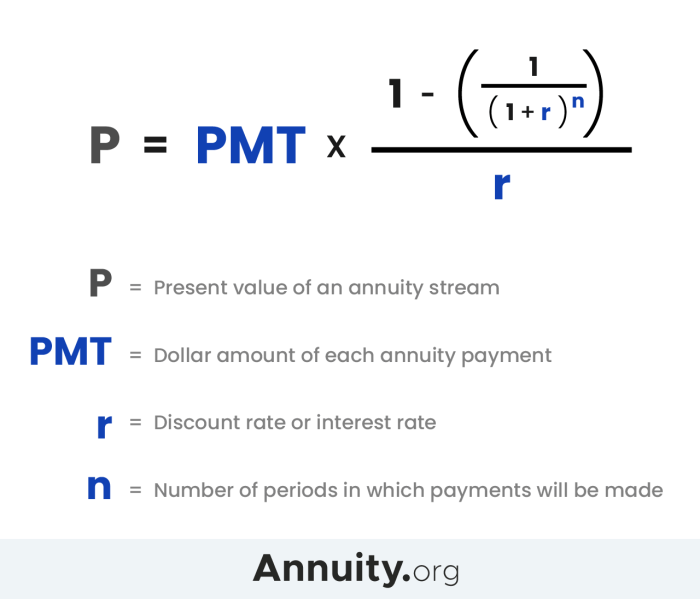

Annuity calculators are online tools that help you estimate the potential income you could receive from an annuity. They work by taking into account various factors, such as your age, gender, health, the amount of your lump sum investment, and the type of annuity you choose.

Looking for annuity quotes? You can find them online! Check out Annuity Quotes Online 2024 for a guide on where to start your search.

The calculator then provides an estimated monthly or annual income based on your chosen parameters.

- Fixed Annuities:These offer a fixed rate of return, providing a predictable income stream.

- Variable Annuities:These offer a variable rate of return, potentially leading to higher income but also carrying higher risk.

- Indexed Annuities:These link the rate of return to a specific index, such as the FTSE 100, providing a balance between stability and potential growth.

Popular annuity calculator websites and tools available in the UK include:

- MoneySavingExpert

- Which?

- The Money Edit

Key Factors Influencing Annuity Calculations

Several factors influence the amount of income you receive from an annuity. These include:

- Age:Younger individuals generally receive lower annuity payments than older individuals, as they are expected to live longer and receive payments for a longer period.

- Gender:Women typically receive lower annuity payments than men due to their generally longer life expectancy.

- Health:Individuals in good health generally receive higher annuity payments than those with health conditions, as they are expected to live longer.

- Investment Choices:The type of annuity you choose (fixed, variable, or indexed) will significantly impact your potential income.

Interest rates and inflation also play a crucial role in annuity calculations. Higher interest rates generally lead to higher annuity payments, while inflation can erode the purchasing power of your annuity income over time.

Want to understand how annuities work? You can find a helpful guide on Annuity How It Works 2024 that explains the basics.

Guaranteed minimum income is a feature offered by some annuities, ensuring a minimum level of income even if investment returns are low. This can provide peace of mind, but it may come with higher fees or a lower initial income stream.

It’s important to understand if annuity payments are considered income. You can find more information on Is Annuity Considered Income 2024 to clarify this.

Using Annuity Calculators in 2024

Using an annuity calculator is straightforward. Follow these steps:

- Choose an annuity calculator:Select a reputable website or tool that provides accurate and up-to-date information.

- Enter your details:Provide your age, gender, health status, and any other relevant information requested by the calculator.

- Specify your investment:Input the amount of your lump sum investment or the amount of your monthly contributions.

- Select an annuity type:Choose the type of annuity that best suits your needs and risk tolerance (fixed, variable, or indexed).

- Review the results:The calculator will provide an estimated income stream based on your inputs.

- Compare options:Use the calculator to explore different scenarios and compare the potential income from various annuity options.

For example, you can input different lump sum amounts to see how they affect your estimated income. You can also compare the potential income from a fixed annuity versus a variable annuity to see which option aligns better with your risk tolerance.

There are different types of annuities, and some are known as “Annuity 3”. You can learn more about this type of annuity on Annuity 3 2024.

Benefits and Considerations of Annuities

Annuities offer several advantages, including:

- Guaranteed Income:Annuities provide a guaranteed stream of income, providing financial security and peace of mind.

- Tax Benefits:Annuity payments are often tax-free, making them an attractive option for retirement income.

- Protection Against Market Volatility:Annuities can protect your savings from market fluctuations, providing a stable income stream regardless of market performance.

However, annuities also have potential drawbacks:

- Limitations on Withdrawals:Some annuities may restrict withdrawals, limiting your access to your funds.

- Potential for Low Returns:Fixed annuities may offer lower returns than other investment options, particularly in periods of high inflation.

- Potential Fees:Annuities can come with fees, such as administrative fees or surrender charges, which can impact your overall returns.

Annuities can be a suitable financial option for individuals seeking a guaranteed income stream, particularly those with a long life expectancy or those who want to protect their savings from market volatility. However, it’s crucial to carefully consider the potential drawbacks and seek professional financial advice before making any decisions.

Government Resources and Information

The UK government provides various resources and information for individuals seeking information about annuities. These include:

- Money Advice Service:This website offers comprehensive information about annuities, including how they work, the different types available, and the factors to consider when choosing an annuity.

- Financial Conduct Authority (FCA):The FCA regulates the financial services industry, including annuities. Their website provides information about the rules and regulations governing annuities, as well as consumer protection guidance.

- The Pensions Regulator:This organization provides information about pensions and retirement planning, including annuities.

The government also offers initiatives and schemes related to annuities, such as the Pension Wise service, which provides free and impartial guidance on retirement planning, including annuities.

Annuity calculations can be a bit tricky, but understanding how to calculate an ordinary annuity is a good starting point. You can find a guide on Calculating Ordinary Annuity 2024 that can help you understand the process.

Financial Advice and Guidance

Seeking professional financial advice is crucial before making any decisions about annuities. A qualified financial advisor can help you understand your financial situation, your goals, and the various annuity options available to you. They can provide personalized advice tailored to your specific circumstances and help you make informed decisions about your retirement income.

Annuity drawdown is a popular option for many. You can find information on Is Annuity Drawdown 2024 to learn more about how it works.

To find a qualified financial advisor, you can contact the Financial Conduct Authority (FCA) or the Money Advice Service. They provide directories of regulated financial advisors who can provide impartial and professional advice.

If you’re studying annuities, you might be looking for practice questions and answers. You can find a helpful resource on Annuity Calculation Questions And Answers 2024 to test your knowledge.

Last Word

Navigating the world of annuities can be a complex endeavor. However, by utilizing the power of annuity calculators and seeking guidance from financial advisors, individuals can gain a better understanding of their options and make informed decisions that align with their financial goals.

Want to learn more about annuities that offer a 7% return? You can find information about Annuity 7 Percent 2024 to explore this option.

The UK government continues to play a vital role in supporting consumers by providing access to valuable resources and information. As we move forward into 2024 and beyond, the importance of annuities in retirement planning is only set to grow.

If you’re in India, you might be wondering about the tax implications of annuity income. You can find information on Is Annuity Income Taxable In India 2024 to learn more.

By embracing the tools and knowledge available, individuals can take control of their financial future and secure a comfortable retirement.

Quick FAQs: Annuity Calculator Uk Gov 2024

What is the minimum age to purchase an annuity in the UK?

There is no minimum age to purchase an annuity in the UK. However, it’s important to note that annuity payouts are typically higher for those who purchase later in life.

Are annuities subject to income tax in the UK?

Yes, annuity payments are generally subject to income tax in the UK. The tax rate will depend on your individual circumstances.

Can I withdraw my annuity payments early?

The terms of your annuity will determine whether you can withdraw your payments early. Some annuities offer flexibility, while others may impose penalties for early withdrawals.

What happens if I die before I receive all my annuity payments?

If you die before receiving all your annuity payments, your beneficiary may be entitled to a lump sum payment or continued annuity payments, depending on the terms of your contract.