Annuity Calculator USA 2024: Navigating the complex world of annuities can feel overwhelming, but it doesn’t have to be. These powerful tools can help you visualize your retirement income potential, understand the different types of annuities available, and make informed decisions about your financial future.

Whether you’re looking for guaranteed income streams, protection against longevity risk, or a way to supplement your existing retirement savings, annuity calculators offer valuable insights. By understanding the fundamentals of how these calculators work, you can gain a clearer picture of your retirement goals and explore the options that best align with your individual circumstances.

For those who prefer a visual representation of their annuity growth, a calculator can be a useful tool. This article on Annuity Calculator Quarterly 2024 explores the use of quarterly calculators to track your annuity’s progress over time.

Contents List

- 1 Understanding Annuities in the US

- 2 Factors to Consider When Choosing an Annuity

- 3 How Annuity Calculators Work

- 4 Using an Annuity Calculator in 2024

- 5 Finding Reputable Annuity Calculators

- 6 Annuities and Retirement Planning

- 7 Tax Implications of Annuities: Annuity Calculator Usa 2024

- 8 Risks Associated with Annuities

- 9 Final Thoughts

- 10 Clarifying Questions

Understanding Annuities in the US

Annuities are financial products that provide a stream of regular payments over a set period of time. They can be a valuable tool for retirement planning, as they can provide a guaranteed income stream and protect against longevity risk. There are several different types of annuities available in the US, each with its own features, benefits, and risks.

Federal employees have specific annuity options available through the Federal Employees Retirement System (FERS). This article on Calculate Annuity Fers 2024 provides guidance on calculating your FERS annuity and understanding its benefits.

Types of Annuities

- Fixed Annuities:These annuities offer a guaranteed rate of return, meaning that you know exactly how much income you will receive each year. This makes them a good option for those who are risk-averse and want to protect their principal. However, the fixed rate of return may not keep up with inflation, so your purchasing power could decline over time.

The “J” calculation in HVAC systems is crucial for determining the appropriate duct sizing and airflow. This article on J Calculation Hvac 2024 provides a detailed explanation of this calculation and its importance in HVAC design.

- Variable Annuities:These annuities invest in a variety of sub-accounts, such as mutual funds or stocks. The rate of return on a variable annuity will fluctuate based on the performance of the underlying investments. This can lead to higher returns than fixed annuities, but it also carries more risk.

There are certain circumstances where withdrawing funds from an annuity before the age of 59 1/2 can result in a penalty. It’s important to familiarize yourself with the Annuity 10 Penalty 2024 rules to ensure you don’t face any unexpected financial burdens.

If the investments underperform, your annuity payments could be reduced.

- Indexed Annuities:These annuities link their returns to the performance of a specific index, such as the S&P 500. They offer the potential for growth, but they also have a guaranteed minimum return, which protects your principal from losses. Indexed annuities are a good option for those who want to participate in the stock market but are concerned about downside risk.

Key Features and Benefits

Annuities offer a number of key features and benefits, including:

- Guaranteed income:Many annuities provide a guaranteed income stream, which can provide peace of mind during retirement.

- Longevity protection:Annuities can help protect against longevity risk, which is the risk that you will outlive your savings. They can provide a stream of income for as long as you live.

- Tax deferral:Annuity payments are typically taxed only when they are withdrawn, which can provide tax advantages during retirement.

- Death benefit:Some annuities offer a death benefit, which can provide financial security for your beneficiaries if you pass away before the annuity payments have been fully received.

Pros and Cons

It is important to consider the pros and cons of each type of annuity before making a decision.

| Type | Pros | Cons |

|---|---|---|

| Fixed Annuities | Guaranteed rate of return, low risk | Returns may not keep up with inflation, limited growth potential |

| Variable Annuities | Potential for higher returns, investment flexibility | Higher risk, returns are not guaranteed |

| Indexed Annuities | Potential for growth, guaranteed minimum return | Returns may be limited, fees can be high |

Factors to Consider When Choosing an Annuity

When choosing an annuity, it is important to consider your individual financial goals, risk tolerance, and time horizon. These factors will help you determine the best type of annuity for your needs.

While both annuities and life insurance offer financial protection, they serve different purposes. This article on Is Annuity The Same As Life Insurance 2024 clarifies the distinctions between these two financial products.

Financial Goals

What are your financial goals for retirement? Do you want to generate a steady stream of income, protect your principal from losses, or grow your savings? Your financial goals will help you narrow down your choices.

If you’re a programmer looking to incorporate annuity calculations into your projects, this guide on Calculate Annuity Java 2024 can provide valuable insights. Learn how to utilize Java to model and calculate annuity values for your applications.

Risk Tolerance

How much risk are you willing to take with your investments? If you are risk-averse, a fixed annuity may be a good option. If you are willing to take on more risk, a variable or indexed annuity may be more suitable.

Time Horizon

How long do you plan to live off your retirement savings? If you have a long time horizon, you may be able to take on more risk. If you have a shorter time horizon, you may want to choose a more conservative investment option.

Thinking about an annuity but have questions? It’s natural to have concerns, and it’s always best to seek clarification. This article on Annuity Questions 2024 addresses common inquiries and provides valuable information to help you make informed decisions.

Checklist of Questions, Annuity Calculator Usa 2024

Here are some questions to ask potential annuity providers:

- What are the fees associated with the annuity?

- What is the surrender charge period?

- What are the guaranteed rates of return, if any?

- What is the death benefit?

- What are the tax implications of the annuity?

How Annuity Calculators Work

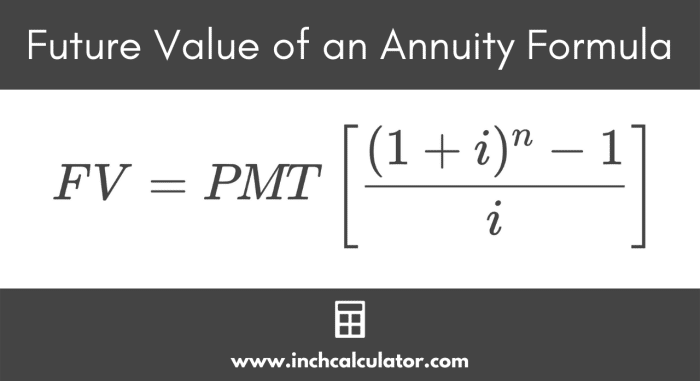

Annuity calculators are tools that can help you estimate the future value of an annuity. They take into account factors such as your age, investment amount, interest rate, and the length of the annuity period.

Key Inputs and Outputs

The key inputs for an annuity calculator are:

- Investment amount:The amount of money you plan to invest in the annuity.

- Interest rate:The rate of return you expect to earn on your investment. This can be a fixed rate or a variable rate.

- Annuity period:The length of time you plan to receive annuity payments. This can be a specific number of years or until your death.

- Age:Your current age. This is used to calculate the present value of the annuity payments.

The key outputs of an annuity calculator are:

- Future value:The estimated value of your annuity at the end of the annuity period.

- Annuity payment:The amount of money you will receive each year during the annuity period.

- Present value:The current value of the annuity payments.

Limitations and Potential Biases

It is important to remember that annuity calculators are just tools. They cannot predict the future with certainty. The results of an annuity calculator are based on assumptions, and those assumptions may not always be accurate.

Annuity calculators may also be biased towards certain types of annuities. For example, a calculator offered by an insurance company may be more likely to recommend annuities sold by that company.

Using an Annuity Calculator in 2024

Using an annuity calculator is a straightforward process. Most annuity calculators are available online and can be accessed for free.

Step-by-Step Guide

- Enter your information:Start by entering your age, investment amount, and the length of the annuity period. You may also need to enter your expected interest rate, which can be based on current market conditions or historical data.

- Choose an annuity type:Select the type of annuity you are interested in, such as fixed, variable, or indexed.

- Review the results:The calculator will provide you with an estimate of the future value of your annuity, the annuity payment amount, and the present value. Review these results carefully and make sure you understand them.

- Consider the assumptions:Remember that the results of the calculator are based on assumptions. It is important to consider whether those assumptions are realistic and to adjust your expectations accordingly.

Interpreting the Results

The results of an annuity calculator can help you make informed decisions about your retirement planning. For example, if you are considering investing $100,000 in a fixed annuity with a 3% interest rate for 20 years, an annuity calculator may show that you will receive an annual payment of $7,434.

This information can help you decide if an annuity is the right investment for you.

Annuity investments can be a valuable tool for retirement planning, but it’s essential to weigh the pros and cons before committing. This article on Annuity Is It A Good Idea 2024 provides a balanced perspective to help you decide if an annuity is right for you.

Finding Reputable Annuity Calculators

There are a number of reputable online annuity calculators available in 2024. These calculators can provide you with accurate and reliable estimates of the future value of an annuity.

Knowing the rate of return on your annuity is essential for evaluating its performance. This article on Calculating Annuity Rate Of Return 2024 explains how to calculate this important metric and assess your annuity’s growth.

Reputable Annuity Calculators

- Bankrate:Bankrate offers a comprehensive annuity calculator that allows you to compare different annuity types and providers. It also provides educational resources on annuities.

- Investopedia:Investopedia offers a simple and easy-to-use annuity calculator. It allows you to input your investment amount, interest rate, and annuity period to get an estimate of your future payments.

- NerdWallet:NerdWallet offers a user-friendly annuity calculator that allows you to compare different annuity products side-by-side. It also provides reviews and ratings of annuity providers.

Features and Functionalities

When choosing an annuity calculator, it is important to consider its features and functionalities. Some features to look for include:

- Multiple annuity types:The calculator should allow you to compare different types of annuities, such as fixed, variable, and indexed.

- Customization options:The calculator should allow you to customize your inputs, such as your age, investment amount, and interest rate.

- Detailed results:The calculator should provide you with detailed results, such as the future value of your annuity, the annuity payment amount, and the present value.

- Educational resources:The calculator should provide you with educational resources on annuities, such as articles, videos, and FAQs.

Recommendations

The best annuity calculator for you will depend on your individual needs and preferences. If you are looking for a comprehensive and user-friendly calculator, Bankrate is a good option. If you prefer a simple and easy-to-use calculator, Investopedia is a good choice.

And if you want a calculator that allows you to compare different annuity products side-by-side, NerdWallet is a good option.

Annuities and Retirement Planning

Annuities can play an important role in retirement planning. They can provide a guaranteed income stream, protect against longevity risk, and help you achieve your financial goals.

Guaranteed Income Streams

Annuities can provide a guaranteed income stream for life, which can be a valuable source of income during retirement. This can help you cover your essential expenses, such as housing, food, and healthcare.

The “712” in annuity terminology often refers to a specific type of annuity. This article on Annuity 712 2024 delves into the details of this particular annuity type and its characteristics.

Longevity Risk Protection

Annuities can help protect against longevity risk, which is the risk that you will outlive your savings. They can provide a stream of income for as long as you live, even if you live longer than expected.

Retirement Savings Options

Annuities are not the only retirement savings option available. Other popular options include 401(k)s and IRAs.

- 401(k)s:These are employer-sponsored retirement savings plans that allow you to contribute pre-tax dollars to an account that grows tax-deferred.

- IRAs:These are individual retirement accounts that allow you to contribute after-tax dollars to an account that grows tax-deferred.

The best retirement savings option for you will depend on your individual circumstances and financial goals.

Tax Implications of Annuities: Annuity Calculator Usa 2024

The tax implications of annuities can be complex, and it is important to understand them before investing in an annuity.

Figuring out how much of your annuity income is taxable can be a bit tricky, especially with all the changing rules. Luckily, there are resources available to help you navigate this process. Check out this article on Calculating Taxable Annuity Income 2024 to learn more about the tax implications of your annuity.

Taxation of Annuity Payouts

Annuity payouts are typically taxed as ordinary income. However, there are some exceptions to this rule. For example, if you have a qualified annuity, your payouts may be taxed at a lower rate.

An annuity can be seen as the opposite of a loan, where you receive regular payments instead of making them. This article on An Annuity Is Sometimes Called The Flip Side Of 2024 explores this concept and its implications.

Qualified vs. Non-Qualified Annuities

A qualified annuity is an annuity that is purchased with pre-tax dollars, such as contributions to a 401(k) or IRA. The payouts from a qualified annuity are taxed as ordinary income.

Understanding the present value of an annuity is crucial for making sound financial decisions. This guide on Pv Annuity Of 1 Table 2024 provides a table and explanations to help you calculate the present value of your annuity.

A non-qualified annuity is an annuity that is purchased with after-tax dollars. The payouts from a non-qualified annuity are taxed as ordinary income, but the portion of the payout that represents your original investment is tax-free.

Dreaming of a million-dollar annuity? While it might seem like a distant goal, it’s not impossible. This article on Annuity 1 Million 2024 provides insights into building a substantial annuity portfolio and achieving financial security.

Tax Advantages and Disadvantages

Annuities can offer some tax advantages, such as tax deferral on the growth of your investment and tax-free withdrawals of your original investment. However, there are also some potential tax disadvantages, such as the taxation of annuity payouts as ordinary income.

Risks Associated with Annuities

Annuities are not without risks. It is important to understand these risks before investing in an annuity.

Potential Risks

- Surrender charges:Some annuities have surrender charges, which are fees that you have to pay if you withdraw your money before a certain period of time.

- Market volatility:Variable annuities are subject to market volatility, which means that the value of your investment can fluctuate.

- Inflation:Inflation can erode the purchasing power of your annuity payments.

Impact on Annuity Value

These risks can impact the value of your annuity. For example, if you withdraw your money from an annuity before the surrender charge period has expired, you may have to pay a substantial fee. And if the market declines, the value of your variable annuity may decrease.

Strategies for Mitigating Risks

There are a number of strategies you can use to mitigate the risks associated with annuities. These strategies include:

- Choosing a fixed annuity:Fixed annuities offer a guaranteed rate of return, which can help protect your principal from losses.

- Investing in a diversified portfolio:If you choose a variable annuity, it is important to invest in a diversified portfolio of investments to reduce your risk.

- Considering an indexed annuity:Indexed annuities offer the potential for growth, but they also have a guaranteed minimum return, which can help protect your principal from losses.

Final Thoughts

With careful planning and the right tools, annuities can play a significant role in securing your financial well-being during retirement. Annuity calculators can help you navigate the complexities of these financial products, allowing you to make informed decisions about your retirement planning.

Remember, it’s crucial to consult with a financial advisor to tailor your retirement strategy and ensure your chosen annuity aligns with your specific goals and risk tolerance.

Clarifying Questions

What are the key factors to consider when using an annuity calculator?

Factors like your age, investment amount, interest rate expectations, and desired payout period significantly influence the results. Additionally, consider your risk tolerance, time horizon, and whether you prefer fixed or variable annuities.

Can I use an annuity calculator to compare different annuity providers?

While annuity calculators can provide insights into the potential returns of various annuity products, it’s crucial to remember that they don’t necessarily reflect the specific terms and conditions of each provider. Comparing multiple providers and their offerings is essential before making a decision.

Annuity rules can be confusing, particularly when it comes to the age at which you can start withdrawing funds without penalty. The Annuity 59 1/2 Rule 2024 outlines the specific regulations surrounding early withdrawals. Understanding these rules is essential to avoid unnecessary penalties.

Are annuity calculators always accurate?

Annuity calculators are valuable tools, but they rely on assumptions and estimations. It’s essential to understand that the results are projections and may not always accurately reflect real-world outcomes. Consulting with a financial advisor is crucial for personalized guidance and to factor in individual circumstances.