Annuity Calculator Vanguard 2024 is a powerful tool that can help you plan for a secure and comfortable retirement. Whether you’re just starting to think about retirement or are already nearing retirement age, this calculator can provide valuable insights into how annuities can fit into your financial strategy.

The Federal Employees Retirement System (FERS) offers a variety of annuity options for federal employees. Calculate Annuity Fers 2024 can help you understand the different annuity options available to you and how to calculate your annuity payments.

Vanguard, a leading investment firm, offers a variety of annuity products designed to meet different needs and risk tolerances. Their online calculator simplifies the process of exploring these options by allowing you to input your personal information and financial goals to receive personalized projections.

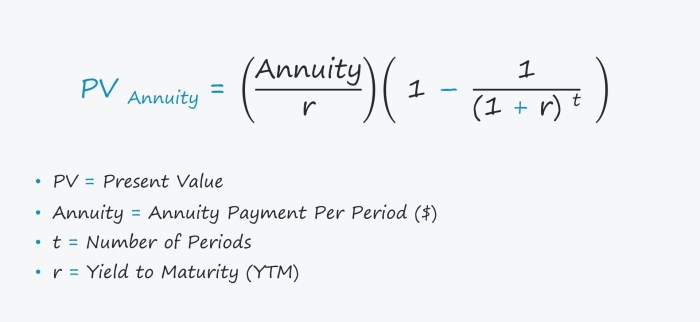

There are various formulas used to calculate the present value or future value of an annuity. Formula For Calculating The Annuity 2024 can help you understand the different formulas and how to use them to calculate the value of an annuity.

Contents List

Understanding Annuities

Annuities are financial products that provide a stream of regular payments for a specified period, often used for retirement income. Vanguard, a well-known investment firm, offers a range of annuity options to meet different financial needs.

A joint and survivor annuity is a type of annuity that provides payments to two individuals, and continues to pay to the surviving individual after the first one passes away. Annuity Joint And Survivor 2024 is a common choice for couples who want to ensure that both of them have a guaranteed income stream throughout their lives.

Types of Annuities Offered by Vanguard

Vanguard offers various annuity types, each with unique features and benefits:

- Fixed Annuities:These provide guaranteed interest rates and predictable payments. They are suitable for those seeking stability and risk aversion.

- Variable Annuities:These link payments to the performance of underlying investment accounts. They offer potential for higher returns but also carry greater risk.

- Indexed Annuities:These link payments to the performance of a specific index, such as the S&P 500. They offer potential for growth with some downside protection.

Benefits and Drawbacks of Investing in an Annuity

Annuities offer advantages and disadvantages to consider:

Benefits:

- Guaranteed Income:Fixed annuities provide predictable payments, offering peace of mind for retirement income.

- Potential for Growth:Variable and indexed annuities offer the potential for higher returns than fixed annuities.

- Tax Advantages:Annuity payments may be tax-deferred, allowing for tax-efficient growth.

- Protection Against Market Volatility:Fixed and indexed annuities offer some protection against market downturns.

Drawbacks:

- Limited Liquidity:Annuities can be difficult to access funds from, especially in the early years.

- Fees and Expenses:Annuities typically come with fees and expenses that can impact returns.

- Potential for Loss:Variable annuities carry investment risk, and there is a potential for loss of principal.

- Complexity:Annuities can be complex financial products, requiring careful consideration and understanding.

How Annuities Work

Annuities involve two phases: the accumulation phase and the payout phase:

- Accumulation Phase:During this phase, you contribute money to the annuity contract. The contributions grow tax-deferred, potentially earning interest or investment returns.

- Payout Phase:Once you reach retirement or a specified age, you begin receiving regular payments from the annuity. The payments can be structured in various ways, such as a fixed amount, a variable amount, or a combination of both.

Using the Vanguard Annuity Calculator

The Vanguard Annuity Calculator is a valuable tool for estimating potential annuity payments and understanding how different factors can impact your income.

The BA II Plus is a financial calculator that can be used to calculate annuity payments. Calculate Annuity Payments Ba Ii Plus 2024 can help you determine the amount of your annuity payments based on various factors such as the present value, the interest rate, and the number of payments.

Features and Functionalities, Annuity Calculator Vanguard 2024

The calculator allows you to input various parameters, including:

- Age:Your current age and desired retirement age.

- Desired Income:The amount of income you want to receive from the annuity.

- Investment Goals:Your financial goals, such as retirement planning, income generation, or legacy planning.

- Risk Tolerance:Your comfort level with investment risk.

- Annuity Type:The type of annuity you are considering, such as fixed, variable, or indexed.

Inputting Data

To use the calculator, you will need to provide accurate information about your personal circumstances and financial goals. This includes:

- Current Age:Your current age in years.

- Desired Retirement Age:The age at which you plan to start receiving annuity payments.

- Desired Income:The amount of income you want to receive from the annuity each year.

- Investment Goals:Your specific financial objectives, such as covering living expenses, funding travel, or leaving a legacy.

- Risk Tolerance:Your comfort level with investment risk.

Interpreting Results

The calculator will provide estimated annuity payments based on your inputs. The results can help you understand:

- Potential Income:The amount of income you could receive from the annuity.

- Duration of Payments:The length of time you would receive annuity payments.

- Impact of Different Factors:How different factors, such as your age, desired income, and investment goals, can affect your annuity payments.

Annuity Options and Considerations

Vanguard offers a range of annuity options, each with its own features and benefits. When choosing an annuity, it is crucial to consider your individual circumstances, financial goals, and risk tolerance.

John Hancock is a financial services company that offers a variety of annuity products. Annuity John Hancock 2024 can help you find the right annuity product to meet your individual needs and goals.

Comparing and Contrasting Annuity Options

Here’s a comparison of different annuity options:

| Annuity Type | Features | Benefits | Drawbacks |

|---|---|---|---|

| Fixed Annuities | Guaranteed interest rates, predictable payments. | Stability, guaranteed income. | Limited growth potential, lower returns. |

| Variable Annuities | Payments linked to underlying investment accounts, potential for higher returns. | Potential for growth, flexibility. | Investment risk, potential for loss of principal. |

| Indexed Annuities | Payments linked to a specific index, potential for growth with some downside protection. | Potential for growth, some protection against market downturns. | Limited growth potential, complex features. |

Factors to Consider When Choosing an Annuity

Several factors influence the best annuity choice for your needs:

- Risk Tolerance:Your comfort level with investment risk.

- Time Horizon:The length of time you need the annuity to provide income.

- Financial Goals:Your specific financial objectives, such as retirement planning, income generation, or legacy planning.

- Tax Situation:Your current and anticipated tax bracket.

- Fees and Expenses:The costs associated with the annuity.

Examples of Annuity Use Cases

Annuities can be used for various purposes, including:

- Retirement Planning:Provide a steady stream of income during retirement.

- Income Generation:Supplement other sources of income.

- Legacy Planning:Leave a financial inheritance to loved ones.

Annuity Fees and Expenses

Annuities come with fees and expenses that can impact the overall return on your investment. Understanding these costs is essential for making informed decisions.

Annuity due is a type of annuity where payments are made at the beginning of each period. Calculate Annuity Due Present Value 2024 can help you understand the present value of such an annuity, which is slightly different from a regular annuity.

Fees Associated with Vanguard Annuities

Vanguard annuities typically involve the following fees:

- Mortality and Expense Risk Charges:These charges cover the insurance risk associated with the annuity.

- Administrative Fees:Fees for managing the annuity contract.

- Investment Fees:Fees associated with the underlying investment accounts in variable annuities.

- Surrender Charges:Penalties for withdrawing funds from the annuity before a certain period.

Impact of Fees on Returns

Fees can significantly reduce the overall return on an annuity investment. It’s important to consider how fees will impact your potential income and growth over time.

Omni Calculator is a website that offers a variety of calculators, including one for annuities. Omni Calculator Annuity 2024 allows you to input various factors such as the amount of the annuity, the interest rate, and the number of payments to calculate the present value or future value of an annuity.

Strategies for Minimizing Annuity Fees

Here are some strategies for minimizing annuity fees:

- Compare Fees:Shop around and compare fees from different annuity providers.

- Choose Low-Cost Options:Opt for annuities with lower fees and expenses.

- Negotiate Fees:If possible, negotiate with the annuity provider to lower fees.

Tax Implications of Annuities

Annuities have tax implications that should be carefully considered. Understanding how annuity payments are taxed can help you minimize your tax liability.

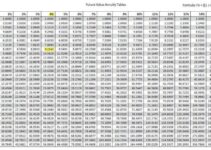

If you’re looking for a way to calculate the present value of an annuity, you can find a table for 2024 that lists the present value of an annuity of 1 at various interest rates and time periods. Pv Annuity Of 1 Table 2024 can help you determine the current value of a stream of future payments.

Tax Treatment of Annuity Payments

Annuity payments are generally taxed as ordinary income. This means that the payments are subject to your marginal tax rate.

An annuity is a type of retirement savings plan that provides guaranteed income payments, while an IRA is a tax-advantaged savings account that can be used for retirement. Annuity V Ira 2024 can help you understand the differences between these two options and which one might be better for your individual situation.

Minimizing Tax Liability

Here are some strategies for minimizing tax liability on annuity payments:

- Tax-Deferred Growth:Contributions to an annuity grow tax-deferred, meaning you don’t pay taxes on the earnings until you start receiving payments.

- Structured Payments:Structure your annuity payments to minimize your tax liability.

- Consult with a Tax Advisor:Seek professional advice from a tax advisor to develop a tax-efficient strategy for your annuity.

Tax Differences Between Fixed and Variable Annuities

The tax treatment of fixed and variable annuities can differ. Fixed annuities are typically taxed as ordinary income, while variable annuities have more complex tax rules.

The basis of an annuity is the interest rate used to calculate the payments. Annuity Basis Is 2024 can help you understand how the interest rate affects the amount of your annuity payments.

Annuity Alternatives: Annuity Calculator Vanguard 2024

Annuities are not the only retirement savings option available. It’s essential to compare annuities with other retirement savings options to determine the best choice for your needs.

An annuity is a type of insurance product that provides a guaranteed stream of income payments. Annuity Is A Life Insurance Product That 2024 is often used for retirement planning, as it can provide a steady source of income for a set period of time or for life.

Comparison with Traditional and Roth IRAs

Traditional and Roth IRAs are popular retirement savings accounts that offer tax advantages. Here’s a comparison of annuities, traditional IRAs, and Roth IRAs:

| Option | Tax Treatment | Contributions | Withdrawals |

|---|---|---|---|

| Annuity | Tax-deferred growth, payments taxed as ordinary income. | Tax-deductible contributions. | Taxable withdrawals. |

| Traditional IRA | Tax-deductible contributions, withdrawals taxed as ordinary income. | Tax-deductible contributions. | Taxable withdrawals. |

| Roth IRA | Non-deductible contributions, tax-free withdrawals in retirement. | Non-deductible contributions. | Tax-free withdrawals. |

Pros and Cons of Each Option

Each retirement savings option has its own advantages and disadvantages:

Annuities:

- Pros:Guaranteed income, potential for growth, tax-deferred growth.

- Cons:Limited liquidity, fees and expenses, potential for loss of principal.

Traditional IRAs:

- Pros:Tax-deductible contributions, tax-deferred growth.

- Cons:Withdrawals are taxable in retirement, income limits for contributions.

Roth IRAs:

- Pros:Tax-free withdrawals in retirement, no income limits for contributions.

- Cons:Contributions are not tax-deductible, may be less beneficial for those in lower tax brackets.

Suitable Situations for Annuities

Annuities can be a suitable choice for individuals who:

- Seek guaranteed income:Fixed annuities provide predictable payments.

- Want to protect against market volatility:Fixed and indexed annuities offer some protection against market downturns.

- Have a long time horizon:Annuities are suitable for long-term financial planning.

Situations Where Other Options Might Be More Appropriate

Other retirement savings options might be more appropriate for individuals who:

- Prefer greater flexibility:IRAs offer more flexibility in accessing funds.

- Have a short time horizon:Annuities may not be suitable for short-term savings goals.

- Are in a lower tax bracket:Roth IRAs may be more beneficial for those in lower tax brackets.

Summary

Using the Annuity Calculator Vanguard 2024 is a great first step in understanding how annuities can play a role in your retirement planning. However, remember that this tool is just a starting point. It’s crucial to consult with a financial advisor who can provide personalized guidance based on your specific circumstances and goals.

Query Resolution

Is the Vanguard Annuity Calculator free to use?

Yes, the Vanguard Annuity Calculator is completely free to use.

Do I need to have a Vanguard account to use the calculator?

No, you don’t need a Vanguard account to use the calculator. It’s available to anyone who wants to explore annuity options.

What happens to my annuity if I pass away?

The specific details of what happens to your annuity upon your death depend on the type of annuity you have and any beneficiary designations you’ve made. It’s important to review the terms of your annuity contract to understand the rules and options.

Can I withdraw money from my annuity before retirement?

It depends on the specific type of annuity you have. Some annuities allow for withdrawals before retirement, but there may be penalties or restrictions. It’s essential to understand the withdrawal rules before making any decisions.

When you withdraw money from an annuity, you may have to pay taxes on the withdrawals. Annuity Withdrawal Tax Calculator 2024 can help you determine how much tax you may have to pay on your annuity withdrawals.

The HP 10bii is a financial calculator that can be used to calculate annuity payments. Calculate Annuity On Hp10bii 2024 can help you understand how to use the calculator to calculate the amount of your annuity payments.

An annuity can be a good option for retirement planning, but it’s not right for everyone. Is Annuity Right For Me 2024 can help you determine if an annuity is the right choice for you.

While both annuities and life insurance are financial products, they serve different purposes. Is Annuity The Same As Life Insurance 2024 can help you understand the key differences between these two products.