Annuity Calculator Visual Basic 2024 provides a comprehensive guide to developing powerful financial tools using the latest Visual Basic capabilities. This guide delves into the intricacies of annuity calculations, exploring the fundamental concepts and techniques necessary to create user-friendly and efficient applications.

If you’re looking to understand the mechanics of annuities, learning how to calculate them is essential. How Calculate Annuity 2024 offers a step-by-step guide on how to do this.

From understanding the core components of annuity calculations to mastering the art of Visual Basic programming, this guide equips you with the knowledge and skills to design and implement robust annuity calculators. You’ll learn how to leverage the power of Visual Basic 2024 to create intuitive user interfaces, implement complex financial algorithms, and enhance your calculator’s functionality with features like data validation, error handling, and graphical representations.

Whether you’re a seasoned developer or a curious beginner, this guide provides a solid foundation for building your own personalized annuity calculator.

Contents List

- 1 Introduction to Annuity Calculators

- 2 Visual Basic 2024 for Annuity Calculator Development

- 3 Designing the User Interface

- 4 Implementing the Annuity Calculation Logic: Annuity Calculator Visual Basic 2024

- 5 Enhancing the Calculator Functionality

- 6 Testing and Deployment

- 7 Final Thoughts

- 8 Commonly Asked Questions

Introduction to Annuity Calculators

An annuity calculator is a valuable tool for individuals planning for their financial future. It helps estimate the present value, future value, or payment amount of an annuity based on user-defined parameters. Annuity calculators are commonly used for retirement planning, investment analysis, and loan calculations.

Purpose and Functionality

An annuity calculator primarily determines the financial implications of a series of regular payments over a specific period. It assists users in understanding the growth of their investments, the cost of borrowing, or the amount they will receive during retirement.

By inputting relevant details like the initial investment, interest rate, payment frequency, and time horizon, the calculator provides insights into the financial outcomes of various annuity scenarios.

Determining the present value of an annuity is important for financial planning. Calculate Annuity Of Present Value 2024 provides guidance on how to calculate this value.

Key Inputs and Outputs

A typical annuity calculator requires several inputs from the user:

- Present Value (PV):The initial amount invested or borrowed.

- Future Value (FV):The estimated value of the annuity at a future point in time.

- Payment Amount (PMT):The regular payment made or received during the annuity period.

- Interest Rate (i):The annual interest rate applied to the annuity.

- Number of Periods (n):The total number of payment periods over the annuity’s duration.

Based on these inputs, the calculator provides the following outputs:

- Present Value (PV):The current value of a future stream of payments.

- Future Value (FV):The estimated value of an annuity at a future date.

- Payment Amount (PMT):The required payment amount for a given present or future value.

When it comes to annuities, there are different types, and one common type is the ordinary annuity. Annuity Is Ordinary 2024 delves into the characteristics of this type and how it functions.

Types of Annuities

Annuities come in various forms, each with its own characteristics and applications:

- Fixed Annuities:Offer a guaranteed interest rate, providing predictable income streams. These are suitable for individuals seeking stability and a known return on their investment.

- Variable Annuities:Link interest rates to the performance of underlying investments, potentially offering higher returns but also carrying greater risk. These are suitable for investors with a higher risk tolerance and a longer investment horizon.

- Immediate Annuities:Begin making payments immediately after the initial investment. They are often used for retirement income or to provide a steady stream of cash flow.

- Deferred Annuities:Start making payments at a later date, typically after a specific period. These are suitable for individuals planning for future financial needs, such as retirement or college expenses.

Visual Basic 2024 for Annuity Calculator Development

Visual Basic 2024 provides a robust and user-friendly platform for developing annuity calculators. Its intuitive interface, comprehensive libraries, and object-oriented programming capabilities make it an ideal choice for building sophisticated financial applications.

To determine the future value of an annuity with monthly compounding, Calculating Annuity Future Value Compounded Monthly 2024 provides the necessary calculations and guidance.

Advantages of Visual Basic 2024

- Ease of Use:Visual Basic’s drag-and-drop interface and intuitive syntax make it easy for developers to create user-friendly applications.

- Comprehensive Libraries:Visual Basic offers a wide range of built-in functions and libraries, including mathematical, financial, and data handling tools, simplifying the development process.

- Object-Oriented Programming:Visual Basic supports object-oriented programming principles, enabling developers to create modular and reusable code, improving efficiency and maintainability.

- Strong Community Support:Visual Basic has a large and active community of developers, providing access to resources, tutorials, and support forums.

Annuities can sometimes come with penalties for early withdrawal. Annuity 10 Penalty 2024 explains the potential 10% penalty and how it applies.

Essential Visual Basic Concepts and Tools

To develop an annuity calculator using Visual Basic 2024, developers need to understand key concepts and tools:

- Variables:Used to store data values, such as user inputs or calculated results.

- Data Types:Specify the type of data a variable can hold, such as integers, decimals, or strings.

- Controls:Visual elements used to interact with the user, including text boxes, buttons, and labels.

- Events:Actions triggered by user interactions, such as button clicks or text box changes.

- Form:The main window of the application, containing all the controls and logic.

Creating a Basic Visual Basic Application, Annuity Calculator Visual Basic 2024

Building a simple annuity calculator in Visual Basic involves the following steps:

- Create a New Project:Start a new Visual Basic project in Visual Studio 2024.

- Design the User Interface:Add necessary controls, such as text boxes for input, buttons for calculations, and labels for displaying results.

- Write the Code:Implement the logic for calculating the annuity based on user inputs. This includes defining variables, handling events, and performing calculations using appropriate formulas.

- Test and Debug:Thoroughly test the application with different inputs and scenarios to ensure accuracy and functionality.

- Deploy the Application:Package the application for distribution to users, ensuring it runs smoothly on their systems.

Designing the User Interface

A well-designed user interface is crucial for a user-friendly annuity calculator. The layout should be intuitive, clear, and easy to navigate.

When considering annuity providers, it’s essential to ensure their legitimacy. Is Annuity Gator Legit 2024 explores the legitimacy of Annuity Gator as a provider.

Wireframe or Mockup

The user interface can be sketched out using a wireframe or mockup. This visual representation helps in planning the layout of input fields, buttons, and output displays.

- Input Fields:Text boxes for entering values like present value, future value, payment amount, interest rate, and number of periods.

- Buttons:A button labeled “Calculate” to trigger the calculation process.

- Output Displays:Labels or text boxes to display the calculated results, such as present value, future value, or payment amount.

Layout and Organization

The layout should be organized logically, grouping related elements together. Input fields should be placed in a clear and accessible manner, while output displays should be easily identifiable.

For those who prefer using spreadsheets, Calculate Annuity Rate In Excel 2024 provides guidance on how to calculate annuity rates within Excel.

- Input Section:Group all input fields together, providing clear labels for each field.

- Calculation Button:Place the “Calculate” button prominently for easy access.

- Output Section:Display calculated results in a separate section, using clear labels to indicate the corresponding values.

Understanding what an annuity statement entails is crucial for financial planning. Annuity Statement Is 2024 explains the key elements of this document and what it represents.

User-Friendliness

The user interface should be designed to be intuitive and user-friendly:

- Clear Instructions:Provide brief instructions or tooltips for each input field to guide users on entering correct data.

- Visual Cues:Use color, font size, and spacing to highlight important elements and make the interface visually appealing.

- Error Handling:Implement error handling mechanisms to prevent invalid inputs and provide helpful error messages.

Implementing the Annuity Calculation Logic: Annuity Calculator Visual Basic 2024

The heart of the annuity calculator lies in its calculation logic. This section focuses on developing the Visual Basic code to perform the annuity calculations based on user inputs.

Understanding the concept of compound annuity can be a great starting point for planning your financial future. Compound Annuity Uses The Principles Of 2024 provides an in-depth look at how this works and how you can leverage it for your benefit.

Formulas and Algorithms

The calculation logic involves using standard annuity formulas and algorithms:

- Present Value (PV):

PV = PMT- [1 – (1 + i)^-n] / i

- Future Value (FV):

FV = PV- (1 + i)^n

For those who prefer using financial calculators, Calculate Annuity With Ba Ii Plus 2024 provides a guide on how to calculate annuities using the BA II Plus calculator.

- Payment Amount (PMT):

PMT = PV- i / [1 – (1 + i)^-n]

Handling Different Scenarios

The code should handle different annuity scenarios, such as:

- Ordinary Annuities:Payments made at the end of each period.

- Annuity Due:Payments made at the beginning of each period.

- Perpetuities:Annuities that continue indefinitely.

Ensuring Accuracy

It is crucial to test the code thoroughly to ensure accurate calculations:

- Unit Testing:Test individual functions and modules to verify their correctness.

- Integration Testing:Test the entire application to ensure that all components work together as expected.

Calculating the payout from an annuity is a crucial step in understanding its value. Calculating Annuity Payout 2024 provides insights into how to determine this payout.

Enhancing the Calculator Functionality

To make the annuity calculator more comprehensive and user-friendly, additional features can be implemented.

For those who prefer using financial calculators, Calculate Annuity On Hp10bii 2024 provides a guide on how to calculate annuities using the HP10bii calculator.

Tax Considerations

Incorporate features to account for tax implications on annuity payments:

- Tax Rate:Allow users to input their tax rate to calculate the after-tax income from the annuity.

- Taxable Interest:Calculate the taxable portion of the annuity interest payments.

To understand the calculations involved in annuities, it’s important to be familiar with the formula. Annuity Formula Quarterly 2024 breaks down the formula and provides examples to help you understand the process.

Inflation Adjustment

Consider the impact of inflation on the value of the annuity over time:

- Inflation Rate:Allow users to input an inflation rate to adjust the future value of the annuity.

- Real Rate of Return:Calculate the real rate of return after accounting for inflation.

Investment Growth

Enable the calculator to account for investment growth beyond the initial investment:

- Investment Growth Rate:Allow users to input an investment growth rate to simulate the growth of their investment over time.

- Projected Future Value:Calculate the projected future value of the annuity based on the investment growth rate.

Data Validation and Error Handling

Implement robust data validation and error handling mechanisms:

- Input Validation:Ensure that users enter valid data types and ranges for each input field.

- Error Messages:Provide clear and informative error messages if invalid data is entered.

Understanding how annuities work with specific amounts is essential. Annuity 300k 2024 explores the implications of having a $300,000 annuity.

Visual Aids

Enhance the calculator’s functionality by incorporating visual aids:

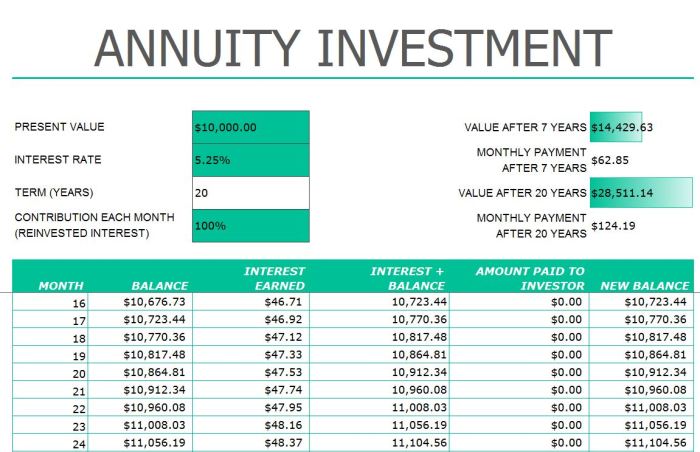

- Charts and Graphs:Display the growth of the annuity over time using charts or graphs.

- Tables:Present the annuity payments and balances in a tabular format for easy visualization.

The 5-year rule is a common consideration when dealing with annuities. Annuity 5 Year Rule 2024 delves into this rule and its implications for annuity holders.

Testing and Deployment

Testing and deployment are crucial steps in ensuring the quality and usability of the annuity calculator.

Testing Process

A thorough testing process is essential to identify and fix any errors or bugs:

- Unit Testing:Test individual functions and modules to verify their correctness.

- Integration Testing:Test the entire application to ensure that all components work together as expected.

- User Acceptance Testing (UAT):Have potential users test the application to ensure it meets their needs and expectations.

Deployment Steps

Deploying the calculator to users involves the following steps:

- Build the Application:Create a distributable package of the application.

- Install the Application:Install the application on user machines or publish it online.

- Configure Settings:Configure any necessary settings, such as database connections or user permissions.

- Provide User Support:Offer documentation, tutorials, or support channels to assist users.

Maintenance and Updates

Ongoing maintenance and updates are essential to keep the calculator functioning correctly and up-to-date:

- Bug Fixes:Address any reported bugs or issues promptly.

- Feature Enhancements:Add new features or improvements based on user feedback.

- Security Updates:Implement security patches to protect against vulnerabilities.

- Version Control:Maintain a version control system to track changes and facilitate updates.

Final Thoughts

By following the steps Artikeld in this guide, you’ll gain the confidence and expertise to develop sophisticated annuity calculators that can empower individuals and organizations to make informed financial decisions. Whether you’re assisting clients with retirement planning, helping businesses analyze investment options, or simply seeking a deeper understanding of annuity concepts, this guide provides the tools and knowledge you need to succeed.

Commonly Asked Questions

What are the main advantages of using Visual Basic 2024 for annuity calculator development?

Visual Basic 2024 offers a user-friendly environment for rapid application development, making it an ideal choice for building annuity calculators. Its intuitive interface, robust libraries, and extensive support for financial calculations streamline the development process.

Can I create a visually appealing user interface for my annuity calculator?

Absolutely! Visual Basic 2024 provides a wide range of controls and design elements to create visually appealing and user-friendly interfaces. You can customize colors, fonts, and layouts to create an engaging experience for your users.

How can I handle errors and ensure accurate calculations in my annuity calculator?

Visual Basic 2024 offers built-in error handling mechanisms and data validation techniques to ensure the accuracy and reliability of your calculator. You can implement checks for invalid inputs, handle potential exceptions, and validate calculations to guarantee robust results.