Annuity Calculator Xls 2024 offers a powerful tool for individuals looking to plan their retirement effectively. This guide will explore the concept of annuities, delve into the functionalities of annuity calculators, and guide you through creating your own in Excel.

Annuity loans can be a useful tool for financing various needs. Learn how to calculate annuity loans in 2024 at Calculate Annuity Loan 2024.

Whether you’re seeking a comprehensive understanding of annuities or a practical approach to calculating your retirement income, this resource will equip you with the knowledge and tools to make informed financial decisions.

It’s essential to understand the tax implications of annuities. Learn more about whether annuities are taxable in 2024 at Annuity Is Taxable 2024.

By understanding the different types of annuities, their advantages and disadvantages, and the key inputs required for calculations, you can gain valuable insights into your retirement planning. Annuity calculators provide a clear picture of potential future income streams and help you assess the long-term impact of your financial choices.

Planning for your future retirement income? An annuity calculator can help you estimate your potential payouts. Check out the latest quarterly annuity calculator for 2024 at Annuity Calculator Quarterly 2024.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a specified period. It’s a popular retirement planning tool that can provide a steady income stream in your later years. Annuities come in different forms, each with its own set of features and benefits.

Annuity payments can be compounded monthly. Learn how to calculate the future value of an annuity compounded monthly in 2024 at Calculating Annuity Future Value Compounded Monthly 2024.

Types of Annuities

The most common types of annuities include:

- Fixed Annuities:These annuities offer a guaranteed rate of return, providing predictable income payments. The interest rate is fixed for the duration of the contract, making them a good option for those seeking stability and certainty.

- Variable Annuities:These annuities offer the potential for higher returns, but they also come with greater risk. The interest rate is linked to the performance of underlying investments, which can fluctuate over time. They are suitable for those with a higher risk tolerance and a longer investment horizon.

X-share annuities are a type of annuity with unique features. Learn more about X-share annuities in 2024 at X Share Annuity 2024.

- Immediate Annuities:These annuities begin paying out immediately after purchase. They are ideal for individuals who need income right away, such as retirees or those with immediate financial needs.

- Deferred Annuities:These annuities start paying out at a later date, allowing you to accumulate wealth over time. They are beneficial for individuals who want to delay income payments, such as those planning for retirement several years in the future.

Advantages and Disadvantages of Annuities

Annuities can offer several advantages, but it’s crucial to understand their potential drawbacks as well:

Advantages

- Guaranteed Income Stream:Fixed annuities provide a guaranteed income stream for life, ensuring a steady source of income in retirement.

- Tax-Deferred Growth:The earnings within an annuity grow tax-deferred, meaning you don’t have to pay taxes on the interest until you start receiving payments.

- Protection Against Market Volatility:Fixed annuities offer protection against market downturns, as their value is not tied to the performance of investments.

Disadvantages

- Limited Liquidity:Annuities can have restrictions on withdrawals, making it difficult to access your money before the payout period begins.

- High Fees:Annuities often come with high fees, which can erode your returns over time.

- Potential for Lower Returns:Fixed annuities typically offer lower returns compared to other investment options, such as stocks or bonds.

Real-World Scenarios

Here are some real-world scenarios where an annuity could be beneficial:

- Retirement Planning:Annuities can provide a steady income stream in retirement, ensuring you have enough money to cover your living expenses.

- Long-Term Care:Annuities can help cover the costs of long-term care, which can be expensive, especially if you require extensive medical assistance.

- Estate Planning:Annuities can be used to create a legacy for your heirs, providing them with a guaranteed income stream after your death.

Using an Annuity Calculator: Annuity Calculator Xls 2024

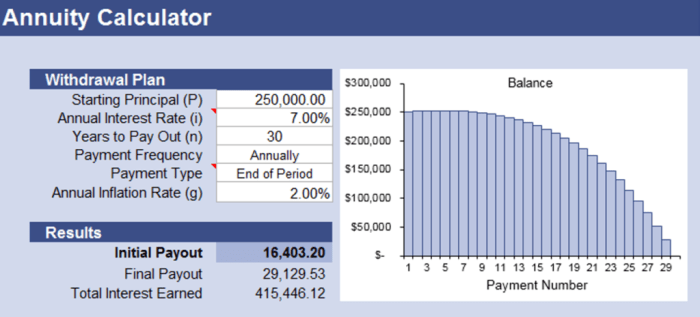

An annuity calculator is a valuable tool that can help you estimate future annuity payments and understand the potential growth of your investment. It simplifies the complex calculations involved in annuity planning, making it easier to make informed decisions.

If you have questions about annuity calculations, this resource can help. Find answers to common annuity calculation questions in 2024 at Annuity Calculation Questions And Answers 2024.

Purpose of an Annuity Calculator

An annuity calculator allows you to input key variables, such as the initial investment amount, interest rate, and payment period, to determine the estimated future value of your annuity. This information can help you:

- Compare Different Annuity Options:You can use the calculator to compare different annuity products and choose the one that best suits your needs and financial goals.

- Determine the Right Annuity Amount:The calculator can help you determine the initial investment amount needed to generate the desired income stream in retirement.

- Plan for Future Expenses:You can use the calculator to estimate the future value of your annuity and plan for potential expenses, such as long-term care or medical costs.

Key Inputs for an Annuity Calculator

To use an annuity calculator effectively, you’ll need to provide the following information:

- Principal:The initial investment amount you plan to deposit into the annuity.

- Interest Rate:The annual interest rate that your annuity will earn.

- Payment Period:The length of time over which you will receive payments from the annuity.

- Payment Frequency:The frequency of payments, such as monthly, quarterly, or annually.

- Growth Rate:The expected rate of growth for your annuity, which can vary depending on the type of annuity and the underlying investments.

Using an Annuity Calculator for Estimation

To use an annuity calculator, simply enter the required information into the designated fields. The calculator will then provide you with estimates of:

- Future Annuity Payments:The amount of money you can expect to receive each payment period.

- Projected Growth:The estimated growth of your annuity over time, taking into account interest rates and compounding.

- Total Payout:The total amount of money you will receive from the annuity over the entire payment period.

Excel Annuity Calculators

Excel spreadsheets offer a powerful and versatile platform for creating custom annuity calculators. You can use Excel’s built-in functions and formulas to perform complex calculations and visualize your annuity projections.

Want to understand how annuities work? This resource explains the basics of annuities in 2024: Annuity How It Works 2024.

Benefits of Excel Annuity Calculators, Annuity Calculator Xls 2024

Using Excel for annuity calculations provides several advantages:

- Customization:You can tailor the calculator to your specific needs and preferences, adding features like variable interest rates, multiple payment options, or custom growth scenarios.

- Flexibility:Excel allows you to easily adjust inputs and see how changes affect the results, making it a valuable tool for exploring different annuity scenarios.

- Data Visualization:You can use Excel’s charting and graphing capabilities to visualize your annuity projections and understand the long-term growth potential of your investment.

Creating a Basic Annuity Calculator in Excel

Here’s a step-by-step guide to creating a basic annuity calculator in Excel:

- Set Up the Spreadsheet:Create a new Excel spreadsheet and label the columns for the following inputs: Principal, Interest Rate, Payment Period, Payment Frequency, and Growth Rate.

- Enter the Inputs:Enter the desired values for each input in the corresponding cells.

- Calculate Future Value:Use the FV function in Excel to calculate the future value of your annuity. The formula for FV is: =FV(rate, nper, pmt, pv, type).

- rate:The interest rate per period.

- nper:The total number of payment periods.

- pmt:The payment made each period (optional, set to 0 for annuity calculations).

- pv:The present value of the annuity (principal).

- type:0 for payments at the end of the period, 1 for payments at the beginning of the period (optional, set to 0 for annuity calculations).

- Calculate Payments:Use the PMT function in Excel to calculate the periodic payments you will receive from the annuity. The formula for PMT is: =PMT(rate, nper, pv, fv, type).

- rate:The interest rate per period.

- nper:The total number of payment periods.

- pv:The present value of the annuity (principal).

- fv:The future value of the annuity (optional, set to 0 for annuity calculations).

- type:0 for payments at the end of the period, 1 for payments at the beginning of the period (optional, set to 0 for annuity calculations).

- Format the Output:Format the cells containing the calculated values to display the results in a clear and readable manner.

Advanced Excel Annuity Calculator Templates

You can find various advanced Excel annuity calculator templates online that offer additional features, such as:

- Variable Interest Rates:Templates that allow you to adjust the interest rate over time, reflecting changes in market conditions.

- Multiple Payment Options:Templates that enable you to calculate annuity payments for different payment frequencies, such as monthly, quarterly, or annually.

- Inflation Adjustment:Templates that adjust the annuity payments for inflation, ensuring that your income keeps pace with rising prices.

Finding Annuity Calculators Online

Numerous websites offer free online annuity calculators that can help you estimate your future annuity payments and understand the potential growth of your investment.

Calculating the amount of your annuity payments can be a bit complex. This resource can help you calculate your annuity amount in 2024: Calculate Annuity Amount 2024.

Popular Websites for Annuity Calculators

Here are some popular websites that provide free online annuity calculators:

- Bankrate:Bankrate offers a comprehensive annuity calculator that allows you to compare different annuity products and adjust key inputs to see how they affect your results.

- NerdWallet:NerdWallet provides a user-friendly annuity calculator that simplifies the process of estimating future payments and projected growth.

- Investopedia:Investopedia offers a variety of financial calculators, including an annuity calculator that allows you to explore different annuity scenarios and understand the potential benefits and risks.

Comparing Online Annuity Calculators

When choosing an online annuity calculator, consider the following factors:

- Features and Functionality:Look for a calculator that offers the features and functionality you need, such as the ability to adjust interest rates, payment frequencies, and growth rates.

- Ease of Use:Choose a calculator with a user-friendly interface that is easy to navigate and understand.

- Accuracy and Reliability:Ensure that the calculator uses accurate formulas and provides reliable results.

- Data Security:If the calculator requires you to enter personal information, ensure that the website has appropriate security measures in place to protect your data.

Factors to Consider When Choosing an Online Calculator

When selecting an online annuity calculator, consider these factors:

- Type of Annuity:Choose a calculator that supports the type of annuity you are interested in, such as fixed, variable, immediate, or deferred.

- Investment Options:Consider whether the calculator allows you to adjust the underlying investments for variable annuities or factor in different investment strategies.

- Customization Options:Look for a calculator that offers customization options, such as the ability to adjust payment frequencies, growth rates, or inflation adjustments.

Annuity Calculator in 2024

The annuity market is constantly evolving, influenced by factors such as interest rate changes, investment options, and regulatory updates. These factors can impact annuity calculations and affect the outcomes of your investment.

A deferred annuity offers income payments in the future. Find out how to calculate a deferred annuity in 2024 at Calculating A Deferred Annuity 2024.

Market Trends and Factors Influencing Annuity Calculations

Here are some key market trends and factors that could influence annuity calculations in 2024:

- Interest Rate Fluctuations:Interest rates are expected to remain volatile in 2024, potentially impacting the returns on fixed annuities. Higher interest rates could lead to higher annuity payouts, while lower rates could result in lower payouts.

- Investment Market Performance:The performance of the stock and bond markets will influence the returns on variable annuities. A strong market could lead to higher growth rates, while a weak market could result in lower returns.

- Regulatory Changes:Regulatory changes, such as those related to insurance or retirement planning, could impact the availability and features of annuity products. It’s important to stay informed about any updates to regulations that might affect your annuity choices.

Potential Changes in Interest Rates, Investment Options, and Regulations

Here are some potential changes that could affect annuity outcomes in 2024:

- Interest Rate Hikes:The Federal Reserve might continue to raise interest rates in 2024 to combat inflation. This could lead to higher interest rates on fixed annuities, potentially resulting in higher payouts.

- New Investment Options:New investment options, such as alternative investments or ESG-focused funds, might become available for variable annuities. This could offer investors a wider range of choices and potentially higher returns.

- Increased Transparency and Disclosure:Regulations might require greater transparency and disclosure regarding annuity fees and charges, helping consumers make more informed decisions.

Tips and Strategies for Using Annuity Calculators Effectively in the Current Economic Environment

Here are some tips and strategies for using annuity calculators effectively in the current economic environment:

- Consider Multiple Scenarios:Use the calculator to explore different interest rate scenarios, investment options, and payment frequencies to understand how they affect your annuity outcomes.

- Factor in Inflation:Consider adjusting your annuity calculations for inflation to ensure that your income keeps pace with rising prices.

- Seek Professional Advice:Consult with a financial advisor to discuss your individual needs and goals and to get personalized advice on choosing the right annuity product.

Outcome Summary

Annuity Calculator Xls 2024 empowers you to take control of your retirement planning by providing the tools and knowledge to navigate the complex world of annuities. Whether you choose to use an online calculator, create your own in Excel, or consult with a financial advisor, the insights gained from these calculations can significantly impact your financial future.

Understanding how your annuity income is taxed is crucial for tax planning. Learn how to calculate your taxable annuity income in 2024 at Calculating Taxable Annuity Income 2024.

Remember to consider your individual circumstances, risk tolerance, and long-term goals when making decisions about annuities.

Considering an annuity for retirement? It’s important to weigh the pros and cons. Read more about whether getting an annuity is worth it in 2024 at Is Getting An Annuity Worth It 2024.

Popular Questions

What is the difference between a fixed and a variable annuity?

If you’re using a financial calculator like the BA II Plus, you’ll need to know how to calculate annuity payments. Find out how to calculate annuity payments using the BA II Plus in 2024 at Calculate Annuity Payments Ba Ii Plus 2024.

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return is linked to the performance of the underlying investments. Fixed annuities offer stability, while variable annuities have the potential for higher growth but also carry more risk.

How do I choose the right annuity for my needs?

The best annuity for you depends on your individual circumstances, risk tolerance, and financial goals. Consider factors such as your age, income, and investment goals when making a decision.

Are there any tax implications for annuities?

Yes, annuities can have tax implications. The income you receive from an annuity is generally taxed as ordinary income. It’s important to consult with a tax advisor to understand the specific tax implications for your situation.

Are you considering a single life annuity? It’s important to understand the tax implications, especially for 2024. Find out more about whether a single life annuity is taxable by visiting Is A Single Life Annuity Taxable 2024.

Looking for a table to help you calculate the present value of an annuity? Find a PV annuity of 1 table for 2024 at Pv Annuity Of 1 Table 2024.

Calculating the internal rate of return (IRR) for an annuity can be helpful. Find an IRR calculator specifically for annuities in 2024 at Irr Calculator Annuity 2024.