Annuity Calculator Yearly Payment 2024: Planning for Your Future, this guide provides a comprehensive overview of annuity calculators, their uses, and how they can help you plan for a secure financial future. Whether you’re looking to supplement your retirement income or simply want to understand how annuities work, this guide will provide you with the knowledge and tools you need to make informed financial decisions.

Discover the benefits of annuity 3 in 2024 and see if it aligns with your retirement planning goals.

Annuities are financial products that provide a stream of regular payments over a set period of time. They can be a valuable tool for retirement planning, as they can provide a predictable source of income in your later years. An annuity calculator can help you determine how much you need to invest in an annuity to receive a desired level of income, and it can also help you compare different annuity options to find the best fit for your needs.

Planning to invest in an SBI annuity? Explore the SBI annuity calculator in 2024 to estimate your potential returns.

Contents List

Annuity Calculator Overview

An annuity calculator is a valuable tool for individuals seeking to understand the potential financial benefits of an annuity. It provides a comprehensive overview of annuity payments, taking into account factors such as the principal amount, interest rate, payment frequency, and term.

Understand the value of an annuity in 2024 and how it can contribute to your financial security.

Purpose of an Annuity Calculator

The primary purpose of an annuity calculator is to estimate the future value of an annuity based on the specified inputs. It helps users determine the amount of regular payments they can expect to receive over a specified period, allowing them to make informed financial decisions.

Looking to calculate the value of a growing annuity on your BA II Plus calculator? Check out our guide on calculating growing annuities on BA II Plus in 2024.

Key Features of an Annuity Calculator

Annuity calculators typically offer a range of features, including:

- Calculation of annuity payments based on different annuity types

- Flexibility in setting the principal amount, interest rate, payment frequency, and term

- Visualization of payment schedules and future annuity values

- Comparison of different annuity options to identify the most suitable choice

History of Annuity Calculators

Annuity calculators have evolved over time, initially relying on manual calculations. With the advent of computers and online platforms, sophisticated annuity calculators have become widely accessible. These calculators leverage advanced algorithms to provide accurate and detailed estimates of annuity payments.

Utilize the NerdWallet annuity calculator in 2024 to compare different annuity options and make informed decisions.

Types of Annuities

Annuities are financial products that provide a stream of regular payments over a defined period. There are several types of annuities available, each with its own characteristics and benefits.

Fixed Annuities

Fixed annuities offer guaranteed interest rates and fixed payment amounts. These annuities provide stability and predictability, making them suitable for individuals seeking a secure income stream. The interest rate is typically set at the time of purchase and remains constant throughout the annuity term.

Looking for guaranteed income for the next five years? Check out the Annuity 5 Year Guarantee 2024 and see if it’s a good fit for your financial goals.

Variable Annuities

Variable annuities offer a potential for higher returns but also carry a higher risk. The interest rate and payment amounts are linked to the performance of underlying investments, such as stocks or mutual funds. This type of annuity is suitable for individuals with a higher risk tolerance and a longer investment horizon.

Wondering about the tax implications of your annuity income? Find out more about the taxability of annuity income in 2024 and plan accordingly.

Immediate Annuities

Immediate annuities begin making payments immediately after the purchase. These annuities are ideal for individuals who need a steady income stream right away, such as retirees or those seeking to supplement their income. The payment amount is typically fixed and based on the initial principal amount and the chosen interest rate.

Deferred Annuities

Deferred annuities start making payments at a later date, often after a specific period or at a certain age. These annuities are suitable for individuals who want to save for retirement or other future financial goals. The payment amount is typically fixed and based on the initial principal amount, the interest rate, and the chosen deferral period.

Need to calculate the loan payments for an annuity? Learn about calculating annuity loans in 2024 and find the right financing option for you.

Annuity Calculator Inputs

To calculate annuity payments accurately, annuity calculators require specific inputs that reflect the characteristics of the annuity. These inputs determine the size and frequency of payments.

Need to determine the number of years for your annuity payments? Our guide on calculating annuity years in 2024 can help.

Essential Inputs for an Annuity Calculator

The essential inputs for an annuity calculator include:

- Principal Amount:The initial amount of money invested in the annuity.

- Interest Rate:The annual rate of return on the annuity. This rate can be fixed or variable depending on the annuity type.

- Payment Frequency:The frequency at which payments are made, such as monthly, quarterly, or annually.

- Term:The duration of the annuity, expressed in years or months.

Impact of Inputs on Yearly Payments

Each input significantly affects the calculated yearly payment.

Planning to invest in a Charles Schwab annuity? Use their annuity calculator in 2024 to explore your options.

| Input Variable | Impact on Yearly Payment |

|---|---|

| Higher Principal Amount | Higher Yearly Payment |

| Higher Interest Rate | Higher Yearly Payment |

| Higher Payment Frequency | Higher Yearly Payment (but spread over more payments) |

| Longer Term | Lower Yearly Payment (but spread over more payments) |

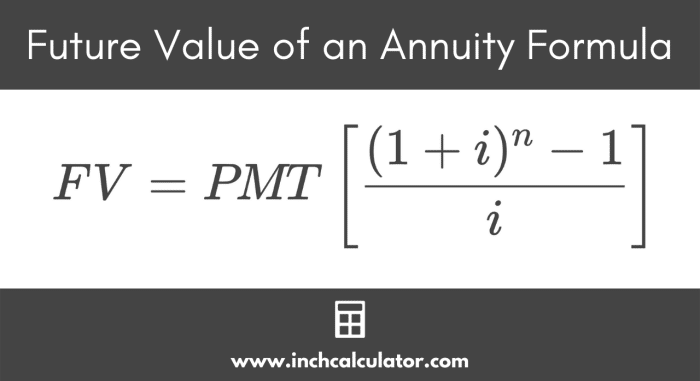

Calculating Yearly Payments

Annuity calculators use a mathematical formula to determine the yearly payments based on the provided inputs. The formula takes into account the present value of the annuity, the interest rate, and the term.

Formula for Calculating Annuity Payments

PMT = PV

Explore different annuity calculation methods in 2024 and find the best approach for your financial situation.

- (r

- (1 + r)^n) / ((1 + r)^n

- 1)

Where:

- PMT = Yearly Payment

- PV = Present Value (Principal Amount)

- r = Interest Rate (per year)

- n = Number of Years

Step-by-Step Guide to Using an Annuity Calculator

- Enter the principal amount (PV).

- Input the interest rate (r).

- Specify the payment frequency.

- Select the term (n) in years.

- Click “Calculate” to generate the yearly payment estimate.

Examples of Calculating Yearly Payments

To illustrate, consider the following scenarios:

- Scenario 1:A $100,000 annuity with a 5% annual interest rate, paid annually for 20 years, would result in a yearly payment of approximately $8,024.

- Scenario 2:A $50,000 annuity with a 3% annual interest rate, paid monthly for 10 years, would result in a monthly payment of approximately $443 and a yearly payment of approximately $5,316.

Factors Affecting Yearly Payments

Several factors can influence the amount of yearly payments received from an annuity. Understanding these factors is crucial for making informed financial decisions.

Factors Impacting Annuity Payments

Key factors affecting annuity payments include:

| Factor | Impact on Yearly Payment |

|---|---|

| Interest Rates | Higher interest rates generally lead to higher yearly payments. |

| Inflation | Inflation can erode the purchasing power of annuity payments over time. |

| Taxes | Annuities may be subject to taxes, which can reduce the net amount of payments received. |

| Fees | Fees associated with annuities can impact the overall return and reduce the amount of payments received. |

Benefits of Using an Annuity Calculator: Annuity Calculator Yearly Payment 2024

Annuity calculators provide numerous benefits for individuals considering annuity products. They help users make informed decisions by providing clear insights into the potential financial implications of different annuity options.

Learn how to use Excel to calculate the value of your annuity with our comprehensive guide on calculating annuity value in Excel in 2024.

Advantages of Using an Annuity Calculator

The benefits of using an annuity calculator include:

- Accurate Payment Estimates:Annuity calculators provide precise estimates of yearly payments based on the chosen inputs.

- Financial Planning:Annuity calculators help users plan for retirement, income needs, and other financial goals.

- Comparison of Options:Annuity calculators allow users to compare different annuity types and identify the most suitable option for their circumstances.

- Informed Decision-Making:Annuity calculators provide valuable information that empowers users to make informed financial decisions.

Examples of Benefits for Retirement Planning

Annuity calculators can be particularly beneficial for retirement planning. They help users determine the amount of income they can expect to receive from an annuity, allowing them to plan for their retirement expenses. Additionally, calculators can assist in identifying the appropriate annuity type and term to meet their individual needs.

Resources and Tools

Several online resources and tools are available to help individuals understand annuities and use annuity calculators effectively. These resources provide comprehensive information, calculator tools, and financial guidance.

Reputable Online Annuity Calculators

Some reputable online annuity calculators include:

- Bankrate Annuity Calculator

- Investopedia Annuity Calculator

- NerdWallet Annuity Calculator

Financial Institutions Offering Annuity Products

Numerous financial institutions offer a wide range of annuity products. These institutions provide expert advice and support in selecting the right annuity for individual needs.

Looking to calculate the internal rate of return (IRR) for your annuity? Use our IRR calculator for annuities in 2024 to assess your investment’s profitability.

- Fidelity Investments

- Vanguard

- Schwab

Other Relevant Resources, Annuity Calculator Yearly Payment 2024

Other relevant resources for understanding annuities and financial planning include:

- The Securities and Exchange Commission (SEC)

- The Financial Industry Regulatory Authority (FINRA)

- The National Endowment for Financial Education (NEFE)

Final Wrap-Up

Annuity calculators are a powerful tool that can help you plan for your financial future. By understanding how they work and the factors that influence annuity payments, you can make informed decisions about your financial well-being. Remember to consult with a financial advisor to determine the best annuity strategy for your individual circumstances.

Questions and Answers

How often are annuity payments made?

Annuity payments can be made monthly, quarterly, semi-annually, or annually, depending on the terms of the annuity contract.

Are there any taxes on annuity payments?

Thinking of rolling over your 401k into an annuity? Learn about the annuity 401k rollover options in 2024 and explore your retirement savings strategies.

Yes, annuity payments are generally subject to taxation. The specific tax treatment of annuity payments depends on the type of annuity and the individual’s tax situation.

Can I withdraw my principal investment from an annuity?

The ability to withdraw your principal investment from an annuity depends on the specific terms of the contract. Some annuities allow for partial withdrawals, while others may have restrictions.

What happens to my annuity payments if I die?

Need to calculate the annuity factor on your BA II Plus calculator? Follow the steps outlined in our guide on calculating annuity factors on BA II Plus in 2024.

The outcome of your annuity payments upon your death depends on the type of annuity you have. Some annuities have a death benefit that pays out to a beneficiary, while others may simply cease payments.