Annuity Equation 2024 takes center stage, providing a roadmap for navigating the complex world of retirement planning. Annuities, financial instruments designed to provide a steady stream of income, are becoming increasingly popular as individuals seek to secure their financial future.

If you’re a restaurant owner or business looking to expand your reach through delivery, the Glovo app offers a suite of features designed to help you manage orders, track deliveries, and connect with customers.

Understanding the annuity equation is crucial for making informed decisions about retirement savings, as it allows you to calculate the present value of future income streams and assess the long-term implications of your choices.

The future of mobile connectivity is 5G, and Snapdragon is at the forefront of this revolution. This article on Snapdragon 2024 5G connectivity highlights the latest 5G advancements, demonstrating how Snapdragon is shaping the future of mobile internet.

This comprehensive guide delves into the intricacies of annuities, explaining their different types, key features, and the factors that influence their value. We’ll explore the annuity equation, its variables, and how to apply it in real-world scenarios, considering the impact of current interest rates and inflation.

Wondering how to turn your Android app into a money-making machine? This guide on monetizing your Android app in 2024 will walk you through different strategies, from in-app purchases to subscription models, helping you choose the best approach for your app.

We’ll also discuss the role of annuities in retirement planning, comparing them to other investment options and helping you determine the best approach for your individual needs.

Pushbullet is a handy tool for seamlessly transferring information between your computer and phone. This article on Pushbullet 2024: How to use Pushbullet to send links from your computer to your phone provides a step-by-step guide on how to use Pushbullet to send links, files, and even notifications between your devices.

Contents List

Understanding Annuities

Annuities are financial products that provide a stream of regular payments over a set period of time. They are often used for retirement planning, but they can also be used for other purposes, such as income generation or estate planning.

If you’re looking to understand the basics of annuities, check out this article: An Annuity Is Defined As 2024. It provides a clear and concise definition, explaining the concept of annuities in a way that’s easy to understand.

Annuities are generally considered to be a relatively safe and predictable way to generate income, as the payments are guaranteed by the insurance company that issues the annuity.

If you’re curious about the latest trends shaping the Android app development landscape, check out this article: Android app development trends in 2024. It covers everything from AI integration to cross-platform development, giving you a glimpse into the future of Android apps.

Types of Annuities

There are many different types of annuities, each with its own unique features and benefits. Here are some of the most common types:

- Fixed Annuities:These annuities provide a guaranteed rate of return, which means that the payments will remain the same throughout the life of the annuity. Fixed annuities are generally considered to be the safest type of annuity, as they are not subject to market fluctuations.

- Variable Annuities:These annuities invest in a variety of assets, such as stocks, bonds, and mutual funds. The payments from a variable annuity will fluctuate based on the performance of the underlying investments. Variable annuities can provide the potential for higher returns than fixed annuities, but they also carry a greater risk of losing money.

Snapdragon is known for its powerful AI capabilities, and this article on Snapdragon 2024 AI and machine learning capabilities dives into the latest advancements in AI and machine learning, showcasing how Snapdragon is pushing the boundaries of mobile technology.

- Immediate Annuities:These annuities begin making payments immediately after the purchase is made. Immediate annuities are often used to provide a steady stream of income for retirees.

- Deferred Annuities:These annuities do not begin making payments until a later date, such as at retirement. Deferred annuities are often used to save for retirement or other long-term goals.

Key Features and Benefits of Annuities

Annuities offer a number of key features and benefits, including:

- Guaranteed Income:Annuities can provide a guaranteed stream of income for life, which can be a valuable source of financial security in retirement.

- Tax-Deferred Growth:The earnings from an annuity grow tax-deferred, which means that you will not have to pay taxes on them until you begin receiving payments.

- Protection from Market Risk:Fixed annuities provide protection from market risk, as the payments are guaranteed regardless of how the market performs.

- Longevity Protection:Annuities can provide longevity protection, which means that you will continue to receive payments even if you live longer than expected.

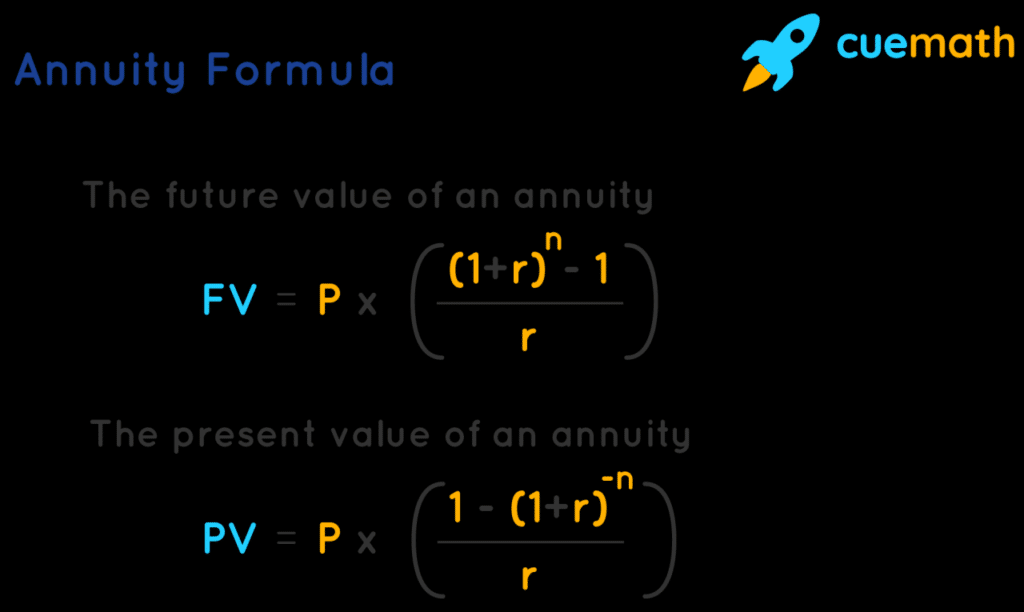

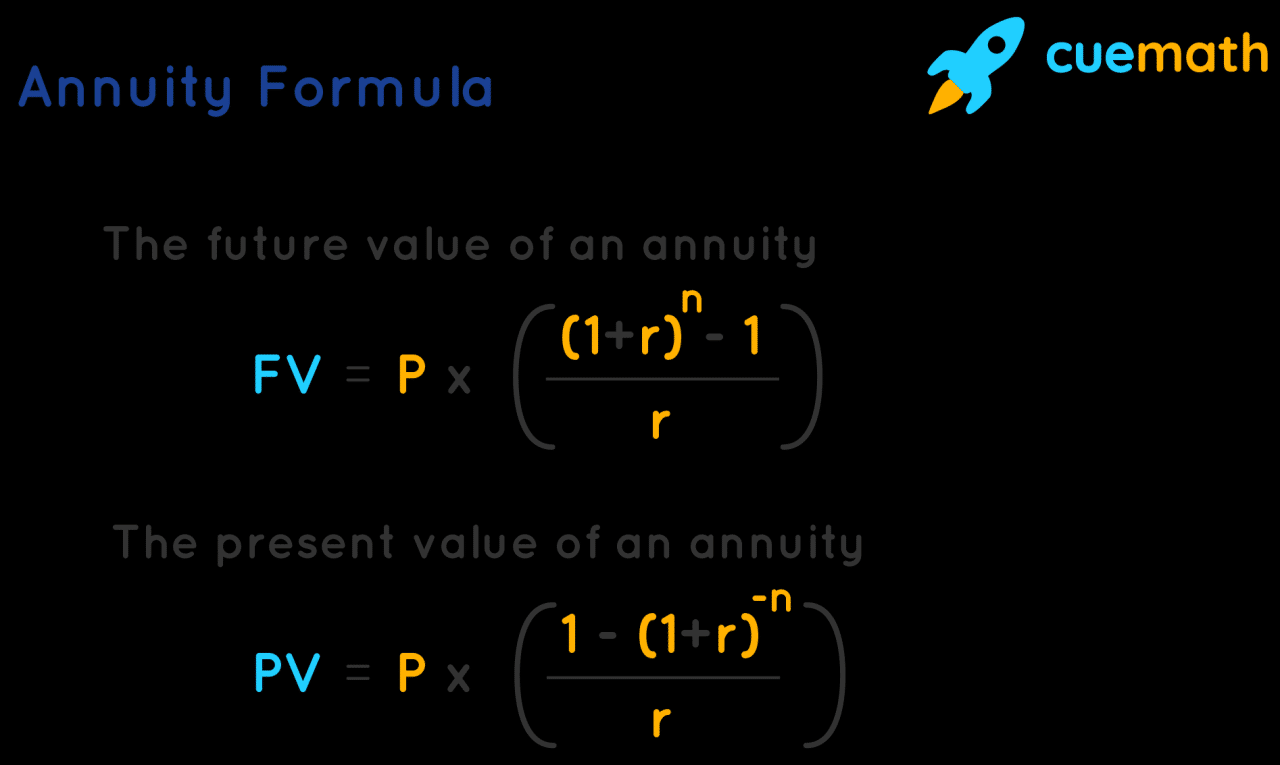

The Annuity Equation

The present value of an annuity is the amount of money that would need to be invested today to generate the same stream of payments as the annuity. The present value of an annuity can be calculated using the following formula:

PV = PMT

Want to know about the latest updates and features of the popular Dollify app? This article on Dollify 2024: New Features and Updates will keep you in the loop about all the exciting new additions, including new customization options and creative tools.

- [1

- (1 + r)^-n] / r

Where:

- PV= Present Value

- PMT= Payment Amount

- r= Interest Rate

- n= Number of Payments

For example, let’s say you want to buy an annuity that will pay you $1,000 per month for 20 years. The interest rate is 5%. Using the formula above, we can calculate the present value of the annuity as follows:

PV = $1,000

For those interested in the world of annuities, learning about the key players is essential. This article on Annuity Issuer 2024 provides insights into the major players in the market, helping you navigate the complex world of annuities.

- [1

- (1 + 0.05)^-240] / 0.05 = $129,099

This means that you would need to invest $129,099 today to generate the same stream of payments as the annuity.

For developers building hybrid apps, Android WebView 202 for hybrid apps offers valuable insights into how to use WebView to create cross-platform apps with enhanced performance and features.

Annuity Calculations in 2024

The value of an annuity is affected by a number of factors, including interest rates and inflation. In 2024, interest rates are expected to remain relatively low, which will have a negative impact on annuity values. This is because a lower interest rate means that the annuity will need to be invested for a longer period of time to generate the same amount of income.

For businesses looking to leverage the power of WebView for their Android apps, Android WebView 202 for enterprise use provides a comprehensive overview of its features and benefits, including enhanced security and performance.

Inflation is also expected to be a factor in 2024, which will erode the purchasing power of annuity payments over time.

To account for these factors, the annuity equation can be adjusted. For example, if inflation is expected to be 3% per year, the interest rate used in the formula should be adjusted to 8% (5% + 3%). This will ensure that the annuity payments keep pace with inflation.

Here is an example of how to calculate annuity payments and future values in 2024:

- Annuity Payment Calculation:Let’s say you want to buy an annuity that will pay you $1,000 per month for 20 years. The interest rate is 5% and inflation is 3%. Using the adjusted formula, we can calculate the annuity payment as follows:

- Future Value Calculation:The future value of an annuity is the amount of money that the annuity will be worth at the end of its term. The future value of an annuity can be calculated using the following formula:

PMT = PV- r / [1 – (1 + r)^-n]

For entrepreneurs looking to streamline their task management, Google Tasks 2024: Google Tasks for Entrepreneurs offers a comprehensive overview of Google Tasks, highlighting its features and how it can be used to organize projects, track deadlines, and boost productivity.

PMT = $129,099- 0.08 / [1 – (1 + 0.08)^-240] = $1,221

Looking for the best deals and discounts on your favorite restaurant orders? The Glovo app offers a variety of promotions and discounts for customers, making it a great option for saving money on your next meal.

FV = PMT- [(1 + r)^n – 1] / r

FV = $1,221- [(1 + 0.08)^240 – 1] / 0.08 = $1,101,000

Factors Affecting Annuity Payments

A number of factors can affect the amount of annuity payments you receive. These factors include:

Key Factors Influencing Annuity Payments

| Factor | Impact on Annuity Payments |

|---|---|

| Age | The older you are when you purchase an annuity, the lower your payments will be. This is because you are expected to live longer, so the insurance company needs to spread the payments out over a longer period of time. |

| Gender | Women generally live longer than men, so they will typically receive lower annuity payments than men. |

| Health | If you are in good health, you will generally receive higher annuity payments than someone who is in poor health. This is because you are expected to live longer. |

| Investment Performance | The performance of the underlying investments in a variable annuity will affect the amount of your annuity payments. If the investments perform well, your payments will be higher. If the investments perform poorly, your payments will be lower. |

Annuity Considerations for Retirement Planning: Annuity Equation 2024

Annuities can be a valuable tool for retirement planning. They can provide a guaranteed stream of income for life, which can help you to cover your essential expenses in retirement. Annuities can also be used to supplement other sources of retirement income, such as Social Security and pensions.

If you’re studying annuities and want to test your knowledge, check out this article on An Annuity Is Quizlet 2024. It provides a comprehensive overview of annuities, with helpful quizzes and flashcards to solidify your understanding.

Pros and Cons of Annuities for Retirement Income, Annuity Equation 2024

- Pros:

- Guaranteed Income

- Tax-Deferred Growth

- Longevity Protection

- Cons:

- Lower Returns than Other Investments

- Limited Flexibility

- High Fees

Here are some examples of how annuities can be used to address specific retirement goals:

- Income Replacement:Annuities can be used to replace a portion of your pre-retirement income, which can help you to maintain your standard of living in retirement.

- Longevity Protection:Annuities can provide longevity protection, which means that you will continue to receive payments even if you live longer than expected. This can help to ensure that you have enough income to cover your expenses throughout your retirement years.

- Estate Planning:Annuities can be used as part of an estate plan. For example, you can purchase an annuity that will provide income for your spouse or other beneficiaries after your death.

Annuity Alternatives

Annuities are not the only retirement savings option available. Other popular options include 401(k)s, IRAs, and Roth IRAs. Each of these options has its own advantages and disadvantages. It is important to carefully consider your individual circumstances and financial goals when choosing a retirement savings option.

New to Android app development? This article on Android app development for beginners in 2024 is a great starting point. It provides a roadmap for beginners, guiding them through the fundamentals of Android app development.

Comparison of Retirement Savings Options

| Option | Advantages | Disadvantages |

|---|---|---|

| 401(k) | Tax-deferred growth, employer matching contributions | Limited investment choices, early withdrawal penalties |

| IRA | Tax-deductible contributions, tax-deferred growth | Limited contribution limits, income limitations |

| Roth IRA | Tax-free withdrawals in retirement, no income limitations | No tax deduction for contributions, limited contribution limits |

| Annuity | Guaranteed income, longevity protection | Lower returns than other investments, limited flexibility, high fees |

Ending Remarks

As you navigate the complex landscape of retirement planning, the annuity equation serves as a powerful tool for making informed decisions. By understanding the factors that influence annuity values and the different types of annuities available, you can choose the option that best aligns with your financial goals and risk tolerance.

Remember, seeking professional financial advice is essential when making significant decisions about your retirement savings. With careful planning and a clear understanding of the annuity equation, you can pave the way for a secure and fulfilling retirement.

Answers to Common Questions

What are the risks associated with annuities?

Annuities, like any investment, carry risks. Some common risks include interest rate risk, market risk, and longevity risk. It’s important to understand these risks and consult with a financial advisor to determine if an annuity is suitable for your circumstances.

How do I choose the right annuity?

The right annuity for you depends on your individual circumstances, financial goals, and risk tolerance. Consider factors such as your age, health, and desired income stream when making a decision. It’s essential to consult with a financial advisor who can provide personalized guidance.

Are annuities regulated?

Yes, annuities are regulated by state and federal agencies. The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) oversee the sale and distribution of annuities, while state insurance departments regulate the insurance companies that issue them.