Annuity Examples 2024 takes center stage, offering a clear look at how these financial instruments can help you plan for your future. Annuities, essentially contracts that guarantee a stream of income, have become increasingly popular in recent years, particularly as individuals seek ways to ensure financial security during retirement.

The basis of an annuity is a contract between you and an insurance company. It outlines the terms of your payments and the guaranteed income you’ll receive. To understand the basics of annuities and how they work, check out this article: Annuity Basis Is 2024.

This guide explores the diverse world of annuities, providing real-world examples and insightful information to help you make informed decisions about your financial future.

We’ll delve into the different types of annuities, including fixed, variable, and indexed, examining their unique features, potential benefits, and potential drawbacks. Understanding the nuances of each type is crucial to determining which option best aligns with your individual financial goals and risk tolerance.

Choosing the right retirement savings plan is a crucial decision. Both 401k and annuities offer advantages, but which one is better for you depends on your individual circumstances. This article explores the differences between 401k and annuities, helping you make an informed decision: Is Annuity Better Than 401k 2024.

By exploring real-world examples, you’ll gain a practical understanding of how these products function in practice, allowing you to assess their suitability for your own circumstances.

The Snapdragon processor has become a popular choice for laptops, offering a balance of power and efficiency. With its advancements in 2024, Snapdragon processors are becoming even more capable, providing a seamless experience for users. To learn more about the latest Snapdragon processors for laptops, you can check out this article: Snapdragon 2024 for laptops.

Contents List

Introduction to Annuities

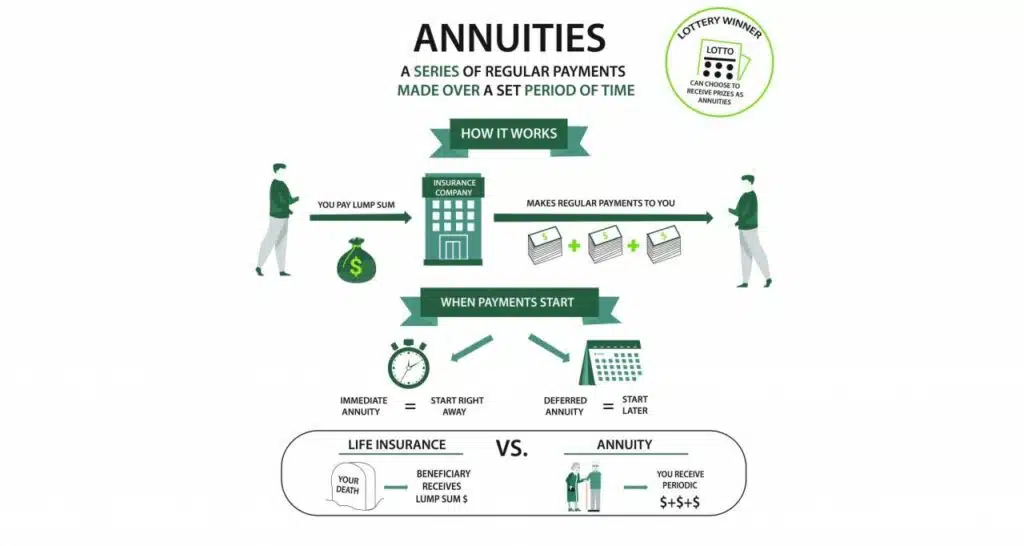

An annuity is a financial product that provides a stream of regular payments for a set period of time. They are often used for retirement planning, but they can also be used for other purposes, such as supplementing income or providing financial security for loved ones.

Types of Annuities

There are many different types of annuities, each with its own unique features and benefits. Here are a few of the most common types:

- Fixed annuities: These annuities provide a guaranteed rate of return, which means that the payments you receive will be fixed for the life of the annuity. They are a good option for people who want to protect their principal and receive predictable income.

- Variable annuities: These annuities invest your money in a variety of sub-accounts, which can fluctuate in value. This means that the payments you receive can vary depending on the performance of the investments. Variable annuities can provide the potential for higher returns, but they also carry more risk.

An annuity is a life insurance product that provides a guaranteed stream of income for a set period. It’s often used as a retirement planning tool, ensuring financial security during your golden years. To learn more about annuities and their role in life insurance, check out this article: An Annuity Is A Life Insurance Product That 2024.

- Indexed annuities: These annuities link their returns to the performance of a specific index, such as the S&P 500. They offer the potential for growth, but they also provide a minimum guaranteed return. Indexed annuities are a good option for people who want to participate in the stock market but also want some protection against losses.

While annuities offer many benefits, it’s important to understand that they are taxable. The income you receive from an annuity is generally subject to taxation. To learn more about the tax implications of annuities, you can check out this article: Annuity Is Taxable 2024.

Benefits of Annuities

Annuities offer a number of benefits, including:

- Guaranteed income: Many annuities provide a guaranteed stream of income for life, which can be a valuable source of financial security in retirement.

- Tax advantages: Some annuities offer tax-deferred growth, which means that you don’t have to pay taxes on the earnings until you start receiving payments. This can help you accumulate more wealth over time.

- Protection from market risk: Fixed and indexed annuities can provide protection against market losses, which can be a valuable feature in times of economic uncertainty.

Annuity Examples in 2024

Fixed Annuity Example

Let’s say you are 65 years old and have $100,000 to invest in a fixed annuity. You find a fixed annuity that offers a guaranteed interest rate of 3% per year. If you choose to receive payments for life, you can expect to receive about $4,500 per year in income.

Pushbullet is a handy tool for keeping your devices connected. It allows you to seamlessly send notifications from your computer to your phone, making sure you never miss a beat. You can easily transfer files, links, and even copy and paste text between devices.

Want to learn more about how Pushbullet works and how to set it up? Check out this article: Pushbullet 2024: How to use Pushbullet to send notifications from your computer to your phone.

However, if you die before receiving all of your payments, the remaining balance will be paid out to your beneficiaries. This type of annuity offers a predictable income stream and protection against market volatility. However, the guaranteed interest rate may not keep up with inflation, so your purchasing power could decline over time.

Keeping your tasks organized across multiple devices is essential for productivity. Google Tasks offers a simple yet powerful way to manage your to-do list. You can easily sync your tasks across different devices, ensuring you never miss a deadline. Learn more about how to sync Google Tasks across your devices in this helpful guide: Google Tasks 2024: How to Sync Google Tasks Across Devices.

Variable Annuity Example

Let’s say you are 55 years old and have $50,000 to invest in a variable annuity. You choose to allocate your money across different sub-accounts, such as stocks, bonds, and mutual funds. The value of your investment will fluctuate based on the performance of these investments.

Developing Android apps can be quite a challenge, especially in 2024 with the ever-evolving landscape of mobile technology. From keeping up with the latest Android versions to navigating the intricacies of different screen sizes and device capabilities, developers face a unique set of hurdles.

If you’re interested in learning more about the challenges of Android app development in 2024, check out this insightful article: Challenges of Android app development in 2024.

If the market performs well, your annuity could grow significantly. However, if the market declines, your annuity could lose value. This type of annuity offers the potential for higher returns, but it also carries more risk than a fixed annuity.

Dollify has been constantly evolving with new features and updates. The latest versions bring exciting additions to the app, enhancing its functionality and user experience. To learn more about the new features and updates in Dollify, check out this article: Dollify 2024: New Features and Updates.

The downside is that the potential for growth comes with the potential for loss, and your payments can be unpredictable.

Android WebView is a crucial component of the Android operating system, allowing apps to display web content within their interfaces. Android WebView 202 has introduced significant improvements over previous versions, enhancing performance, security, and compatibility. To learn more about the differences between Android WebView 202 and its predecessors, check out this article: Android WebView 202 vs previous versions.

Indexed Annuity Example

Let’s say you are 60 years old and have $75,000 to invest in an indexed annuity. You find an indexed annuity that links its returns to the performance of the S&P 500. The annuity offers a minimum guaranteed return of 1% per year, but it also has the potential to earn a higher return based on the performance of the index.

This type of annuity offers the potential for growth, but it also provides some protection against market losses. The downside is that the return is limited by the index’s performance and may not be as high as other investment options.

An annuity is a financial product that provides a steady stream of income for a specific period, often throughout retirement. It’s a way to secure your financial future and ensure you have a reliable source of income. If you’re interested in learning more about annuities and how they work, you can check out this article: An Annuity Is 2024.

How Annuities Work

An annuity contract is a legal agreement between you and the insurance company that Artikels the terms of the annuity. The contract will specify the type of annuity, the amount of your investment, the payment schedule, and other important details.

Dollify has gained immense popularity for its ability to create cute cartoon avatars. While it’s a fantastic app, there are other alternatives available that offer unique features and styles. If you’re looking for some great alternatives to Dollify, this article provides a comprehensive list: Dollify 2024: The Best Dollify 2024 Alternatives.

Phases of an Annuity

Annuities typically have two phases:

- Accumulation phase: During this phase, you make contributions to the annuity. The money you contribute grows tax-deferred, meaning you don’t have to pay taxes on the earnings until you start receiving payments.

- Payout phase: During this phase, you start receiving payments from the annuity. The payments can be made for a fixed period of time, for the rest of your life, or for a combination of both.

Factors Affecting Annuity Payouts

Several factors can affect the amount of your annuity payouts, including:

- Interest rates: Higher interest rates generally lead to higher annuity payouts.

- Investment performance: For variable annuities, the performance of the investments in the sub-accounts will affect the amount of your payouts.

- Longevity: If you live longer than expected, you will receive more payments from your annuity.

Annuity Considerations for 2024

Interest Rate Environment

Interest rates are currently rising, which can have a positive impact on fixed annuities. As interest rates rise, insurance companies can offer higher guaranteed interest rates, which can lead to larger annuity payouts. However, rising interest rates can also make it more expensive to purchase an annuity, as the insurance company will need to offer a higher return to compete with other investment options.

Annuity is a voluntary retirement vehicle, providing a steady stream of income during your golden years. It’s a popular option for those seeking guaranteed payments and financial security. Want to learn more about annuities and how they can benefit your retirement planning?

Check out this article: Annuity Is A Voluntary Retirement Vehicle 2024.

Market Volatility

The stock market has been volatile in recent years, and this volatility can affect the performance of variable annuities. If the market declines, your annuity could lose value. However, if the market rises, your annuity could grow significantly. It is important to consider your risk tolerance and investment goals when choosing an annuity.

Individual Financial Goals and Risk Tolerance, Annuity Examples 2024

When choosing an annuity, it is important to consider your individual financial goals and risk tolerance. If you are looking for a guaranteed income stream and are not comfortable with market risk, a fixed annuity may be a good option.

If you are willing to take on more risk in exchange for the potential for higher returns, a variable annuity may be a better choice. It is also important to consider your age, health, and financial situation when making this decision.

Dollify has become a popular app for creating cute cartoon avatars. While it’s a fun and engaging app, you might be wondering if the latest updates and features are worth the upgrade. This article provides a detailed analysis of Dollify’s new features and whether it’s worth upgrading: Dollify 2024: Is it Worth the Upgrade?

.

Advantages and Disadvantages of Annuities

Comparison Table

| Annuity Type | Advantages | Disadvantages |

|---|---|---|

| Fixed Annuity |

|

|

| Variable Annuity |

|

|

| Indexed Annuity |

|

|

Tax Implications

The tax implications of annuities can be complex. It is important to understand the tax rules that apply to your specific annuity. In general, the earnings from an annuity are not taxed until you start receiving payments. However, the payments you receive are taxed as ordinary income.

Glovo is a popular delivery app that offers a wide range of services, from groceries to restaurant meals. The app provides estimated delivery times for different orders, helping you plan your day accordingly. To learn more about Glovo’s delivery time estimates and how they work, you can check out this article: Glovo app delivery time estimates for different orders.

Fees and Charges

Annuities typically have fees and charges associated with them. These fees can include:

- Surrender charges: These are fees you pay if you withdraw your money from the annuity before a certain period of time.

- Administrative fees: These are fees charged to cover the costs of managing the annuity.

- Mortality and expense charges: These are fees charged to cover the costs of providing guaranteed income payments.

Alternatives to Annuities

There are a number of alternatives to annuities that can provide guaranteed income, such as:

- Bonds: Bonds are debt securities that pay a fixed interest rate. They are generally considered to be less risky than stocks and can provide a steady stream of income.

- Certificates of Deposit (CDs): CDs are time deposits that pay a fixed interest rate. They are generally considered to be safe investments and can provide a predictable return.

Pros and Cons of Alternatives

Bonds and CDs offer several advantages over annuities, including:

- Lower fees: Bonds and CDs typically have lower fees than annuities.

- More flexibility: You can typically access your money from bonds and CDs more easily than from an annuity.

However, bonds and CDs also have some disadvantages:

- Lower returns: Bonds and CDs generally offer lower returns than annuities.

- Interest rate risk: The value of bonds and CDs can decline if interest rates rise.

Choosing the Best Investment Strategy

The best investment strategy for you will depend on your individual circumstances, including your age, risk tolerance, and financial goals. If you are looking for a guaranteed income stream and are not comfortable with market risk, a fixed annuity may be a good option.

However, if you are willing to take on more risk in exchange for the potential for higher returns, bonds or CDs may be a better choice. It is important to consult with a financial advisor to determine the best investment strategy for you.

Tips for Choosing the Right Annuity: Annuity Examples 2024

Here are some tips for choosing an annuity that meets your needs:

- Determine your financial goals: What are you trying to achieve with an annuity? Are you looking for guaranteed income, growth potential, or protection from market risk?

- Consider your risk tolerance: How much risk are you willing to take? If you are risk-averse, a fixed annuity may be a good option. If you are willing to take on more risk, a variable annuity may be a better choice.

- Compare different annuity products: There are many different annuity products available, so it is important to compare them carefully. Consider factors such as interest rates, fees, and payout options.

- Consult with a financial advisor: A financial advisor can help you understand the different types of annuities and choose the one that is right for you.

- Read the annuity contract carefully: Before you purchase an annuity, be sure to read the contract carefully and understand all of the terms and conditions.

Resources for Researching and Comparing Annuity Products

There are a number of resources available to help you research and compare annuity products. These resources include:

- Financial websites: Websites such as Bankrate.com and NerdWallet.com provide information on annuity products and allow you to compare quotes.

- Insurance company websites: Most insurance companies have websites that provide information on their annuity products.

- Financial advisors: Financial advisors can provide personalized advice on annuity products and help you choose the one that is right for you.

Closure

In conclusion, annuities offer a compelling way to supplement your retirement income and potentially enhance your financial security. By carefully considering your individual needs and goals, you can choose an annuity that aligns with your risk tolerance and provides the level of income you desire.

Remember, seeking professional financial advice is crucial before making any significant financial decisions. With the right guidance and understanding, annuities can play a valuable role in your overall financial plan, helping you achieve your long-term financial objectives.

Popular Questions

What are the tax implications of annuities?

The tax implications of annuities vary depending on the type of annuity and the specific provisions of the contract. Generally, the income received from an annuity is taxed as ordinary income, but there are exceptions, such as tax-deferred growth in certain annuities.

How do I choose the right annuity for my needs?

Choosing the right annuity requires careful consideration of your individual financial goals, risk tolerance, and time horizon. It’s highly recommended to consult with a financial advisor to discuss your specific needs and explore the various options available to you.

Are there any penalties for withdrawing from an annuity early?

Yes, most annuities have surrender charges for early withdrawals. These charges can vary depending on the annuity type and the length of time the money has been in the contract. It’s essential to understand the surrender charge schedule before making any withdrawal decisions.