Annuity Formula Is 2024, a comprehensive guide to understanding the intricacies of annuities in today’s financial landscape. This guide delves into the fundamentals of annuities, explores the key components of the annuity formula, and provides practical applications for calculating annuity payments in 2024.

Dollify 2024 has a bunch of cool new features! Dollify 2024: How to Use the New Features walks you through the latest additions and how to make the most of them.

We’ll examine the current interest rate environment, the impact of inflation, and the pros and cons of investing in annuities, offering a balanced perspective on their suitability for various financial goals.

Looking for the best Snapdragon chip for your tablet? Snapdragon 2024 for tablets breaks down the latest options and their strengths.

Annuities are financial products that provide a stream of regular payments for a specified period, often used for retirement planning or income generation. Understanding the annuity formula is crucial for making informed financial decisions, particularly as interest rates and inflation influence the value of annuity payments.

Want to see how the latest Snapdragon chips perform? Snapdragon 2024 performance benchmarks provides detailed insights into the speed and efficiency of these powerful processors.

This guide aims to demystify the complexities of annuities and equip readers with the knowledge necessary to navigate the world of annuity investments.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a specified period. It’s essentially a contract between you and an insurance company where you invest a lump sum or make regular payments, and in return, you receive a series of payments in the future.

Android WebView 202 brings a significant performance boost. Android WebView 202 performance improvements delves into the key improvements and how they benefit developers.

Annuities can be a valuable tool for retirement planning, income generation, and other financial goals.

Types of Annuities

Annuities come in various forms, each with its own characteristics and features. Here are some common types:

- Fixed Annuities:These provide a guaranteed rate of return, meaning your payments will be predictable and consistent. However, the return is often lower than other investment options.

- Variable Annuities:These offer the potential for higher returns, but they also come with greater risk. The payments you receive can fluctuate based on the performance of the underlying investments.

- Immediate Annuities:These begin paying out immediately after you purchase them. You can use them to generate income right away, for example, to supplement your retirement income.

Real-World Examples of Annuities

- Retirement Income:Many retirees use annuities to provide a steady stream of income during their golden years. The payments can help cover essential expenses and maintain a comfortable lifestyle.

- Long-Term Care:Annuities can be used to pay for long-term care expenses, such as assisted living or nursing home care. This can provide peace of mind knowing that your financial needs will be met in the event of unexpected health challenges.

- Estate Planning:Annuities can be incorporated into estate planning strategies to ensure that beneficiaries receive a regular income stream after your passing.

Key Components of the Annuity Formula

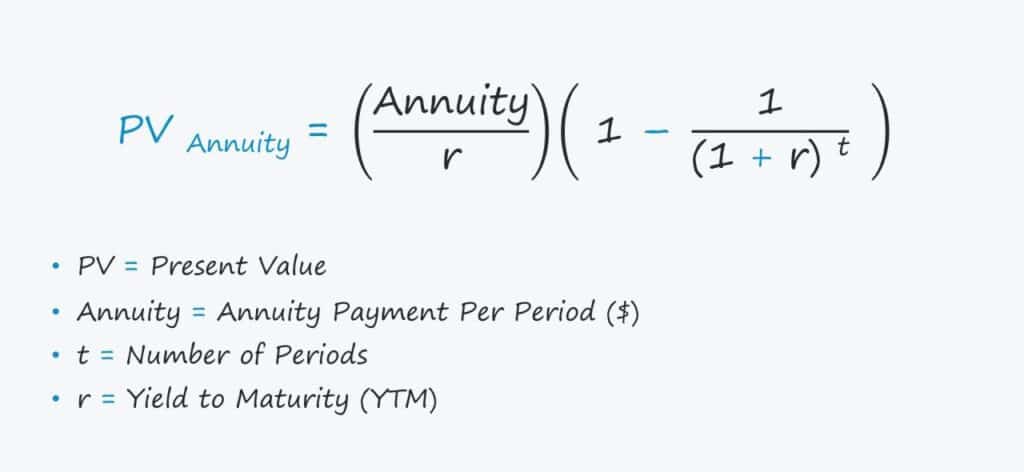

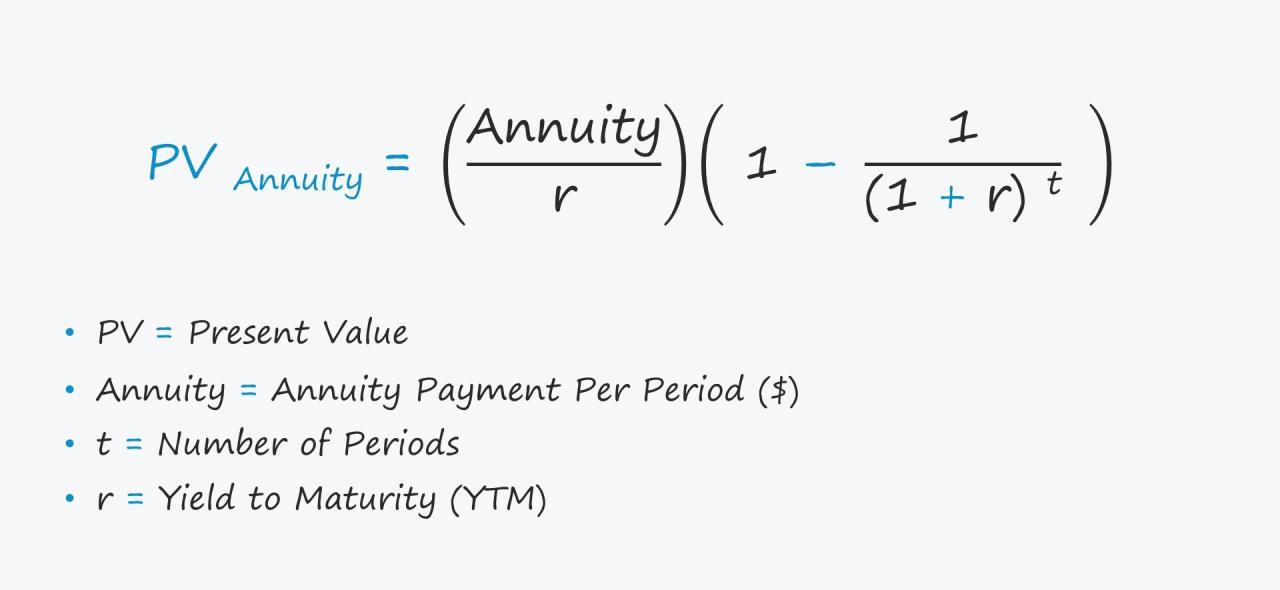

The annuity formula is a mathematical equation used to calculate the present or future value of a series of payments. Understanding the components of this formula is crucial for making informed decisions about annuity investments.

Need real-world examples of how annuities work? Annuity Examples In Real Life 2024 breaks down various scenarios to help you understand this financial tool better.

Variables in the Annuity Formula

The annuity formula involves several key variables:

- PMT:The amount of each payment.

- r:The interest rate per period.

- n:The number of periods.

- PV:The present value of the annuity (the lump sum you invest today).

- FV:The future value of the annuity (the total amount you will receive at the end of the period).

The Basic Annuity Formula

PV = PMT- [1 – (1 + r)^-n] / r

Want to learn more about annuities in general? Annuity Is 2024 gives you a comprehensive overview of this financial product.

This formula helps calculate the present value of an annuity, which is the amount you need to invest today to receive a series of future payments.

Relationship Between Variables

| Variable | Impact on Annuity Amount |

|---|---|

| PMT (Payment Amount) | Higher payments result in a higher annuity amount. |

| r (Interest Rate) | Higher interest rates lead to a higher annuity amount. |

| n (Number of Periods) | A longer payment period generally results in a higher annuity amount. |

Applying the Annuity Formula in 2024

The current interest rate environment plays a significant role in annuity calculations. In 2024, interest rates have been fluctuating, impacting the returns on annuities.

Is annuity income considered earned income? Is Annuity Earned Income 2024 clarifies this common question about tax implications.

Interest Rate Environment and Annuity Calculations

When interest rates are high, annuities tend to offer higher returns. Conversely, when interest rates are low, the returns on annuities may be lower. It’s essential to consider the current interest rate environment and its potential impact on your annuity investments.

Want to see how Android WebView 202 compares to previous versions? Android WebView 202 vs previous versions provides a detailed side-by-side comparison.

Calculating Present and Future Value

The annuity formula can be used to calculate both the present value and future value of an annuity. For example, if you want to know how much you need to invest today to receive $1,000 per year for 20 years at an interest rate of 5%, you can use the present value formula.

Android app development for enterprise is on the rise. Android app development for the enterprise in 2024 explores the trends and opportunities in this exciting space.

Conversely, if you want to know how much your annuity will be worth in 10 years if you invest $10,000 today at an interest rate of 4%, you can use the future value formula.

Wondering if annuity drawdown is a good option for you in 2024? Is Annuity Drawdown 2024 dives into the pros and cons of this financial strategy.

Impact of Inflation

Inflation erodes the purchasing power of money over time. It’s crucial to consider the impact of inflation on annuity payments. Even if your annuity payments remain constant, their real value may decrease due to inflation. This means you may need to adjust your annuity calculations to account for inflation to ensure your payments maintain their purchasing power over time.

Beyond personal use, Dollify 2024 can be a powerful tool for businesses. Dollify 2024: How to Use Dollify 2024 for Business explores creative ways to leverage the app for marketing, branding, and more.

Annuity Calculations in Practice

Calculating annuity payments using the formula can seem daunting, but it’s a straightforward process once you understand the steps involved.

Step-by-Step Guide to Annuity Calculations

- Identify the variables:Determine the payment amount (PMT), interest rate (r), and number of periods (n).

- Choose the appropriate formula:Select the present value or future value formula depending on your objective.

- Plug in the values:Substitute the identified variables into the chosen formula.

- Solve the equation:Calculate the result using a calculator or financial software.

Practical Examples of Annuity Calculations

- Retirement Planning:You want to receive $50,000 per year in retirement for 20 years. Assuming an interest rate of 3%, you can use the present value formula to calculate how much you need to invest today to achieve this goal.

- Investment Strategies:You’re considering investing $100,000 in an annuity that pays 4% interest per year for 10 years. You can use the future value formula to calculate the total amount you will receive at the end of the period.

Using Online Calculators or Financial Software

Many online calculators and financial software programs can simplify annuity calculations. These tools allow you to input the relevant variables and instantly generate the present or future value of an annuity. This can save you time and effort compared to manual calculations.

Considerations for Annuity Investments

Annuities can be a valuable investment option, but they also come with certain risks and considerations. It’s essential to weigh the pros and cons before making a decision.

Pros of Investing in Annuities, Annuity Formula Is 2024

- Guaranteed Income:Fixed annuities provide a guaranteed stream of income, which can be helpful for retirement planning or other financial goals.

- Tax Advantages:Annuities can offer tax advantages, depending on the type of annuity and how it’s structured.

- Protection from Market Volatility:Fixed annuities provide protection from market downturns, as your payments are not tied to the performance of investments.

Cons of Investing in Annuities

- Lower Returns:Fixed annuities generally offer lower returns compared to other investment options, such as stocks or bonds.

- Liquidity Constraints:Annuities often have surrender charges if you withdraw funds before a certain period, limiting your access to your money.

- Interest Rate Risk:The value of fixed annuities can be affected by interest rate fluctuations, which can impact your returns.

Risks Associated with Annuities

- Market Volatility:Variable annuities are subject to market risk, meaning the value of your investment can fluctuate based on the performance of the underlying investments.

- Interest Rate Fluctuations:Interest rate changes can impact the returns on both fixed and variable annuities.

- Insurance Company Risk:Annuities are backed by insurance companies, and if the company fails, your investment may be at risk.

Comparison to Other Investment Options

Annuities are just one of many investment options available. It’s essential to compare annuities to other investment choices, such as stocks, bonds, mutual funds, and real estate, to determine which best suits your financial goals and risk tolerance.

Foldable phones are getting even better! Snapdragon 2024 for foldable phones highlights the latest Snapdragon chips designed for these innovative devices.

Conclusive Thoughts

By understanding the annuity formula and its components, you can make informed decisions about whether annuities are the right investment for your financial goals. Whether you’re planning for retirement, seeking a steady stream of income, or looking to protect your savings from market volatility, the information presented in this guide will empower you to navigate the world of annuities with confidence.

Want to see how the new Dollify 2024 version stacks up against its predecessors? Check out Dollify 2024: What’s New and Different for a detailed breakdown of the latest features and changes.

Remember to consider your individual circumstances, consult with a financial advisor, and make decisions that align with your long-term financial objectives.

FAQ Explained: Annuity Formula Is 2024

What are the different types of annuities?

Curious about the Bengali meaning of “annuity”? Annuity Is Bengali Meaning 2024 provides a clear and concise explanation.

Annuities can be categorized into fixed, variable, and immediate annuities, each offering different features and risk profiles.

How do I calculate the present value of an annuity?

The present value of an annuity is the current value of future payments, considering the time value of money and the discount rate.

Looking to boost your Android app development skills? Best Android app development courses in 2024 rounds up top-rated courses to help you learn from the best.

What are the risks associated with annuity investments?

Annuities carry risks such as market volatility, interest rate fluctuations, and potential loss of principal.

Are annuities suitable for everyone?

The suitability of annuities depends on individual financial goals, risk tolerance, and time horizon.