Annuity Formula Jaiib 2024 is your guide to understanding the core concepts of annuities, essential for navigating financial instruments. Whether you’re a budding financial professional or a seasoned investor, this formula unlocks the secrets to calculating present and future values, making informed financial decisions.

From retirement planning to loan repayment, the annuity formula plays a crucial role in various financial scenarios, empowering you to make sound choices for your financial future.

Excel can be a valuable tool for calculating annuity payments. Learn more about the different methods and formulas for Calculating Annuity In Excel 2024 to ensure you’re making the right financial decisions.

This guide delves into the intricacies of the annuity formula, exploring its applications and the key factors that influence its calculations. Prepare to navigate the world of annuities with confidence, understanding how this powerful tool can help you achieve your financial goals.

Contents List

Understanding Annuities: Annuity Formula Jaiib 2024

Annuities are financial instruments that provide a stream of regular payments over a specified period of time. They are commonly used for retirement planning, income generation, and other financial goals. Annuities can be structured in various ways, depending on the needs and preferences of the individual.

Some annuities offer variable payout options, where the income stream can fluctuate based on market performance. Learn more about Annuity Is Variable 2024 and whether this type of annuity is right for you.

Types of Annuities

Annuities can be classified based on their payment timing and investment features. Some common types of annuities include:

- Immediate Annuities:These annuities begin making payments immediately after the purchase. They are ideal for individuals who need a steady stream of income right away.

- Deferred Annuities:These annuities start making payments at a future date, typically after a specified period of time. They allow individuals to accumulate funds over time before receiving payments.

- Fixed Annuities:These annuities guarantee a fixed rate of return on the invested principal. They provide predictable income payments, but the returns may not keep up with inflation.

- Variable Annuities:These annuities invest the principal in a portfolio of assets, such as stocks or bonds. The returns are not guaranteed and can fluctuate based on market performance. However, variable annuities offer the potential for higher returns than fixed annuities.

Key Features of Annuities

Annuities have several key features that determine their value and suitability for different financial situations. These features include:

- Payment Period:This refers to the duration over which the annuity payments will be made. It can be for a fixed period, such as 10 years, or for the lifetime of the annuitant.

- Interest Rate:This determines the rate of return on the invested principal. The interest rate can be fixed or variable, depending on the type of annuity.

- Principal Amount:This is the initial amount of money invested in the annuity. The principal amount will determine the size of the annuity payments.

Annuity Formula

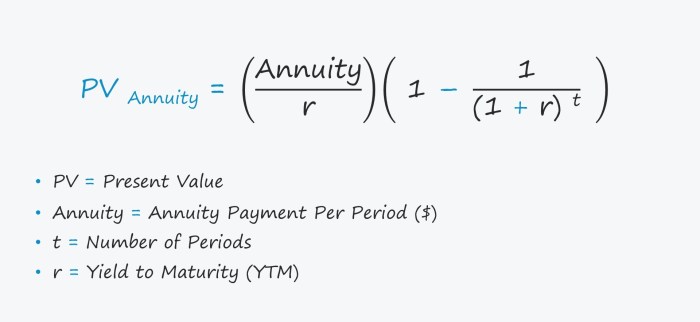

The annuity formula is a mathematical equation used to calculate the present value and future value of an annuity. It helps determine the amount of money needed to generate a desired stream of payments or the total value of an annuity at a future point in time.

Annuities can be structured for different durations, including 30-year terms. If you’re considering a long-term annuity, it’s important to understand the implications of Annuity 30 Years 2024 and how it might affect your financial planning.

Basic Annuity Formula

PV = PMT- [1 – (1 + r)^-n] / r

Where:

- PV = Present Value of the annuity

- PMT = Periodic payment amount

- r = Interest rate per period

- n = Number of periods

Applications of the Annuity Formula

- Present Value Calculation:The formula can be used to determine the present value of an annuity stream. This is useful for evaluating the current worth of future income payments.

- Future Value Calculation:The formula can also be used to calculate the future value of an annuity. This helps determine the total amount accumulated at the end of the payment period.

- Payment Amount Calculation:The formula can be rearranged to determine the periodic payment amount required to achieve a specific present value or future value goal.

Practical Applications of Annuity Formulas

Annuity formulas have various practical applications in personal finance, business, and investment planning. Here are some scenarios where they are commonly used:

Scenarios

| Scenario | Application |

|---|---|

| Retirement Planning | Calculating the amount needed to save for retirement and the monthly income that can be generated from an annuity |

| Loan Repayment | Determining the monthly payments required to repay a loan over a specified period |

| Investment Calculations | Estimating the future value of an investment that generates regular income payments |

Present Value of an Annuity Stream

The annuity formula is crucial for determining the present value of an annuity stream. This value represents the current worth of the future income payments, taking into account the time value of money. It helps investors make informed decisions about the purchase or sale of annuities.

Example: Future Value Calculation

Let’s say you invest $1,000 per year for 10 years in an annuity that earns an annual interest rate of 5%. Using the annuity formula, the future value of this annuity would be:

FV = PMT- [(1 + r)^n – 1] / r

Some annuities provide lifetime income, ensuring payments for as long as you live. You can find out more about whether Is Annuity Lifetime 2024 is a suitable option for your retirement planning.

FV = $1,000 – [(1 + 0.05)^10 – 1] / 0.05

FV = $1,000 – [1.62889 – 1] / 0.05

An annuity can be structured as a fixed term or a lifetime payout. Understanding the difference between a fixed term and a lifetime payout is important when deciding whether Annuity Is Term 2024 is right for you.

FV = $1,000 – 0.62889 / 0.05

FV = $12,577.80

Therefore, the future value of the annuity after 10 years would be approximately $12,577.80.

Excel is a powerful tool for financial calculations, including those related to annuities. You can learn how to use Excel to calculate the present value of an annuity by exploring Pv Annuity Excel 2024 resources.

Factors Affecting Annuity Calculations

Several factors influence the calculations of present and future values of an annuity. These factors determine the overall value and suitability of the annuity for different financial goals.

Key Factors

- Interest Rate:A higher interest rate generally results in a higher future value and a lower present value. This is because the principal earns more interest over time.

- Payment Period:A longer payment period generally leads to a higher future value and a lower present value. This is because the annuity payments accumulate for a longer duration.

- Principal Amount:A larger principal amount results in higher annuity payments and a higher future value. This is because more money is invested initially.

Impact of Inflation

Inflation can significantly impact annuity calculations, especially over longer periods. As inflation erodes the purchasing power of money, the real value of annuity payments may decrease over time. This is an important consideration for individuals planning for retirement or other long-term financial goals.

Annuity Calculations in JAIIB Exam

The JAIIB exam often includes questions related to annuity formulas and their applications. It is essential to understand the concepts and be able to solve problems involving annuity calculations.

Annuity rates in the UK for 2024 are influenced by various factors, including interest rates and life expectancy. You can find more information about Annuity Rates Uk 2024 and how they might impact your retirement planning.

Sample Question

A person wants to accumulate $100,000 in 15 years by making annual deposits into an annuity that earns an annual interest rate of 6%. What is the amount of the annual deposit required?

Annuities are often considered a type of fixed income investment, providing a predictable stream of payments. You can find out more about whether Is Annuity Fixed Income 2024 by exploring different types of annuities and their features.

Solution

To solve this problem, we need to use the annuity formula and rearrange it to solve for the payment amount (PMT):

FV = PMT- [(1 + r)^n – 1] / r

PMT = FV – r / [(1 + r)^n – 1]

The “6 Annuity” is a term that may refer to a specific type of annuity or a group of six annuities. Learn more about 6 Annuity 2024 and how it might be relevant to your financial planning.

PMT = $100,000 – 0.06 / [(1 + 0.06)^15 – 1]

Understanding who the owner of an annuity is crucial for managing your finances. You can learn more about the responsibilities and rights associated with Annuity Owner Is 2024 and how it impacts your retirement planning.

PMT = $6,000 / [2.39656 – 1]

PMT = $6,000 / 1.39656

Whether an annuity is a good investment depends on your individual financial goals and risk tolerance. You can find out more about the pros and cons of annuities and whether Is Annuity Good Investment 2024 is a good option for you.

PMT = $4,300.45

Understanding the terms and conditions of your annuity contract is crucial. A Annuity Contract Is 2024 can be a complex document, so it’s important to carefully review it before making any decisions.

Therefore, the person needs to make an annual deposit of approximately $4,300.45 to accumulate $100,000 in 15 years.

Common Mistakes, Annuity Formula Jaiib 2024

- Incorrect Formula Application:Using the wrong annuity formula or applying it incorrectly can lead to inaccurate results.

- Misunderstanding of Variables:Failing to understand the meaning of the variables in the formula can lead to errors in calculation.

- Ignoring Time Value of Money:Not accounting for the time value of money can result in unrealistic estimates of present and future values.

End of Discussion

By mastering the annuity formula, you equip yourself with a valuable tool for navigating the complexities of financial planning. From understanding the intricacies of retirement planning to making informed investment decisions, the annuity formula empowers you to make sound choices that align with your financial aspirations.

Finding the right annuity formula for your needs can be crucial for accurate calculations. You can learn about different annuity formulas and how to apply them by exploring resources on How To Find Annuity Formula 2024.

As you delve deeper into the world of finance, the annuity formula will remain a constant companion, helping you navigate the path to financial success.

Question & Answer Hub

What is the difference between an ordinary annuity and an annuity due?

Choosing between an annuity and a lump sum can be a difficult decision. Learn about the pros and cons of each option to determine what might be best for you when considering Annuity Or Lump Sum 2024.

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period. This difference in timing impacts the calculation of the present and future values.

The annuity exclusion ratio is a factor that can affect the amount of income you receive from an annuity. Learn more about the Annuity Exclusion Ratio 2024 and how it might impact your retirement income.

How does inflation affect annuity calculations?

Inflation erodes the purchasing power of future payments. When calculating annuities, it’s crucial to factor in inflation to ensure the future value of the annuity is sufficient to maintain its real value.

What are some common mistakes to avoid when solving annuity problems?

Common mistakes include using the wrong interest rate, failing to account for the time value of money, and misinterpreting the payment period. Carefully review the problem statement and ensure you’re using the correct formula and inputs.