Annuity Formula Youtube 2024: Are you looking to understand the ins and outs of annuities? Annuities are a powerful financial tool, often used for retirement planning and investment purposes. But the concept can seem complex, especially when it comes to the annuity formula.

Annuity payments can vary depending on the initial investment amount. For instance, an annuity with an initial investment of 70,000 might have different payment structures compared to a smaller investment. You can explore the specifics of a 70,000 annuity at Annuity 70000 2024.

This video is your comprehensive guide to unraveling the mysteries of annuities, breaking down the formula and its applications into easily digestible chunks.

Annuity types can vary, and understanding the different options available is crucial for making informed financial decisions. If you’re looking to learn more about the various types of annuities, you can explore the different categories at 7 Annuities 2024.

We’ll start with the basics, explaining what an annuity is and exploring the different types available. Then, we’ll dive into the heart of the matter – the annuity formula. We’ll dissect its components, step-by-step, showing you how to calculate annuity payments and understand the variables that influence the outcome.

An annuity is a stream of regular payments over a set period. It’s a valuable tool for retirement planning, income generation, and more. If you’re looking for a simple explanation of what an annuity is and how it works, check out 1 An Annuity Is 2024.

From there, we’ll demonstrate how to use the formula to calculate the present value of an annuity, providing real-world examples to solidify your understanding.

Understanding how to calculate annuity cash flows is essential for anyone dealing with financial planning or investment strategies. Excel 2024 provides powerful tools for these calculations, making it easier than ever to analyze the future value of your investments. If you’re interested in learning more about this process, you can find detailed information on Calculating Annuity Cash Flows 2024.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s like a guaranteed income stream, designed to provide financial security during retirement or other life stages. Annuities are often used to supplement other retirement income sources, such as Social Security or pensions.

When working with annuities, it’s crucial to understand the number of periods involved. This calculator can help you determine the number of periods based on your specific annuity parameters. To access this valuable tool, visit Annuity Number Of Periods Calculator 2024.

Types of Annuities

Annuities come in various forms, each with unique features and benefits. Here are a few common types:

- Fixed Annuities:These offer guaranteed interest rates and fixed payments, providing predictable income. They are less susceptible to market fluctuations but may offer lower returns than variable annuities.

- Variable Annuities:These link your payments to the performance of underlying investments, such as stocks or bonds. They offer the potential for higher returns but also come with higher risk. Your payments may fluctuate based on the market’s performance.

- Immediate Annuities:These start providing payments immediately after you purchase them. They are often used for immediate income needs, such as supplementing retirement income or covering living expenses.

Key Features and Benefits of Annuities

- Guaranteed Income:Many annuities provide guaranteed payments, ensuring a steady stream of income regardless of market conditions. This can offer peace of mind and financial security.

- Tax Advantages:Annuities can offer tax advantages, particularly for tax-deferred growth. This means you may not have to pay taxes on the earnings until you withdraw them.

- Protection Against Outliving Your Savings:Annuities can help you avoid outliving your savings by providing a guaranteed income stream for a specific period or for life.

- Flexibility:Some annuities offer flexibility, allowing you to choose payment options, such as lump-sum payouts or monthly installments.

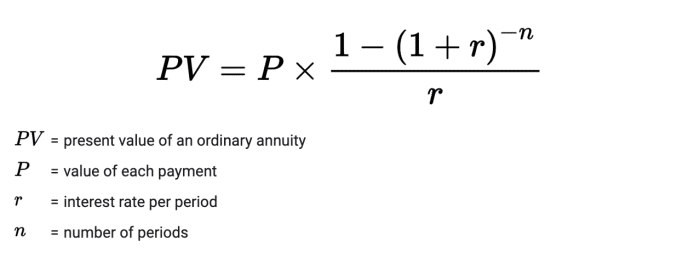

The Annuity Formula: Annuity Formula Youtube 2024

The annuity formula is a mathematical equation that helps calculate the present value or future value of an annuity. It’s essential for understanding the financial implications of annuities and making informed investment decisions.

The date on which an annuity starts can impact the overall value of the investment. It’s important to consider the starting date and how it affects the payment schedule. To learn more about how the date of an annuity can influence its value, visit Annuity Date Is 2024.

Basic Annuity Formula

The basic annuity formula is as follows:

PV = PMT- [1 – (1 + r)^-n] / r

Understanding how to calculate annuity cash flows is essential for anyone dealing with financial planning or investment strategies. Excel 2024 provides powerful tools for these calculations, making it easier than ever to analyze the future value of your investments. If you’re interested in learning more about this process, you can find detailed information on Calculating Annuity Cash Flows Excel 2024.

Where:

- PV = Present Value of the annuity

- PMT = Payment amount per period

- r = Interest rate per period

- n = Number of periods

Calculating Annuity Payments

To calculate an annuity payment, you need to know the present value (PV), interest rate (r), and number of periods (n). You can then use the annuity formula to solve for PMT.

Annuity concepts are often tested in multiple-choice questions (MCQs) in finance courses. To familiarize yourself with the key aspects of annuities and how they’re presented in MCQs, visit Annuity Is A Mcq 2024.

Here’s a step-by-step breakdown:

- Determine the present value (PV).This is the total amount of money you are investing in the annuity.

- Identify the interest rate (r).This is the rate of return you expect to earn on your investment.

- Calculate the number of periods (n).This is the total number of payments you will receive from the annuity.

- Plug the values into the annuity formula.

- Solve for PMT.This will give you the payment amount you will receive per period.

Annuity Formula Applications

The annuity formula has various applications in financial planning, investment analysis, and other areas.

Annuity regulations and options can vary depending on the country. If you’re in the UK, you can find specific information on annuities and their implications in the UK market at Annuity Uk 2024.

Calculating the Present Value of an Annuity

The annuity formula can be used to calculate the present value of an annuity. This is the amount of money you need to invest today to receive a specific stream of payments in the future.

Deciding whether an annuity is the right choice for you depends on your individual financial goals and circumstances. Before making a decision, it’s essential to weigh the pros and cons of annuities. To help you determine if an annuity is right for you, check out Is Getting An Annuity Worth It 2024.

For example, if you want to receive $1,000 per year for 10 years, with an interest rate of 5%, you can use the annuity formula to calculate the present value of this annuity.

Calculating the present value of an annuity due, where payments are made at the beginning of each period, requires a slightly different approach. For a step-by-step guide on calculating the present value of an annuity due, visit Calculate Annuity Due Present Value 2024.

Real-World Scenarios

Here are some real-world scenarios where the annuity formula is used:

- Retirement Planning:Annuities can be used to estimate retirement income needs and determine how much you need to save to achieve your financial goals.

- Loan Calculations:The annuity formula can be used to calculate loan payments, such as mortgage payments or car loans.

- Investment Analysis:The annuity formula can help you compare the returns of different investment options and make informed decisions.

Annuity Scenarios Table, Annuity Formula Youtube 2024

| Scenario | Present Value (PV) | Interest Rate (r) | Number of Periods (n) | Payment Amount (PMT) |

|---|---|---|---|---|

| Retirement Income | $100,000 | 5% | 20 years | $7,950 |

| Mortgage Payment | $200,000 | 4% | 30 years | $954 |

| Investment Analysis | $50,000 | 7% | 10 years | $7,150 |

Annuity Formula Resources

There are numerous online resources and tools available to help you calculate annuities and learn more about them.

If you’re in South Africa and looking for an annuity calculator, there are resources available specifically for the South African market. You can find a comprehensive annuity calculator designed for South African residents at Annuity Calculator South Africa 2024.

Online Calculators and Tools

Books and Articles

- “The Annuity Handbook: A Guide to Understanding and Choosing the Right Annuity” by Mark B. Balasa

- “Annuities: A Comprehensive Guide for Retirees” by Kenneth R. Hardy

Annuity Resources Table

| Resource Type | Resource Name | Description |

|---|---|---|

| Online Calculator | Calculator.net Annuity Calculator | Provides a comprehensive annuity calculator with various options for customizing calculations. |

| Book | “The Annuity Handbook: A Guide to Understanding and Choosing the Right Annuity” by Mark B. Balasa | Offers a detailed guide to annuities, covering their different types, features, and benefits. |

| Article | “Annuities: A Comprehensive Guide for Retirees” by Kenneth R. Hardy | Provides a comprehensive overview of annuities, focusing on their relevance for retirement planning. |

Annuity Formula Considerations

While annuities can offer financial security and income stability, it’s essential to consider various factors before investing in them.

The interest rate plays a significant role in determining the future value of an annuity. A 4% interest rate can result in a different growth trajectory compared to a higher or lower rate. For a detailed look at how a 4% interest rate impacts annuities, check out Annuity 4 Percent 2024.

Factors Influencing Annuity Payments

- Interest Rates:Interest rates play a significant role in determining annuity payments. Higher interest rates generally lead to higher payments.

- Time Period:The length of the annuity period also affects payments. Longer periods generally result in lower payments per period.

- Annuity Type:The type of annuity you choose, such as fixed or variable, can influence the payment amount and risk level.

Risks and Drawbacks

- Limited Liquidity:Annuities may have restrictions on withdrawals, making it difficult to access your money in emergencies.

- Fees and Expenses:Annuities often come with fees and expenses that can reduce your overall returns.

- Inflation Risk:Fixed annuities may not keep pace with inflation, reducing the purchasing power of your payments over time.

Choosing the Right Annuity

- Consider Your Financial Goals:Determine what you want to achieve with an annuity, such as retirement income, long-term savings, or legacy planning.

- Assess Your Risk Tolerance:Choose an annuity that aligns with your risk appetite. Fixed annuities are less risky, while variable annuities offer higher potential returns but come with more volatility.

- Compare Different Options:Research and compare different annuity products from various providers to find the best fit for your needs and financial situation.

- Seek Professional Advice:Consult with a financial advisor to discuss your individual circumstances and get personalized recommendations.

Final Conclusion

By the end of this video, you’ll have a firm grasp of the annuity formula, its applications, and the key considerations to make when working with annuities. You’ll be equipped to make informed decisions about your financial future, confident in your understanding of this essential financial tool.

So, buckle up and join us on this journey to demystify the annuity formula!

Detailed FAQs

What are the main types of annuities?

There are several types of annuities, including fixed, variable, immediate, and deferred annuities. Each type has its own features and benefits, and the best choice for you will depend on your individual needs and goals.

How do I choose the right annuity for me?

It’s crucial to consider factors such as your risk tolerance, investment goals, and time horizon when selecting an annuity. It’s also essential to compare different annuity options and consult with a financial advisor to make an informed decision.

When calculating the present value of an annuity, you need to consider the annuity factor, which represents the present value of a series of future payments. To learn more about how to calculate this crucial factor, visit Calculating The Annuity Factor 2024 for a comprehensive guide.

Are there any risks associated with annuities?

Yes, like any investment, annuities carry certain risks. These can include interest rate risk, market risk, and the potential for loss of principal. It’s important to understand these risks before investing in an annuity.

An annuity certain is a type of annuity where the payment schedule is fixed and guaranteed for a specific duration. To learn more about the formula used to calculate the present value of an annuity certain, visit Formula Annuity Certain 2024.