Annuity Immediate Vs Due, a concept often encountered in financial planning, presents two distinct approaches to receiving periodic payments. The key distinction lies in the timing of the first payment, with an annuity immediate starting at the end of the first period and an annuity due beginning at the start.

This seemingly subtle difference can significantly impact the overall value of the annuity, influencing both present and future value calculations.

A 30-year annuity is a type of annuity that provides payments for a period of 30 years. Annuity 30 Years 2024 can be a good option for those who want a long-term income stream, but it’s important to consider the impact of inflation.

Understanding the nuances of these two types of annuities is crucial for individuals seeking to maximize their financial returns. By carefully considering the timing of payments, individuals can make informed decisions regarding their investment strategies and retirement planning, ensuring they choose the option that best aligns with their financial goals and circumstances.

The exclusion ratio is a formula used to determine the portion of an annuity payment that is considered taxable income. Variable Annuity Exclusion Ratio 2024 can be a complex topic, so it’s important to consult with a financial advisor to understand how it applies to your situation.

Contents List

Annuities: Immediate vs. Due

Annuities are financial instruments that provide a stream of regular payments over a specified period. They are often used for retirement planning, income generation, and other financial goals. There are two main types of annuities: annuities immediate and annuities due.

Understanding the differences between these two types is crucial for making informed financial decisions.

An immediate annuity is a type of annuity that begins making payments immediately after you purchase it. Immediate Annuity Def is a simple explanation of this financial product, but it’s important to do your research and understand the terms and conditions of the policy.

Annuity Immediate

An annuity immediate is a type of annuity where the first payment is made at the end of the first period. This means that the first payment is received one period after the annuity is purchased.

An annuity is a financial product that provides a stream of payments for a certain period of time. Annuity Is Meaning 2024 can be a valuable tool for retirement planning, but it’s important to understand the different types of annuities available and how they work.

For example, if you purchase an annuity immediate with monthly payments, the first payment would be received one month after the purchase date. The payments continue for a predetermined period, which can be for a fixed number of years or for the lifetime of the annuitant.

Many people dream of retiring with a comfortable nest egg. Annuity 2 Million 2024 could be a potential option to help you achieve that goal, but it’s important to do your research and understand the risks and rewards.

- Payment Schedule:Payments are made at the end of each period.

- First Payment Timing:One period after the annuity is purchased.

- Suitable Situations:

- Retirement planning: When you need a steady stream of income starting after you retire.

- Income generation: When you want to generate regular income from a lump sum of money.

- Present Value Calculation:The present value of an annuity immediate is the discounted value of all future payments, taking into account the time value of money. It is calculated using the formula:

PV = PMT

- [1

- (1 + i)^-n] / i

where:

- PV = Present Value

- PMT = Payment amount

- i = Interest rate per period

- n = Number of periods

- Future Value Calculation:The future value of an annuity immediate is the accumulated value of all payments, compounded at a specific interest rate. It is calculated using the formula:

FV = PMT

Immediate annuities are popular in India, offering a guaranteed income stream for life. Immediate Annuity India can be a valuable tool for retirement planning, particularly for those seeking financial security and peace of mind.

- [(1 + i)^n

- 1] / i

where:

- FV = Future Value

- PMT = Payment amount

- i = Interest rate per period

- n = Number of periods

Annuity Due

An annuity due is a type of annuity where the first payment is made at the beginning of the first period. This means that the first payment is received immediately after the annuity is purchased.

Annuity products can be used for a variety of purposes, including retirement planning, income generation, and estate planning. Annuity is used in many different ways, and it’s important to understand how they work before investing.

For example, if you purchase an annuity due with monthly payments, the first payment would be received on the purchase date. The payments continue for a predetermined period, which can be for a fixed number of years or for the lifetime of the annuitant.

An annuity with a 6-year guarantee is a type of annuity that provides guaranteed payments for a period of 6 years. Annuity 6 Guaranteed 2024 can be a good option for those who want a short-term income stream with some level of security.

- Payment Schedule:Payments are made at the beginning of each period.

- First Payment Timing:Immediately after the annuity is purchased.

- Suitable Situations:

- Income replacement: When you need immediate income after a life-changing event like a job loss or disability.

- Rent payments: When you want to use an annuity to cover your monthly rent expenses.

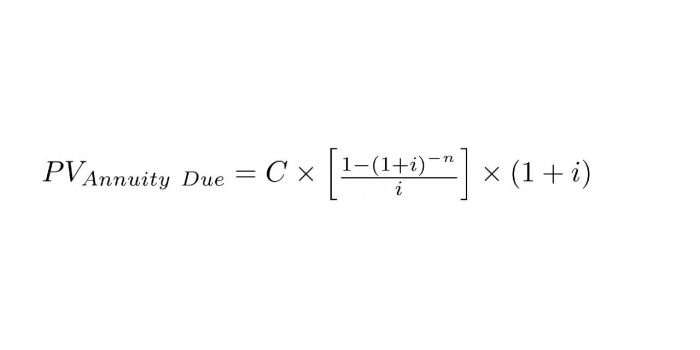

- Present Value Calculation:The present value of an annuity due is calculated using the formula:

PV = PMT

A 401(k) plan is a retirement savings plan offered by many employers. Annuity 401k Plan 2024 can be a valuable tool for retirement planning, but it’s important to understand the different options available to you.

- [1

- (1 + i)^-n] / i

- (1 + i)

where:

- PV = Present Value

- PMT = Payment amount

- i = Interest rate per period

- n = Number of periods

- Future Value Calculation:The future value of an annuity due is calculated using the formula:

FV = PMT

AIG is a major provider of insurance and financial products, including variable annuities. Aig Beneficiary Payout P Variable Annuity 2024 can be a valuable tool for estate planning, but it’s important to understand the terms and conditions of the policy.

- [(1 + i)^n

- 1] / i

- (1 + i)

where:

- FV = Future Value

- PMT = Payment amount

- i = Interest rate per period

- n = Number of periods

Comparison of Annuity Immediate and Annuity Due

The key difference between an annuity immediate and an annuity due lies in the timing of the first payment. This difference has a significant impact on the present value and future value of the annuity.

| Feature | Annuity Immediate | Annuity Due |

|---|---|---|

| First Payment Timing | End of the first period | Beginning of the first period |

| Present Value | Lower than annuity due | Higher than annuity immediate |

| Future Value | Lower than annuity due | Higher than annuity immediate |

Because the first payment in an annuity due is received earlier, its present value is higher than that of an annuity immediate. Similarly, the future value of an annuity due is also higher because the payments are compounded for one extra period.

An immediate annuity is a type of annuity that begins making payments immediately after you purchase it. Immediate annuity example s are often used by retirees who want a guaranteed income stream for life.

Factors Influencing Choice

The choice between an annuity immediate and an annuity due depends on individual financial goals and circumstances. Here are some factors to consider:

- Timing of income needs:If you need immediate income, an annuity due might be a better choice. If you can wait for a period before receiving payments, an annuity immediate might be more suitable.

- Investment horizon:If you have a longer investment horizon, an annuity due might provide higher returns due to the earlier compounding of interest.

- Tax implications:The tax treatment of annuities can vary depending on the type of annuity and the jurisdiction. It is important to consult with a financial advisor to understand the tax implications of each type of annuity.

Real-World Applications, Annuity Immediate Vs Due

Annuities immediate and due have various real-world applications, including:

- Retirement planning:Annuities can provide a steady stream of income during retirement. Annuities due can be particularly beneficial for individuals who need immediate income after retirement.

- Income generation:Annuities can be used to generate regular income from a lump sum of money. This can be helpful for individuals who want to supplement their income or create a passive income stream.

- Estate planning:Annuities can be used to provide income to beneficiaries after the death of the annuitant. This can be helpful for ensuring that loved ones are financially secure.

Conclusive Thoughts

Choosing between an annuity immediate and an annuity due is a decision that demands careful consideration, as the timing of payments can have a significant impact on the overall value of the annuity. By understanding the key differences between these two types of annuities, individuals can make informed choices that align with their financial objectives, ensuring they receive the maximum benefit from their investment.

Annuity is a financial product that provides a stream of payments for a certain period of time. Annuity Ka Hindi Meaning 2024 is “वार्षिकी,” and it can be a valuable tool for retirement planning, particularly in India where the concept of financial security is paramount.

FAQ Compilation: Annuity Immediate Vs Due

What are some real-world examples of annuity immediate and annuity due?

Annuity products can be complex, and it’s important to understand what you’re getting into. A variable annuity does not provide a guaranteed rate of return, and your investment could lose value. However, they can be a good option for those seeking growth potential and tax-deferred income.

Annuity immediate is often used in traditional pension plans, where payments begin after retirement. Annuity due, on the other hand, is commonly found in mortgage payments, where the first payment is due at the start of the loan term.

If you’re considering an annuity, it’s helpful to use an annuity estimator to get an idea of your potential payments. This can help you make informed decisions about your retirement planning.

How do I calculate the present value of an annuity immediate and an annuity due?

The present value of an annuity immediate is calculated using the formula PV = PMT – [(1 – (1 + r)^-n) / r], where PV is the present value, PMT is the periodic payment, r is the discount rate, and n is the number of periods.

The present value of an annuity due is calculated by multiplying the present value of an annuity immediate by (1 + r).

Which type of annuity is generally more beneficial?

An annuity is a financial product that provides a stream of payments for a certain period of time. Annuity is defined as a series of payments made at regular intervals, and it can be a valuable tool for retirement planning.

The best type of annuity depends on individual circumstances and financial goals. If you need immediate income, an annuity due may be more beneficial. However, if you are looking to maximize your future returns, an annuity immediate may be a better choice.