Annuity Is Excel 2024 takes center stage, guiding you through the intricate world of annuities using the power of Microsoft Excel. This guide unveils the secrets of managing financial plans, unlocking the potential of annuities for your future.

If you’re planning for retirement, understanding how annuities work is crucial. Learn about annuity calculations to make informed decisions about your financial future.

From understanding the basics of annuities, including their various types and benefits, to harnessing the capabilities of Excel 2024 to calculate payments, model scenarios, and visualize data, this comprehensive resource equips you with the knowledge and tools to make informed financial decisions.

Google Tasks is getting a refresh in 2024 with exciting new features. Discover the new features and enhancements that will make managing your tasks easier than ever.

Contents List

What is an Annuity?

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s often used for retirement planning, but it can also be used for other purposes like income generation or estate planning.

Glovo is expanding its reach, and their future plans are exciting. Explore Glovo’s expansion strategy and see how they’re revolutionizing the delivery industry.

Types of Annuities

There are several types of annuities, each with its own characteristics and benefits:

- Fixed Annuities:These annuities offer a guaranteed rate of return, which means that you know exactly how much you will receive each month. This type of annuity is ideal for those who are risk-averse and want a predictable income stream.

- Variable Annuities:These annuities invest in a portfolio of assets, such as stocks or bonds. The payments you receive will fluctuate based on the performance of the investments. This type of annuity can provide the potential for higher returns, but it also comes with more risk.

Pushbullet is a handy tool for seamless communication between your devices. Learn how to use Pushbullet to send links from your computer to your phone and simplify your workflow.

- Immediate Annuities:These annuities begin making payments immediately after you purchase them. This type of annuity is ideal for those who need income right away, such as retirees.

- Deferred Annuities:These annuities begin making payments at a future date, such as when you retire. This type of annuity allows you to accumulate a larger sum of money before you start receiving payments.

Benefits and Drawbacks of Annuities

- Benefits:

- Guaranteed income stream

- Tax-deferred growth

- Potential for higher returns (with variable annuities)

- Protection from market volatility (with fixed annuities)

- Drawbacks:

- Lower returns compared to other investments

- High fees and commissions

- Limited flexibility (with fixed annuities)

- Potential for market risk (with variable annuities)

Annuities in Excel 2024

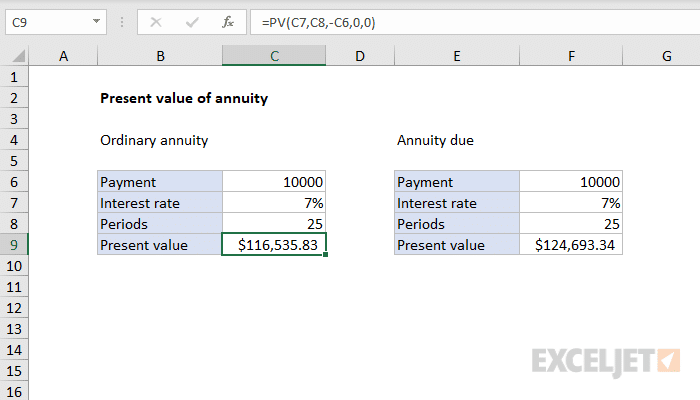

Excel 2024 offers powerful tools for calculating and analyzing annuity values. By leveraging its built-in financial functions, you can easily model different annuity scenarios and make informed decisions.

What do users think about the Glovo app? Read user reviews and ratings for 2024 to get a better understanding of the app’s strengths and weaknesses.

Calculating Annuity Payments in Excel

Excel provides a range of financial functions that can be used to calculate annuity values. The most common function used for this purpose is the PMT function. This function calculates the periodic payment amount for a loan or annuity.

Annuities can provide a steady stream of income during retirement, but are they guaranteed? Find out if annuities are certain and how they can benefit your retirement planning.

- Step 1: Define the Annuity Parameters

- Rate:The interest rate per period. This can be an annual interest rate divided by the number of payment periods per year.

- Nper:The total number of payment periods.

- PV:The present value of the annuity, which is the lump sum you are investing today.

- FV:The future value of the annuity, which is the amount you expect to have at the end of the annuity period.

- Type:This argument specifies whether payments are made at the beginning or end of each period. 0 indicates payments at the end of the period, and 1 indicates payments at the beginning of the period.

- Step 2: Use the PMT Function

- In an empty cell, type the formula “=PMT(Rate, Nper, PV, FV, Type)”.

- Replace the placeholders with the actual values of the annuity parameters you defined in Step 1.

- Press Enter to calculate the annuity payment amount.

Examples of Annuity Scenarios in Excel

Excel can be used to model various annuity scenarios, such as:

- Retirement Planning:You can use Excel to calculate the monthly income you can expect from an annuity during retirement, based on your savings, expected interest rates, and desired retirement duration.

- Loan Repayments:You can use Excel to calculate the monthly payments for a loan, taking into account the loan amount, interest rate, and loan term.

- Investment Growth:You can use Excel to project the future value of an investment, assuming a specific rate of return and investment period.

Key Annuity Functions in Excel 2024

Excel offers several built-in functions specifically designed for working with annuities. These functions simplify the calculation of key annuity values, including present value, future value, payments, and interest rates.

The metaverse is booming, and Android app development is playing a key role. Discover how Android app development is shaping the metaverse and the opportunities it presents.

Understanding the Functions

- PV (Present Value):This function calculates the present value of a future sum of money or a series of future payments. It is used to determine the lump sum you need to invest today to receive a specific stream of future payments.

Google Tasks is getting a major upgrade in 2024. Learn about the integration with Google Workspace and how it can streamline your workflow.

- FV (Future Value):This function calculates the future value of an investment or a series of payments. It is used to determine the total amount you will have at the end of a specific period, based on a certain interest rate and payment amount.

Looking to dive into Android app development? Find the best Android app development courses in 2024 to launch your career in this exciting field.

- PMT (Payment):This function calculates the periodic payment amount for a loan or annuity. It is used to determine the fixed payment amount you need to make each period to repay a loan or receive a specific stream of income.

- RATE (Interest Rate):This function calculates the interest rate per period for a loan or annuity. It is used to determine the interest rate required to achieve a specific future value or payment amount.

Using the Functions

Each of these functions requires specific arguments to perform the calculations:

- PV Function Arguments:

- Rate:The interest rate per period.

- Nper:The total number of payment periods.

- PMT:The payment amount per period.

- FV:The future value of the investment or annuity.

- Type:This argument specifies whether payments are made at the beginning or end of each period.

- FV Function Arguments:

- Rate:The interest rate per period.

- Nper:The total number of payment periods.

- PMT:The payment amount per period.

- PV:The present value of the investment or annuity.

- Type:This argument specifies whether payments are made at the beginning or end of each period.

- PMT Function Arguments:

- Rate:The interest rate per period.

- Nper:The total number of payment periods.

- PV:The present value of the investment or annuity.

- FV:The future value of the investment or annuity.

- Type:This argument specifies whether payments are made at the beginning or end of each period.

- RATE Function Arguments:

- Nper:The total number of payment periods.

- PMT:The payment amount per period.

- PV:The present value of the investment or annuity.

- FV:The future value of the investment or annuity.

- Type:This argument specifies whether payments are made at the beginning or end of each period.

Creating Annuity Tables in Excel 2024

Annuity tables provide a clear and organized way to track the growth of an annuity over time. By creating a table in Excel, you can easily visualize the impact of interest earned, payment amounts, and accumulated value.

Android WebView 202 is a powerful tool for mobile developers. Discover how Android WebView 202 can enhance your mobile development projects and create seamless web experiences.

Designing the Annuity Table

To create an annuity table in Excel, follow these steps:

- Step 1: Set up the Table Structure

- In a new worksheet, create a table with the following columns:

- Payment Number

- Payment Amount

- Interest Earned

- Accumulated Value

- In a new worksheet, create a table with the following columns:

- Step 2: Input Initial Values

- In the first row of the table, enter the initial values for the annuity, such as the starting principal, interest rate, and payment amount.

- Step 3: Use Formulas to Calculate Values

- In the second row of the table, use formulas to calculate the values for the remaining columns:

- Payment Number:Increment the payment number by 1 for each subsequent row.

- Payment Amount:Enter the fixed payment amount for each row.

- Interest Earned:Multiply the previous accumulated value by the interest rate.

- Accumulated Value:Add the payment amount and interest earned to the previous accumulated value.

- In the second row of the table, use formulas to calculate the values for the remaining columns:

- Step 4: Copy Formulas Down

- Copy the formulas from the second row down to the remaining rows of the table to automatically calculate the values for each payment period.

Visualizing Annuity Data: Annuity Is Excel 2024

Excel provides a range of charting tools that can be used to visualize annuity data. By creating charts, you can gain a better understanding of the growth of an annuity over time and the impact of different factors, such as interest rates and payment amounts.

Are annuities a bad investment? Explore the pros and cons of annuities to make informed financial decisions.

Creating a Line Chart

To create a line chart to visualize the growth of an annuity, follow these steps:

- Step 1: Select the Data

- Select the columns for “Payment Number” and “Accumulated Value” from the annuity table.

- Step 2: Insert a Line Chart

- Go to the “Insert” tab and click on the “Line” chart icon.

- Choose the line chart type that best suits your needs.

- Step 3: Format the Chart

- Add a title to the chart that clearly describes the data being visualized.

- Label the axes with appropriate units and descriptions.

- Customize the chart colors and styles to improve readability.

Adding a Bar Chart, Annuity Is Excel 2024

To add a bar chart to represent the interest earned each year, follow these steps:

- Step 1: Select the Data

- Select the columns for “Payment Number” and “Interest Earned” from the annuity table.

- Step 2: Insert a Bar Chart

- Go to the “Insert” tab and click on the “Bar” chart icon.

- Choose the bar chart type that best suits your needs.

- Step 3: Format the Chart

- Add a title to the chart that clearly describes the data being visualized.

- Label the axes with appropriate units and descriptions.

- Customize the chart colors and styles to improve readability.

Real-World Applications of Annuities in Excel 2024

Annuities are versatile financial tools that can be used in a variety of real-world scenarios. Excel provides a powerful platform for analyzing and modeling annuity options to make informed financial decisions.

Looking for a powerful laptop with long battery life? Consider getting one with a Snapdragon 2024 processor. These processors are known for their efficiency and performance, making them ideal for demanding tasks.

Retirement Planning

Annuities can be a valuable component of retirement planning, providing a guaranteed stream of income during retirement years. Excel can be used to model different annuity scenarios, considering factors such as:

- Retirement Savings:The amount of money you have saved for retirement.

- Expected Interest Rates:The interest rate you expect to earn on your annuity investments.

- Desired Retirement Income:The amount of monthly income you want to receive during retirement.

- Retirement Duration:The number of years you expect to live in retirement.

Income Generation

Annuities can also be used for income generation purposes, providing a regular stream of payments that can supplement other income sources. Excel can be used to analyze different annuity options, considering factors such as:

- Investment Amount:The amount of money you are willing to invest in an annuity.

- Annuity Type:The type of annuity you are considering, such as fixed or variable.

- Payment Frequency:The frequency of payments you want to receive, such as monthly or annually.

- Annuity Duration:The length of time you want to receive payments.

Estate Planning

Annuities can be incorporated into estate planning strategies to provide financial support for beneficiaries after your death. Excel can be used to model different annuity scenarios, considering factors such as:

- Beneficiary Needs:The financial needs of your beneficiaries.

- Annuity Type:The type of annuity you want to use for estate planning purposes.

- Payment Schedule:The schedule of payments you want to provide to your beneficiaries.

- Tax Implications:The tax implications of using an annuity for estate planning.

Final Conclusion

As we conclude our exploration of Annuity Is Excel 2024, you are empowered to leverage the dynamic duo of annuities and Excel for your financial planning needs. Whether you are seeking to secure a comfortable retirement, generate consistent income, or plan for your estate, this guide has equipped you with the knowledge and skills to navigate the complex world of annuities with confidence.

Questions Often Asked

What are the main advantages of using Excel for annuity calculations?

Excel offers a user-friendly environment for calculating annuities, allowing for flexibility, customization, and the ability to create visual representations of your financial plans.

Can I use Excel to compare different annuity options?

Absolutely! Excel’s versatility allows you to model various annuity scenarios, compare their projected outcomes, and make informed decisions based on your specific financial goals.

Is there a specific type of annuity best suited for retirement planning?

Want to create a personalized avatar that looks just like you? Check out Dollify 2024 , a tool that allows you to create realistic avatars with ease. From hairstyles to facial features, you can customize your avatar to perfection.

The ideal annuity for retirement planning depends on your individual circumstances, risk tolerance, and financial objectives. Consulting a financial advisor can help you determine the best option for your needs.

When it comes to retirement planning, should you choose an annuity or drawdown? Compare annuities and drawdown options to find the best fit for your needs.

Want to make money from your Android app? Discover different monetization strategies to turn your app into a profitable venture.