Annuity Is Taxable Or Not 2024: A Guide to Understanding Tax Implications – Annuities are a popular retirement savings tool, offering a steady stream of income in your later years. But understanding the tax implications of annuities can be tricky.

This guide will delve into the intricacies of annuity taxation, explaining how different types of annuities are treated by the IRS and outlining key tax strategies to minimize your tax burden.

We’ll cover everything from the basics of annuity taxation to the latest changes in tax laws affecting annuities in 2024. Whether you’re considering purchasing an annuity or already own one, this information will empower you to make informed financial decisions.

Annuity is a financial product that provides a stream of regular payments for a specified period of time. To understand how it works, you can refer to Annuity How It Works 2024. It’s a series of equal payments, as explained in Annuity Is A Series Of Equal Payments 2024 , and can be used for various purposes, such as retirement planning.

Contents List

Types of Annuities: Annuity Is Taxable Or Not 2024

Annuities are financial products that provide a stream of regular payments, either for a fixed period or for the lifetime of the annuitant. They can be a valuable tool for retirement planning, providing a steady source of income during your golden years.

Choosing between an annuity and a 401(k) can be a tough decision. You can explore the pros and cons of each option in Is Annuity Better Than 401k 2024. Annuity due is a type of annuity where payments are made at the beginning of each period.

You can find more information about it in Annuity Due Is 2024.

In 2024, there are several different types of annuities available, each with its own set of features, risks, and potential benefits. Let’s explore the most common types of annuities.

Fixed Annuities

Fixed annuities offer a guaranteed rate of return on your investment. This means that you know exactly how much interest you will earn each year, providing a sense of security and predictability. However, the downside is that the rate of return is typically lower than what you might earn with other investments, such as stocks or bonds.

Variable Annuities

Variable annuities are linked to the performance of the stock market. The value of your investment can fluctuate based on the performance of the underlying investments. This offers the potential for higher returns, but also carries a higher risk of losing money.

Indexed Annuities

Indexed annuities offer a blend of the stability of fixed annuities and the potential for growth of variable annuities. They are linked to a specific index, such as the S&P 500, but with a guaranteed minimum rate of return. This provides a level of protection against market downturns while still offering the potential for upside growth.

Table Comparing Annuity Types

| Feature | Fixed Annuity | Variable Annuity | Indexed Annuity |

|---|---|---|---|

| Rate of Return | Guaranteed, but typically lower | Fluctuates based on market performance | Linked to an index, with a guaranteed minimum rate of return |

| Risk | Low | High | Moderate |

| Potential Benefits | Guaranteed income stream, predictable returns | Potential for higher returns, flexibility | Potential for growth, downside protection |

Taxation of Annuity Payments

Understanding how annuity payments are taxed is crucial for maximizing your financial benefits. The IRS treats annuity payments as a combination of principal and interest, and taxes are applied accordingly. The specific tax treatment of annuity payments can vary depending on the type of annuity and the individual’s circumstances.

Annuity can be a useful tool for financial planning, but it’s important to understand its meaning and how it works. You can find a clear explanation with examples in Annuity Meaning With Example 2024. The “Annuity Number,” as described in Annuity Number 2024 , can help you determine the value of your annuity.

Tax Treatment of Annuity Payments

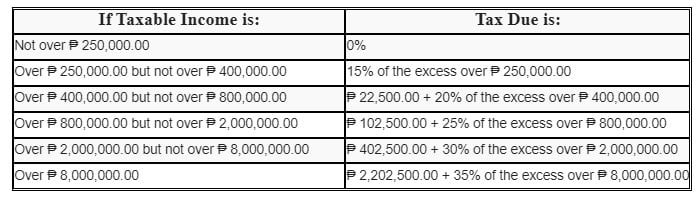

Annuity payments are generally taxed as ordinary income, which means they are taxed at your marginal tax rate. However, the portion of the payment that represents your original investment (principal) is not taxed. This is known as the “cost basis” of the annuity.

Examples of Annuity Taxation

Let’s consider a few examples to illustrate how annuity payments are taxed:

- Example 1:You purchased a $100,000 fixed annuity with a 4% annual interest rate. After 10 years, you begin receiving annual payments of $10,000. Each year, a portion of the $10,000 payment will represent the return of your original investment ($10,000/10 = $1,000), and the remaining $9,000 will be considered taxable income.

- Example 2:You purchased a variable annuity with a $100,000 investment. After 10 years, the value of your annuity has grown to $150,000. You decide to start receiving annual payments of $15,000. The portion of each payment that represents your original investment ($100,000/10 = $10,000) is not taxed.

The remaining $5,000 will be considered taxable income.

Tax Implications of Annuity Growth

The growth of your annuity investment can also have tax implications. Depending on the type of annuity, the growth may be tax-deferred or tax-sheltered. Understanding the tax implications of annuity growth is essential for making informed financial decisions.

Annuity is a complex financial product, and it’s important to understand its different aspects. If you’re taking a quiz or exam, you might encounter a multiple-choice question (MCQ) about annuities. You can find information on this in Annuity Is A Mcq 2024.

Annuity joint ownership, as explained in Annuity Joint Ownership 2024 , allows multiple people to benefit from the payments.

Tax-Deferred Growth

With tax-deferred growth, you do not pay taxes on the earnings until you begin receiving payments. This allows your investment to grow tax-free for a longer period. For example, with a traditional IRA annuity, the earnings grow tax-deferred, but you will pay taxes on the distributions when you begin receiving payments in retirement.

An annuity can be a part of a pension plan. You can learn more about this connection in Annuity Is Pension Plan 2024. Living annuities are often used for retirement income. You can find information on their taxability in Is A Living Annuity Taxable 2024.

Tax-Sheltered Growth

With tax-sheltered growth, the earnings are never taxed. This is typically the case with Roth IRAs. You pay taxes on your contributions upfront, but your earnings grow tax-free, and your withdrawals in retirement are also tax-free.

Tax Advantages of Annuities

Annuities can offer several tax advantages compared to other investment options. These advantages include:

- Tax-deferred growth:As mentioned earlier, tax-deferred growth allows your investment to grow tax-free for a longer period.

- Potential for tax-free withdrawals:With certain types of annuities, such as Roth IRAs, you can withdraw your earnings tax-free in retirement.

- Protection from taxes:Annuities can help protect your assets from taxes, especially if you choose a tax-sheltered option.

Tax Strategies for Annuities

There are several tax strategies that individuals can employ to minimize their tax liability on annuity income. These strategies can help you maximize your retirement savings and ensure that you keep more of your hard-earned money.

Tax-Efficient Strategies

Here are some tax-efficient strategies for annuities:

- Utilize Roth IRAs:Roth IRAs offer tax-sheltered growth and tax-free withdrawals in retirement. If you are in a lower tax bracket now than you expect to be in retirement, a Roth IRA can be a beneficial option.

- Consider a Qualified Longevity Annuity Contract (QLAC):A QLAC is a type of annuity that allows you to defer receiving payments until age 85 or later. This can help you avoid taxes on the annuity income until later in life, when you are likely in a lower tax bracket.

- Time your withdrawals strategically:You can control the timing of your annuity withdrawals to minimize your tax liability. For example, you might choose to take larger withdrawals in years when you are in a lower tax bracket.

Table of Common Tax Strategies for Annuities

| Strategy | Potential Benefits | Potential Drawbacks |

|---|---|---|

| Roth IRA | Tax-free withdrawals in retirement | Limited contributions, may not be suitable for everyone |

| QLAC | Defer taxes until later in life | Limited contribution amounts, potential for longevity risk |

| Strategic Withdrawal Timing | Minimize taxes by taking larger withdrawals in years with lower tax brackets | Requires careful planning and monitoring |

Considerations for Annuity Taxation in 2024

The tax landscape is constantly evolving, and it is important to stay informed about any changes that may affect your annuity taxation in 2024. Here are some key factors to consider:

Recent Changes to Tax Laws

Keep an eye out for any new tax legislation or regulations that may impact annuities. For example, changes to tax rates or deductions could affect your tax liability on annuity income.

Economic Climate, Annuity Is Taxable Or Not 2024

The current economic climate can also influence annuity taxation. For instance, if interest rates rise, it could affect the growth of your annuity and, consequently, your tax liability.

If you’re currently receiving annuity payments, you might be considered an annuitant. You can find more information on this in K Is An Annuitant Currently Receiving Payments 2024. Annuity is a term used in various languages, including Bengali.

You can find its meaning in Bengali in Annuity Is Bengali Meaning 2024.

Key Factors to Consider

Here are some key factors to consider when evaluating the tax implications of annuities in 2024:

- Type of annuity:Different types of annuities have different tax treatments. It’s important to understand the specific tax implications of the annuity you are considering.

- Your tax bracket:Your current and future tax bracket will influence your tax liability on annuity income.

- Your financial goals:Your financial goals will determine how you use your annuity and how it will be taxed.

- Professional advice:Consult with a tax advisor or financial planner to discuss your specific situation and develop a tax-efficient strategy for your annuity.

Closure

Navigating the tax landscape of annuities can seem daunting, but with careful planning and understanding, you can maximize your retirement income and minimize your tax liability. Remember, seeking professional advice from a qualified tax advisor is always recommended, especially when making significant financial decisions.

Essential FAQs

What are the different types of annuities?

Before purchasing an annuity, you might wonder if it’s qualified, as explained in Annuity Is Qualified 2024. Deciding if getting an annuity is worth it can be a personal choice, but you can find insights in Is Getting An Annuity Worth It 2024.

Annuity calculators can help you estimate your potential payments. You can find a UK-specific calculator in Annuity Calculator Uk 2024.

Annuities come in various forms, including fixed, variable, and indexed annuities. Each type offers different features, risks, and potential returns.

How are annuity payments taxed?

The tax treatment of annuity payments depends on the type of annuity and how it was funded. Generally, a portion of each payment is considered a return of your principal (tax-free) and the remaining portion is taxed as ordinary income.

Are annuities a good investment for everyone?

Annuities can be a valuable part of a diversified retirement portfolio, but they may not be suitable for everyone. Consider your individual financial situation, risk tolerance, and long-term goals before investing in an annuity.