Annuity Is The Value Of 2024 takes center stage as we delve into the world of retirement income. Annuities, often viewed as a cornerstone of financial planning, offer a unique blend of guaranteed payments and potential growth, making them a compelling option for individuals seeking financial security in their later years.

Annuities are not life insurance, but they can provide a guaranteed income stream for life. To understand the differences and similarities, check out the article Is Annuity Life Insurance 2024.

In today’s economic climate, characterized by market volatility and rising inflation, annuities provide a sense of stability and predictability that many investors find appealing. They can serve as a safety net against unexpected expenses and help ensure a consistent stream of income throughout retirement.

Looking for annuity quotes in Canada? Finding the right annuity can be a challenge, but comparing quotes from different providers can help you find the best option. Check out Annuity Quotes Canada 2024 to get started.

Contents List

- 1 Annuities: The Value of 2024

- 1.1 What is an Annuity?, Annuity Is The Value Of 2024

- 1.2 Types of Annuities

- 1.3 Key Features of Annuities

- 1.4 Why Annuities Might Be Relevant in 2024

- 1.5 Factors to Consider When Choosing an Annuity

- 1.6 Annuity vs. Other Investment Options

- 1.7 How to Find the Right Annuity

- 1.8 Potential Risks Associated with Annuities

- 2 Outcome Summary

- 3 Expert Answers: Annuity Is The Value Of 2024

Annuities: The Value of 2024

In an era marked by economic uncertainty and shifting investment landscapes, annuities have emerged as a compelling financial tool for individuals seeking security and growth. Annuities offer a unique blend of guaranteed income, tax advantages, and potential for long-term wealth accumulation, making them a valuable consideration for investors of all ages, especially those nearing retirement.

Annuity due refers to a payment made at the beginning of each period. Understanding the concept of annuity due can be beneficial when calculating financial returns. For a comprehensive explanation, check out Annuity Due Is 2024.

What is an Annuity?, Annuity Is The Value Of 2024

An annuity is a financial product that provides a stream of regular payments over a specified period. Imagine it as a contract between you and an insurance company where you make a lump-sum payment or a series of payments, and in return, the insurance company guarantees to pay you a fixed or variable amount of money for a specific period, either for life or for a set number of years.

Understanding annuity examples can make the concept easier to grasp. By looking at real-world scenarios, you can see how annuities work in practice. Explore Annuity Examples 2024 for practical insights.

Types of Annuities

- Fixed Annuities:These annuities offer a guaranteed rate of return on your investment. The payments you receive are fixed and predictable, providing financial stability and peace of mind.

- Variable Annuities:These annuities invest your money in a range of sub-accounts, such as stocks or bonds. Your payments can fluctuate based on the performance of these investments, offering the potential for higher returns but also carrying greater risk.

- Immediate Annuities:These annuities begin paying out immediately after you purchase them. They are ideal for those seeking a steady income stream right away.

- Deferred Annuities:These annuities start paying out at a later date, typically after a certain period or when you reach a specific age. They allow you to accumulate wealth tax-deferred before receiving payments.

Key Features of Annuities

- Guaranteed Payments:Annuities provide guaranteed income streams, ensuring you receive regular payments even if your investments underperform.

- Tax Advantages:Annuity payments are typically taxed as ordinary income, but the growth of your investment within the annuity is tax-deferred until you begin receiving payments.

- Potential for Growth:Variable annuities offer the potential for growth based on the performance of your investments, allowing your money to grow over time.

Why Annuities Might Be Relevant in 2024

The current economic climate presents a compelling case for considering annuities. Inflation remains a concern, and interest rates are rising, making it challenging to find investments that provide guaranteed returns. Annuities offer a solution by providing a stable stream of income that can help mitigate the effects of inflation and market volatility.

An annuity is a financial product that provides a steady stream of income for a specific period. For a comprehensive explanation of how annuities work, check out Annuity Explained 2024.

Factors to Consider When Choosing an Annuity

- Fees and Charges:Understand the fees associated with the annuity, including surrender charges, administrative fees, and mortality and expense charges. Compare fees across different annuity providers to find the most cost-effective option.

- Guarantees:Carefully evaluate the guarantees offered by the annuity, such as the guaranteed rate of return, the guaranteed minimum death benefit, and the guaranteed income stream.

- Flexibility:Consider the flexibility of the annuity in terms of withdrawal options, death benefits, and the ability to adjust payments.

Annuity vs. Other Investment Options

Annuities are not a one-size-fits-all solution. It’s crucial to compare them with other investment options, such as stocks, bonds, and mutual funds, to determine the best fit for your individual needs and goals.

Annuity home loans can offer a unique way to manage mortgage payments. By using an annuity to fund your loan, you can ensure regular payments and potentially save on interest costs. Learn more about Annuity Home Loan 2024 and its advantages.

| Investment Option | Pros | Cons |

|---|---|---|

| Annuities | Guaranteed income, tax advantages, potential for growth, protection against longevity risk | Fees and charges, surrender charges, limited liquidity |

| Stocks | Potential for high returns, growth potential, liquidity | Volatility, market risk, no guaranteed returns |

| Bonds | Lower risk than stocks, potential for income, stability | Lower returns than stocks, interest rate risk, inflation risk |

| Mutual Funds | Diversification, professional management, liquidity | Fees and charges, market risk, potential for underperformance |

How to Find the Right Annuity

- Research and Compare:Utilize online resources, such as annuity comparison websites, to research different annuity providers and compare their products and fees.

- Consult a Financial Advisor:Seek guidance from a qualified financial advisor who can help you assess your financial goals, risk tolerance, and understand the intricacies of different annuity options.

Potential Risks Associated with Annuities

- Surrender Charges:These charges are imposed if you withdraw your money from the annuity before a certain period. Carefully review the surrender charge schedule before investing.

- Market Risk:Variable annuities are subject to market risk, meaning the value of your investment can fluctuate based on the performance of the underlying investments.

- Inflation Risk:Fixed annuities may not keep pace with inflation, meaning your purchasing power could erode over time.

Outcome Summary

As we conclude our exploration of Annuity Is The Value Of 2024, it’s clear that annuities offer a valuable tool for individuals seeking to build a robust retirement plan. By carefully considering the various types of annuities, understanding the potential risks and rewards, and seeking expert advice, individuals can make informed decisions that align with their financial goals and aspirations.

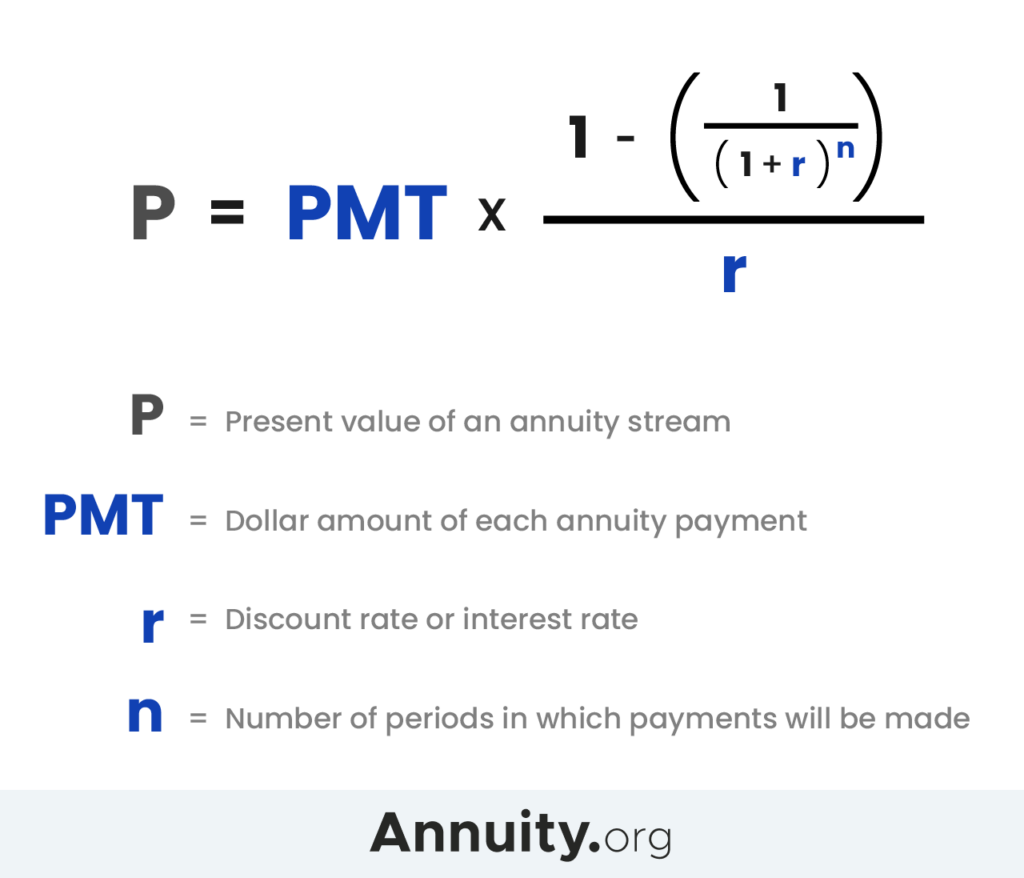

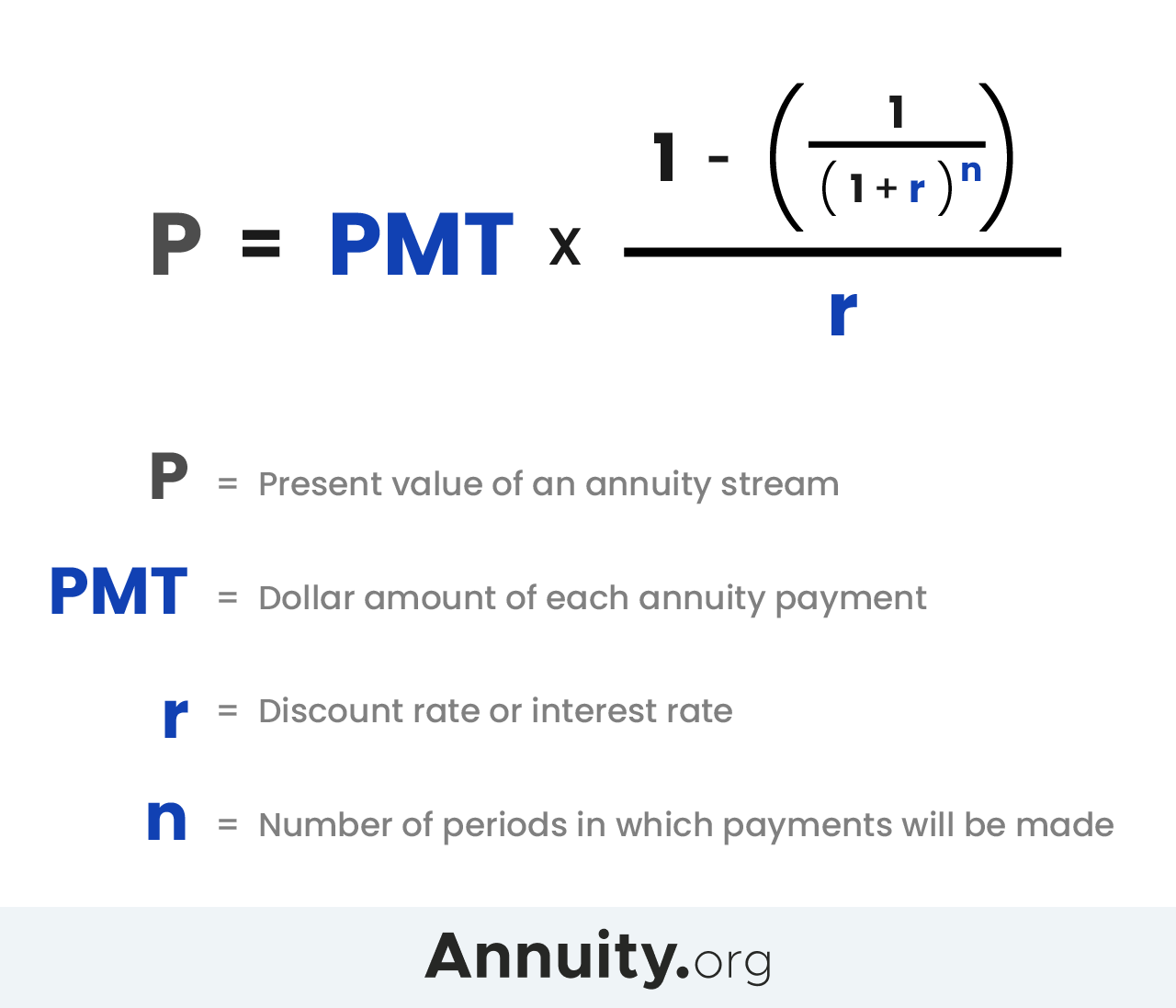

The annuity equation helps calculate the present or future value of a stream of payments. Understanding this equation is crucial for making informed financial decisions. Explore the article Annuity Equation 2024 for a deeper understanding.

Expert Answers: Annuity Is The Value Of 2024

What are the tax implications of annuity payments?

Annuity payments are generally taxed as ordinary income. However, the specific tax treatment may vary depending on the type of annuity and the terms of the contract.

While annuities and pensions share similarities, they are not the same. Pensions are typically provided by employers, while annuities are purchased individually. To understand the differences, explore the article Is Annuity Same As Pension 2024 for a detailed explanation.

Can I withdraw my money from an annuity before retirement?

Yes, but you may be subject to penalties and surrender charges depending on the terms of the annuity contract. It’s important to consult with a financial advisor before withdrawing funds from an annuity.

Annuity beneficiaries can be trusts, which can provide a structured way to distribute funds to heirs. If you’re considering this option, it’s essential to understand the implications. You can learn more about Annuity Beneficiary Is A Trust 2024 and its implications for your financial planning.

How do I choose the right annuity provider?

It’s essential to research reputable annuity providers with a proven track record of financial stability and customer service. Consider factors like fees, guarantees, and customer reviews.

The field of health careers offers a wide range of opportunities, and annuities can play a role in financial planning for those in this field. To learn more about Annuity Health Careers 2024 , explore the article.

Staying up-to-date on annuity news is crucial for making informed financial decisions. To stay informed, check out Annuity News 2024 for the latest developments and trends.

Annuities can provide a source of income, but it’s important to understand how they are taxed. To learn more about the tax implications, explore the article Is Annuity Income 2024.

The Hindi meaning of “annuity” can be helpful for understanding financial concepts in different languages. To learn the Hindi translation, visit Annuity Ka Hindi Meaning 2024.

Annuity payments represent the present value of a future stream of income. To understand this concept better, check out Annuity Is Present Value 2024 for a detailed explanation.

Annuity Gator is a company that offers annuity products. Before investing, it’s crucial to research the legitimacy of any financial provider. To learn more about Is Annuity Gator Legit 2024 , explore the article.