Annuity Issues 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The year 2024 promises to be a pivotal one for the annuity market, with significant trends and challenges shaping the landscape for individuals seeking retirement income solutions.

This comprehensive guide delves into the intricacies of annuities, exploring market trends, rate dynamics, tax considerations, and the evolving regulatory environment.

Sharing files between Android and iOS devices can be a hassle, but Pushbullet offers a seamless solution. Learn how to easily transfer files between your devices with Pushbullet 2024: How to use Pushbullet to share files between Android and iOS devices.

This article provides a step-by-step guide to using Pushbullet for efficient file sharing.

From understanding the anticipated growth or decline of the annuity market to navigating the complexities of tax implications and potential risks, this exploration equips readers with the knowledge necessary to make informed decisions about their retirement planning. Whether you are considering an annuity for the first time or seeking to optimize your existing strategy, this in-depth analysis provides valuable insights and actionable advice.

Pushbullet is a handy tool for staying connected across devices. Learn how to send messages from your computer to your phone with Pushbullet 2024: How to use Pushbullet to send messages from your computer to your phone. This article explains the simple process of using Pushbullet for cross-device communication.

Contents List

Annuity Market Trends in 2024

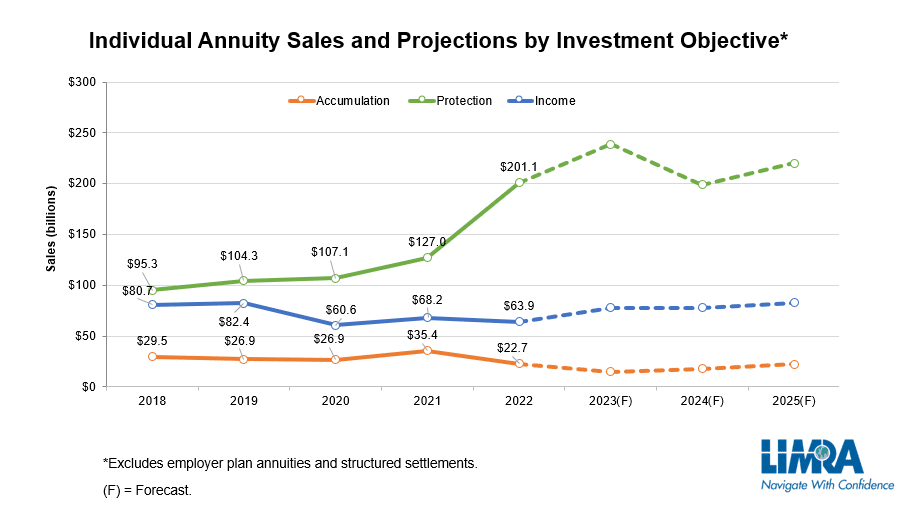

The annuity market is constantly evolving, driven by factors such as demographic shifts, interest rate fluctuations, and regulatory changes. In 2024, the market is expected to see continued growth, albeit at a slower pace than in previous years. This trend is influenced by several key factors, including the aging population, the search for guaranteed income streams, and the increasing demand for personalized financial solutions.

For Mobile Legends enthusiasts, GameGuardian offers a range of tools to enhance gameplay. Explore the features and benefits of GameGuardian 2024 for Mobile Legends , including speed adjustments, resource manipulation, and more. Discover how GameGuardian can help you take your Mobile Legends skills to the next level.

Growth and Decline Projections

While the annuity market is projected to grow in 2024, the rate of growth is expected to be more moderate compared to previous years. This moderation can be attributed to factors such as rising interest rates, which can make annuities less attractive compared to other investment options, and potential regulatory changes that might impact the industry.

Create stunning and realistic avatars with Dollify 2024! Explore the capabilities of Dollify 2024: Creating Realistic Avatars , including advanced customization options, detailed features, and a wide range of styles. Discover how Dollify can help you bring your avatar ideas to life.

Driving Factors

- Demographic Shifts:The aging population is a significant driver of annuity demand. As baby boomers enter retirement, they seek reliable income streams to supplement their savings and ensure financial security.

- Interest Rate Fluctuations:Interest rates play a crucial role in annuity pricing. Rising interest rates can lead to higher annuity rates, making them more attractive to investors. Conversely, falling interest rates can result in lower annuity rates, potentially reducing their appeal.

- Regulatory Changes:Regulatory changes can significantly impact the annuity market. New regulations may introduce stricter requirements for annuity providers, potentially affecting the types of products offered and their pricing.

Evolving Demand for Annuity Types

The demand for different types of annuities is evolving as investors seek solutions tailored to their specific needs and risk tolerance. Here’s a breakdown of the evolving demand:

- Fixed Annuities:Fixed annuities offer guaranteed interest rates and predictable income streams, making them popular among risk-averse investors seeking stability. However, their returns may not keep pace with inflation, potentially eroding the purchasing power of their income over time.

- Variable Annuities:Variable annuities offer the potential for higher returns but also carry greater risk. They invest in mutual funds or other securities, and their value can fluctuate based on market performance. This makes them suitable for investors with a higher risk tolerance and a longer investment horizon.

Security is paramount in Android app development. Stay informed about the latest security updates for Android WebView 202 with Android WebView 202 security updates. This article provides insights into common vulnerabilities and how to mitigate them, ensuring the safety of your WebView-based applications.

- Indexed Annuities:Indexed annuities offer a balance between guaranteed returns and the potential for higher growth. They link their returns to the performance of a specific market index, such as the S&P 500, while providing a minimum guaranteed return. This makes them attractive to investors seeking a mix of security and potential upside.

Android WebView 202 is constantly evolving, bringing new features and improvements. Stay updated with the latest advancements in Android WebView 202 new features. This article provides an overview of the most recent additions to WebView 202, including performance enhancements, security updates, and new APIs.

Annuity Rates and Returns

Annuity rates are influenced by various factors, including interest rates, market conditions, and the type of annuity. Understanding current rates and their potential changes is crucial for making informed decisions.

Looking for the best camera phones of 2024? Android Authority has compiled a comprehensive list of the top contenders in Android Authority 2024 top camera phone picks. Whether you’re a professional photographer or just enjoy capturing everyday moments, this article provides valuable insights to help you choose the perfect camera phone for your needs.

Current Annuity Rates

As of [Current Date], annuity rates vary depending on the type of annuity, the issuing company, and the individual’s age and health. For example, a fixed annuity might offer an annual interest rate of [Example Rate] while a variable annuity might offer a potential return linked to a specific market index.

The metaverse is rapidly evolving, and Android app development is playing a key role. Discover the latest trends and opportunities in Android app development for the metaverse in 2024. This article explores the exciting future of app development in the metaverse, covering essential aspects like user experience, virtual reality integration, and emerging technologies.

Historical Data and Comparisons

Comparing current annuity rates to historical data can provide insights into potential trends. Over the past [Number] years, annuity rates have generally [Trend Description], influenced by [Factors Influencing Trends]. This historical context helps investors understand the current market environment and make informed decisions.

Potential Rate Changes in 2024

Predicting future annuity rates with certainty is impossible, but analyzing current market conditions and economic forecasts can provide insights into potential rate changes. In 2024, annuity rates are expected to be influenced by factors such as [Factors Affecting Rates]. For instance, [Example Scenario].

Market Volatility and Risk Management

Market volatility can significantly impact annuity returns. While some annuities offer guarantees, others are subject to market fluctuations. Investors must understand the risks associated with their chosen annuity and implement strategies to mitigate potential losses. This might involve diversifying their investments, adjusting their investment horizon, or seeking professional financial advice.

Tax Considerations for Annuities

Understanding the tax implications of annuities is crucial for maximizing returns and minimizing tax liabilities. The tax treatment of annuities varies depending on the type of annuity and the specific payout options chosen.

Android WebView 202 is a powerful tool for mobile development. Learn how to effectively leverage its features and capabilities in Android WebView 202 for mobile development. This article covers key aspects like performance optimization, integration with native code, and creating engaging user experiences.

Tax Implications of Different Annuity Types

- Fixed Annuities:Interest earned on fixed annuities is generally taxed as ordinary income. When withdrawals are made, a portion of the withdrawal is considered taxable income, while the remaining portion represents a return of principal and is not taxed.

- Variable Annuities:The growth of investments within a variable annuity is not taxed until the money is withdrawn. However, withdrawals are taxed as ordinary income.

- Indexed Annuities:Indexed annuities typically offer tax-deferred growth, meaning that earnings are not taxed until they are withdrawn. Withdrawals are generally taxed as ordinary income.

Tax Advantages and Disadvantages

Annuities offer certain tax advantages compared to other retirement savings options, such as traditional IRAs or 401(k) plans. These advantages include:

- Tax-Deferred Growth:Earnings within an annuity are not taxed until they are withdrawn.

- Potential for Tax-Free Income:In some cases, withdrawals from an annuity may be tax-free, depending on the type of annuity and the payout options chosen.

However, annuities also have some tax disadvantages, including:

- Taxable Withdrawals:When withdrawals are made, a portion of the withdrawal is typically considered taxable income.

- Potential for Higher Tax Rates:Withdrawals from an annuity may be taxed at a higher rate than other forms of income, depending on the individual’s tax bracket.

Minimizing Tax Liabilities

To minimize tax liabilities related to annuities, investors can consider the following strategies:

- Choose Tax-Efficient Payout Options:Some payout options, such as a fixed income stream, may result in lower tax liabilities than others, such as lump sum payments.

- Maximize Tax-Deferred Growth:By keeping money invested within an annuity, investors can benefit from tax-deferred growth and potentially lower their overall tax burden.

- Seek Professional Financial Advice:A financial advisor can help develop a tax-efficient strategy for managing annuities and minimizing tax liabilities.

Annuity Risks and Considerations

While annuities offer potential benefits, it’s crucial to understand the associated risks and considerations. Being aware of these risks can help investors make informed decisions and choose annuities that align with their individual needs and risk tolerance.

Dollify 2024 offers a fun and creative way to create avatars, but there are also other great options available. Discover the best alternatives to Dollify 2024 in Dollify 2024: The Best Dollify 2024 Alternatives. This article explores a range of avatar creation apps, highlighting their unique features and capabilities.

Potential Risks

- Market Risk:Variable annuities are subject to market risk, meaning their value can fluctuate based on the performance of the underlying investments. This can lead to potential losses, especially during periods of market downturn.

- Interest Rate Risk:Interest rate risk is particularly relevant for fixed annuities. When interest rates rise, the value of fixed annuities may decline, as they are typically issued with a fixed interest rate.

- Longevity Risk:Longevity risk refers to the risk of outliving one’s savings. If an individual lives longer than anticipated, their annuity payments may not last as long as needed, potentially leading to financial insecurity in their later years.

Risk Mitigation Strategies

Investors can mitigate these risks by:

- Diversifying Investments:Diversifying investments across different asset classes, such as stocks, bonds, and real estate, can help reduce market risk.

- Adjusting Investment Horizon:Choosing annuities with longer payout periods can help mitigate longevity risk by ensuring a steady stream of income for a longer duration.

- Seeking Professional Financial Advice:A financial advisor can help assess individual risk tolerance, understand the risks associated with different annuity types, and recommend appropriate solutions.

Common Annuity Scams

Unfortunately, annuity scams are prevalent, and investors must be vigilant to protect themselves from fraud. Common scams include:

- High-Pressure Sales Tactics:Scammers may use aggressive sales tactics to pressure individuals into purchasing annuities without fully understanding the risks and terms.

- Misleading Information:Scammers may provide false or misleading information about annuity rates, guarantees, or payout options to entice potential investors.

- Promises of High Returns:Be wary of promises of unusually high returns, as these are often a sign of a scam.

Tips for Avoiding Annuity Scams

To avoid annuity scams, investors should:

- Do Thorough Research:Research potential annuity providers and their products carefully, checking their reputation and track record.

- Seek Professional Advice:Consult with a trusted financial advisor before purchasing an annuity to ensure it’s a suitable investment for your needs.

- Be Cautious of High-Pressure Sales Tactics:Don’t be pressured into making a quick decision. Take your time, ask questions, and carefully review all documents before signing anything.

Annuity Options and Features: Annuity Issues 2024

The annuity market offers a wide range of options and features, allowing investors to customize contracts to meet their specific needs and financial goals. Understanding these options and features is crucial for making informed decisions and choosing the right annuity.

Comparing Annuity Types

| Annuity Type | Key Features | Benefits | Limitations |

|---|---|---|---|

| Fixed Annuity | Guaranteed interest rates, predictable income streams | Security, stability, guaranteed returns | Returns may not keep pace with inflation, limited potential for growth |

| Variable Annuity | Investment in mutual funds or other securities, potential for higher returns | Potential for higher returns, flexibility in investment choices | Market risk, potential for losses, higher fees |

| Indexed Annuity | Returns linked to a market index, minimum guaranteed return | Potential for higher returns, protection from market downturns, guaranteed return | Returns may be limited by the index’s performance, potential for lower returns than variable annuities |

Payout Options

Annuities offer various payout options, allowing investors to receive their funds in different ways. Common payout options include:

- Lump Sum:The entire annuity value is paid out as a single lump sum. This option is suitable for individuals who need a large sum of money immediately.

- Fixed Income:A fixed amount of money is paid out periodically, such as monthly or annually. This option provides a predictable and reliable income stream.

- Variable Income:The amount of money paid out varies based on the performance of the underlying investments. This option offers the potential for higher returns but also carries greater risk.

Riders and Guarantees

Riders and guarantees are optional features that can be added to an annuity contract to provide additional benefits or protection. These features can help customize the annuity to meet specific needs and preferences. Common riders include:

- Death Benefit Rider:Guarantees a death benefit to beneficiaries, even if the annuitant dies before receiving all of the annuity payments.

- Guaranteed Income Rider:Provides a guaranteed minimum income stream, regardless of market performance.

- Long-Term Care Rider:Provides access to long-term care benefits if the annuitant needs assistance with daily living activities.

Annuity Regulations and Consumer Protection

The annuity market is subject to a complex regulatory framework designed to protect consumers and ensure fair market practices. Understanding these regulations and the consumer protection resources available is essential for making informed decisions and navigating the annuity market effectively.

Building successful Android apps in 2024 requires adhering to best practices. Discover essential guidelines and strategies in Best practices for Android app development in 2024 , covering topics like user interface design, performance optimization, security, and more. These practices will help you create high-quality apps that meet user expectations.

Regulatory Landscape

Annuities are regulated by both federal and state agencies. The primary federal regulator is the Securities and Exchange Commission (SEC), which oversees the sale of variable annuities. State insurance regulators oversee the sale of fixed annuities and other types of annuities.

Android WebView 202 offers a versatile platform for various use cases. Explore its capabilities and discover how Android WebView 202 for specific use cases can be tailored to meet your specific requirements. This article provides examples and practical applications of WebView 202 in different scenarios.

In 2024, the regulatory landscape for annuities is expected to continue evolving, with potential changes in regulations impacting the industry.

Wondering if the Glovo app is available in your city or country? You can easily find out by checking this helpful resource: Is Glovo app available in my city or country. This article will provide you with all the information you need to know about Glovo’s availability in your region.

Consumer Protection Laws and Resources

Several consumer protection laws and resources are available to protect annuity holders. These include:

- The National Association of Insurance Commissioners (NAIC):The NAIC provides information and resources on annuity regulations, consumer protection, and complaint resolution.

- The Financial Industry Regulatory Authority (FINRA):FINRA oversees the sale of securities, including variable annuities. It provides information on investor protection, complaint resolution, and investor education.

Importance of Professional Advice, Annuity Issues 2024

Purchasing an annuity is a complex financial decision that should not be taken lightly. Seeking professional financial advice from a qualified and experienced advisor is crucial to ensure that the annuity is suitable for your individual needs and financial goals.

A financial advisor can help you understand the risks and benefits of different annuity types, choose the right annuity for your situation, and develop a comprehensive financial plan that includes annuities.

Staying organized across multiple devices is essential. Learn how to seamlessly sync your Google Tasks across all your devices with Google Tasks 2024: How to Sync Google Tasks Across Devices. This article provides step-by-step instructions and helpful tips to ensure your tasks are always accessible, no matter where you are.

Last Recap

As we conclude our exploration of Annuity Issues 2024, it is clear that the landscape for annuities is dynamic and evolving. By understanding the key trends, risks, and opportunities, individuals can position themselves to make informed decisions that align with their retirement goals.

Remember, seeking professional financial advice is crucial when navigating the complexities of annuities, ensuring your chosen strategy is tailored to your specific needs and risk tolerance. With careful consideration and a proactive approach, annuities can play a vital role in securing a comfortable and financially secure retirement.

Clarifying Questions

What are the main types of annuities?

Optimizing your Android WebView 202 implementation is crucial for a smooth and secure user experience. Learn about the best practices for Android WebView 202 best practices , including performance tuning, security measures, and effective resource management. These practices will help you create robust and efficient WebView applications.

There are several types of annuities, including fixed annuities, variable annuities, and indexed annuities. Each type offers different features and benefits, so it’s essential to understand their differences before making a decision.

How do I choose the right annuity for me?

Choosing the right annuity depends on your individual circumstances, including your age, risk tolerance, and financial goals. It’s recommended to consult with a financial advisor to determine the most suitable option for your needs.

Are there any penalties for withdrawing money from an annuity early?

Yes, most annuities have surrender charges for early withdrawals, which can vary depending on the contract. It’s important to review the terms of your annuity contract before making any withdrawals.

How do annuities work with Social Security?

Annuities can complement Social Security income, providing additional retirement income. However, it’s essential to consider the tax implications of both Social Security benefits and annuity payouts.

Are annuities a safe investment?

Annuities can provide a guaranteed stream of income, but they are not without risks. It’s crucial to understand the potential risks associated with each type of annuity before making an investment.