Annuity John Hancock 2024 presents a comprehensive exploration of John Hancock’s annuity offerings, designed to guide you through the complexities of retirement planning. From understanding the diverse types of annuities available to navigating the investment options and tax considerations, this guide aims to empower you with the knowledge you need to make informed decisions about your financial future.

While annuities are often associated with life insurance, the tax implications can vary depending on the type of annuity and how it’s structured. Is Annuity For Life Insurance Taxable 2024 explores the taxability of annuity payouts.

John Hancock, a renowned financial services provider, offers a wide range of annuity products designed to cater to various retirement needs and risk tolerances. Whether you’re seeking guaranteed income streams, growth potential, or a combination of both, John Hancock provides a diverse selection of annuities to help you secure your financial well-being during retirement.

Annuity certain is a type of annuity that guarantees payments for a fixed period of time, regardless of how long the annuitant lives. Annuity Certain Is An Example Of 2024 explains this type of annuity in detail.

Contents List

John Hancock Annuities

John Hancock is a well-established financial services company that offers a range of annuity products designed to provide income security and financial protection in retirement. Annuities are insurance contracts that provide a guaranteed stream of income, either for a specific period or for life.

Microsoft Excel can be used to calculate and analyze annuity payments, making it a useful tool for financial planning. Annuity Is Excel 2024 demonstrates how to use Excel for annuity calculations.

John Hancock annuities offer various features and benefits that can help individuals meet their retirement income needs and financial goals.

Annuity contracts can be a great way to secure a steady stream of income in retirement, but it’s important to weigh the pros and cons before making a decision. Is Annuity Good Investment 2024 provides insights on whether an annuity is a good investment for you.

John Hancock Annuity Products

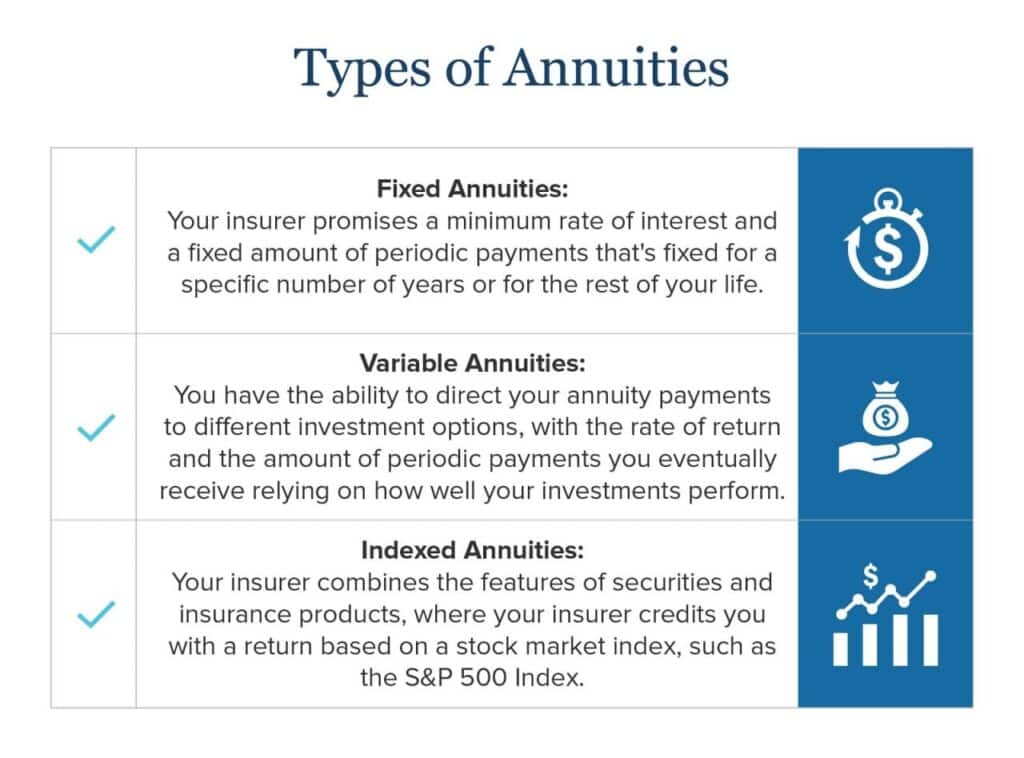

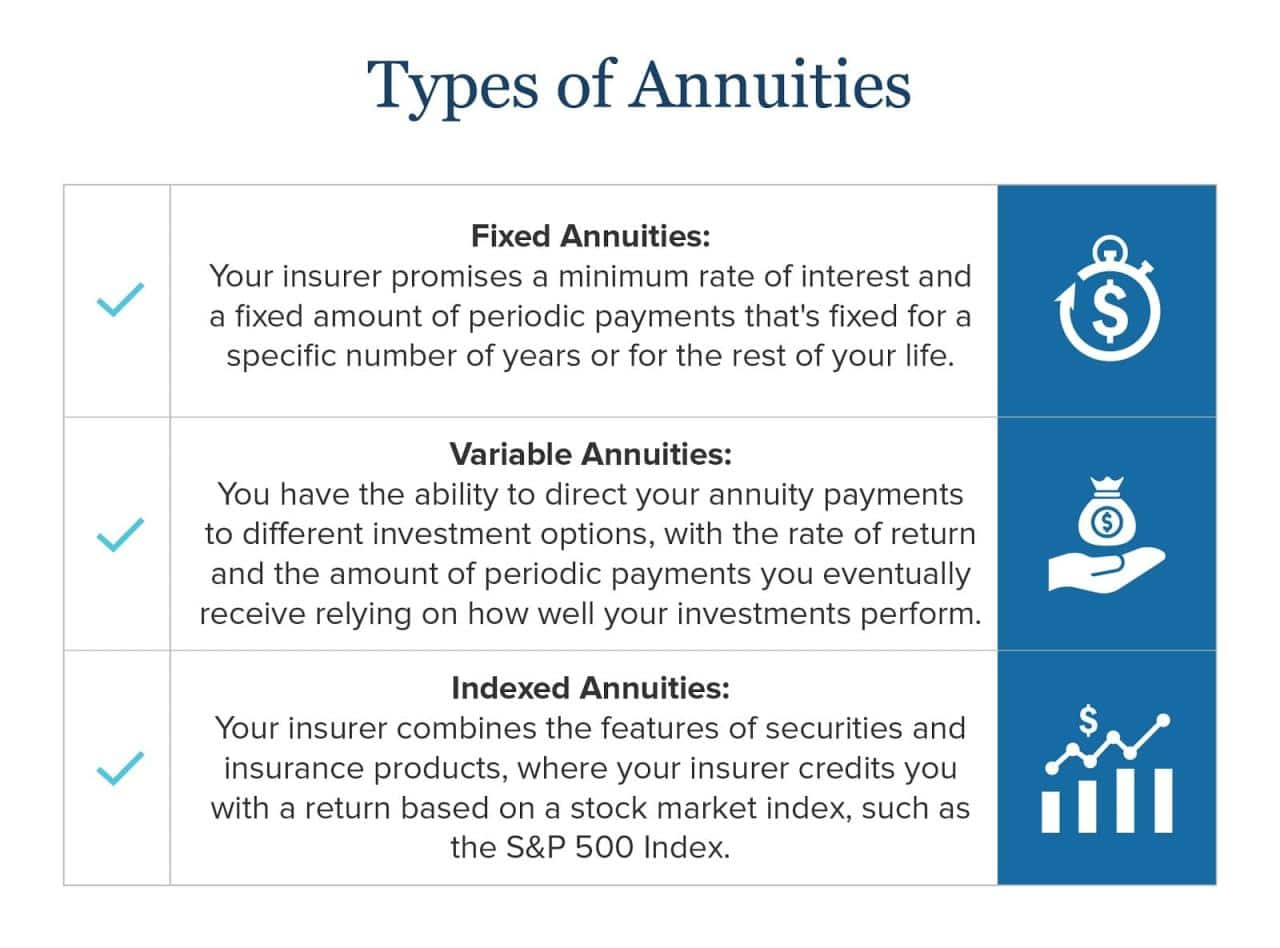

John Hancock offers a diverse range of annuity products to cater to different financial needs and risk tolerances. Here’s a breakdown of the common types of annuities offered by John Hancock:

- Fixed Annuities:These annuities provide a guaranteed interest rate for a specific period, offering predictable income payments. They are ideal for individuals seeking stability and protection from market volatility.

- Variable Annuities:These annuities allow you to invest your premiums in a variety of sub-accounts, similar to mutual funds. The value of your annuity can fluctuate based on the performance of the underlying investments. Variable annuities offer the potential for higher returns but also carry higher risk.

- Indexed Annuities:These annuities offer a return linked to the performance of a specific market index, such as the S&P 500. Indexed annuities provide potential for growth while also offering some protection from market downturns.

- Immediate Annuities:These annuities begin making payments immediately after you purchase them. They are often used to provide a steady stream of income for retirees.

- Deferred Annuities:These annuities start making payments at a later date, allowing your money to grow tax-deferred until you start receiving income. They are suitable for individuals who want to save for retirement and delay income until they need it.

Key Features and Benefits

John Hancock annuities come with various features and benefits that can enhance their value and appeal. Here are some key features to consider:

- Guaranteed Income:Many John Hancock annuities offer guaranteed income payments, providing peace of mind and financial security.

- Tax-Deferred Growth:Your annuity earnings grow tax-deferred, meaning you don’t pay taxes on them until you withdraw them. This can help your money grow faster over time.

- Death Benefit:Some John Hancock annuities include a death benefit, which can provide a lump sum payment to your beneficiaries upon your death.

- Riders:John Hancock offers various riders, or optional add-ons, that can enhance your annuity’s features and benefits. These riders can provide additional protection, income guarantees, or other valuable features.

- Flexibility:John Hancock annuities offer flexibility in terms of how you choose to receive your income payments, allowing you to customize your annuity to meet your individual needs.

Comparison Table

| Annuity Type | Key Features | Benefits | Risks |

|---|---|---|---|

| Fixed Annuity | Guaranteed interest rate, predictable income payments | Stability, protection from market volatility | Limited growth potential, interest rates may be lower than market returns |

| Variable Annuity | Investment options, potential for higher returns | Growth potential, flexibility | Market risk, potential for loss of principal |

| Indexed Annuity | Return linked to market index, potential for growth | Growth potential, some downside protection | Limited upside potential, may not keep pace with inflation |

| Immediate Annuity | Immediate income payments | Steady income stream, no waiting period | Limited flexibility, may not be suitable for long-term planning |

| Deferred Annuity | Tax-deferred growth, delayed income payments | Tax advantages, time for growth | May not be suitable for immediate income needs, potential for market risk |

Riders

John Hancock offers a variety of riders to enhance your annuity’s features and benefits. Some common riders include:

- Guaranteed Income Rider:Provides a guaranteed minimum income payment, even if your annuity’s investment performance is poor.

- Death Benefit Rider:Pays a lump sum payment to your beneficiaries upon your death.

- Long-Term Care Rider:Provides coverage for long-term care expenses, such as assisted living or nursing home care.

- Withdrawal Rider:Allows you to withdraw a portion of your annuity’s principal without penalty.

- Inflation Protection Rider:Helps protect your income payments from the effects of inflation.

Annuity Rates and Fees

Understanding the interest rates and fees associated with John Hancock annuities is crucial for making informed financial decisions. Rates and fees can vary depending on the type of annuity, the amount of your investment, and other factors.

WebView 202 is a powerful tool for mobile app development, allowing you to seamlessly embed web content within your applications. Android WebView 202 for mobile development showcases the benefits of using WebView 202 for mobile app development.

Interest Rates

The current interest rates offered by John Hancock for different annuity types can fluctuate based on market conditions. Here’s a general overview of interest rates:

- Fixed Annuities:Interest rates for fixed annuities are typically lower than those for variable annuities, but they provide guaranteed income.

- Variable Annuities:Interest rates for variable annuities are not fixed and can fluctuate based on the performance of the underlying investments.

- Indexed Annuities:Interest rates for indexed annuities are linked to the performance of a specific market index, offering potential for growth.

It’s important to note that interest rates can change over time, so it’s essential to review your annuity’s terms and conditions regularly. You can contact John Hancock directly or consult with a financial advisor to obtain current interest rates.

A deferred annuity is one where payments are delayed until a later date, often after a certain age or period of time. Annuity Is Deferred 2024 sheds light on the mechanics of deferred annuities.

Fees, Annuity John Hancock 2024

John Hancock annuities come with various fees that can impact your overall returns. These fees can include:

- Mortality and Expense Charges:These fees cover the insurance company’s costs of providing the annuity, including mortality risk and administrative expenses.

- Surrender Charges:These charges may apply if you withdraw your money from the annuity before a certain period.

- Rider Fees:Some riders, such as guaranteed income riders or long-term care riders, may have additional fees associated with them.

- Administrative Fees:These fees cover the costs of managing your annuity account.

Comparison with Other Providers

It’s essential to compare the rates and fees of John Hancock annuities with those of other major annuity providers. This can help you ensure you are getting a competitive rate and minimizing your overall costs. You can research online, consult with a financial advisor, or compare quotes from different providers.

The annuity equation is a mathematical formula used to calculate the present value of a series of future payments. Annuity Equation 2024 explains the annuity equation and its applications.

Annual Fees Table

| Fee Type | Description | Typical Fee Range |

|---|---|---|

| Mortality and Expense Charges | Covers the insurance company’s costs | 0.5% to 1.5% of your account balance |

| Surrender Charges | Applies to early withdrawals | 7% to 10% of your account balance, decreasing over time |

| Rider Fees | Varies depending on the rider | 0.5% to 1.5% of your account balance |

| Administrative Fees | Covers account management costs | $10 to $50 per year |

Investment Options

John Hancock annuities offer a variety of investment options within their variable and indexed annuity products. These options allow you to customize your investment strategy based on your risk tolerance and financial goals.

Investment Options

Here are some common investment options available within John Hancock annuities:

- Mutual Funds:John Hancock offers a wide range of mutual funds, covering various asset classes, including stocks, bonds, and money market instruments.

- Exchange-Traded Funds (ETFs):ETFs provide access to a diversified portfolio of assets, offering a cost-effective way to invest.

- Sub-Accounts:John Hancock annuities often offer sub-accounts, which are separate investment accounts within your annuity contract. You can allocate your funds to different sub-accounts based on your investment strategy.

Investment Strategies

You can employ various investment strategies within your John Hancock annuity. Here are some examples:

- Growth-Oriented:This strategy focuses on investments that have the potential for high returns, such as stocks or growth-oriented mutual funds. It is suitable for individuals with a higher risk tolerance and a long-term investment horizon.

- Income-Oriented:This strategy focuses on investments that provide regular income, such as bonds or dividend-paying stocks. It is suitable for individuals seeking a steady stream of income.

- Conservative:This strategy focuses on investments with low risk, such as money market instruments or short-term bonds. It is suitable for individuals with a low risk tolerance or who need to preserve their principal.

Managing Investments

Managing your investments within a John Hancock annuity involves several steps:

- Choose Investment Options:Select investment options that align with your risk tolerance, financial goals, and investment horizon.

- Allocate Funds:Allocate your funds among different investment options based on your chosen strategy.

- Monitor Performance:Regularly monitor the performance of your investments and adjust your strategy as needed.

- Rebalance:Rebalance your portfolio periodically to maintain your desired asset allocation.

- Seek Professional Advice:Consult with a financial advisor to help you develop and implement an investment strategy that meets your individual needs.

Investment Options and Risk Profiles Table

| Investment Option | Risk Profile | Potential Return |

|---|---|---|

| Large-Cap Stocks | High | High |

| Small-Cap Stocks | Higher | Higher |

| Bonds | Moderate | Moderate |

| Money Market Instruments | Low | Low |

Tax Considerations

Understanding the tax implications of owning a John Hancock annuity is crucial for maximizing your returns and minimizing your tax liability. Here’s a breakdown of the tax considerations:

Tax Implications

John Hancock annuities offer tax-deferred growth, meaning your earnings grow tax-deferred until you withdraw them. This can help your money grow faster over time. However, withdrawals from your annuity are generally taxed as ordinary income.

Whether an annuity is a good idea for you depends on your individual financial circumstances and goals. Annuity Is It A Good Idea 2024 explores the pros and cons of annuities to help you decide.

Withdrawals

Withdrawals from a John Hancock annuity are generally taxed as ordinary income, regardless of whether the withdrawals are made before or after you reach retirement age. However, there are some exceptions to this rule, such as withdrawals made for qualified education expenses or for certain medical expenses.

Tax Benefits

While withdrawals from a John Hancock annuity are taxed as ordinary income, there are some tax benefits to owning an annuity. These benefits include:

- Tax-Deferred Growth:Your annuity earnings grow tax-deferred, allowing your money to grow faster over time.

- Potential for Tax-Free Income:If you withdraw your annuity funds after you reach age 59 1/2, you may be able to access a portion of your annuity’s principal tax-free.

- Tax-Free Death Benefit:The death benefit from a John Hancock annuity is generally tax-free to your beneficiaries.

Tax Implications of Distributions Table

| Distribution Type | Tax Implications |

|---|---|

| Withdrawals before age 59 1/2 | Taxed as ordinary income, may be subject to a 10% penalty |

| Withdrawals after age 59 1/2 | Taxed as ordinary income |

| Death Benefit | Generally tax-free to beneficiaries |

Customer Service and Reputation: Annuity John Hancock 2024

John Hancock’s customer service policies and reputation are essential factors to consider when choosing an annuity provider. Here’s a look at their customer service and overall reputation:

Customer Service

John Hancock provides various customer service channels, including phone, email, and online resources. They have a dedicated customer service team that can assist you with your annuity needs, including account inquiries, payment options, and policy changes.

The tax implications of an annuity’s death benefit can be complex, and understanding the rules is crucial for beneficiaries. Is Annuity Death Benefit Taxable 2024 examines the taxability of death benefits from annuities.

Customer Reviews and Testimonials

You can find customer reviews and testimonials online about John Hancock annuities. These reviews can provide insights into their customer service, product offerings, and overall satisfaction levels. It’s important to read a variety of reviews to get a balanced perspective.

There are various types of annuities available, each with its own features and benefits. Annuity Examples 2024 provides a comprehensive overview of different annuity types.

Financial Stability and Reputation

John Hancock is a well-established and financially stable company with a long history in the financial services industry. They have a strong reputation for providing reliable and secure annuity products.

An annuity is essentially a series of payments made over a specific period of time. Annuity Is A Series Of 2024 provides a fundamental understanding of the concept of annuities.

Complaint Resolution Process

John Hancock has a detailed complaint resolution process in place. If you have a complaint, you can contact their customer service team directly or file a formal complaint with the company. They will investigate your complaint and attempt to resolve it in a timely manner.

If you are not satisfied with their resolution, you can escalate your complaint to the appropriate regulatory agency.

Annuity Planning and Strategies

Annuity planning is an essential part of retirement planning, and John Hancock annuities can play a significant role in achieving your financial goals. Here’s a guide to annuity planning and strategy development:

Annuity Planning

Annuity planning involves considering your financial goals, risk tolerance, and income needs. Here are some key steps to consider:

- Determine Your Income Needs:Calculate how much income you will need in retirement to cover your expenses.

- Assess Your Risk Tolerance:Determine how much risk you are willing to take with your investments.

- Evaluate Your Financial Goals:Identify your retirement goals, such as paying for healthcare expenses, traveling, or leaving a legacy.

- Consider Your Investment Horizon:Determine how long you will need your annuity to provide income.

Choosing the Right Annuity

Once you have considered your financial goals and risk tolerance, you can choose the right John Hancock annuity for your needs. Here are some factors to consider:

- Annuity Type:Choose an annuity type that aligns with your risk tolerance and income needs.

- Investment Options:Select investment options that align with your investment strategy.

- Fees:Compare fees and rates to ensure you are getting a competitive offer.

- Riders:Consider riders that can enhance your annuity’s features and benefits.

Role of Annuities in Retirement Planning

Annuities can play a crucial role in retirement planning by providing a guaranteed stream of income, protecting your principal, and offering tax advantages. They can help you meet your income needs, cover expenses, and achieve your retirement goals.

If you inherit an annuity, the tax treatment of the payments can differ from receiving them directly. How Is Inherited Annuity Taxed 2024 provides insights into the tax implications of inherited annuities.

Setting Up a John Hancock Annuity

Here’s a step-by-step guide to setting up a John Hancock annuity:

- Contact John Hancock:Contact a John Hancock representative to discuss your annuity needs and options.

- Provide Information:Provide your personal information, financial goals, and risk tolerance.

- Choose an Annuity:Select the annuity type that best suits your needs.

- Fund Your Annuity:Deposit funds into your annuity account.

- Review Your Policy:Carefully review your annuity policy and make sure you understand the terms and conditions.

Ultimate Conclusion

As you embark on your retirement planning journey, understanding the nuances of annuities is crucial. This guide has provided a comprehensive overview of John Hancock’s annuity offerings, empowering you with the knowledge to make informed decisions about your financial future.

Android WebView 202 provides developers with a more modern and efficient way to integrate web content into their apps. Android WebView 202 for custom web views highlights the advantages of using WebView 202 for custom web views.

Remember, consulting with a qualified financial advisor is always recommended to personalize your retirement planning strategy and ensure your chosen annuity aligns with your individual needs and goals.

General Inquiries

What are the minimum investment requirements for John Hancock annuities?

The minimum investment requirements for John Hancock annuities vary depending on the specific product you choose. It’s best to contact a John Hancock representative or visit their website for the most up-to-date information on minimum investment amounts.

Can I withdraw funds from my John Hancock annuity before retirement?

The date on which annuity payments begin is important to understand, as it determines when you start receiving income. Annuity Date Is 2024 delves into the concept of annuity start dates.

Yes, you can generally withdraw funds from your John Hancock annuity before retirement, but there may be penalties associated with early withdrawals. The specific rules and penalties vary depending on the type of annuity and the terms of your contract.

Annuity payments can be used to make mortgage payments, providing a consistent source of income to cover your housing expenses. Annuity Home Loan 2024 examines how annuities can be used to finance home loans.

Consult your annuity contract or contact John Hancock for detailed information.

How can I contact John Hancock customer service for assistance?

You can reach John Hancock customer service through their website, phone number, or email address. Their contact information is typically available on their website or within your annuity policy documents.