Annuity Kinds 2024: Navigating the world of annuities can feel overwhelming, especially with the diverse options available. This guide aims to demystify these retirement income tools, exploring their different types, features, and implications for your financial future. From fixed annuities providing guaranteed income streams to variable annuities offering growth potential, understanding the nuances of each kind is crucial for making informed decisions.

Whether you’re nearing retirement or just starting to plan, annuities can play a vital role in securing your financial well-being. By exploring the various features and options available, you can choose an annuity that aligns with your risk tolerance, income goals, and long-term financial objectives.

This comprehensive guide provides insights into the key aspects of annuities, helping you make informed decisions for a secure and comfortable retirement.

Contents List

Types of Annuities: Annuity Kinds 2024

Annuities are financial products that provide a stream of regular payments for a specified period of time. They are often used in retirement planning to provide a steady income stream. Annuities can be a complex product, but understanding the different types and features can help you make informed decisions.

Types of Annuities

There are several types of annuities available, each with its own unique features and risks. Here are some of the most common types:

- Fixed Annuities: These annuities provide a guaranteed rate of return for a set period of time. The payments you receive are fixed, and they are not affected by market fluctuations. Fixed annuities are a good option for those who want a predictable income stream and are risk-averse.

- Variable Annuities: These annuities invest in a portfolio of securities, such as stocks and bonds. The payments you receive are based on the performance of the underlying investments. Variable annuities offer the potential for higher returns, but they also carry a higher risk of losing money.

- Indexed Annuities: These annuities link their returns to the performance of a specific index, such as the S&P 500. You receive a minimum guaranteed rate of return, but your potential returns are capped. Indexed annuities offer a balance between potential growth and downside protection.

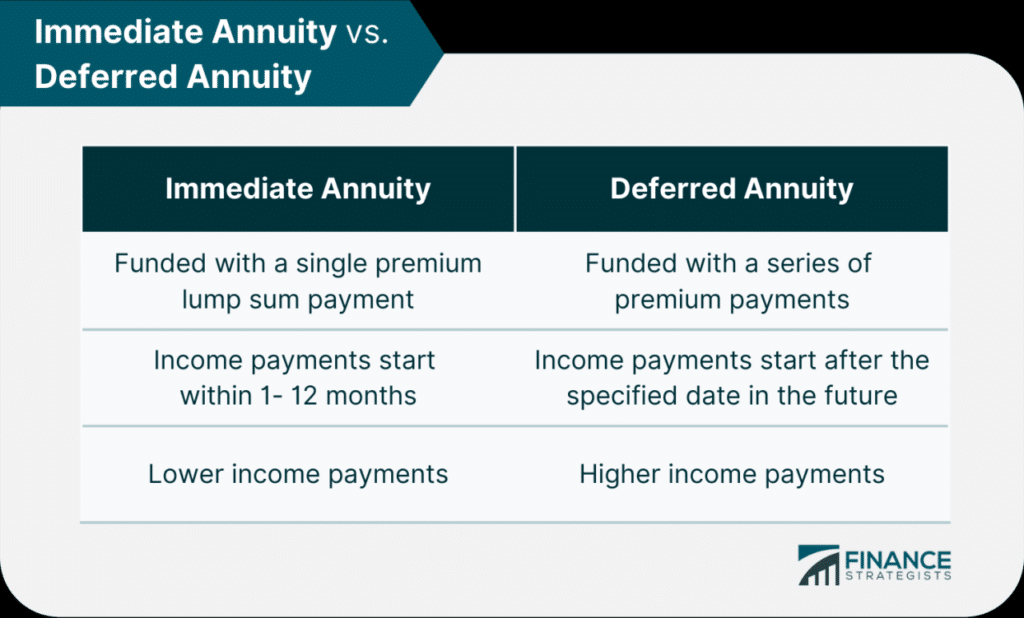

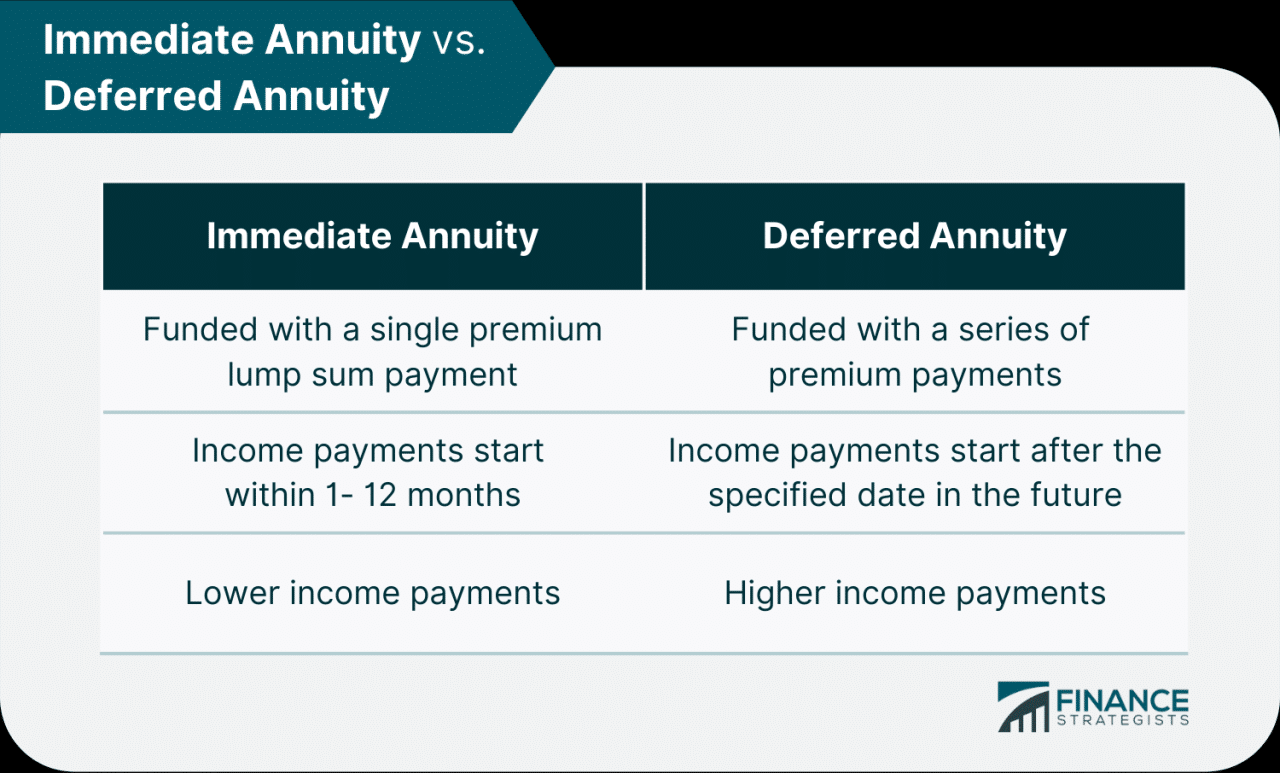

- Immediate Annuities: These annuities begin paying out immediately after you purchase them. They are often used to provide a lump sum payment or a steady stream of income for a specific period of time. Immediate annuities are a good option for those who need income right away.

Annuity Features and Options

Annuities can be customized with a variety of features and options to meet your specific needs. Here are some common features to consider:

Common Annuity Features

- Death Benefits: Some annuities provide a death benefit to your beneficiaries if you die before the annuity payments are exhausted.

- Withdrawal Options: Most annuities allow you to withdraw a portion of your principal or accumulated interest, but there may be penalties for early withdrawals.

- Guaranteed Minimum Interest Rates: Some annuities offer a guaranteed minimum interest rate, even if the underlying investments perform poorly.

These features can impact the cost and value of an annuity. For example, a death benefit or guaranteed minimum interest rate will typically increase the cost of the annuity. It is important to carefully consider the features and options available to you and choose the annuity that best meets your needs and financial goals.

Annuity Taxation and Regulations

The tax implications of annuities can be complex, so it is important to understand the rules before you purchase one.

Taxation of Annuities

| Tax Treatment | Withdrawal Rules | Required Minimum Distributions (RMDs) |

|---|---|---|

| Generally, the interest earned on an annuity is taxed as ordinary income when it is withdrawn. | Withdrawals before age 59 1/2 may be subject to a 10% penalty, in addition to ordinary income tax. | If you purchase an annuity with after-tax dollars, you will not be required to take RMDs. However, if you purchase an annuity with pre-tax dollars, you will be required to start taking RMDs at age 72. |

It is important to note that these are general rules and may vary depending on the specific type of annuity and your individual circumstances. You should consult with a tax advisor to discuss the tax implications of an annuity in your specific situation.

Annuity Considerations for Retirement Planning

Annuities can play a significant role in retirement planning, but it is important to consider both the pros and cons before incorporating them into your portfolio.

Pros and Cons of Annuities, Annuity Kinds 2024

- Pros:

- Provide a guaranteed income stream

- Offer potential growth through variable or indexed annuities

- Can help protect against outliving your savings

- Cons:

- Can be complex and difficult to understand

- May have high fees and expenses

- May not be as liquid as other investments

Hypothetical Retirement Plan

Imagine a 65-year-old retiree, Sarah, who has $500,000 in savings. She wants to use a portion of her savings to purchase an immediate annuity that will provide her with a guaranteed income stream of $30,000 per year for the rest of her life.

This would provide her with a stable income stream that she can rely on in retirement. The remaining portion of her savings can be invested in a diversified portfolio of stocks, bonds, and other assets to provide potential growth. This combination of an annuity and a diversified portfolio can help Sarah achieve her retirement goals.

Annuity Market Trends and Outlook

The annuity market is constantly evolving, and there are several trends that are shaping the industry.

Key Trends in the Annuity Market

| Trend | Potential Impact on Annuity Investors |

|---|---|

| Rising interest rates | May lead to higher annuity rates, making them more attractive to investors. |

| Increased demand for guaranteed income products | May drive innovation in the annuity market, with new products and features being developed. |

| Growing awareness of longevity risk | May increase the popularity of annuities, as they can help protect against outliving your savings. |

It is important to stay informed about the latest trends in the annuity market and to consult with a financial advisor to discuss how these trends may impact your retirement planning.

Final Summary

As you navigate the world of annuities, remember that each type offers unique benefits and drawbacks. Understanding your individual financial goals, risk tolerance, and time horizon is paramount. By carefully evaluating the different options and seeking professional advice, you can choose an annuity that aligns with your retirement aspirations and helps you achieve financial security in your later years.

Clarifying Questions

What are the main types of annuities?

The main types of annuities include fixed, variable, indexed, and immediate annuities. Each type offers different features and benefits, catering to diverse financial needs and risk profiles.

What are the tax implications of annuities?

Annuities offer tax-deferred growth, meaning you don’t pay taxes on the earnings until you withdraw them. However, withdrawals are generally taxed as ordinary income. Specific tax rules apply depending on the type of annuity and your individual circumstances.

How do I choose the right annuity for me?

Choosing the right annuity depends on your individual needs, risk tolerance, and financial goals. Consulting with a financial advisor can help you assess your options and make an informed decision.

What are the risks associated with annuities?

Risks associated with annuities vary depending on the type. For example, variable annuities carry market risk, while fixed annuities may have limited growth potential. Understanding the risks involved is crucial before investing.

What are the advantages of using annuities for retirement planning?

Annuities offer guaranteed income streams, tax-deferred growth, and potential for longevity protection. They can provide a sense of security and financial stability during retirement.