Annuity Loan Calculator 2024 is your comprehensive guide to navigating the world of loan payments. Whether you’re planning a mortgage, a personal loan, or even retirement savings, understanding annuity loans is crucial. This calculator helps you break down the complex world of loan calculations into simple, manageable steps, empowering you to make informed financial decisions.

Annuity loans, characterized by fixed payments over a set period, are a common financial tool. Our calculator provides you with the essential tools to analyze loan terms, interest rates, and payment frequencies, giving you a clear picture of your financial obligations and potential savings.

Contents List

Annuity Loan Calculator Basics

An annuity loan, also known as a level payment loan, is a type of loan where the borrower makes regular, equal payments over a set period of time. These payments cover both the principal amount borrowed and the accrued interest.

Key Features of Annuity Loans

Annuity loans are characterized by several key features:

- Fixed Payments:The borrower makes consistent, predetermined payments throughout the loan term, simplifying budgeting and financial planning.

- Interest Rates:The interest rate on an annuity loan is typically fixed, meaning it remains constant for the duration of the loan. This provides predictable borrowing costs and eliminates the risk of fluctuating interest rates.

- Loan Terms:The loan term, or repayment period, is clearly defined and agreed upon upfront, allowing borrowers to plan their repayment schedule effectively.

Common Scenarios for Annuity Loans

Annuity loans are widely used in various financial situations:

- Mortgages:Most mortgages are structured as annuity loans, with fixed monthly payments over a term of 15 or 30 years.

- Personal Loans:Many personal loans, such as auto loans or home improvement loans, are also annuity loans, providing borrowers with predictable repayment schedules.

- Retirement Savings:Annuity loans can be used to finance retirement savings plans, ensuring regular contributions to a retirement fund.

Components of an Annuity Loan Calculator

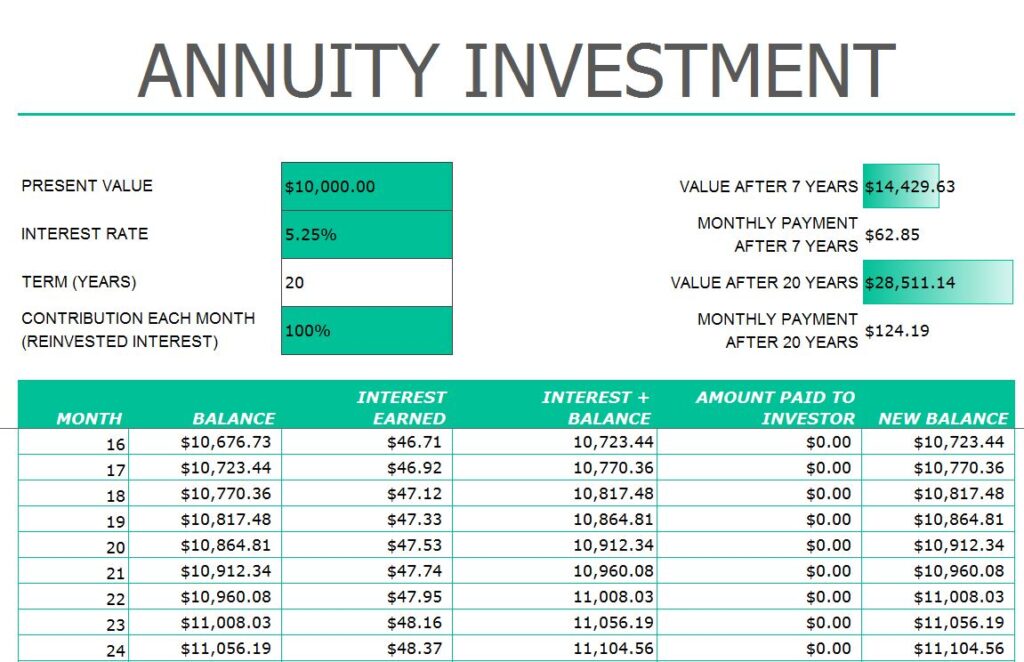

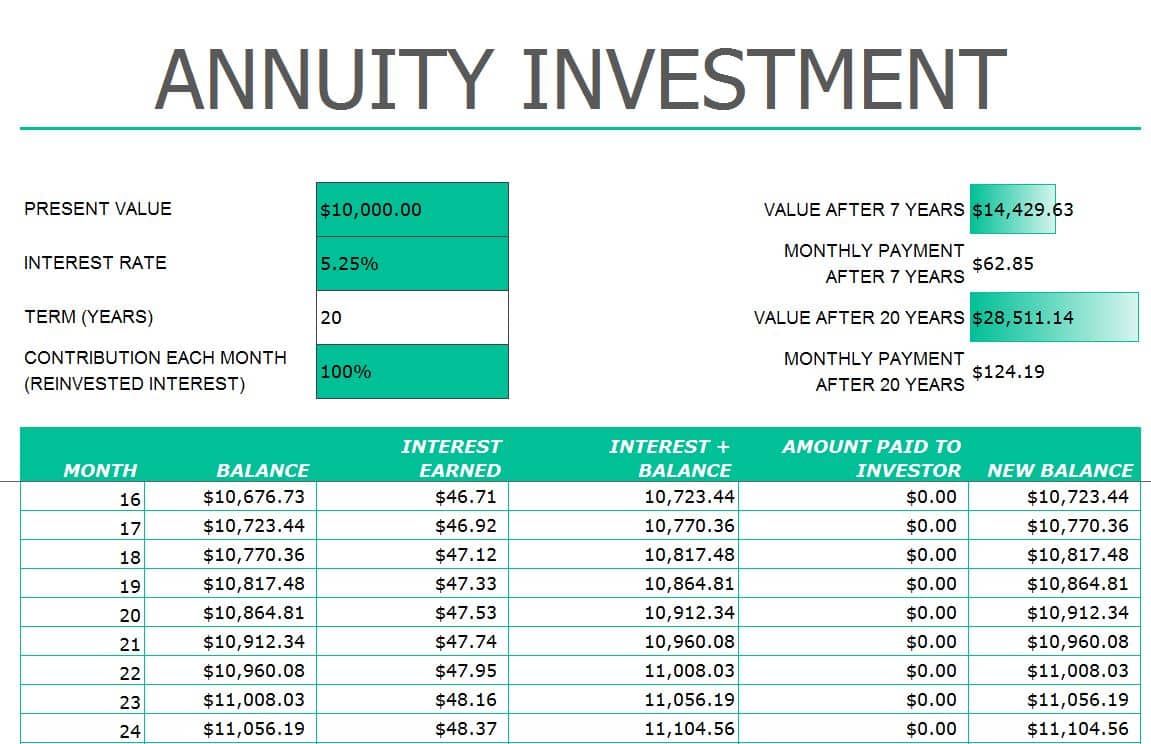

An annuity loan calculator is a valuable tool for understanding the financial implications of an annuity loan. It requires specific inputs and provides comprehensive outputs to help borrowers make informed decisions.

Essential Inputs

An annuity loan calculator typically requires the following inputs:

- Loan Amount:The total amount of money borrowed.

- Interest Rate:The annual percentage rate (APR) charged on the loan.

- Loan Term:The duration of the loan, expressed in years or months.

- Payment Frequency:The number of payments made per year (e.g., monthly, bi-weekly, weekly).

Output Generated

An annuity loan calculator generates several key outputs:

- Total Interest Paid:The cumulative amount of interest paid over the entire loan term.

- Monthly Payments:The fixed amount due each payment period.

- Loan Amortization Schedule:A detailed breakdown of how each payment is allocated between principal and interest over the loan term.

Input Fields and Output Results

| Input Field | Output Result |

|---|---|

| Loan Amount | Total Interest Paid |

| Interest Rate | Monthly Payments |

| Loan Term | Loan Amortization Schedule |

| Payment Frequency |

Using an Annuity Loan Calculator

Using an annuity loan calculator is straightforward and can provide valuable insights into loan repayment scenarios.

Step-by-Step Guide

- Identify the Loan Details:Gather the essential information about the loan, including the loan amount, interest rate, loan term, and payment frequency.

- Input the Values:Enter the loan details into the annuity loan calculator’s input fields.

- Calculate the Results:Run the calculator to generate the outputs, such as total interest paid, monthly payments, and the loan amortization schedule.

- Analyze the Outputs:Carefully review the outputs to understand the financial implications of the loan, including the total cost of borrowing and the repayment schedule.

Real-World Applications

Annuity loan calculators have numerous real-world applications:

- Mortgage Payments:Calculate monthly mortgage payments and compare different loan options.

- Personal Loan Repayments:Determine the monthly payments for personal loans and assess affordability.

- Retirement Savings Contributions:Estimate the amount needed to save regularly for retirement goals.

Benefits and Drawbacks

Using an annuity loan calculator offers several benefits:

- Financial Planning:Helps borrowers understand the financial commitments of a loan and plan accordingly.

- Comparison Shopping:Enables borrowers to compare different loan options and choose the most favorable terms.

- Debt Management:Provides insights into repayment schedules and helps borrowers manage debt effectively.

However, there are also potential drawbacks:

- Assumptions:Calculators rely on assumptions about interest rates and loan terms, which may not always reflect actual market conditions.

- Oversimplification:Calculators may not account for all factors, such as closing costs or prepayment penalties, that can affect loan expenses.

Factors Affecting Annuity Loan Calculations

Several factors can significantly influence the results of annuity loan calculations, impacting the total cost of borrowing and the repayment schedule.

Interest Rates

Interest rates play a crucial role in annuity loan calculations. Higher interest rates result in higher monthly payments and a greater total amount of interest paid over the loan term.

For example, a $100,000 loan at a 5% interest rate will have lower monthly payments and less total interest paid compared to the same loan at a 7% interest rate.

Loan Terms

The loan term also impacts annuity loan calculations. Longer loan terms generally result in lower monthly payments but higher total interest paid over the loan term.

A 30-year mortgage will have lower monthly payments than a 15-year mortgage for the same loan amount and interest rate, but the borrower will pay significantly more interest over the longer term.

Payment Frequencies, Annuity Loan Calculator 2024

The frequency of payments can affect annuity loan calculations. More frequent payments, such as bi-weekly or weekly, result in lower total interest paid over the loan term, even though the monthly payment amount may be higher.

Making bi-weekly payments instead of monthly payments can shorten the loan term and reduce the total interest paid, even if the total amount paid per year remains the same.

Annuity Loan Calculator Tools and Resources

Numerous online annuity loan calculators are available to help borrowers understand the financial implications of loans.

Reputable Online Calculators

- Bankrate:Provides a comprehensive annuity loan calculator that allows users to adjust various loan parameters and compare different loan options.

- NerdWallet:Offers a user-friendly calculator that helps borrowers estimate monthly payments, total interest paid, and loan amortization schedules.

- Calculator.net:Provides a simple and straightforward annuity loan calculator that can be used to calculate monthly payments, total interest, and loan term.

Relevant Websites and Resources

- Investopedia:Offers in-depth articles and explanations on annuity loans and related concepts.

- The Balance:Provides practical advice and resources for managing personal finances, including loan repayment strategies.

- Consumer Financial Protection Bureau (CFPB):Offers information and guidance on consumer financial products, including loans and mortgages.

Advantages and Disadvantages

Online annuity loan calculators offer several advantages:

- Accessibility:Easily accessible from any device with an internet connection.

- Convenience:Quick and easy to use, providing instant results.

- Flexibility:Allow users to adjust various loan parameters to explore different scenarios.

However, there are also potential disadvantages:

- Accuracy:The accuracy of results depends on the calculator’s algorithm and the accuracy of user inputs.

- Limitations:Calculators may not account for all factors that can affect loan costs, such as closing costs or prepayment penalties.

Final Wrap-Up: Annuity Loan Calculator 2024

Armed with the knowledge and insights from our Annuity Loan Calculator 2024, you can confidently approach your loan decisions. By understanding the intricate workings of loan calculations, you gain control over your financial future. Remember, informed decisions lead to greater financial security and peace of mind.

Frequently Asked Questions

What is an annuity loan?

An annuity loan is a type of loan where you make regular, fixed payments over a predetermined period. These payments cover both the principal amount borrowed and the accumulated interest.

How does the annuity loan calculator work?

The calculator takes your loan amount, interest rate, loan term, and payment frequency as inputs. It then calculates your monthly payments, total interest paid, and provides a detailed amortization schedule, showing how your loan is paid down over time.

Is there a difference between using an online calculator and a financial advisor?

Online calculators provide a quick and convenient way to estimate your loan payments. However, for complex financial situations, consulting a financial advisor is recommended for personalized guidance.