Annuity NPV Calculator 2024 provides a powerful tool for understanding the true value of annuity contracts. By factoring in interest rates, payment amounts, and time periods, this calculator helps you make informed decisions about your financial future.

Annuity is a financial product that provides a stream of payments over a set period of time. If you’re interested in learning more about annuities, Khan Academy offers a valuable resource: Annuity Khan Academy 2024. This resource provides a clear and concise explanation of annuities and their applications.

Annuities are a common financial instrument that provides a stream of regular payments over a specified period. Understanding the present value (NPV) of an annuity is crucial for determining its worth and comparing different investment options. This article explores the concept of annuities, the key features of an annuity NPV calculator, and its application in decision-making.

If you’re considering an annuity as a financial tool, it’s important to understand its nature. This article explores the relationship between annuities and life insurance: Is Annuity A Life Insurance Policy 2024. While annuities share some similarities with life insurance, they are distinct financial products with different purposes.

Contents List

- 1 Understanding Annuities

- 2 Annuity NPV Calculator: Key Features and Functionality

- 3 Using an Annuity NPV Calculator in Decision-Making: Annuity Npv Calculator 2024

- 4 Annuity NPV Calculator in 2024: Current Trends and Considerations

- 5 Illustrative Example: Using an Annuity NPV Calculator

- 6 Final Review

- 7 Essential Questionnaire

Understanding Annuities

Annuities are financial products that provide a stream of regular payments over a specified period. They are commonly used for retirement planning, income generation, and estate planning. Annuities can be classified into different types based on their features and payout structure.

Annuity is a financial product that provides a stream of payments over a set period of time. This article explores the tax implications of living annuities: Is A Living Annuity Taxable 2024. It discusses the tax treatment of living annuities and provides insights into managing tax liabilities.

Types of Annuities

- Fixed Annuities:These annuities offer a guaranteed rate of return, providing predictable income payments. The interest rate is fixed for the duration of the contract, providing stability and security.

- Variable Annuities:These annuities link the payout to the performance of underlying investments, such as mutual funds or stocks. The payments can fluctuate based on market conditions, offering potential for higher returns but also exposing investors to greater risk.

- Immediate Annuities:These annuities begin making payments immediately after the initial investment is made. They are ideal for individuals who need immediate income and are willing to commit a lump sum.

- Deferred Annuities:These annuities start making payments at a later date, allowing investors to accumulate funds over time before receiving income. They are suitable for long-term retirement planning.

Present Value and Annuities, Annuity Npv Calculator 2024

The present value (PV) of an annuity is the current worth of future payments, discounted to reflect the time value of money. In simpler terms, it represents the lump sum amount that, if invested today at a certain interest rate, would generate the same stream of payments as the annuity.

Annuity is a financial product that provides a stream of payments over a set period of time. If you’re considering an annuity, you might be curious about its relationship with LIC (Life Insurance Corporation of India). This article explores the connection between annuities and LIC: Is Annuity Lic 2024.

It discusses LIC’s offerings in the annuity market.

The concept of present value is crucial for evaluating the financial viability of an annuity.

Understanding whether or not an annuity is considered earned income can be crucial for tax purposes. This article provides detailed information about the tax implications of annuities: Is Annuity Earned Income 2024. It’s important to consult with a tax professional to ensure you’re filing your taxes correctly.

Annuity Scenarios

Here are some examples of different annuity scenarios:

- Retirement Income:A retiree may purchase a fixed annuity to receive a guaranteed stream of income for life.

- Estate Planning:An individual may purchase a deferred annuity to provide a legacy for their heirs, ensuring a steady stream of income after their death.

- Income Supplement:An individual may purchase an immediate annuity to supplement their current income, providing additional financial security.

Annuity NPV Calculator: Key Features and Functionality

An annuity NPV calculator is a valuable tool for evaluating the financial attractiveness of annuity contracts. It helps determine the present value of the annuity, taking into account the time value of money and other relevant factors.

If you’re interested in learning more about the definition of an annuity, you can find a comprehensive explanation in this article: Annuity Is Definition 2024. An annuity is a contract that guarantees a stream of payments for a specific period of time, either for a fixed term or for the rest of your life.

Key Input Variables

To use an annuity NPV calculator, you need to provide several key input variables, including:

- Interest Rate:The discount rate used to calculate the present value of future payments. This rate reflects the opportunity cost of investing the money elsewhere.

- Payment Amount:The amount of each regular payment that the annuity will provide.

- Time Period:The length of time over which the annuity payments will be made. This could be a fixed period or a lifetime.

Output Values

The annuity NPV calculator provides several output values, including:

- Present Value (PV):The current worth of the future annuity payments, discounted to reflect the time value of money.

- Future Value (FV):The total value of the annuity at the end of the payment period, assuming the payments are reinvested at a specific rate.

Using an Annuity NPV Calculator in Decision-Making: Annuity Npv Calculator 2024

An annuity NPV calculator can be a powerful tool for comparing different investment options and making informed financial decisions.

Annuity is a financial product that provides a stream of payments over a set period of time. If you’re wondering if you can still work while receiving an annuity, you can find more information about it in this article: Can You Receive Annuity And Still Work 2024.

The answer depends on the type of annuity and your individual circumstances.

Comparing Investment Options

By calculating the NPV of different annuities, investors can compare their relative profitability and choose the option that offers the highest return for their investment. For example, an investor may compare a fixed annuity with a variable annuity to determine which option aligns better with their risk tolerance and financial goals.

Annuity leads can be a valuable asset for financial advisors looking to expand their client base. This article explores the current trends in annuity leads and provides insights for professionals: Annuity Leads 2024. It discusses strategies for generating and managing annuity leads effectively.

Evaluating Annuity Contracts

The NPV calculator can be used to evaluate the profitability of an annuity contract by comparing the present value of the annuity payments to the initial investment amount. If the NPV is positive, it suggests that the annuity is likely to generate a return that exceeds the opportunity cost of investing the money elsewhere.

Annuity is a financial product that provides a stream of payments over a set period of time. It can be a valuable tool for retirement planning or income generation. This article explores the potential benefits of annuities: Annuity Is Good 2024.

It discusses various types of annuities and their advantages and disadvantages.

Conversely, a negative NPV indicates that the annuity may not be a profitable investment.

The term “annuity” might sound familiar, but you might be curious about its meaning in Hindi. You can find a clear translation of the word “annuity” in Hindi in this article: Annuity Ka Hindi Meaning 2024. This article provides a breakdown of the term and its usage in the Indian context.

Interpreting NPV Results

When interpreting the results of an annuity NPV calculation, it is important to consider several factors, including:

- Interest Rate:A higher interest rate will result in a lower NPV, as the future payments are discounted more heavily.

- Payment Amount:A higher payment amount will result in a higher NPV, as the total value of the annuity payments is greater.

- Time Period:A longer time period will result in a higher NPV, as the payments are received over a longer duration.

Annuity NPV Calculator in 2024: Current Trends and Considerations

The current economic environment and regulatory changes are influencing the use and functionality of annuity NPV calculators.

Annuity is a financial product that provides a stream of payments over a set period of time. If you’re interested in learning more about annuities, this article provides a definition: Annuity Is Defined As 2024. It explains the key features of annuities and how they work.

Impact of Interest Rates

Current interest rates are relatively low, which can impact annuity NPV calculations. Lower interest rates generally lead to higher NPVs, making annuities more attractive as investments. However, investors should be aware that low interest rates may also limit potential returns on annuities.

Understanding the tax implications of an annuity is crucial for financial planning. This article provides insights into whether or not annuity income is taxable: Is Annuity Income Taxable 2024. It explains the different tax treatments for annuities and offers guidance for managing tax liabilities.

Tax Law Changes

Changes in tax laws or regulations can affect the valuation of annuities. For example, tax deductions or credits related to annuity payments can impact the overall profitability of an annuity contract. Investors should stay informed about any relevant tax changes that may affect their annuity investments.

Annuity is a financial product that provides a stream of payments over a set period of time. This article provides a comprehensive overview of annuities: Annuity Is 2024. It explains the different types of annuities, their benefits and drawbacks, and how they can be used for retirement planning.

New Features and Functionalities

Annuity NPV calculators are constantly evolving to incorporate new features and functionalities. Some emerging trends include:

- Advanced Scenario Analysis:Calculators may offer more sophisticated scenario analysis tools, allowing investors to evaluate different market conditions and economic scenarios.

- Integration with Financial Planning Software:Annuity NPV calculators may be integrated with financial planning software, providing a more comprehensive view of an investor’s financial portfolio.

- Personalized Recommendations:Some calculators may provide personalized recommendations based on an investor’s individual financial goals and risk tolerance.

Illustrative Example: Using an Annuity NPV Calculator

Imagine a hypothetical scenario where an individual is considering purchasing a fixed annuity that will provide annual payments of $10,000 for 10 years. The interest rate is 3% per year. To determine the present value of this annuity, we can use an annuity NPV calculator.

Calculation Steps

- Input Values:

- Payment Amount: $10,000

- Time Period: 10 years

- Interest Rate: 3%

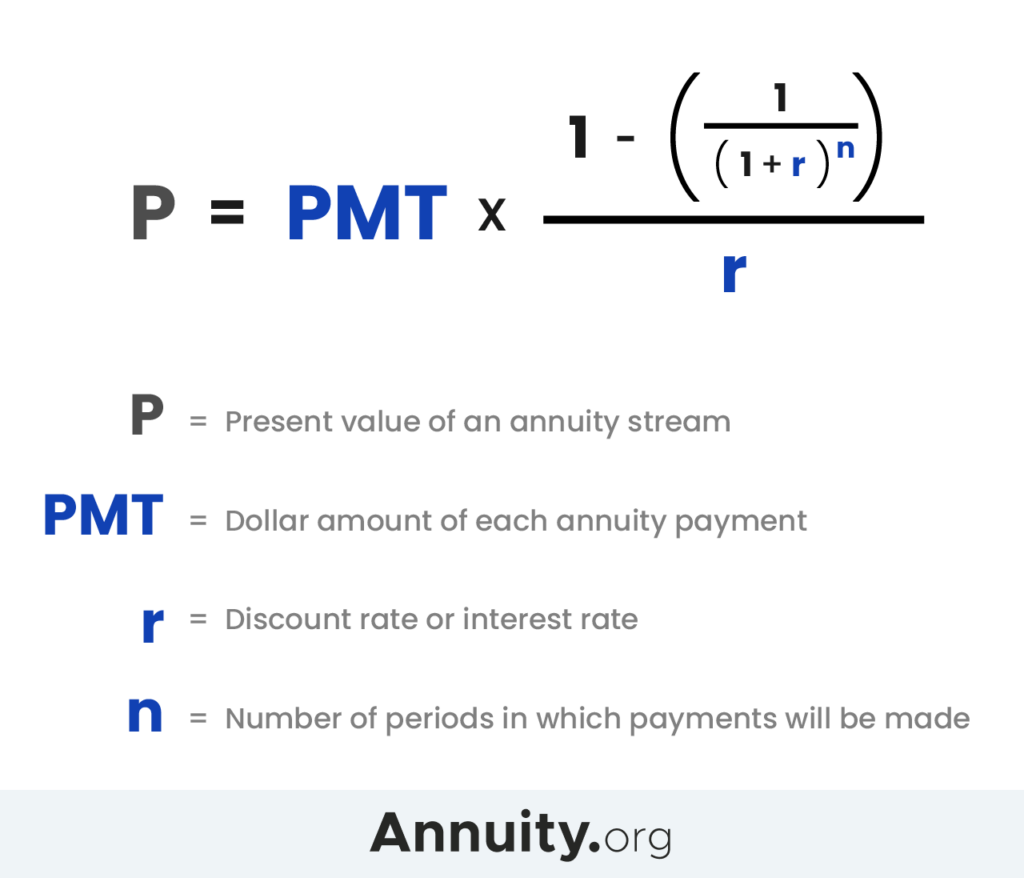

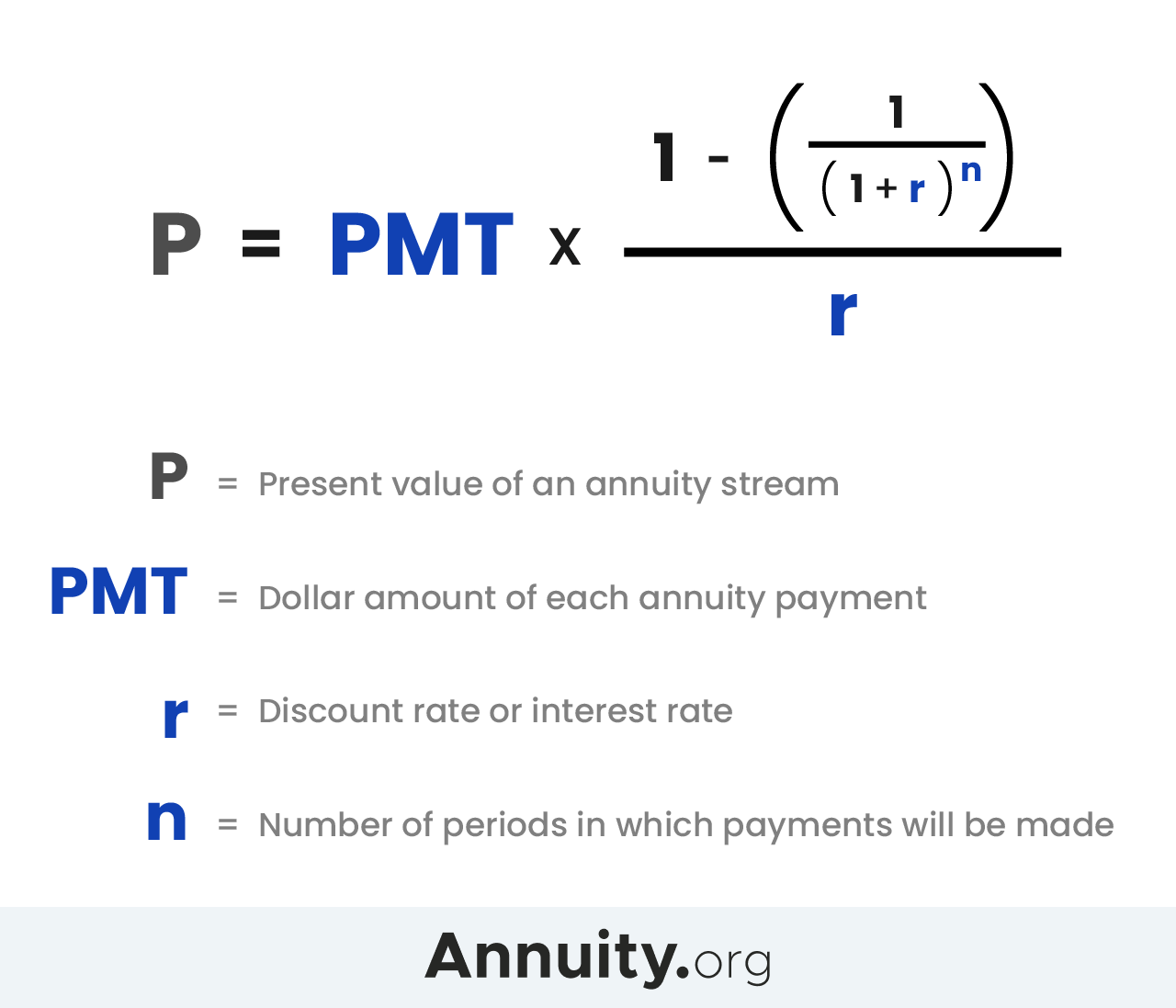

- Formula:The annuity NPV calculator uses the following formula to calculate the present value:

PV = Payment Amount

- [1

- (1 + Interest Rate)^-Time Period] / Interest Rate

- Output Result:Based on the input values and formula, the annuity NPV calculator would calculate the present value of the annuity to be approximately $85,302. This means that the annuity is worth $85,302 today, given the specified interest rate and payment schedule.

Final Review

In conclusion, the Annuity NPV Calculator 2024 is an indispensable tool for individuals seeking to understand the financial implications of annuity contracts. By considering current interest rates, tax regulations, and emerging features, the calculator provides a comprehensive analysis of the present and future value of annuities, empowering users to make informed financial decisions.

Essential Questionnaire

How accurate are the results from an annuity NPV calculator?

The accuracy of the calculator depends on the accuracy of the input variables. It’s important to use reliable data and consider any potential changes in interest rates or tax laws.

Are there any free annuity NPV calculators available online?

Yes, several free annuity NPV calculators are available online. You can find them through search engines or financial websites.

What are the limitations of using an annuity NPV calculator?

An annuity NPV calculator provides a numerical analysis but cannot account for all factors, such as personal financial goals, risk tolerance, or future market conditions.

Annuity is a financial product that provides a stream of payments over a set period of time. If you’re considering an annuity, you might be wondering if it’s a single lump sum payment. This article provides information about the structure of annuity payments: Annuity Is A Single Sum 2024.

It explains how annuities are typically structured and how payments are made.