Annuity Or Lump Sum 2024: Retirement Planning Choices presents a crucial decision for individuals nearing retirement. As you approach this significant milestone, understanding the intricacies of annuities and lump sums becomes paramount. This guide explores the advantages and disadvantages of each option, considering the evolving economic landscape and its impact on retirement planning.

Whether you’re seeking a guaranteed stream of income or prefer the flexibility of a lump sum, this comprehensive analysis will equip you with the knowledge to make an informed decision tailored to your unique financial goals.

This guide delves into the intricacies of annuities and lump sums, examining their key features, benefits, and potential drawbacks. We’ll explore different annuity types, including fixed, variable, immediate, and deferred, and analyze the potential uses of a lump sum payment.

By considering the current economic climate, interest rate environment, and inflation projections, we’ll provide insights into how these factors may influence your choice. Ultimately, this guide aims to empower you to navigate the complexities of retirement planning and make a decision that aligns with your financial aspirations and risk tolerance.

Contents List

Understanding Annuities and Lump Sums

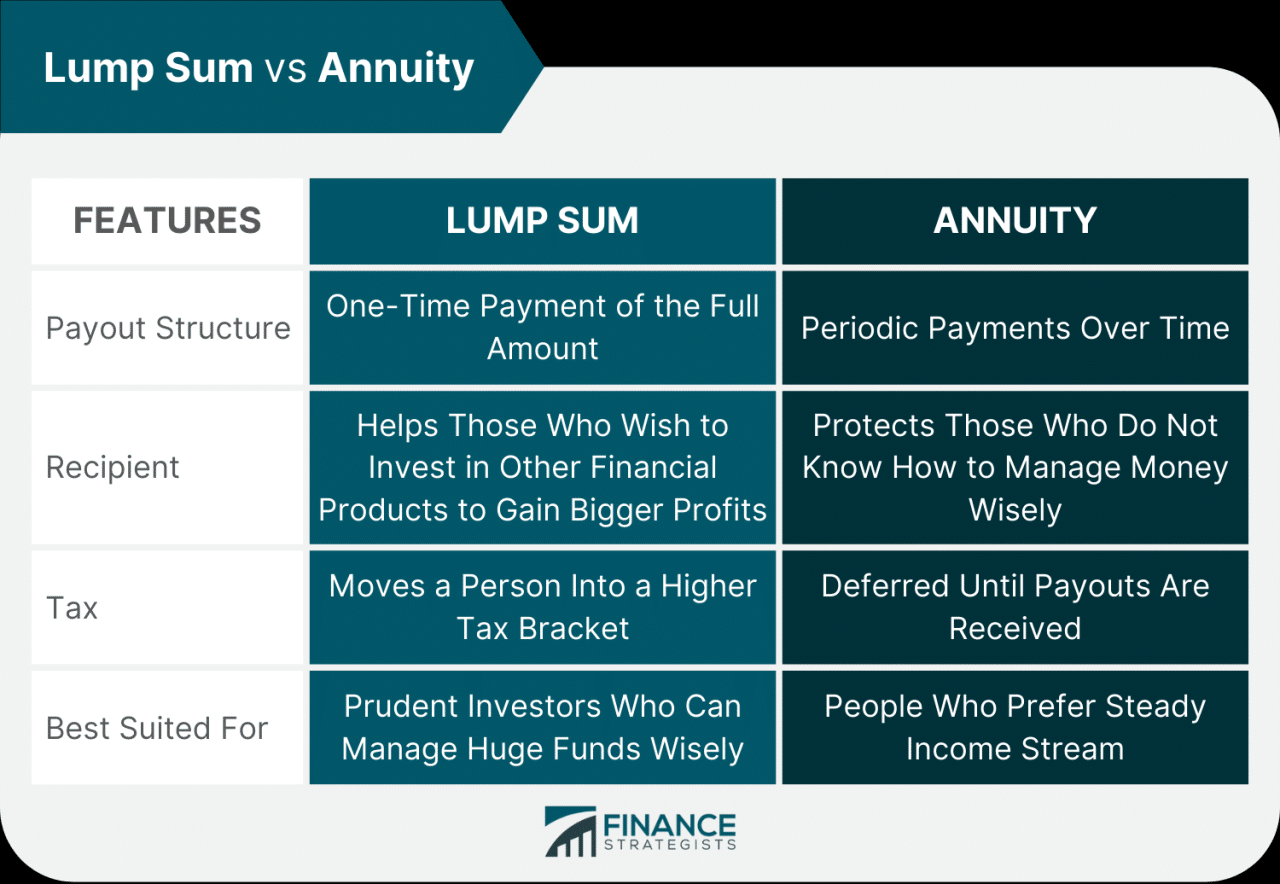

When it comes to retirement planning, one of the most significant decisions you’ll face is how you want to receive your retirement savings. You have two primary options: an annuity or a lump sum. Each option presents distinct advantages and disadvantages, and understanding the nuances of each can help you make the most informed decision for your individual needs.

Annuities, Annuity Or Lump Sum 2024

Annuities are financial products that provide a guaranteed stream of income for a specific period, typically throughout your retirement years. They offer a way to transform a lump sum of money into a reliable source of income, ensuring financial security during retirement.

- Key Features and Benefits:Annuities provide a guaranteed stream of income, protecting you from outliving your savings. They also offer tax-deferred growth, allowing your investment to grow tax-free until you begin receiving payments.

- Types of Annuities:

- Fixed Annuities:These annuities offer a fixed interest rate, providing a predictable income stream. They are ideal for those seeking stability and guaranteed returns.

- Variable Annuities:These annuities link your returns to the performance of underlying investments, offering the potential for higher returns but also carrying greater risk. They are suitable for those with a higher risk tolerance and a longer time horizon.

- Immediate Annuities:These annuities begin paying out immediately after purchase, providing a reliable income stream right away.

- Deferred Annuities:These annuities offer a future stream of income, allowing you to accumulate your investment before receiving payments. They are ideal for those who want to grow their savings before retirement.

Lump Sum

A lump sum is a single, one-time payment that you receive, typically from a retirement account or other investment. It gives you complete control over your funds, allowing you to invest them as you see fit.

- Potential Uses:A lump sum can be used for a variety of purposes, including purchasing a home, paying off debt, investing in other assets, or simply providing a financial cushion.

- Pros and Cons:

- Pros:You have complete control over your funds and can invest them according to your risk tolerance and goals.

- Cons:You bear the responsibility of managing your money effectively. You also face the risk of outliving your savings if you don’t invest wisely.

Financial Considerations for 2024: Annuity Or Lump Sum 2024

The current economic landscape plays a significant role in your retirement planning decisions. Factors such as interest rates, inflation, and tax implications can impact the value and attractiveness of both annuities and lump sums.

Economic Landscape and Retirement Planning

The year 2024 is expected to present a mix of challenges and opportunities for retirees. While the economy has shown signs of resilience, uncertainties remain regarding inflation, interest rates, and geopolitical tensions. These factors can influence the growth of your retirement savings and the purchasing power of your income.

Interest Rates and Annuity Payouts

Interest rates have been on an upward trajectory in recent years, impacting annuity payouts. Higher interest rates can lead to higher guaranteed income streams from fixed annuities, but they can also increase the cost of purchasing an annuity. It’s crucial to analyze the current interest rate environment and its implications for your chosen annuity type.

Inflation and the Value of Savings

Inflation continues to be a significant concern for retirees, eroding the purchasing power of their savings over time. While both annuities and lump sums are subject to inflation, annuities can provide a hedge against inflation through features like inflation adjustments or variable annuity options.

Tax Implications

The tax implications of receiving an annuity or a lump sum can vary significantly. Understanding these implications is essential for making an informed decision. For example, annuity payments are typically taxed as ordinary income, while lump sums may be subject to capital gains taxes depending on the type of investment and the holding period.

Choosing the Right Option for Your Needs

The best choice between an annuity and a lump sum depends on your individual circumstances, financial goals, and risk tolerance. Carefully consider your unique needs and preferences before making a decision.

Advantages and Disadvantages

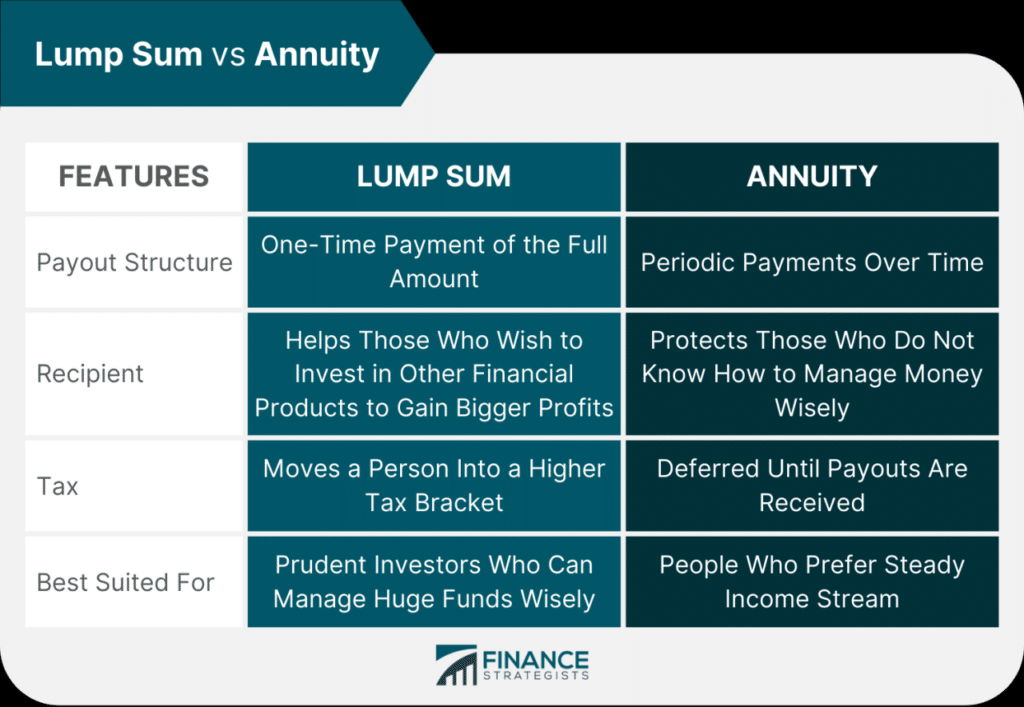

The following table Artikels the key advantages and disadvantages of each option, helping you weigh the pros and cons:

| Factor | Annuity | Lump Sum |

|---|---|---|

| Guaranteed Income | Yes | No |

| Risk | Lower (fixed annuities) to higher (variable annuities) | Higher |

| Control over Funds | Limited | Complete |

| Tax Implications | Taxed as ordinary income | Capital gains taxes may apply |

| Flexibility | Limited | High |

Decision-Making Framework

To help you make a well-informed decision, consider the following factors:

- Financial Goals:What are your retirement income needs? Do you require a guaranteed income stream or prefer greater flexibility in managing your funds?

- Risk Tolerance:How comfortable are you with investment risk? Do you prefer a stable income stream or are you willing to take on more risk for the potential of higher returns?

- Time Horizon:How long do you expect to live in retirement? A longer time horizon may justify taking on more risk, while a shorter time horizon might favor a more conservative approach.

- Health and Longevity:Your health and longevity can influence your retirement planning. If you anticipate a longer life expectancy, a guaranteed income stream from an annuity may be more appealing.

- Tax Situation:Consider your current and projected tax bracket. Annuities may be more advantageous in lower tax brackets, while lump sums may be more favorable in higher tax brackets.

Professional Financial Advice

Making a decision about annuities and lump sums can be complex. Seeking professional financial advice from a qualified financial advisor is highly recommended. They can help you assess your individual circumstances, understand the nuances of each option, and create a personalized retirement plan that aligns with your goals.

Strategies for Maximizing Your Retirement Income

Whether you choose an annuity or a lump sum, there are strategies you can employ to maximize your retirement income and achieve financial security.

Managing a Lump Sum Payment

If you receive a lump sum, it’s crucial to manage it wisely to generate ongoing income. Here are some strategies:

- Invest in a diversified portfolio:Allocate your funds across different asset classes, such as stocks, bonds, and real estate, to reduce risk and potentially increase returns.

- Consider a combination of investments:Explore a mix of high-yield savings accounts, CDs, and other fixed-income investments to generate a steady stream of income.

- Utilize tax-advantaged accounts:Consider contributing to Roth IRAs or traditional IRAs to reduce your tax burden and grow your savings tax-deferred.

Using an Annuity for Retirement Income

Annuities can provide a guaranteed stream of income for retirement, offering peace of mind and financial security. Here are some strategies for using annuities effectively:

- Choose the right type of annuity:Consider your risk tolerance, time horizon, and income needs when selecting between fixed and variable annuities.

- Maximize your payout:Explore options for increasing your annuity payments, such as adding a guaranteed lifetime withdrawal benefit or selecting a longer payout period.

- Consider an income rider:Some annuities offer income riders that provide additional income guarantees, helping to protect you from inflation and market volatility.

Combining Annuities and Lump Sums

A combination of annuities and lump sums can offer a balanced approach to retirement planning. Here are some examples:

- Use an annuity for essential expenses:Purchase a fixed annuity to provide a guaranteed income stream for basic living expenses, such as housing, utilities, and healthcare.

- Invest a lump sum for growth:Allocate a portion of your lump sum to investments with higher growth potential, such as stocks or real estate, to potentially increase your overall wealth.

- Create a “buffer” with a lump sum:Keep a portion of your lump sum in a liquid account to serve as an emergency fund, providing financial security in case of unexpected expenses.

Optimizing Retirement Savings and Investments

In 2024, it’s essential to stay informed about market trends and investment strategies to optimize your retirement savings. Consider the following tips:

- Rebalance your portfolio regularly:Periodically adjust your asset allocation to ensure your portfolio remains aligned with your risk tolerance and investment goals.

- Monitor your expenses:Track your spending habits and identify areas where you can cut back to free up more funds for retirement savings.

- Explore tax-efficient investment strategies:Seek opportunities to reduce your tax burden through tax-advantaged accounts, such as Roth IRAs, traditional IRAs, and 401(k)s.

Real-World Examples and Case Studies

To illustrate the potential benefits and drawbacks of annuities and lump sums, let’s examine real-world examples and case studies.

Case Studies

| Case Study | Age | Income | Financial Goals | Chosen Option | Outcome |

|---|---|---|---|---|---|

| John, 65 | $50,000 | Guaranteed income for life | Fixed annuity | John received a guaranteed income stream of $3,000 per month, providing him with financial security and peace of mind in retirement. | |

| Mary, 62 | $75,000 | Invest for growth and income | Lump sum and investment portfolio | Mary received a lump sum of $1 million, which she invested in a diversified portfolio of stocks, bonds, and real estate. She was able to generate a higher income stream than an annuity would have provided, but she also faced greater risk. | |

| David, 68 | $40,000 | Pay off debt and live comfortably | Combination of annuity and lump sum | David purchased a fixed annuity to cover his essential expenses, while using a portion of his lump sum to pay off his mortgage and invest in a high-yield savings account. This approach provided him with both guaranteed income and flexibility for discretionary spending. |

Closing Summary

Choosing between an annuity or a lump sum is a personal decision that requires careful consideration of your financial goals, risk tolerance, and individual circumstances. By understanding the advantages and disadvantages of each option, evaluating the current economic landscape, and seeking professional financial advice, you can make an informed decision that sets you on a path toward a secure and fulfilling retirement.

Whether you opt for the guaranteed income stream of an annuity or the flexibility of a lump sum, remember that retirement planning is an ongoing process that requires regular adjustments and proactive management.

FAQ Explained

What is the difference between a fixed and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return is tied to the performance of underlying investments.

How do taxes affect annuities and lump sums?

Tax implications vary depending on the type of annuity and the source of the lump sum. Consult a tax professional for personalized advice.

What are some strategies for managing a lump sum payment?

Strategies include investing in a diversified portfolio, setting up a structured settlement, or using a portion for immediate expenses and investing the rest.