Annuity Vs Perpetuity 2024: In the world of finance, annuities and perpetuities are two key concepts that often cause confusion. Both represent a stream of regular payments, but their key differences can significantly impact investment strategies. This exploration dives into the intricacies of these financial instruments, analyzing their defining features, applications, and relevance in the ever-evolving financial landscape of 2024.

Annuity payments can be made for an indefinite duration, such as for life. You can learn more about this by reading this article, Annuity Is Indefinite Duration 2024. This can provide a guaranteed income stream for as long as the annuitant lives.

Annuity, a series of payments made over a fixed period, offers a structured approach to income generation or debt repayment. Perpetuities, on the other hand, provide a continuous stream of payments indefinitely, making them a valuable tool for long-term planning.

A single premium annuity is a type of annuity that is purchased with a lump sum payment. You can learn more about this by reading this article, G Purchased A $50 000 Single Premium 2024. This can be a good option for those who want to lock in a guaranteed rate of return.

Understanding these differences is crucial for making informed financial decisions, particularly in today’s complex market.

An annuity can be a qualified plan, meaning it meets certain IRS requirements. You can learn more about this by reading this article, Is Annuity A Qualified Plan 2024. This can offer tax advantages for both the individual and the employer.

Contents List

Annuity vs Perpetuity: Understanding the Differences: Annuity Vs Perpetuity 2024

In the realm of finance, annuities and perpetuities are two distinct concepts that often come up when discussing long-term investments and income streams. While both involve a series of regular payments, they differ significantly in their duration and the way they are calculated.

Choosing between an annuity and an IRA depends on your individual financial goals and risk tolerance. You can learn more about this by reading this article, Annuity Or Ira 2024. An IRA offers tax advantages for retirement savings, while an annuity can provide a guaranteed income stream.

This article aims to provide a comprehensive overview of annuities and perpetuities, highlighting their key characteristics, applications, and the factors that differentiate them.

The interest earned on an annuity is generally taxable. You can learn more about this by reading this article, Is Annuity Interest Taxable 2024. However, there are some exceptions to this rule, so it’s important to consult with a tax advisor.

Annuity: A Detailed Look, Annuity Vs Perpetuity 2024

An annuity is a series of equal payments made over a fixed period. It is a financial product that provides a steady stream of income for a specific duration. Annuities can be structured in various ways, each with its own set of features and benefits.

Annuity calculations can be performed in Excel. You can learn more about this by reading this article, Annuity Is Excel 2024. This can help you understand the potential returns and payments associated with different annuity options.

- Fixed Annuities:These annuities offer a guaranteed rate of return, providing predictable income payments. The payments are typically based on a fixed interest rate that remains constant throughout the annuity’s term.

- Variable Annuities:Unlike fixed annuities, variable annuities link the rate of return to the performance of underlying investments, such as mutual funds or stocks. The income payments can fluctuate based on the market performance of the chosen investment options.

- Immediate Annuities:These annuities start paying out immediately after the purchase. They are often used for retirement income or to supplement existing income streams.

- Deferred Annuities:Deferred annuities offer a future stream of income payments that begin at a later date, typically after a specified period. These are often used for long-term savings or retirement planning.

Annuities can be advantageous for individuals seeking a reliable source of income, particularly during retirement. They provide a guaranteed stream of payments, helping to mitigate the risk of outliving one’s savings. However, it is crucial to consider the potential downsides of annuities.

An annuitant is a person who receives payments from an annuity. You can learn more about this by reading this article, K Is An Annuitant Currently Receiving Payments 2024. Annuity payments can be made for a fixed term or for life.

They often come with high fees, and the returns may be limited compared to other investment options.

An immediate annuity is a type of annuity that begins making payments immediately after the purchase. You can learn more about this by reading this article, Annuity Is Immediate 2024. This can be a good option for those who need income right away.

Real-world examples of annuities include:

- Retirement Annuities:Many individuals purchase annuities to provide a steady income stream during retirement, ensuring financial security in their later years.

- Structured Settlements:In legal cases, annuities are sometimes used to provide periodic payments to individuals who have suffered injuries or losses.

- Insurance Annuities:Insurance companies offer annuities as part of their product offerings, providing a way to generate income or supplement existing retirement plans.

Perpetuity: A Detailed Look

A perpetuity is a stream of equal payments that continues indefinitely. Unlike annuities, which have a finite duration, perpetuities extend forever. This concept is particularly relevant in situations where a long-term income stream is required, such as charitable foundations or endowments.

Annuity M is a type of annuity that offers a fixed rate of return. You can learn more about this by reading this article, Annuity M 2024. This can provide a predictable income stream for a set period of time.

Perpetuities differ from annuities in several key aspects. First, they lack a defined end date, meaning the payments continue indefinitely. Second, the present value of a perpetuity is calculated using a different formula than that used for annuities. The present value of a perpetuity is determined by dividing the annual payment by the discount rate.

Perpetuities are typically used in scenarios where a constant stream of income is required for an extended period. Examples of perpetuities include:

- Charitable Endowments:Many charitable organizations establish perpetuities to ensure a consistent source of funding for their operations and programs.

- Government Bonds:Certain government bonds, known as consols, are considered perpetuities as they have no maturity date and pay interest indefinitely.

- Preferred Stocks:Some preferred stocks pay a fixed dividend indefinitely, making them essentially perpetuities.

Annuity vs. Perpetuity: A Comparison

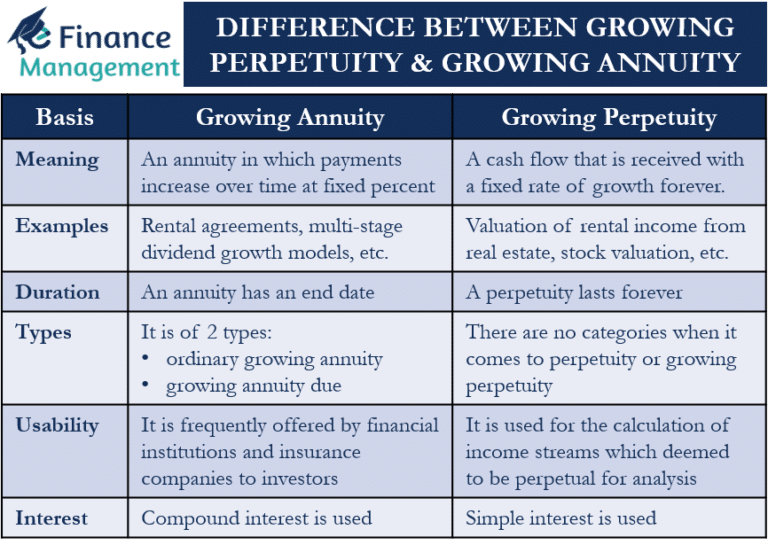

To understand the key differences between annuities and perpetuities, it is helpful to compare their characteristics in a tabular format.

An annuity is a life insurance product that provides a stream of payments over a set period of time. You can learn more about this by reading this article, Annuity Is A Life Insurance Product That 2024. It can be a valuable tool for retirement planning, as it can provide a guaranteed income stream for life.

| Characteristic | Annuity | Perpetuity |

|---|---|---|

| Duration | Finite (fixed period) | Infinite (indefinite) |

| Payment Structure | Equal payments over a defined term | Equal payments that continue indefinitely |

| Present Value Calculation | Based on a formula that accounts for the time value of money and the annuity’s duration | Calculated by dividing the annual payment by the discount rate |

| Applications | Retirement planning, structured settlements, insurance products | Charitable endowments, government bonds, preferred stocks |

The choice between an annuity and a perpetuity depends on various factors, including the desired investment horizon, risk tolerance, and financial goals. Annuities are suitable for individuals seeking a guaranteed income stream for a specific period, while perpetuities are more appropriate for long-term commitments, such as charitable giving or funding ongoing projects.

The taxability of annuities in India can be complex and depends on various factors. You can learn more about this by reading this article, Is Annuity Taxable In India 2024. It’s best to consult with a tax advisor to understand the specific implications for your situation.

For example, consider an individual planning for retirement. If they need a guaranteed income stream for 20 years, an annuity would be a suitable option. However, if a charitable foundation aims to provide funding for a specific program indefinitely, a perpetuity would be a more appropriate choice.

Whether an annuity is better than a 401k is a question that depends on your individual circumstances. To learn more about the pros and cons of each, you can read this article, Is Annuity Better Than 401k 2024.

An annuity can provide a guaranteed income stream, while a 401k can offer more flexibility and potential for growth.

Final Conclusion

As we navigate the complexities of financial planning in 2024, the choice between an annuity and a perpetuity becomes a strategic one. While annuities offer a predictable stream of income over a defined period, perpetuities provide a consistent flow of payments for generations.

Ultimately, the decision hinges on individual needs, risk tolerance, and long-term financial goals. By carefully evaluating the advantages and disadvantages of each, investors can make informed choices that align with their financial aspirations.

An annuity certain is a type of annuity that provides payments for a fixed period of time, regardless of how long the annuitant lives. To learn more about annuity certain, you can read this article, Annuity Certain Is An Example Of 2024.

Annuity certain is often used for retirement planning, as it provides a guaranteed income stream for a specific period of time.

Question & Answer Hub

What are some real-world examples of annuities?

Common examples include retirement annuities, insurance payouts, and structured settlements.

What are some real-world examples of perpetuities?

An annuity is a financial product that provides a stream of payments over a set period of time. You can learn more about the definition of an annuity by reading this article, Annuity Is Definition 2024. Annuity payments can be made for a fixed term or for life, and they can be used for a variety of purposes, such as retirement income, income for life, or income for a specific period of time.

Perpetuities are often used in charitable foundations and endowments, where a continuous stream of income is needed for ongoing operations.

What are the key factors to consider when choosing between an annuity and a perpetuity?

Key factors include the desired payment duration, risk tolerance, and the availability of capital for the initial investment.