Annuity Withdrawal Tax Calculator 2024 is your guide to understanding the tax implications of withdrawing from an annuity. Whether you’re planning for retirement or simply curious about the tax treatment of your annuity income, this calculator can help you make informed financial decisions.

If you’re interested in how annuities work within the context of the National Pension System (NPS), this article: Annuity Nps 2024 will be helpful. It explains how annuities can be integrated into your NPS plan and how they can contribute to your overall retirement savings strategy.

Annuities offer a way to secure a steady stream of income during retirement, but understanding how withdrawals are taxed is crucial for maximizing your after-tax income.

This comprehensive guide explores the different types of annuities, their withdrawal options, and the tax implications associated with each. We’ll delve into the concept of the “taxable portion” and “non-taxable portion” of withdrawals, providing clear examples to illustrate how taxes are calculated.

You’ll also discover how to utilize an annuity withdrawal tax calculator, a valuable tool for estimating your tax liability and planning for future withdrawals.

A common question about annuities is whether they are taxable. This article: Annuity Is Taxable Or Not 2024 dives into the tax implications of annuities, explaining how the tax treatment can vary depending on the type of annuity and other factors.

Contents List

Understanding Annuity Withdrawals

Annuities are financial products that provide a stream of regular payments over a specified period. They are often used for retirement planning, but they can also be used for other purposes, such as funding college expenses or providing income for a loved one.

When you withdraw money from an annuity, you need to understand the tax implications.

Types of Annuities and Withdrawal Options

There are two main types of annuities: fixed annuities and variable annuities. Fixed annuities provide a guaranteed rate of return, while variable annuities offer the potential for higher returns but also carry more risk. Annuities offer various withdrawal options, including:

- Fixed withdrawals:You receive a set amount of money each month.

- Variable withdrawals:You can withdraw a different amount each month, depending on your needs.

- Lump sum withdrawals:You can withdraw all or part of the annuity’s value at once.

- Systematic withdrawals:You withdraw a predetermined amount at regular intervals.

Tax Implications of Annuity Withdrawals

The tax implications of annuity withdrawals depend on the type of annuity and the withdrawal option you choose. In general, a portion of each withdrawal is considered taxable income, while the remaining portion is considered a return of your principal investment.

Many people wonder if annuities and pensions are the same thing. This article: Is Annuity The Same As Pension 2024 addresses this question directly, highlighting the similarities and differences between these two financial tools.

The taxable portionof an annuity withdrawal is determined using the “first-in, first-out” (FIFO) method. This means that the first money you withdraw from an annuity is considered to be the money you contributed, which is generally not taxed. Any money withdrawn after your contributions are returned is considered income and is taxed as ordinary income.

If you’re trying to figure out a word puzzle and the answer is related to annuities, this article: Annuity Unscramble 2024 might help. It offers a fun way to learn more about annuities while solving a word puzzle.

The non-taxable portionof an annuity withdrawal is the return of your principal investment. This portion is not taxed.

Examples of Taxed Annuity Withdrawals

- Example 1:You contribute $100,000 to a fixed annuity and receive $120,000 in total payouts over the years. The first $100,000 you withdraw is considered a return of principal and is not taxed. The remaining $20,000 is considered income and is taxed as ordinary income.

Understanding the definition of an annuity is crucial for making informed financial decisions. This article: Annuity Is Definition 2024 provides a clear and concise explanation of what an annuity is and how it works.

- Example 2:You contribute $50,000 to a variable annuity and withdraw $75,000 after a few years. The first $50,000 you withdraw is considered a return of principal and is not taxed. The remaining $25,000 is considered income and is taxed as ordinary income.

If you’re looking for information about a specific type of annuity, this article: Annuity Due Is 2024 provides details about annuity due, its characteristics, and how it works.

Using an Annuity Withdrawal Tax Calculator

An annuity withdrawal tax calculator is a valuable tool for individuals who are considering withdrawing money from an annuity. This calculator can help you estimate the tax implications of your withdrawals and make informed financial decisions.

Purpose of an Annuity Withdrawal Tax Calculator

An annuity withdrawal tax calculator helps you estimate the taxable portion of your annuity withdrawals. It also helps you understand the potential tax liability you may face.

Annuity is a financial product that provides regular payments, often used for retirement planning. If you’re looking for information about how annuities work and their differences from IRAs, you can check out this article: Annuity Vs Ira 2024. This article explains the key distinctions between annuities and IRAs, helping you make informed decisions about your retirement savings.

Key Inputs for the Calculator

To use an annuity withdrawal tax calculator, you will need to provide the following information:

- Annuity type:Fixed or variable

- Contract value:The total value of your annuity contract

- Withdrawal amount:The amount you want to withdraw

- Tax bracket:Your current federal income tax bracket

Pros and Cons of Using an Annuity Withdrawal Tax Calculator

| Feature | Pros | Cons | Example |

|---|---|---|---|

| Accuracy | Provides an accurate estimate of your tax liability. | May not account for all tax-related factors, such as state income taxes. | The calculator may estimate a $5,000 tax liability, but your actual liability may be slightly higher or lower due to state taxes. |

| Convenience | Easy to use and readily available online. | May not be available for all annuity types or withdrawal options. | A calculator may be available for fixed annuities but not for variable annuities. |

| Transparency | Helps you understand the tax implications of your withdrawals. | May not provide detailed explanations of the calculations. | The calculator may show the taxable portion of your withdrawal but may not explain how it arrived at that figure. |

Tax Considerations for Annuity Withdrawals in 2024: Annuity Withdrawal Tax Calculator 2024

The tax laws governing annuity withdrawals can change from year to year. It’s crucial to stay updated on any relevant tax law changes or updates related to annuity withdrawals for 2024. These changes can significantly impact your tax liability.

Potential Impact of Tax Law Changes

For example, in 2024, the government might:

- Increase the tax rate on annuity withdrawals.

- Introduce new tax deductions or credits for annuity withdrawals.

- Change the rules for determining the taxable portion of an annuity withdrawal.

It’s essential to consult with a qualified tax advisor to understand the specific tax implications of your annuity withdrawals in 2024. They can provide personalized guidance based on your individual circumstances.

The distinction between annuities and IRAs can be confusing. This article: Is Annuity Same As Ira 2024 explores the similarities and differences between these two retirement savings options, helping you understand their unique features.

Comparison of Tax Implications in 2024 vs. Previous Years

To compare the tax implications of withdrawing from an annuity in 2024 versus previous years, you’ll need to consider the specific tax laws in effect for each year. For example, if the tax rate on annuity withdrawals was increased in 2024, you would likely pay more taxes on your withdrawals compared to previous years.

Buying an annuity can be a significant financial decision. This article: Annuity Is Purchased 2024 explains the process of purchasing an annuity, including factors to consider and key steps involved.

Again, consulting with a tax advisor is crucial to understand the specific tax implications of your annuity withdrawals in any given year.

The term “annuity stream” can be confusing. This article: Is Annuity Stream 2024 clarifies what an annuity stream is and how it relates to the overall concept of annuities.

Strategies for Minimizing Annuity Withdrawal Taxes

Several strategies can help you minimize your annuity withdrawal taxes. These strategies can help you maximize your after-tax income and achieve your financial goals.

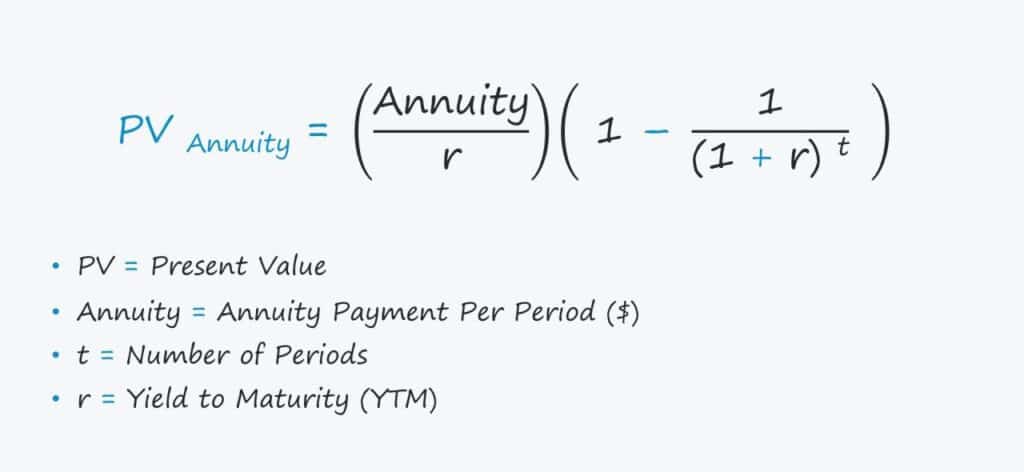

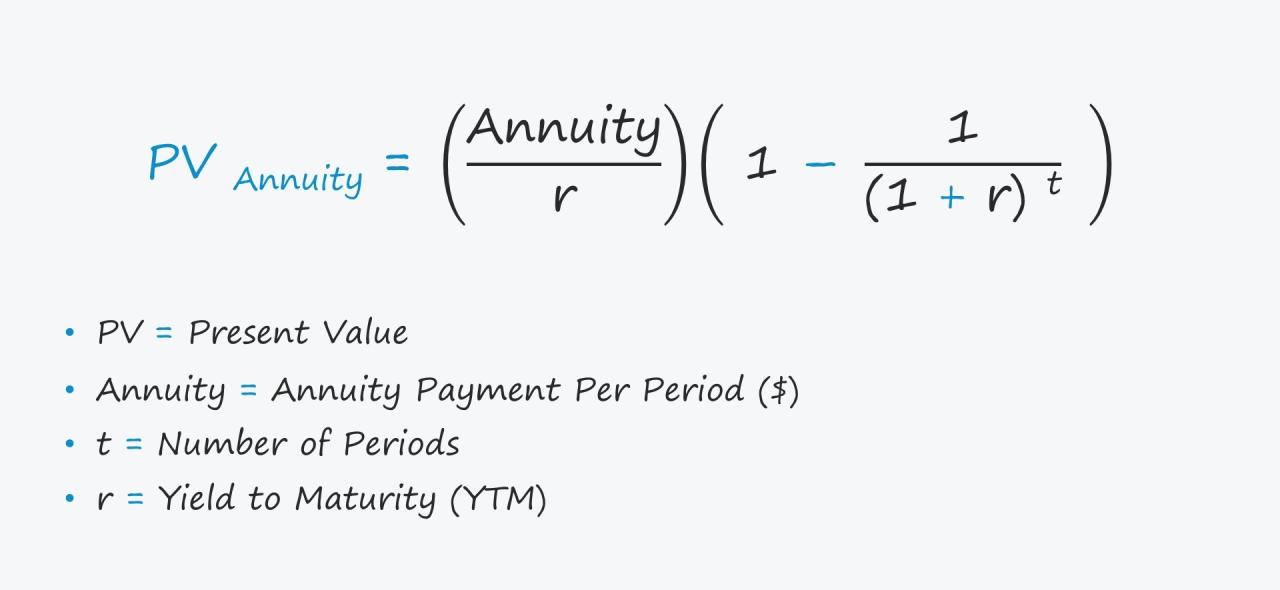

Calculating the Taxable Portion of an Annuity Withdrawal

Here’s a step-by-step guide for calculating the taxable portion of an annuity withdrawal:

- Determine your original investment:This is the amount you contributed to the annuity.

- Calculate your total annuity payments:This is the total amount you have received or will receive from the annuity.

- Subtract your original investment from your total annuity payments:This difference represents your income from the annuity.

- Multiply your income from the annuity by your tax bracket:This will give you an estimate of your tax liability.

Flowchart Illustrating Tax Liability on Annuity Withdrawals

A flowchart can visually represent the process of determining the tax liability on annuity withdrawals. This flowchart would illustrate the steps involved in calculating the taxable portion of your withdrawal and identifying your potential tax liability.

For example, the flowchart might show the following steps:

- Start:Determine the type of annuity and withdrawal amount.

- Calculate original investment:Subtract the original investment from the total annuity payments.

- Determine income:Multiply the income by your tax bracket.

- Calculate tax liability:This is your estimated tax liability on the withdrawal.

- End:You now have an understanding of the tax implications of your annuity withdrawal.

Strategies to Minimize Annuity Withdrawal Taxes

- Withdraw only the amount you need:This will minimize your taxable income and help you avoid unnecessary tax liability.

- Consider withdrawing from a Roth IRA:Withdrawals from a Roth IRA are generally tax-free, making it a more tax-efficient option compared to an annuity.

- Time your withdrawals strategically:If you are in a lower tax bracket in a particular year, you may want to withdraw more from your annuity during that year to minimize your tax liability.

- Consult with a tax advisor:A tax advisor can help you develop a personalized plan for minimizing your annuity withdrawal taxes.

Real-World Examples and Case Studies

Real-world examples and case studies can help illustrate how individuals have used an annuity withdrawal tax calculator to make informed financial decisions. These examples can also demonstrate how the tax implications of annuity withdrawals can vary depending on individual circumstances.

Real-World Examples

- Example 1:A retiree used an annuity withdrawal tax calculator to determine the tax implications of withdrawing $10,000 from their fixed annuity. The calculator showed that $2,000 of the withdrawal would be considered taxable income, while the remaining $8,000 would be considered a return of principal.

If you’re currently receiving annuity payments, this article: K Is An Annuitant Currently Receiving Payments 2024 might be helpful. It discusses the process of receiving annuity payments and provides insights for annuitants.

The retiree used this information to adjust their withdrawal amount and minimize their tax liability.

- Example 2:A couple used an annuity withdrawal tax calculator to compare the tax implications of withdrawing from their annuity in different tax brackets. The calculator showed that they would pay less in taxes if they withdrew more from their annuity in a year when they were in a lower tax bracket.

Are you curious if annuities qualify as a retirement plan? This article: Is An Annuity A Qualified Retirement Plan 2024 provides a clear explanation of whether annuities are considered qualified retirement plans under current regulations.

Case Study, Annuity Withdrawal Tax Calculator 2024

Consider a 65-year-old retiree, John, who has a fixed annuity with a contract value of $200,000. John contributed $100,000 to the annuity and has received $50,000 in payments over the years. John wants to withdraw $25,000 from his annuity this year.

Using an annuity withdrawal tax calculator, John can determine the tax implications of his withdrawal. The calculator would show that $15,000 of the withdrawal would be considered taxable income, while the remaining $10,000 would be considered a return of principal.

The relationship between annuities and pensions is often a topic of discussion. This article: Annuity Is Pension 2024 clarifies the connection between annuities and pensions, explaining how they differ and how they can be used in retirement planning.

This is because John has already received $50,000 in payments, which means that $50,000 of his original investment has been returned to him. The remaining $50,000 is considered income, and any withdrawal above that amount is considered taxable income.

John’s tax liability on the $15,000 of taxable income would depend on his tax bracket. If John is in the 12% tax bracket, his tax liability would be $1,800 (12% of $15,000). However, if John is in the 22% tax bracket, his tax liability would be $3,300 (22% of $15,000).

Want to know more about annuities in general? This article: Annuity General 2024 provides a comprehensive overview of annuities, covering their benefits, risks, and how they work. It’s a good starting point for anyone wanting to learn more about this financial tool.

This case study demonstrates how the tax implications of annuity withdrawals can vary depending on individual circumstances, including the amount of the withdrawal, the original investment, and the individual’s tax bracket.

Last Recap

By understanding the tax implications of annuity withdrawals and utilizing an annuity withdrawal tax calculator, you can optimize your retirement income strategy. This guide equips you with the knowledge to make informed decisions about your annuity withdrawals, ensuring you maximize your after-tax income and achieve your financial goals.

Understanding the different types of annuities can be a bit overwhelming, but this article on Annuity Is Mcq 2024 provides a clear explanation of the various types of annuities and their features. This information can help you choose the best annuity for your specific needs and financial goals.

Remember, planning for retirement is an ongoing process, and seeking professional financial advice is always recommended to address your specific circumstances.

Q&A

What is an annuity?

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s often used for retirement planning, but it can also be used for other purposes, such as income generation or long-term care.

What are the different types of annuities?

There are many different types of annuities, including fixed annuities, variable annuities, and indexed annuities. Each type has its own features and risks, so it’s important to choose the right one for your needs.

How do I find an annuity withdrawal tax calculator?

Many financial websites and software programs offer annuity withdrawal tax calculators. You can also consult with a financial advisor for assistance.

What are the tax implications of withdrawing from an annuity?

The tax implications of withdrawing from an annuity depend on the type of annuity and the withdrawal method. In general, a portion of your withdrawals will be taxed as ordinary income, while the rest will be considered tax-free return of principal.