Annuity Yields Calculator 2024 is your key to unlocking the potential of annuities in today’s financial landscape. Annuity yields are a crucial factor for anyone considering retirement planning or seeking guaranteed income streams. Understanding how to calculate and maximize these yields can make a significant difference in your long-term financial well-being.

An annuity loan is a type of loan that uses an annuity as collateral. Learn more about how to calculate annuity loans in 2024 here. Understanding these loans can help you explore different financing options.

This guide will demystify annuity yields and provide you with the knowledge and tools to make informed decisions. We’ll delve into the key factors that influence annuity yields, explore the different types of annuities available, and show you how to use an annuity yields calculator to find the best options for your needs.

Contents List

- 1 Annuity Yields Calculator 2024: A Comprehensive Guide

- 2 Closing Notes: Annuity Yields Calculator 2024

- 3 Essential Questionnaire

Annuity Yields Calculator 2024: A Comprehensive Guide

Annuity yields calculator is a powerful tool that can help you make informed decisions about your retirement savings. This article will provide a comprehensive guide to understanding annuity yields, how to use an annuity yields calculator, and the factors that affect annuity yields in 2024.

Calculating an annuity involves understanding the specific terms and conditions. Find a detailed guide on calculating annuities in 2024 here. This resource will help you understand the steps and formulas involved in determining the value of an annuity.

Introduction to Annuity Yields

Annuity yields refer to the rate of return you can expect to earn on your annuity investment. It represents the annual percentage of your principal that you will receive as income payments. Annuity yields are influenced by several factors, including interest rates, inflation, economic conditions, investment performance, and fees.

Want to know how much annuity income you can expect from a lump sum of £40,000? Find out how to calculate the potential annuity income for a £40,000 investment in 2024 here. This information can help you estimate your retirement income and plan accordingly.

Understanding Annuity Yields Calculator

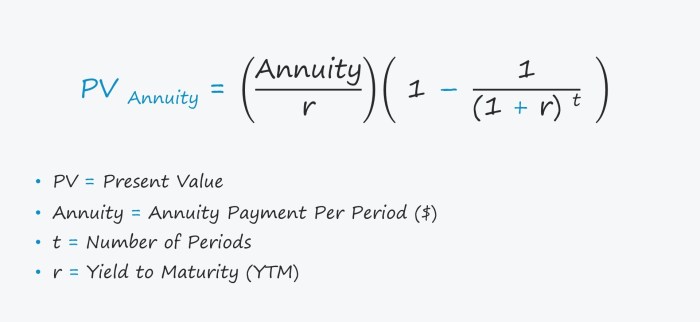

An annuity yields calculator is a financial tool that helps you estimate the potential income payments you can receive from an annuity. It takes into account various factors, such as the amount of your initial investment, the type of annuity, the interest rate, and the duration of the payout period.

Sometimes, early withdrawal from an annuity can result in penalties. Learn about the potential 10% penalty associated with early withdrawal from an annuity in 2024 here. Understanding these penalties can help you make informed decisions about your annuity investment.

- Purpose:To estimate the potential income payments from an annuity.

- Functionality:Calculates yields based on user-defined inputs.

- Inputs:Initial investment, annuity type, interest rate, payout period.

- Benefits:Provides a clear picture of potential income, allows comparison of different annuities, aids in decision-making.

Factors Affecting Annuity Yields

Several factors influence annuity yields, affecting the income payments you can expect to receive. Understanding these factors is crucial for making informed investment decisions.

Annuity products are primarily used to provide a consistent stream of income during retirement. Learn more about the common uses of annuities and how they can contribute to your financial security in 2024 here. This information can help you determine if an annuity is a suitable investment for your retirement plan.

Interest Rates

Interest rates play a significant role in determining annuity yields. Higher interest rates generally lead to higher annuity yields. Conversely, lower interest rates result in lower yields. The Federal Reserve’s monetary policy and market conditions influence interest rate movements.

If you’re working with annuity formulas, you might encounter some common questions. Explore a collection of frequently asked questions about annuity formulas in 2024 here. This resource can help you clarify any confusion and ensure accurate calculations.

Inflation and Economic Conditions

Inflation erodes the purchasing power of your income payments over time. Annuities with higher yields can help offset the impact of inflation. Economic conditions, such as growth and stability, also affect annuity yields. During periods of economic uncertainty, annuity yields may be lower.

Annuity products are available in the UK to provide a guaranteed income stream during retirement. Learn more about annuities in the UK in 2024 here. This information can help you understand the different types of annuities available and choose the one that best suits your needs.

Investment Performance and Fees

Annuity yields can also be influenced by the performance of the underlying investments. Annuities that invest in stocks or other assets may have higher yields, but also carry higher risk. Fees associated with annuities, such as surrender charges and management fees, can impact the overall yield.

Microsoft Excel offers tools to help you calculate growing annuities. Find a guide on how to calculate growing annuities in Excel in 2024 here. This guide can help you streamline your calculations and make informed decisions.

Using Annuity Yields Calculator for 2024

Annuity yields calculator is a valuable tool for planning your retirement savings. It allows you to compare different annuity options and estimate the potential income you can receive.

Annuity 250k refers to an annuity with a starting principal value of £250,000. Find information about annuities with a £250,000 principal value in 2024 here. This information can help you explore different annuity options and make informed financial decisions.

Step-by-Step Guide

- Choose an Annuity Yields Calculator:Select a reputable online calculator or use a financial advisor’s tool.

- Input Your Information:Provide the required information, such as the amount of your initial investment, the type of annuity, and the payout period.

- Review the Results:The calculator will display the estimated annuity yield and the potential income payments you can receive.

- Compare Different Options:Use the calculator to compare yields from different annuity providers and types.

Examples of Scenarios

- Scenario 1:A $100,000 investment in a fixed annuity with a 3% annual yield for 20 years would generate an estimated annual income of $3,000.

- Scenario 2:A $100,000 investment in a variable annuity with an average annual return of 5% for 20 years could result in higher income payments, but also carries greater risk.

Importance of Comparing Yields

It’s crucial to compare annuity yields from different providers before making a decision. Look for competitive yields, favorable terms, and reputable companies.

Choosing the Right Annuity, Annuity Yields Calculator 2024

Selecting the right annuity depends on your individual needs, financial goals, and risk tolerance. Consider these factors:

Individual Needs and Goals

Determine your retirement income needs, the duration of your income stream, and your desired level of risk. Consider your age, health, and financial situation.

Annuity 9 refers to a type of annuity that provides guaranteed payments for a specific period. Learn more about the characteristics and features of annuity 9 in 2024 here. Understanding different annuity types can help you choose the right one for your needs.

Fixed vs. Variable Annuities

Fixed annuitiesoffer guaranteed income payments, while variable annuitiesprovide potential for higher returns but also carry higher risk. Choose the type that aligns with your risk tolerance and income needs.

If you’re in the UK, you can use HMRC’s annuity calculator to estimate your potential income. Find information about the HMRC annuity calculator in 2024 here. This tool can help you plan for your retirement and make informed financial decisions.

Terms and Conditions

Carefully review the terms and conditions of the annuity contract, including surrender charges, fees, and limitations. Understand the rules governing withdrawals and income payments.

When dealing with annuities, it’s important to understand how income is taxed. Find guidance on calculating taxable annuity income in 2024 here. This information can help you accurately calculate your tax liability and plan accordingly.

Risks and Considerations

While annuities can provide a steady stream of income, it’s important to understand the potential risks associated with them.

Looking to calculate the potential income from a growing annuity? You can find helpful resources on how to calculate growing annuities in 2024 here. This information can help you plan for your financial future and understand the potential growth of your investments.

Potential Risks

- Market Fluctuations:Variable annuities are susceptible to market fluctuations, which can affect your income payments.

- Surrender Charges:If you withdraw funds before a certain period, you may incur surrender charges.

- Inflation:The purchasing power of your income payments can be eroded by inflation.

Surrender Charges and Fees

Surrender charges are penalties imposed if you withdraw funds from the annuity before a specified period. Fees, such as management fees and administrative fees, can also impact your overall yield.

Market Fluctuations

Variable annuities are exposed to market fluctuations. If the underlying investments perform poorly, your income payments may be lower than expected.

Need to calculate an annuity using your HP10bii calculator? Find a comprehensive guide on how to calculate annuities with the HP10bii in 2024 here. This guide will walk you through the steps and formulas to ensure accurate calculations.

Closing Notes: Annuity Yields Calculator 2024

Armed with the insights gained from this guide, you can approach annuity investments with greater confidence. Remember, understanding the nuances of annuity yields is essential for making sound financial choices. While this guide provides valuable information, always consult with a qualified financial advisor before making any investment decisions.

Annuity certain is a type of annuity that guarantees payments for a specific period. Learn more about the characteristics and examples of annuity certain in 2024 here. Understanding different types of annuities is crucial for making informed financial decisions.

Essential Questionnaire

What is the difference between fixed and variable annuities?

Fixed annuities offer a guaranteed interest rate, while variable annuities provide the potential for higher returns but also carry more risk. The choice between fixed and variable depends on your risk tolerance and investment goals.

How often are annuity yields updated?

Annuity yields are typically updated on a daily or monthly basis, depending on the provider. You can check with your annuity provider for the most up-to-date information.

Can I withdraw my annuity funds before retirement?

You may be able to withdraw some or all of your annuity funds before retirement, but this may be subject to penalties or fees. Consult your annuity contract for specific details.