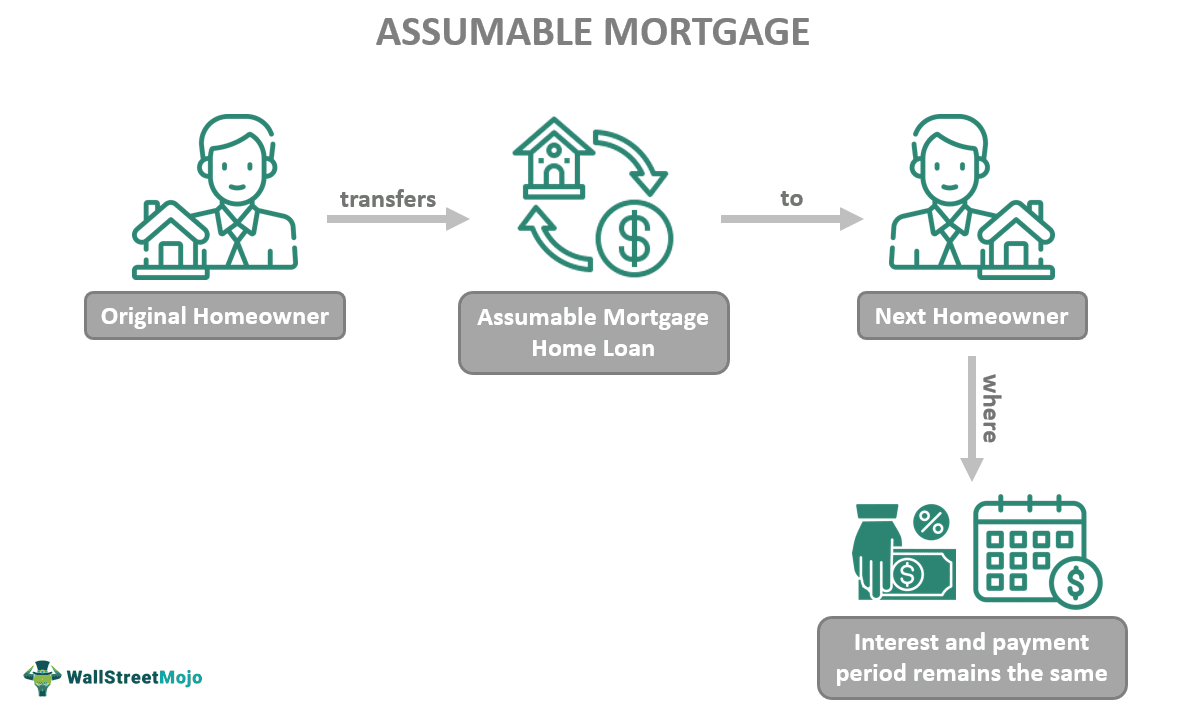

Assumable Mortgages offer a unique pathway for both buyers and sellers to navigate the real estate market, presenting opportunities for potential savings and flexibility. In essence, an assumable mortgage allows a new buyer to take over the existing mortgage terms from the original borrower, often with a lower interest rate than current market rates.

An interest-only loan allows you to pay only the interest on your loan for a set period of time, which can be a good option if you want to keep your monthly payments low. However, it’s important to remember that you’ll have to make a larger lump sum payment at the end of the loan term.

If you’re interested in learning more about this type of loan, check out our guide on interest-only loans.

This can be a win-win situation, particularly in a fluctuating interest rate environment.

Instant payday loans are short-term loans that can be a quick way to get cash in a pinch. However, they often come with high interest rates and fees. It’s important to weigh the pros and cons before taking out an instant payday loan.

Historically, assumable mortgages were more prevalent, but their availability has diminished in recent years. However, they remain a viable option for certain types of mortgages, particularly those issued before 2009. Understanding the intricacies of assumable mortgages, their benefits, and potential risks is crucial for both buyers and sellers seeking to leverage this unique financing option.

Capital One Auto Navigator is a helpful tool that can help you find the best car loan rates and financing options. You can compare offers from different lenders and get pre-approved for a loan, all in one place. If you’re shopping for a new or used car, check out Capital One Auto Navigator.

Contents List

What is an Assumable Mortgage?

An assumable mortgage allows a new buyer to take over an existing mortgage from the current homeowner. This can be a beneficial option for both the buyer and seller, as it can potentially save money on interest rates and closing costs.

Oportun Loans provides financial products and services to underserved communities. They offer a variety of loan options, including personal loans, auto loans, and credit cards. If you’re looking for a lender that caters to diverse communities, consider exploring Oportun Loans.

Defining Assumable Mortgages

In simple terms, an assumable mortgage is a type of mortgage that can be transferred from the original borrower to a new borrower. This means that the new buyer takes over the existing loan terms, including the interest rate and remaining principal balance.

Santander Loans offers a variety of loan products, including personal loans, auto loans, and mortgages. They are known for their competitive rates and flexible repayment options. If you’re looking for a loan from a reputable lender, consider exploring Santander Loans.

The Difference Between Assumable and Non-Assumable Mortgages

Not all mortgages are assumable. The key difference between an assumable mortgage and a non-assumable mortgage lies in the loan agreement. Assumable mortgages specifically allow for the transfer of the loan, while non-assumable mortgages do not.

An FHA mortgage, also known as a Federal Housing Administration mortgage, is a government-insured loan that can help borrowers with lower credit scores or a smaller down payment purchase a home. If you’re considering buying a home, it’s worth exploring the benefits of an FHA mortgage.

Historical Context of Assumable Mortgages

Assumable mortgages were more common in the past, particularly during periods of high interest rates. They provided an attractive option for buyers who wanted to secure a lower interest rate than what was currently available in the market. However, the popularity of assumable mortgages declined in recent years due to changes in lending practices and regulations.

A $10,000 loan can be a helpful way to cover a variety of expenses, from home repairs to medical bills. There are a number of lenders who offer personal loans in this amount. If you’re looking for a $10,000 loan , compare your options carefully.

Benefits of Assumable Mortgages

Assumable mortgages can offer significant advantages for both buyers and sellers, primarily due to the potential for lower interest rates and reduced closing costs.

Getting the best home loan rates can save you thousands of dollars over the life of your mortgage. There are a number of factors that affect your interest rate, including your credit score, debt-to-income ratio, and the type of loan you choose.

Learn how to get the best home loan rates.

Advantages for Buyers

- Lower Interest Rates:Assuming a mortgage with a lower interest rate than current market rates can result in substantial savings over the life of the loan. This is particularly beneficial in a rising interest rate environment.

- Reduced Closing Costs:Assuming a mortgage can often reduce closing costs compared to obtaining a new mortgage. This is because the new buyer does not have to pay for origination fees, appraisal fees, and other associated costs.

Advantages for Sellers

- Faster Sale:Assumable mortgages can make a home more attractive to buyers, potentially leading to a faster sale. This can be especially advantageous in a competitive market.

- Higher Selling Price:Buyers may be willing to pay a higher price for a home with an assumable mortgage, as they can benefit from the lower interest rate.

Types of Assumable Mortgages

Different types of assumable mortgages exist, each with its own eligibility requirements and terms and conditions. Understanding these differences is crucial when considering an assumable mortgage.

USDA Rural Development loans are government-backed loans that can help eligible borrowers purchase or improve a home in rural areas. These loans often come with lower interest rates and down payment requirements than conventional loans. If you’re interested in buying a home in a rural area, explore the benefits of a USDA Rural Development loan.

Types of Assumable Mortgages

- FHA-insured Mortgages:FHA-insured mortgages are generally assumable, subject to lender approval. The new borrower must meet FHA’s credit and income requirements.

- VA-guaranteed Mortgages:VA-guaranteed mortgages are also typically assumable, with certain conditions. The new borrower must qualify for VA financing and meet the eligibility criteria.

- Conventional Mortgages:Conventional mortgages may be assumable, but this is not always the case. The assumability of a conventional mortgage depends on the specific loan terms and the lender’s policies.

- USDA Rural Housing Loans:USDA Rural Housing Loans are generally assumable, subject to lender approval and the new borrower meeting the eligibility requirements.

Eligibility Requirements

The eligibility requirements for assumable mortgages vary depending on the type of loan and the lender. Generally, the new borrower must meet the following criteria:

- Creditworthiness:The new borrower must have a good credit score and a history of responsible financial management.

- Income:The new borrower’s income must be sufficient to meet the mortgage payments.

- Debt-to-Income Ratio:The new borrower’s debt-to-income ratio should be within acceptable limits.

- Down Payment:The new borrower may be required to make a down payment, depending on the loan terms and the remaining principal balance.

Terms and Conditions

The terms and conditions of assumable mortgages can vary significantly. It’s important to review the loan documents carefully to understand the following:

- Interest Rate:The interest rate will typically remain the same as the original mortgage, but it may be subject to a small adjustment.

- Remaining Principal Balance:The new borrower will assume the remaining principal balance of the mortgage.

- Loan Term:The loan term will typically remain the same, but it may be shortened if the new borrower makes additional payments.

- Assumption Fee:Some lenders may charge an assumption fee to cover administrative costs.

How to Find an Assumable Mortgage

Finding an assumable mortgage requires a strategic approach. It’s not as straightforward as searching for a traditional mortgage, but with the right resources and techniques, it’s achievable.

Kashable loans are a type of personal loan designed to help people consolidate their debt or cover unexpected expenses. They offer competitive interest rates and flexible repayment terms. If you’re considering a personal loan, check out our information on Kashable loans.

Step-by-Step Guide

- Identify Your Needs:Determine your financial goals, budget, and desired loan terms. This will help you narrow down your search for assumable mortgages that meet your requirements.

- Consult with a Real Estate Agent:Real estate agents are familiar with the local market and can often identify homes with assumable mortgages. They can also provide guidance on the assumption process.

- Explore Online Resources:Several online platforms specialize in listing homes with assumable mortgages. These platforms allow you to filter your search by location, loan type, and other criteria.

- Network with Other Professionals:Connect with mortgage brokers, lenders, and other professionals in the real estate industry. They may have access to information about assumable mortgages that are not publicly available.

- Review MLS Listings:Many MLS listings will indicate if a property has an assumable mortgage. Pay close attention to the loan details and contact the listing agent for more information.

Negotiating an Assumable Mortgage

Once you’ve identified a property with an assumable mortgage, it’s important to negotiate the terms with the seller. Here are some tips:

- Review the Loan Documents:Carefully review the loan documents to understand the interest rate, remaining principal balance, and other terms.

- Negotiate the Purchase Price:Consider the value of the lower interest rate and factor it into your offer price. You may be able to negotiate a lower purchase price because of the benefits of the assumable mortgage.

- Assumption Fee:If the lender charges an assumption fee, try to negotiate for the seller to cover it or split the cost.

- Closing Costs:Discuss the closing costs associated with the assumption process and see if you can negotiate a favorable arrangement with the seller.

Epilogue

Navigating the world of assumable mortgages requires careful consideration of factors like interest rates, loan terms, and potential risks. While they can offer significant advantages, it’s essential to conduct thorough research, consult with a qualified mortgage professional, and weigh the pros and cons before making a decision.

Ultimately, the decision to assume a mortgage should be driven by a clear understanding of your financial goals and a comprehensive assessment of the available options.

Popular Questions

What is the difference between a conventional mortgage and an assumable mortgage?

A line of credit is a flexible financing option that allows you to borrow money as needed, up to a pre-approved limit. This can be a helpful tool for unexpected expenses or larger purchases. If you’re looking for a flexible financing option, learn more about lines of credit.

A conventional mortgage is a standard mortgage that cannot be assumed by a new buyer, while an assumable mortgage allows a new buyer to take over the existing loan terms.

What are the eligibility requirements for assuming a mortgage?

Eligibility requirements vary depending on the specific mortgage and lender. Typically, the new buyer must meet the lender’s creditworthiness standards and undergo a credit and income verification process.

What are the potential downsides of assuming a mortgage?

Potential downsides include assuming a mortgage with a higher interest rate than current market rates, inheriting any existing loan problems, and potentially facing a higher closing cost.

Home mortgage interest rates fluctuate regularly, so it’s important to stay informed about current rates before you apply for a loan. There are a number of factors that affect interest rates, including the current economic climate and the type of loan you choose.

Learn more about home mortgage interest rates to find the best deal.

An instant personal loan can provide you with quick access to cash for unexpected expenses or emergencies. However, it’s important to compare interest rates and fees carefully before you apply. Learn more about instant personal loans to find the best option for your needs.

Brightlending is a platform that connects borrowers with lenders who specialize in personal loans. They offer a variety of loan options with competitive interest rates and flexible repayment terms. If you’re looking for a personal loan, consider exploring Brightlending.

BHG Loans is a lender that offers a variety of financial products, including personal loans, home equity loans, and debt consolidation loans. They are known for their competitive rates and excellent customer service. If you’re looking for a loan from a reputable lender, consider exploring BHG Loans.