Chloe Bellamy

Copyright Attorney: Protecting Your Creative Works

Copyright Attorney: Navigating the complex world of copyright law can be daunting, especially for creators and businesses seeking to protect ...

Elder Care Lawyer: Navigating Senior Legal Needs

Elder Care Lawyer: As individuals age, they often face complex legal and financial challenges that require specialized guidance. Navigating the ...

Mental health care access and affordability on World Mental Health Day 2024

Mental health care access and affordability on World Mental Health Day 2024 is a crucial topic, highlighting the disparities and ...

Mental Health Challenges & Solutions for World Mental Health Day 2024

Mental health challenges and solutions for World Mental Health Day 2024 – World Mental Health Day 2024 spotlights the critical ...

American Red Cross RapidPass 2024: Streamlining Emergency Response

American Red Cross RapidPass 2024 takes center stage, ushering in a new era of streamlined emergency response. This innovative program ...

Criminal Law Solicitors: Your Guide to Legal Representation

Criminal Law Solicitors are legal professionals who specialize in defending individuals facing criminal charges. They navigate the complexities of the ...

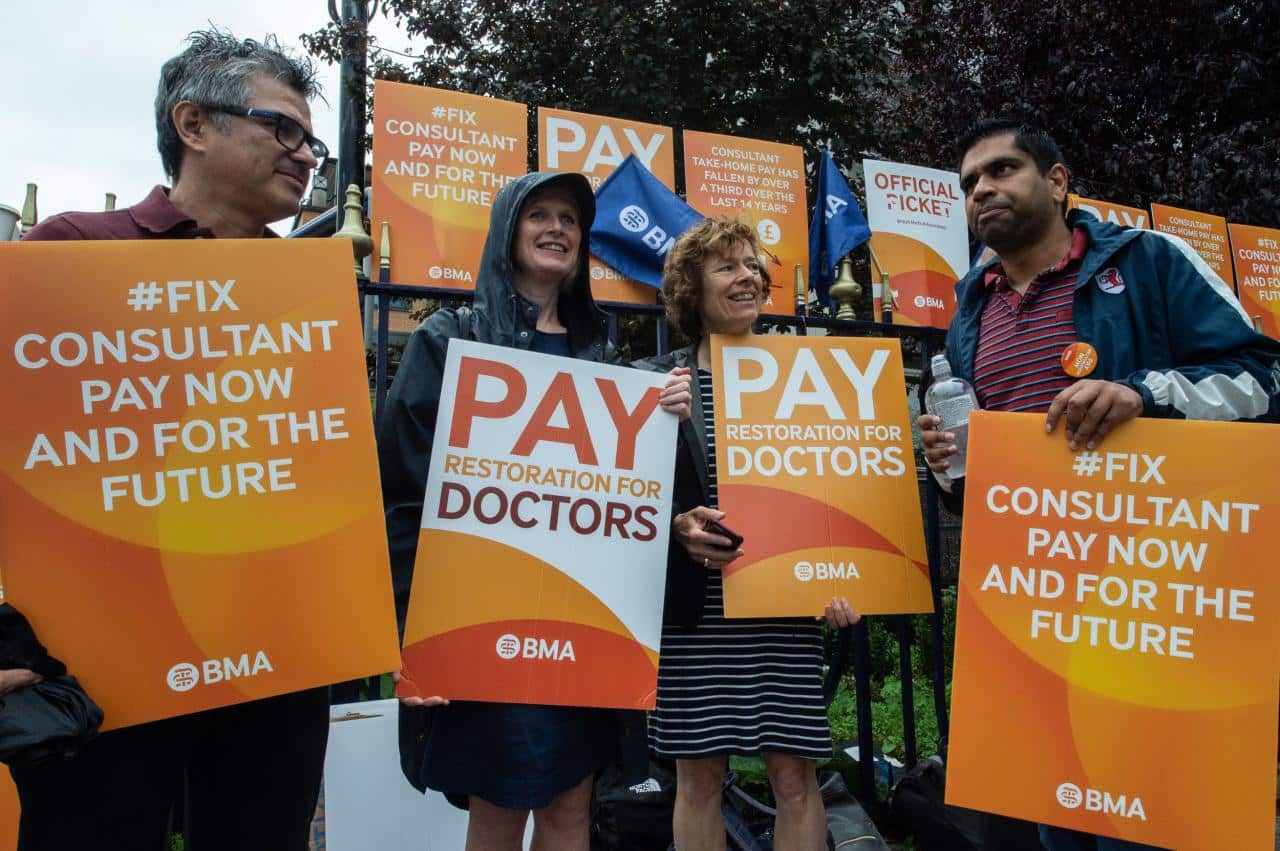

Pharmacy Strike in October 2024: Finding Solutions

Pharmacy strike in October 2024 potential solutions – Pharmacy Strike in October 2024: Finding Solutions, a potential disruption to healthcare ...

Pro Bono Criminal Lawyers: Ensuring Justice for All

Pro Bono Criminal Lawyers play a crucial role in ensuring that everyone has access to legal representation, regardless of their ...

Pharmacy Strike in October 2024: News Updates

Pharmacy strike in October 2024 news updates sets the stage for this enthralling narrative, offering readers a glimpse into a ...