Average APR For Car Loan is a crucial factor to consider when financing a vehicle. It represents the annual interest rate you’ll pay on your loan, and understanding its components and influencing factors is essential for making informed financial decisions.

From credit score to loan term, various aspects can affect your APR, ultimately determining the total cost of your car loan.

When unexpected expenses arise, fast payday loans can provide quick financial relief. These short-term loans offer a fast and convenient solution for bridging the gap until your next paycheck, although it’s important to be aware of the associated costs.

This guide delves into the intricacies of average APR for car loans, providing insights into current trends, key influencing factors, and strategies for securing the best possible rate. We’ll explore how your creditworthiness, loan term, and even the type of vehicle you choose can impact your APR, ultimately empowering you to make smart choices when financing your next car.

If you’re looking to tap into your home equity for renovations, debt consolidation, or other financial needs, exploring best HELOC rates is essential. Comparing rates and terms from different lenders can help you secure the most favorable financing options for your home equity line of credit.

Contents List

Understanding Average APR for Car Loans

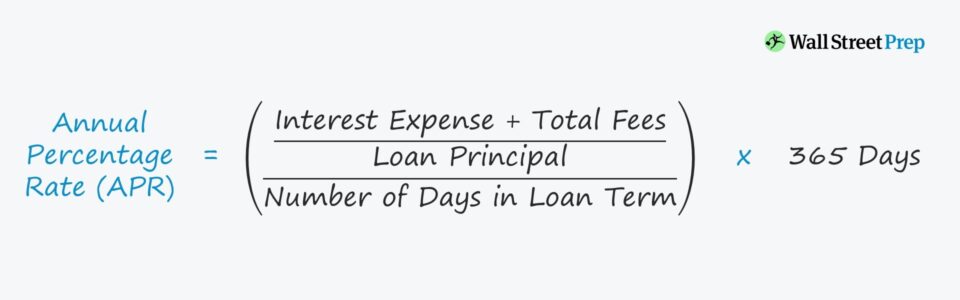

Buying a car is a significant financial decision, and understanding the average APR for car loans is crucial. APR, or Annual Percentage Rate, represents the annual cost of borrowing money, expressed as a percentage. It encompasses the interest rate charged on the loan plus any additional fees or charges associated with it.

For eligible veterans, VA home loans offer a unique advantage in the housing market. These loans often come with lower interest rates and no down payment requirements, making homeownership more accessible for those who have served our country.

Components of APR

The APR for a car loan typically comprises the following components:

- Interest Rate:The fundamental cost of borrowing money. This rate reflects the lender’s risk assessment based on your creditworthiness.

- Loan Origination Fee:A fee charged by the lender for processing your loan application.

- Other Fees:These can include fees for document preparation, credit reporting, or other services.

Factors Influencing Average APR

Several factors contribute to the average APR for car loans. These include:

- Credit Score:Borrowers with higher credit scores typically qualify for lower APRs as they are considered less risky by lenders.

- Loan Term:Longer loan terms generally lead to lower monthly payments but higher overall interest costs, resulting in a higher APR.

- Vehicle Type:The type of vehicle you are financing, such as new or used, and its make and model, can affect the APR. Newer vehicles may have higher APRs due to their higher value.

- Current Market Conditions:Interest rates in the broader financial market can influence car loan APRs. During periods of economic uncertainty, APRs may rise.

Examples of APR Variation

Here are some examples of how APR can vary based on different factors:

- Credit Score:A borrower with a credit score of 750 might receive an APR of 4%, while a borrower with a score of 650 might face an APR of 6%.

- Loan Term:A 60-month loan term could have an APR of 5%, whereas a 36-month loan term might have an APR of 4.5%.

- Vehicle Type:A new car loan might have an APR of 5.5%, while a used car loan could have an APR of 6.5%.

Current Average APR Trends

The average APR for car loans fluctuates based on economic conditions and lender policies. It’s essential to stay informed about current trends to make informed borrowing decisions.

Whether you need a personal loan, a home loan, or something else, exploring your options is essential. Loans are available for a variety of purposes, and understanding the different types and terms can help you find the right fit for your financial situation.

Average APR for New and Used Car Loans

As of [Current Date], the average APR for new car loans is around [Average APR for New Car Loans]%, while the average APR for used car loans is around [Average APR for Used Car Loans]%.

Historical APR Trends

Over the past few years, average APRs for car loans have generally [Trend Description – e.g., increased, decreased, remained relatively stable]. This trend can be attributed to [Reasons for Trend – e.g., changes in interest rates, economic growth, lender competition].

Investing in property can be a smart move, but securing the right financing is crucial. Investment property loans can help you acquire properties for rental income or future appreciation, offering tailored terms and flexible options for your investment goals.

Recent APR Fluctuations

In recent months, average APRs for car loans have [Recent Fluctuation Description – e.g., experienced a slight increase, remained stable]. This fluctuation could be attributed to [Potential Causes – e.g., changes in the Federal Reserve’s monetary policy, inflation, supply chain disruptions].

Unlocking the equity in your home can provide access to funds for various needs. An equity line of credit allows you to borrow against your home’s value, offering a flexible line of credit for home improvements, debt consolidation, or other personal expenses.

Factors Affecting Individual APRs

While average APRs provide a general picture, your individual APR will depend on your specific circumstances. Understanding the key factors influencing your APR can help you secure a favorable rate.

Staying informed about current interest rates is crucial for making sound financial decisions. Interest rates today can fluctuate based on various factors, so it’s essential to monitor the market and compare rates from different lenders before making a decision.

Credit Score Impact

Your credit score is a primary factor determining your APR. Lenders consider your credit history, payment history, and overall financial responsibility when assessing your creditworthiness. A higher credit score indicates a lower risk for the lender, resulting in a lower APR.

Adjustable-rate mortgages (ARMs) can offer lower initial interest rates compared to fixed-rate loans. 5/1 ARM rates are a popular choice, offering a fixed rate for the first five years and adjusting annually thereafter. This can be a good option for borrowers who plan to stay in their home for a shorter period.

Loan Term and APR

The length of your loan term also influences your APR. Longer loan terms typically result in lower monthly payments but higher overall interest costs, leading to a higher APR. Conversely, shorter loan terms have higher monthly payments but lower overall interest costs, resulting in a lower APR.

Financing a new car can be a significant expense. New car loan rates vary depending on factors such as your credit score, the vehicle’s make and model, and the loan term. Shopping around for the best rates and terms can help you save money over the life of your loan.

Vehicle Type and APR

The type of vehicle you are financing can impact your APR. New vehicles often have higher APRs due to their higher value and associated risks for lenders. Used vehicles may have lower APRs, but their condition and age can influence the rate.

Payday loans can provide quick access to cash but often come with high interest rates and fees. Payday loans are designed for short-term financial needs, and it’s crucial to understand the associated costs and repayment terms before considering this option.

Factors Influencing APR: A Summary Table

| Factor | Impact on APR | Examples |

|---|---|---|

| Credit Score | Higher credit score = Lower APR | A borrower with a score of 750 might receive an APR of 4%, while a borrower with a score of 650 might face an APR of 6%. |

| Loan Term | Longer term = Higher APR (generally) | A 60-month loan term could have an APR of 5%, whereas a 36-month loan term might have an APR of 4.5%. |

| Vehicle Type | New vehicles = Higher APR (generally) | A new car loan might have an APR of 5.5%, while a used car loan could have an APR of 6.5%. |

| Lender Policies | Varying APRs based on lender’s risk assessment | Different lenders may offer different APRs even for borrowers with similar credit scores and loan terms. |

| Market Conditions | Interest rates in the broader market influence APRs | During periods of economic uncertainty, APRs may rise. |

Finding the Best APR for You: Average Apr For Car Loan

Securing a competitive APR for your car loan requires proactive steps and careful planning.

Variable interest rates can fluctuate based on market conditions. Variable interest rates can be beneficial if interest rates are expected to decline, but they can also lead to higher payments if rates rise. It’s important to consider your risk tolerance and financial goals when deciding on a variable interest rate loan.

Shop Around for Loans

Comparing loan offers from multiple lenders is essential to find the best APR. Don’t settle for the first offer you receive; take the time to explore different options.

Looking for a reliable and convenient way to access funds? Home Credit Cash Loan offers a quick and easy solution for your financial needs. Their services provide a streamlined application process and flexible repayment options, making it a potential option for those seeking short-term financing.

Comparing Loan Offers

When comparing loan offers, focus on the following key factors:

- APR:Compare the APRs of different lenders to identify the lowest rate.

- Loan Term:Consider the loan term that aligns with your budget and financial goals.

- Fees:Pay attention to any associated fees, such as origination fees or prepayment penalties.

- Loan Amount:Ensure the loan amount covers the purchase price and any additional costs.

Pre-Approval for Loans

Getting pre-approved for a car loan before shopping for a vehicle can give you an advantage. Pre-approval provides you with a loan amount and APR, allowing you to negotiate with car dealerships from a position of strength.

For personal loans and home equity loans, Lightstream Loans offers competitive rates and a streamlined application process. They provide a wide range of loan options, catering to different financial needs and circumstances.

Improving Credit Score

Improving your credit score can significantly impact your APR. Here are some tips to enhance your creditworthiness:

- Pay bills on time:Consistent on-time payments are crucial for building a positive credit history.

- Reduce credit utilization:Keep your credit card balances low compared to your credit limit.

- Avoid opening new accounts:Applying for too many new credit accounts can negatively impact your credit score.

- Monitor your credit report:Regularly review your credit report for errors and discrepancies.

Understanding APR and Loan Costs

The APR significantly impacts the total cost of your car loan. A higher APR means you’ll pay more in interest over the loan term, leading to a higher overall cost.

Impact of APR on Loan Cost, Average Apr For Car Loan

| Loan Term (Years) | APR (%) | Total Loan Cost |

|---|---|---|

| 3 | 4.5 | [Total Loan Cost with 4.5% APR over 3 years] |

| 3 | 6 | [Total Loan Cost with 6% APR over 3 years] |

| 5 | 4.5 | [Total Loan Cost with 4.5% APR over 5 years] |

| 5 | 6 | [Total Loan Cost with 6% APR over 5 years] |

APR and Monthly Payments

The APR also influences your monthly payments. A higher APR results in higher monthly payments, even if the loan amount and term remain the same.

Visual Representation of Loan Costs

A visual representation, such as a chart or graph, can effectively demonstrate the impact of different APRs on loan costs. [Describe the visual representation – e.g., a bar chart comparing the total interest paid for different APRs over a fixed loan term].

Need a reliable source for quick cash? Cash Net provides a convenient and accessible way to access funds when you need them most. Their services offer flexibility and a streamlined application process, making it a potential solution for your immediate financial needs.

Closing Notes

By understanding the factors influencing average APR and employing strategic approaches to loan shopping, you can increase your chances of securing a favorable interest rate. Remember, a lower APR translates to lower monthly payments and reduced overall interest paid, ultimately saving you money in the long run.

Managing multiple debts can be overwhelming. Credit consolidation offers a way to simplify your finances by combining several loans into a single, manageable payment. This can help you reduce interest rates, lower monthly payments, and improve your credit score.

Armed with the knowledge and tools discussed in this guide, you can confidently navigate the car loan market and make a wise financial decision that aligns with your needs and budget.

Question & Answer Hub

How can I improve my credit score to qualify for a lower APR?

You can improve your credit score by making payments on time, keeping your credit utilization low, and avoiding opening too many new credit accounts. It’s also important to check your credit report for any errors and dispute them if necessary.

What is the difference between APR and interest rate?

APR (Annual Percentage Rate) includes the interest rate plus other loan fees, while the interest rate is just the percentage charged on the loan principal.

How long does it take for a car loan to be approved?

The approval process for a car loan can vary depending on the lender and your creditworthiness. It can take anywhere from a few hours to a few days.