Average Mortgage Interest Rate 2024 takes center stage as a pivotal factor in the housing market. Understanding the current trends, forecasts, and implications of interest rates is crucial for both prospective homebuyers and existing homeowners. This guide explores the current average mortgage interest rate, compares it to previous years, and delves into the factors driving these fluctuations.

FHA loans can be a good option for first-time homebuyers. FHA first-time home buyer programs in 2024 offer down payment assistance and other benefits that can make buying a home more affordable.

We’ll also examine the impact of rising rates on affordability and explore strategies for navigating this challenging environment.

Jumbo loans are designed for borrowers who are purchasing homes that exceed the conforming loan limits. Jumbo loan rates in 2024 can be higher than conventional loan rates, but they can be a good option for those who need to borrow a large amount of money.

The average mortgage interest rate in 2024 has been influenced by a complex interplay of economic forces. Inflation, economic growth, and Federal Reserve policy have all played a significant role in shaping the current rate environment. The Federal Reserve’s efforts to combat inflation have led to increased interest rates, which in turn impact the cost of borrowing for mortgages.

Chase is one of the largest banks in the country and offers a variety of mortgage products. Chase mortgage rates in 2024 are worth checking out, especially if you’re already a Chase customer.

Contents List

Average Mortgage Interest Rates in 2024

The average mortgage interest rate in 2024 is a key factor influencing the housing market. It directly affects affordability for homebuyers and the overall demand for properties. Understanding the current trends and forecasts for mortgage rates is crucial for making informed decisions in the housing market.

If you’re a veteran, you might be eligible for a VA loan. VA home loan rates in 2024 can be very competitive, and there are often no down payment requirements. This can make buying a home more accessible, especially for first-time buyers.

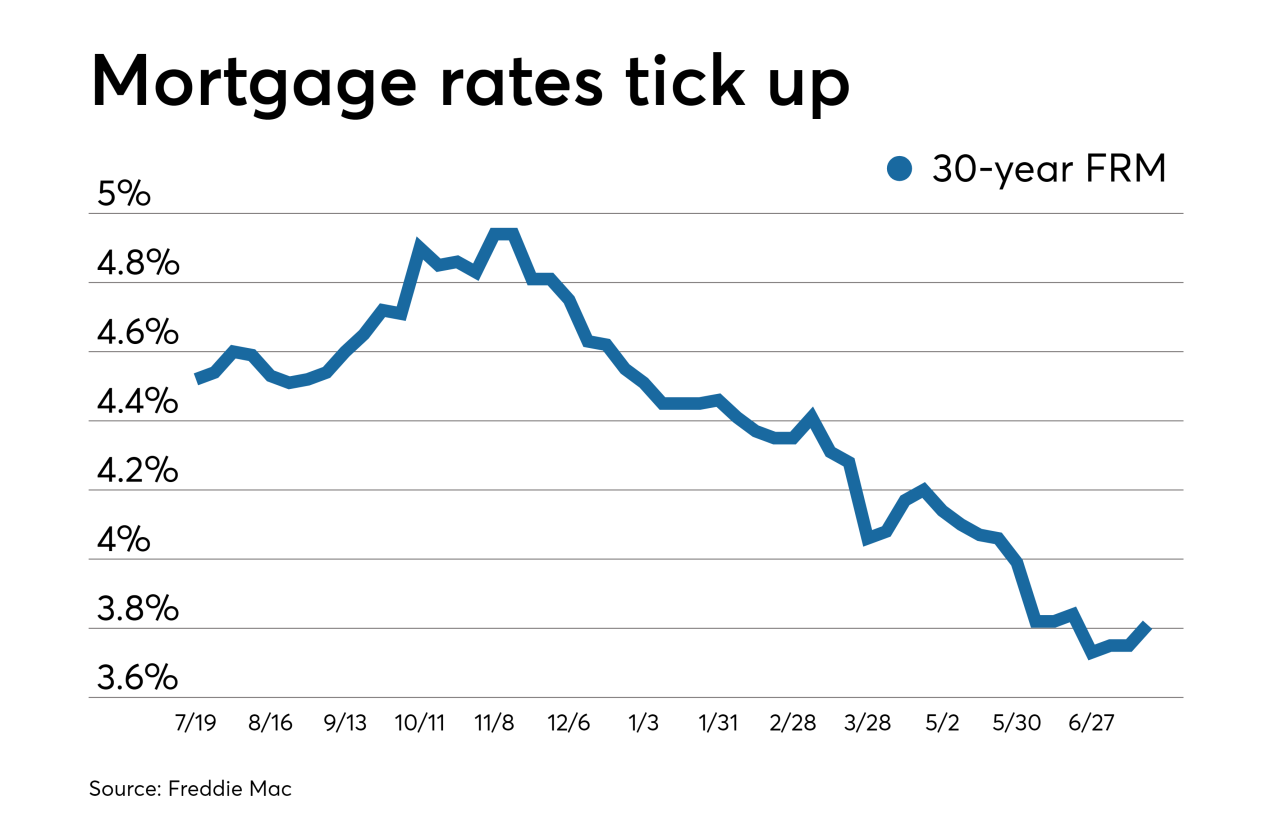

Current Mortgage Interest Rate Trends

As of [Tanggal terkini], the average 30-year fixed-rate mortgage is currently at [Rata-rata tingkat suku bunga terkini]%, according to [Sumber data]. This rate is [Tingkat kenaikan/penurunan] compared to the average rate in 2023. The fluctuations in mortgage rates are influenced by several factors, including inflation, economic growth, and Federal Reserve policy.

FHA loans are designed to help borrowers with lower credit scores or a smaller down payment purchase a home. FHA mortgage rates in 2024 can be a good option for those who are just starting out or who need a little extra help qualifying for a loan.

- Inflation:Rising inflation typically leads to higher interest rates as lenders demand higher returns to compensate for the eroding value of their money. The current high inflation environment has contributed to the increase in mortgage rates.

- Economic Growth:A strong economy generally supports higher interest rates as investors anticipate greater returns. Conversely, concerns about economic slowdowns can lead to lower interest rates.

- Federal Reserve Policy:The Federal Reserve’s monetary policy decisions, including interest rate adjustments, significantly impact mortgage rates. When the Fed raises interest rates, it becomes more expensive for lenders to borrow money, leading to higher mortgage rates.

Forecasted Mortgage Interest Rate Trends

Forecasting mortgage rates is a complex process that involves analyzing various economic indicators and market trends. While predicting the future with certainty is impossible, based on current conditions and expert opinions, it is anticipated that average mortgage interest rates will remain [Kenaikan/penurunan] for the remainder of 2024.

Mortgage interest rates are constantly fluctuating. Mortgage interest rates in 2024 are influenced by a variety of factors, including the economy, inflation, and the Federal Reserve’s monetary policy.

- Economic Outlook:The [Kondisi ekonomi terkini] economic outlook suggests [Perkiraan ekonomi] which could [Dampak perkiraan ekonomi pada tingkat suku bunga].

- Federal Reserve Projections:The Federal Reserve has indicated [Rencana kebijakan moneter] which could [Dampak kebijakan moneter pada tingkat suku bunga].

- Market Volatility:The current market volatility, driven by [Faktor yang menyebabkan volatilitas], could [Dampak volatilitas pada tingkat suku bunga].

These forecasts suggest that [Dampak perkiraan pada pasar perumahan].

Low doc home loans can be a good option for borrowers who don’t have all the documentation that lenders typically require. Low doc home loans in 2024 may have higher interest rates, but they can be a good option for self-employed borrowers or those who have recently changed jobs.

Impact of Mortgage Interest Rates on Homebuyers, Average Mortgage Interest Rate 2024

Rising mortgage interest rates directly impact affordability for homebuyers. As rates increase, monthly mortgage payments become higher, reducing the amount of money available for other expenses. The impact of interest rate changes on monthly mortgage payments can be significant.

It’s always a good idea to compare bank rates before you take out a loan. Bank rates today in 2024 can vary significantly, so it’s worth shopping around to find the best deal.

| Interest Rate (%) | Monthly Payment ($) |

|---|---|

| [Tingkat suku bunga 1] | [Pembayaran bulanan 1] |

| [Tingkat suku bunga 2] | [Pembayaran bulanan 2] |

| [Tingkat suku bunga 3] | [Pembayaran bulanan 3] |

As the table illustrates, even a small increase in interest rates can lead to a substantial difference in monthly mortgage payments. For example, a [Contoh perbedaan pembayaran bulanan].

Rocket Mortgage is one of the largest online mortgage lenders in the country. Rocket Mortgage rates in 2024 are known for being competitive, and the company offers a streamlined online application process.

Strategies for Homebuyers in a High-Interest Rate Environment

Navigating a high-interest rate environment can be challenging for homebuyers. However, there are strategies to mitigate the impact of higher rates and secure a competitive mortgage.

Some lenders offer 0 down mortgage options, which can be a great way to buy a home without having to save up a large down payment. 0 down mortgage options in 2024 are often available for VA and FHA loans.

- Shop Around for Rates:Compare rates from multiple lenders to find the most competitive offer. Online mortgage calculators can help estimate monthly payments at different interest rates.

- Improve Credit Score:A higher credit score typically qualifies you for lower interest rates. Take steps to improve your credit score by paying bills on time, reducing debt, and avoiding new credit applications.

- Consider a Shorter Loan Term:A 15-year mortgage typically has a lower interest rate than a 30-year mortgage. While the monthly payments may be higher, you will pay less interest overall and pay off the loan faster.

- Explore Government Programs:Government programs like FHA and VA loans can offer lower interest rates and down payment requirements, making homeownership more accessible.

- Seek Professional Advice:Consult with a mortgage broker or financial advisor to discuss your financial situation and explore options for securing a mortgage in a high-interest rate environment.

Resources available to homebuyers include [Daftar sumber daya]:

Historical Perspective on Mortgage Interest Rates

Over the past decade, mortgage interest rates have fluctuated significantly. During periods of economic growth and low inflation, rates have generally been lower. Conversely, periods of economic uncertainty and high inflation have often been associated with higher rates.

If you’re a veteran, you might be eligible for a VA loan. Current VA mortgage rates in 2024 can be very competitive, and there are often no down payment requirements.

For example, in [Tahun], the average 30-year fixed-rate mortgage was [Tingkat suku bunga]. This period was characterized by [Kondisi ekonomi dan tingkat suku bunga]. In contrast, in [Tahun], the average rate was [Tingkat suku bunga] due to [Kondisi ekonomi dan tingkat suku bunga].

Online mortgage brokers can be a great way to shop around for the best rates and terms. Online mortgage brokers in 2024 use technology to streamline the process and make it easier to compare offers from multiple lenders.

The relationship between mortgage interest rates and broader economic conditions is complex and influenced by a multitude of factors. Understanding historical trends can provide valuable insights into the current rate environment and potential future movements.

Conclusion: Average Mortgage Interest Rate 2024

Navigating the current high-interest rate environment requires careful planning and informed decision-making. Understanding the factors influencing mortgage rates, exploring strategies for securing a competitive rate, and utilizing available resources can empower homebuyers to make informed choices. By staying informed and proactive, individuals can position themselves to navigate the complexities of the housing market in 2024.

FAQ Insights

What is the average mortgage interest rate in 2024?

The average mortgage interest rate in 2024 varies depending on the type of loan and lender. It’s best to consult with a mortgage professional for the most accurate and up-to-date information.

Wells Fargo is one of the largest mortgage lenders in the country. Wells Fargo mortgage rates in 2024 are worth checking out, as they offer a variety of loan options, including conventional, FHA, and VA loans.

How do mortgage interest rates affect my monthly payments?

Higher interest rates result in higher monthly mortgage payments. A small increase in the interest rate can significantly impact the overall cost of a mortgage over its lifetime.

What are some strategies for finding a competitive mortgage rate?

Shop around with multiple lenders, consider a fixed-rate mortgage for stability, improve your credit score, and consider a shorter loan term to lower your interest rate.

A 5/1 ARM is a type of adjustable-rate mortgage (ARM) that has a fixed interest rate for the first five years. 5/1 ARM rates in 2024 can be lower than fixed-rate mortgages, but they can also increase after the initial fixed period.

Home loan rates are constantly changing. Home loan rates in 2024 can vary depending on the type of loan, the lender, and the borrower’s credit score.